Personal Care Ingredients Market

Global Personal Care Ingredients Market Size, Share & Trends Analysis Report by Ingredients (Rheology Control Agents, Surfactants, Emollients, Conditioning Polymers, Emulsifiers, and Others) and by Application (Hair Care, Oral Care, Skin Care, Cosmetics, and Others) and Forecast 2019-2025

Personal care ingredients refer to the group of chemicals and natural extracts that are used in hair care, skincare, and oral care products. With the growing demand for personal care products, the adoption of personal care ingredients is anticipated to grow significantly during the forecast period. The demand for plant-derived and natural ingredients is growing at a considerable pace, while animal-based ingredients are declining owing to the negative perception of the manufacturing process among consumers. The major factors that are encouraging the market growth include rising per capita income, a significant rise in the personal care industry, and growing R&D investment for personal care ingredients. For instance, in October 2018, Genomatica, Inc., issued $90 million financings in its latest equity offerings. This finance will be used for the development of new commercial chemical production technologies, reinforce the company’s position, and advance existing partnerships as a supplier of personal care ingredients. In addition, this funding will enable the firm to make available Brontide, a bio-based butylene glycol, globally.

Moreover, in January 2019, the company declared commercial production of Brontide butylene glycol. More than 600 tons of high-purity, naturally-sourced Brontide was produced in less than five weeks and packaged in thousands of drums. The company is focusing on meeting the demand for more natural ingredients from personal care industry. The product enables to meet such demand as it has 50% lower global warming potential (GWP), as compared to traditional butylene glycol. As the demand for natural ingredients in personal care products is on the rise, the manufacturers of personal care ingredients are significantly investing in the R&D of ingredients with natural extracts, which in turn, is leading to an increase in the growth of the global personal care ingredients market.

Segment Outlook

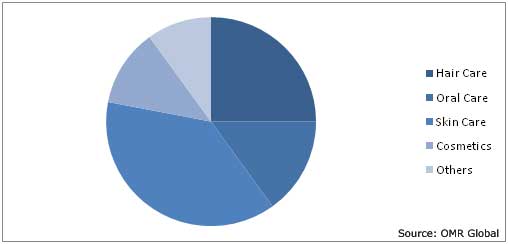

The personal care ingredients market is segmented on the basis of ingredients and application. Based on ingredients, the market is segmented into rheology control agents, surfactants, emollients, conditioning polymers, emulsifiers, and others. Based on application, the market is classified into hair care, oral care, skincare, cosmetics, and others (nail care and toiletries).

Global Personal Care Ingredients Market: By Application Analysis

Among applications, skin care contributes a considerable share in the personal care ingredient market in 2018. This is owing to the significant demand for skincare products, such as creams, lotions, moisturizers, and cleansers. The growing geriatric population is augmenting the adoption of personal grooming products, which is primarily driving the demand for skincare products across the globe. For instance, as per the UN, 1 in every 6 individuals in the world will be age over 65 (16%) by 2050, up from one in 11 in 2019 (9%). Middle aged population is on rise, the manufacturers of skincare products have introduced anti-aging creams that aids to reduce and prevent signs of skin aging. Furthermore, significant R&D investments for skincare products are further driving the demand for more natural ingredients. For instance, L’Oréal has generated nearly $30.8 billion in 2018, of which 39% of its revenue is generated from skincare, 21% from hair care, 19% from makeup, 11% from fragrances, and 10% from hygiene products. The company uses naturally sourced ingredients in their personal care products. Therefore, significant R&D investment is reinforcing the demand for personal care ingredients market.

Global Personal Care Ingredients Market Share by Application, 2018 (%)

Regional Outlook

The global personal care ingredients market is further segmented into North America, Europe, Asia-Pacific, and Rest of the World. The factors that are contributing to the market growth in these regions include R&D investment in personal care products and rising demand for naturally sourced ingredients in cosmetic products.

Global Personal Care Ingredients Market Growth by Region, 2019-2025

Asia-Pacific is anticipated to hold a significant share in the global market

Asia-Pacific accounted for a significant share in the global personal care ingredients market in 2018. The significant presence of the younger population is propelling the growth of personal care industry in the region. For instance, according to International Brand Equity Foundation (IBEF), in fast-moving consumer goods (FMCG), India’s household and personal care is the leading segment, accounting for 50% of the overall market, healthcare (31%), and food & beverages (19%) in terms of market share. The market size of personal care was $3.0 billion in 2000 and reached $12.6 billion in 2018. In India, the share of Hindustan Unilever Ltd. (HUL) in FMCG market (personal care) was 37.4% in 2018. Rising per capita income are some major factors encouraging market growth in the region.

Competitive Landscape

The major players operating in the global personal care ingredient market include BASF SE, The Dow Chemical Co., Evonik Industries AG, Solvay SA, and Koninklijke DSM NV. The market is highly fragmented owing to the presence of several and significant contracts between providers of personal care products and ingredients manufacturers have been reported, which, in turn, helping to leverage their competitive advantage. For instance, in June 2019, DuPont Tate & Lyle Bio Products, Corbion, INOLEX, and ACT Solutions announced a collaboration for the development of a range of personal care product formulations delivering high performance and up to 100% bio-based content. Moreover, significant investment in the production of personal care ingredients is witnessed over the years. For instance, in January 2019, BASF SE declared to invest its operations in South Carolina, US, to enable the production of pearlizers and opacifiers that are used in cosmetic products. Start-up of the new production line is planned for the end of 2019. The addition of capacity will enable the company to meet the rising demand for pearlizers and opacifiers, reduce lead times, and improve supply reliability in North America.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global personal care ingredients market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Dow Chemical Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Evonik Industries AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Solvay SA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Koninklijke DSM NV

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Recent Developments

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Personal Care Ingredients Market by Ingredients

5.1.1. Rheology Control Agents

5.1.2. Surfactants

5.1.3. Emollients

5.1.4. Conditioning Polymers

5.1.5. Emulsifiers

5.1.6. Others (UV Filters and Pearlizers and Opacifiers)

5.2. Global Personal Care Ingredients Market by Application

5.2.1. Hair Care

5.2.2. Oral Care

5.2.3. Skin Care

5.2.4. Cosmetics

5.2.5. Others (Toiletries)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ashland Global Holdings, Inc.

7.2. BASF SE

7.3. Clariant International Ltd.

7.4. Corbion NV

7.5. Croda International PLC

7.6. DuPont de Nemours, Inc.

7.7. Eastman Chemical Co.

7.8. Evonik Industries AG

7.9. Fitz Chem LLC, a company of NAGASE Group

7.10. Galaxy Surfactants Ltd.

7.11. Gattefossé Group

7.12. Genomatica, Inc.

7.13. Huntsman International LLC

7.14. Ingredion Inc.

7.15. Koninklijke DSM NV

7.16. Lonza Group

7.17. Merck KGaA

7.18. Momentive Performance Materials Inc.

7.19. Solvay SA

7.20. Stephenson Group Ltd.

7.21. Symrise AG

7.22. The Dow Chemical Co.

7.23. The Lubrizol Corp.

7.24. Wacker Chemie AG

1. GLOBAL PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2018-2025 ($ MILLION)

2. GLOBAL PERSONAL CARE RHEOLOGY CONTROL AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PERSONAL CARE SURFACTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PERSONAL CARE EMOLLIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL PERSONAL CARE CONDITIONING POLYMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL PERSONAL CARE EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHER PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

9. GLOBAL PERSONAL CARE INGREDIENTS IN HAIR CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PERSONAL CARE INGREDIENTS IN ORAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PERSONAL CARE INGREDIENTS IN SKIN CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL PERSONAL CARE INGREDIENTS IN COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL PERSONAL CARE INGREDIENTS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2018-2025 ($ MILLION)

17. NORTH AMERICAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. EUROPEAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2018-2025 ($ MILLION)

20. EUROPEAN PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. REST OF THE WORLD PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENTS, 2018-2025 ($ MILLION)

25. REST OF THE WORLD PERSONAL CARE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL PERSONAL CARE INGREDIENTS MARKET SHARE BY INGREDIENTS, 2018 VS 2025 (%)

2. GLOBAL PERSONAL CARE INGREDIENTS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL PERSONAL CARE INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PERSONAL CARE INGREDIENTS MARKET SIZE, 2018-2025 ($ MILLION)