Payment security Market

Global Payment security Market Size, Share & Trends Analysis Report by Solution (Encryption, Tokenization, and Fraud Detection and Prevention), By Industry (Retail and Commercial, Travel & Hospitality, BFSI, IT & Telecom, Media & Entertainment, and Others) and Forecast 2019-2025

The global payment security market is projected to have a significant CAGR of around 14% during the forecast period. The major factors propelling the market growth of the market include- increasing digitalization across the globe, growing demand for mobile and internet banking, and rising payment security solutions in the BFSI industry coupled with internet penetration. Rising internet penetration is primarily encouraging the banks to adopt advanced payment platforms to attract customers towards their banks. For instance, as per Asia-Pacific Economic Co-Operation (APEC), there was 55.8% internet penetration in China which equals to 772 million internet users in 2018. Moreover, there were 209 million Internet users in rural areas (27.0% of total Internet users) in China in 2018.

The growing payment transactions in the retail industry is backing the growth of the global payment security market. For instance, Alibaba and Tencent are leading the mobile payment sector in China and have branched out to other parts of the financial services supply chain. As per the International Monetary Fund (IMF), the value of China’s consumption-related mobile payments by individuals totaled $790 billion in 2016. Additionally, rising venture capital funding in China for key digitalization technologies, such as AI and VR is further anticipated to offer significant opportunity for the advent of advanced technologies that tend to increase reliability and safety in banking transaction. This, in turn, will drive the growth of the payment security industry.

Segmental Outlook

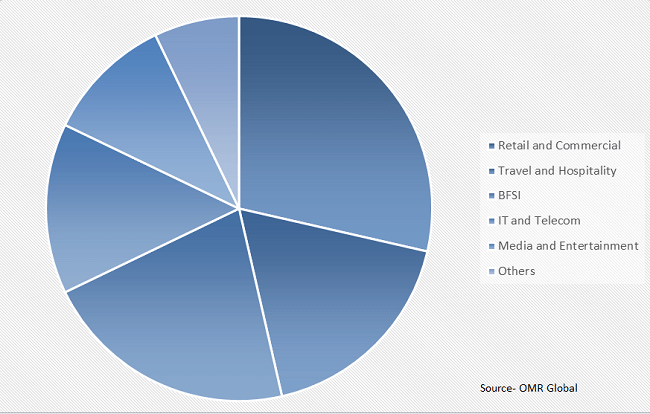

The global payment security market is classified on the basis of solution and industry. Based on the solution, the market is further categorized into encryption, tokenization, fraud detection and prevention. There are various industries using payment security solutions and contributing to the growth of the market. The various industries include retail and commercial, travel and hospitality, BFSI, IT and telecom, media and entertainment, and others (healthcare, education). The fraud detection and prevention solutions are anticipated to have significant market growth during the forecast period. The increasing number of fraud-related activities in BFSI and retail industry encouraging the demand for fraud detection and prevention solutions across the globe.

Global Payment Security Market Share by Industry, 2018 (%)

Global Payment Security Market to Be Driven by Retail and Commercial Industry

Retail and commercial segment is projected to have a significant market share during the forecast period. The segmental growth is attributing to rising demand for online shopping and increasing adoption of smartphones coupled with significant internet penetration. For instance, according to the US Census Bureau, the estimate of the US retail e-commerce sales for the second quarter of 2019 was $146.2 billion, an increase of 4.2% from the first quarter of 2019. Mobile devices have a significant role to perform an e-commerce transaction. This, in turn, is contributing significantly to the growth of retail and commercial industry that further contribute to the market share.

Regional Outlook

Moreover, the global payment security market is further classified on the basis of geography into North America, Europe, Asia-Pacific and Rest of the World. North America is expected to have a considerable market share in the global market during the forecast period. Presence of large payment security providers such as CyberSource Corp., Elavon Inc., TNS Inc., and others in the country and high adoption of the advanced payment security solutions are the factors that contribute significantly in the regional growth of the market.

Global Payment Security Market Growth, by Region 2019-2025

Asia-Pacific: Lucrative Opportunity for Global Payment Security Market

Asia-Pacific is estimated to show steady growth during the forecast period. The growth is attributed to the rising government initiatives for digitalization and rising demand for rural banking services in the region. For instance, as per a report by Google and Boston Consulting Group (BCG), the Indian digital payments industry is estimated to touch $500 billion by 2020, contributing 15% to the country’s GDP. The growth of Indian digital payment industry is led by digital/mobile wallets. Moreover, the Indian government has taken initiatives such as the launch of new payments systems, including UPI, Aadhar linked electronic payments, and improvement of the digital infrastructure in the banking sector. This, in turn, is likely to drive the growth of the market.

Market Players Outlook

The key players in the payment security market contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key market players of the market include Broadcom Inc., CyberSource Corp., Elavon Inc., Ingenico Group, S.A., PayPal, Inc. The other market players that contribute to the growth of the market include Bluefin Payment Systems LLC, Index Systems, Inc., Intelligent Payments Group Ltd., Shift4 Payments, LLC., TNS Inc., TokenEx, LLC. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in July 2018, Bluefin Payment Systems LLC and Verifone Inc., partnered to offer advanced payment security solutions. With this partnership both companies will enhance their payment solutions offering and sustain the significant position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global payment security market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. CA Technologies

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. CyberSource Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. PayPal, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Ingenico Group, S.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Elavon Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Payment Security Market by Solution

5.1.1. Encryption

5.1.2. Tokenization

5.1.3. Fraud detection and Prevention

5.2. Global Payment Security Market by Industry

5.2.1. Retail and Commercial

5.2.2. Travel and Hospitality

5.2.3. BFSI

5.2.4. IT and Telecom

5.2.5. Media and Entertainment

5.2.6. Others (Healthcare, Education)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 2Checkout

7.2. Acculynk, Inc.

7.3. Adyen

7.4. Bluefin Payment Systems LLC

7.5. BluePay Processing, LLC

7.6. CA Technologies (A Broadcom Company)

7.7. CipherCloud

7.8. CyberSource Corp. (A Visa Inc. Company)

7.9. Elavon Inc.

7.10. First Data Corp.

7.11. Gemalto NV (A Thales Group Company)

7.12. Index Systems, Inc.

7.13. Ingenico Group, S.A.

7.14. Intelligent Payments Group Ltd.

7.15. Paymetric (A Worldpay Company)

7.16. PayPal, Inc.

7.17. SafeNet, Inc.

7.18. Secure Payment Systems

7.19. Shift4 Payments, LLC.

7.20. SIGNIFYD Inc.

7.21. SISA Information Security Pvt. Ltd.

7.22. TNS Inc.

7.23. TokenEx, LLC

7.24. Total System Services, Inc.

7.25. Trustwave Holdings, Inc.

- GLOBAL PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

- GLOBAL ENCRYPTION SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL TOKENIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL FRAUD DETECTION AND PREVENTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN RETAIL AND COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN TRAVEL AND HOSPITALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN MEDIA AND ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY IN OTHER INDUSTRY LAB MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

- NORTH AMERICAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

- EUROPEAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

- EUROPEAN PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

- ASIA-PACIFIC PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

- REST OF THE WORLD PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

- REST OF THE WORLD PAYMENT SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

- GLOBAL PAYMENT SECURITY MARKET SHARE BY SOLUTION, 2018 VS 2025 (%)

- GLOBAL PAYMENT SECURITY MARKET SHARE BY INDUSTRY, 2018 VS 2025 (%)

- GLOBAL PAYMENT SECURITY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- UK PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- ROE PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD PAYMENT SECURITY MARKET SIZE, 2018-2025 ($ MILLION)