Pharmaceutical Drug Delivery System Market

Pharmaceutical Drug Delivery System Market Size, Share & Trends Analysis Report by Route of Administration (Injectable Drug Delivery, Topical Drug Delivery, Pulmonary Drug Delivery, Nasal Drug Delivery, and Others), by Application (Infectious Diseases, Cancer, Cardiovascular Diseases (CVDs), Diabetes, Nervous System Disorders, Respiratory Diseases, and Others), by End-User (Hospitals and Clinics, Ambulatory Surgery Centers (ASCs), Homecare, and Diagnostic Centers) Forecast Period (2025-2035)

Industry Overview

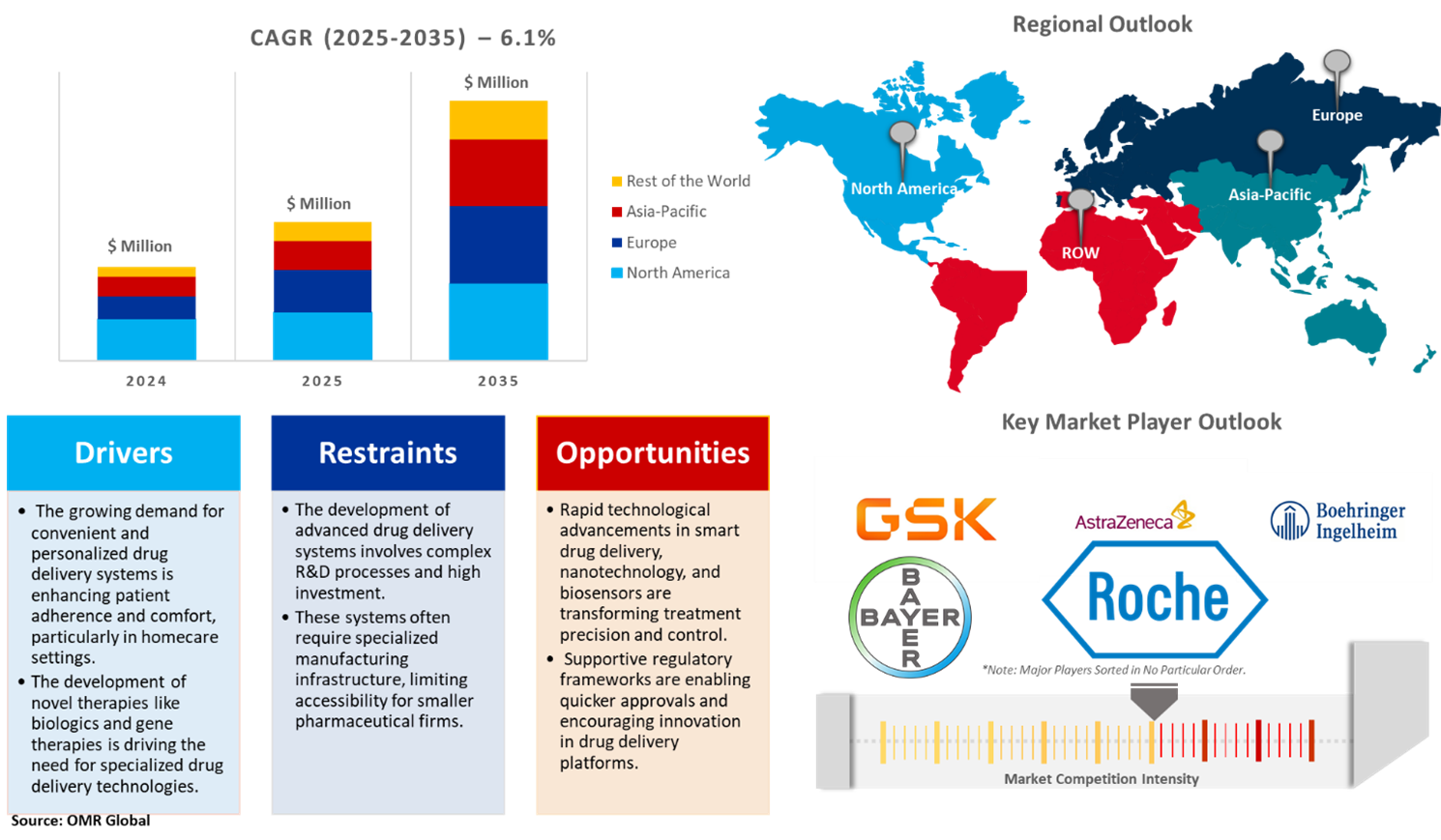

Pharmaceutical drug delivery system market was valued at $1,932.1 billion in 2024 and is projected to reach $3,687.3 billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035. Pivotal factors such as the growing requirement for convenient and economic drug delivery systems, increasing advancements in drug delivery system technology promoting the development of non-invasive & smart drug delivery systems, and the introduction of novel therapies necessitating the use of specialized drug delivery systems are expected to drive market growth. Further, the growing support for regulatory organizations in terms of faster approvals & lesser hindrances is also projected to act as an enabler for the pharmaceutical drug delivery systems market to expand. For instance, in September 2023, Enable Injections, Inc. announced that the FDA has approved the EMPAVELI Injector (enFuse) for the subcutaneous delivery of EMPAVELI (pegcetacoplan) for adults with paroxysmal nocturnal hemoglobinuria (PNH).

Market Dynamics

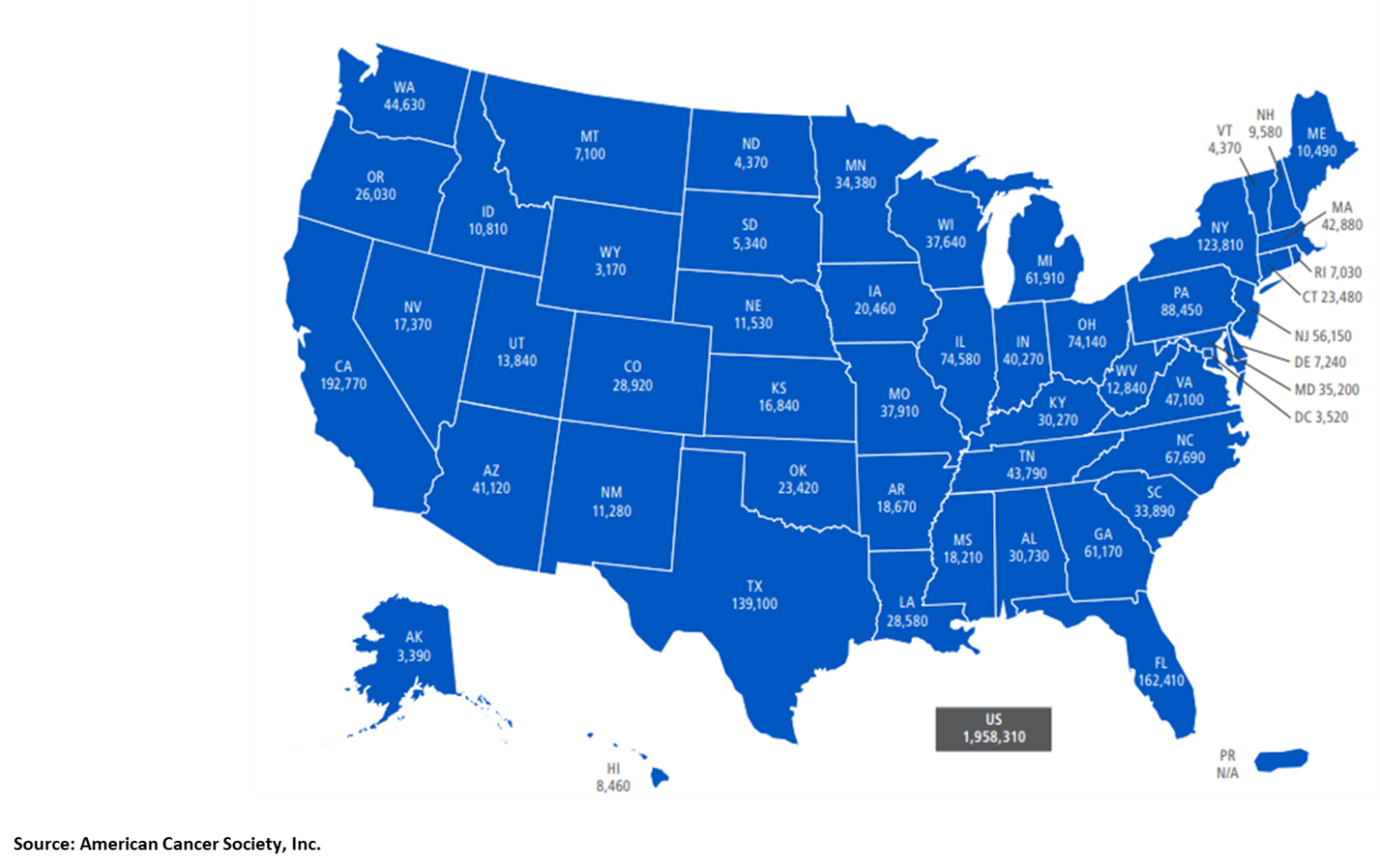

Rising Prevalence of Chronic Diseases Driving Demand for Advanced Drug Delivery Systems

Chronic conditions such as cancer, chronic respiratory problems, and diabetes are leading causes of death across OECD countries, but they can also lead to significant disabilities. This growing disease has amplified the need for innovative pharmaceutical drug delivery systems that can enhance therapeutic effectiveness, minimize side effects, and improve patient compliance. Advanced delivery platforms, such as inhalers for respiratory conditions, insulin pumps for diabetes, and nanocarriers for targeted cancer therapy, are essential tools in managing chronic diseases more efficiently. As a result, the rising prevalence of chronic conditions continues to drive demand for sophisticated drug-delivery technologies that support long-term disease management and improve patient outcomes.

Number of New Cancer Cases for 2023

The Rise of Precision Medicine and Personalized Delivery

In precision medicine, drugs are tailor-made for disease prevention and treatment, taking into account the differences in environments, lifestyles, and genes of people. It aims to accurately provide the right treatments to the right patients at the right time by understanding the molecular or cellular characteristics of the patient’s genetics, allowing for more precise strategies in diagnosis, treatment of diseases, and prevention. Focusing on the variability of patients, enhances the efficiency of drugs and medical care, leading to better treatment and healthcare options. Novel drug delivery systems are a step forward from precision medicine and are customized for individual patient needs. It helps maximize the potential and minimize the side effects of drug treatments in a targeted and controlled manner through various technologies such as:

- Nanotechnology

- 3D Printing

- AI-Powered Drug Delivery System

- Smart and Responsive Drug Delivery System

Market Segmentation

- Based on the route of administration, the market is segmented into injectable drug delivery, topical drug delivery, pulmonary drug delivery, nasal drug delivery, and others.

- Based on the application, the market is segmented into infectious diseases, cancer, cardiovascular diseases (CVDS), diabetes, nervous system disorders, respiratory diseases, and others.

- Based on the end-user, the market is segmented into hospitals and clinics, ambulatory surgery centers (Ascs), home care, and diagnostic centers.

Hospitals and Clinics Segment to Lead the Market with the Largest Share

The growing number of patient admissions, particularly for palliative care which requires consistent medication administration, contributes to the expansion of the hospitals and clinics segment in the the market. According to the Australian Institute of Health and Welfare, in 2021–22, there were 11.6 million hospitalizations across Australia, including 94,800 hospitalizations where palliative care was provided during all or part of the episode of care. More than half of these hospitalizations (54% or 51,300) had a care type of palliative care (referred to as primary palliative care hospitalization), while 43,500 had a diagnosis of palliative care but the type of care delivered was not recorded as palliative care (referred to as other palliative care hospitalization). This equates to 19.9 primary palliative care hospitalizations per 10,000 population and 16.9 other palliative care hospitalizations per 10,000 population, respectively.

Injectable Drug Delivery: A Key Segment in Market Growth

Injectable drug delivery devices are critical tools in the modern healthcare landscape. These devices ensure the accurate administration of medications directly into the bloodstream, muscles, or tissues, bypassing the digestive system. This method enhances the drug's effectiveness and allows for rapid onset of action, a crucial factor for managing acute conditions such as infections, chronic diseases, and autoimmune disorders. Pharmaceutical companies are improving the delivery and packaging of these injectables and making them more efficient and user-friendly. In January 2025, SCHOTT Pharma launched the SCHOTT TOPPAC infuse polymer syringes, a system designed to improve safety, efficiency, and sustainability in healthcare. Developed with SCHOTT Pharma's Alliance to Zero partners, Schreiner MediPharm and Körber Pharma, the system consists of a new cap, a functional label, and a carton packaging.

Regional Outlook

The global pharmaceutical drug delivery system market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Region Dominates the Market with Major Share

North America is expected to dominate the global pharmaceutical drug delivery system market. The dominant share of the region is attributed to well-developed healthcare infrastructure, significant growth in biologics in the pharmaceutical market, and the presence of key players across the regions such as 3M Co., Baxter International, Inc., and Boston Scientific Corp., among others. In June 2024, Bionova Scientific, a US-based biologics contract development and manufacturing organization (CDMO) within the Asahi Kasei Group, announced plans to establish a new facility in Texas. This expansion aims to enhance its capabilities in biologics manufacturing, contributing to the pharmaceutical drug delivery system market.

Asia Pacific is the fastest-growing regional market.

Asia-Pacific is expected to register the fastest growth in the global pharmaceutical drug delivery system market over the forecast period. This rapid growth is primarily attributed to the increasing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, as well as the rising geriatric population, which is more susceptible to such conditions. Countries such as India, China, Indonesia, and South Korea are at the forefront of this growth due to ongoing investments in healthcare infrastructure, expanding pharmaceutical manufacturing capabilities, and government support for local drug development. China is becoming a digital transformation powerhouse for biopharma enterprises. Local and multinational biopharma companies in China are expanding their investment and application scenarios for digital technology. China is emerging as a global frontrunner in patenting AI technologies for drug discovery, particularly in the field of compound screening. This trend reflects the country’s growing emphasis on pharmaceutical innovation and its strategic push to leverage AI in healthcare and life sciences. According to the World Intellectual Property Organization (WIPO), China has filed over 38,000 generative AI patent applications between 2014 and 2023, far outpacing other nations. While this figure covers various sectors, a significant portion is dedicated to AI applications in drug development and compound screening.

Market Players Outlook

The major companies operating in the global pharmaceutical drug delivery system market include GlaxoSmithKline PLC, AstraZeneca PLC, Boehringer Ingelheim International GmbH, Bayer AG, F. Hoffmann-La Roche Ltd. among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In September 2023, SCHOTT Pharma continued to expand its production capacity in Germany to meet the growing demand for drug delivery systems, which are part of the strong-margin high-value solutions.

- In April 2022, Halozyme Therapeutics’ acquisition of Antares Pharma for approximately $960 million marked a significant development in the pharmaceutical drug delivery space. The merger combined Halozyme’s expertise in drug delivery, particularly its ENHANZE technology platform with Antares’ best-in-class auto-injector platform and proprietary commercial products.

- In June 2021, The FDA approved Bayer’s Astepro allergy nasal spray for over-the-counter use. The product is the first steroid-free antihistamine nasal spray for allergy relief to be authorized for OTC use in the US.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical drug delivery system market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Pharmaceutical Drug Delivery System Market Sales Analysis – Route of Administration | Application | End-User ($ Million)

• Pharmaceutical Drug Delivery System Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Pharmaceutical Drug Delivery System Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Pharmaceutical Drug Delivery System Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Pharmaceutical Drug Delivery System Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Pharmaceutical Drug Delivery System Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Pharmaceutical Drug Delivery System Market Revenue and Share by Manufacturers

• Pharmaceutical Drug Delivery System Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. GlaxoSmithKline PLC

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. AstraZeneca PLC

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Boehringer Ingelheim International GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Bayer AG

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. F. Hoffmann-La Roche Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Pharmaceutical Drug Delivery System Market by Route of Administration ($ Million)

5.1. Injectable Drug Delivery

5.2. Topical Drug Delivery

5.3. Pulmonary Drug Delivery

5.4. Nasal Drug Delivery

5.5. Others (Ocular Drug Delivery)

6. Global Pharmaceutical Drug Delivery System Market by Application ($ Million)

6.1. Infectious Diseases

6.2. Cancer

6.3. Cardiovascular Diseases (CVDs)

6.4. Diabetes

6.5. Nervous System Disorders

6.6. Respiratory Diseases

6.7. Others (Autoimmune Disorders)

7. Global Pharmaceutical Drug Delivery System Market by End-User ($ Million)

7.1. Hospitals and Clinics

7.2. Ambulatory Surgery Centers (ASCs)

7.3. Homecare

7.4. Diagnostic Centers

8. Regional Analysis

8.1. North American Pharmaceutical Drug Delivery System Market Sales Analysis – Route of Administration | Application | End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Pharmaceutical Drug Delivery System Market Sales Analysis – – Route of Administration | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Pharmaceutical Drug Delivery System Market Sales Analysis – Route of Administration | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Pharmaceutical Drug Delivery System Market Sales Analysis – Route of Administration | Application | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Acorda Therapeutics Inc.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Adare Pharma Solutions

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Amgen Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Antares Pharma, Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. AptarGroup, Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Baxter International, Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Becton, Dickinson, and Co.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. BMC Medical Co. Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Boston Scientific Corp.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Constantia Flexibles

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Johnson & Johnson

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Koninklijke Philips N.V.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Medtronic PLC

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Merck KGaA

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Mylan N.V.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Novartis AG

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Omron Healthcare Inc.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Pfizer, Inc.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. SAE Media Group

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. SCHOTT Pharma

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

1. Global Pharmaceutical Drug Delivery System Market Research And Analysis By Route Of Administration, 2024-2035 ($ Million)

2. Global Injectable Pharmaceutical Drug Delivery System Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Topical Pharmaceutical Drug Delivery System Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Pulmonary Pharmaceutical Drug Delivery System Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Nasal Pharmaceutical Drug Delivery System Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Routes For Pharmaceutical Drug Delivery Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Pharmaceutical Drug Delivery System Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Pharmaceutical Drug Delivery For Infectious Diseases Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Pharmaceutical Drug Delivery For Cancer Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Pharmaceutical Drug Delivery For CVD Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Pharmaceutical Drug Delivery For Diabetes Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Pharmaceutical Drug Delivery For Nervous System Disorders Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Pharmaceutical Drug Delivery For Respiratory Diseases Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Pharmaceutical Drug Delivery For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Pharmaceutical Drug Delivery System Market Research And Analysis By End-User, 2024-2035 ($ Million)

16. Global Pharmaceutical Drug Delivery In Hospitals And Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Pharmaceutical Drug Delivery In ASC Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Pharmaceutical Drug Delivery In Homecare Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Pharmaceutical Drug Delivery In Diagnostic Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Pharmaceutical Drug Delivery System Market Research And Analysis By Geography, 2024-2035 ($ Million)

21. North American Pharmaceutical Drug Delivery System Market Research And Analysis By Country, 2024-2035 ($ Million)

22. North American Pharmaceutical Drug Delivery System Market Research And Analysis By Route Of Administration, 2024-2035 ($ Million)

23. North American Pharmaceutical Drug Delivery System Market Research And Analysis By Application, 2024-2035 ($ Million)

24. North American Pharmaceutical Drug Delivery System Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. European Pharmaceutical Drug Delivery System Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European Pharmaceutical Drug Delivery System Market Research And Analysis By Route Of Administration, 2024-2035 ($ Million)

27. European Pharmaceutical Drug Delivery System Market Research And Analysis By Application, 2024-2035 ($ Million)

28. European Pharmaceutical Drug Delivery System Market Research And Analysis By End-User, 2024-2035 ($ Million)

29. Asia-Pacific Pharmaceutical Drug Delivery System Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Pharmaceutical Drug Delivery System Market Research And Analysis By Route Of Administration, 2024-2035 ($ Million)

31. Asia-Pacific Pharmaceutical Drug Delivery System Market Research And Analysis By Application, 2024-2035 ($ Million)

32. Asia-Pacific Pharmaceutical Drug Delivery System Market Research And Analysis By End-User, 2024-2035 ($ Million)

33. Rest Of The World Pharmaceutical Drug Delivery System Market Research And Analysis By Route Of Administration, 2024-2035 ($ Million)

34. Rest Of The World Pharmaceutical Drug Delivery System Market Research And Analysis By Application, 2024-2035 ($ Million)

35. Rest Of The World Pharmaceutical Drug Delivery System Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Pharmaceutical Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

2. Global Injectable Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

3. Global Topical Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

4. Global Pulmonary Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

5. Global Nasal Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

6. Global Other Drug Delivery System Market Share By Route Of Administration, 2024 Vs 2035 (%)

7. Global Pharmaceutical Drug Delivery System Market Share By Application, 2024 Vs 2035 (%)

8. Global Pharmaceutical Drug Delivery System For Infectious Diseases Market Share By Application, 2024 Vs 2035 (%)

9. Global Pharmaceutical Drug Delivery System For Cardiovascular Diseases (CVDS) Market Share By Application, 2024 Vs 2035 (%)

10. Global Pharmaceutical Drug Delivery System For Diabetes Market Share By Application, 2024 Vs 2035 (%)

11. Global Pharmaceutical Drug Delivery System For Nervous System Disorders Market Share By Application, 2024 Vs 2035 (%)

12. Global Pharmaceutical Drug Delivery System For Respiratory Diseases Market Share By Application, 2024 Vs 2035 (%)

13. Global Pharmaceutical Drug Delivery System For Others Market Share By Application, 2024 Vs 2035 (%)

14. Global Pharmaceutical Drug Delivery System Market Share By End-User, 2024 Vs 2035 (%)

15. Global Pharmaceutical Drug Delivery System For Hospitals And Clinics Market Share By End-User, 2024 Vs 2035 (%)

16. Global Pharmaceutical Drug Delivery System For Ambulatory Surgery Centers (ASCS) Market Share By End-User, 2024 Vs 2035 (%)

17. Global Pharmaceutical Drug Delivery System For Homecare Market Share By End-User, 2024 Vs 2035 (%)

18. Global Pharmaceutical Drug Delivery System For Diagnostic Centers Market Share By End-User, 2024 Vs 2035 (%)

19. Global Pharmaceutical Drug Delivery System Market Share By Geography, 2024 Vs 2035 (%)

20. US Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

21. Canada Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

22. UK Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

23. France Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

24. Germany Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

25. Italy Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

26. Spain Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

27. Rest of Europe Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

28. India Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

29. China Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

30. Japan Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

31. South Korea Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

32. Australia and New Zealand Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

33. ASEAN Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

34. Rest Of Asia-Pacific Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

35. Latin America Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

36. Middle East and Africa Pharmaceutical Drug Delivery System Market Size, 2024–2035 ($ Million)

FAQS

The size of the Pharmaceutical Drug Delivery System market in 2024 is estimated to be around $1,932.1 billion.

North America holds the largest share in the Pharmaceutical Drug Delivery System market.

Leading players in the Pharmaceutical Drug Delivery System market include GlaxoSmithKline PLC, AstraZeneca PLC, Boehringer Ingelheim International GmbH, Bayer AG, F. Hoffmann-La Roche Ltd. among others.

Pharmaceutical Drug Delivery System market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Rising chronic diseases, demand for targeted therapies, and advancements in drug delivery technologies are driving the pharmaceutical drug delivery system market growth.