Pipeline Security System Market

Pipeline Security System Market Size, Share & Trends Analysis Report by Product (Natural Gas, Crude Oil, and Hazardous Liquid Pipelines/ Chemicals), by Solution (SCADA System, Perimeter Security/ Intruder Detection System, Industrial Control Systems Security, Video Surveillance & GIS Mapping, and Pipeline Monitoring) Forecast Period (2024-2031)

Pipeline security system market is anticipated to grow at a significant CAGR of 9.1% during the forecast period (2024-2031). The pipeline security system detects all the potential threats and provides the security personnel with the exact location of the threat in a pipeline. The growing construction of pipelines and increasing investment in the safety of these pipelines to avoid security threats are the key factors driving the global market growth. The high cost of this system may restrain its market growth.

Market Dynamics

Growing Demand for Energy to Fuel Global Market

According to the US Energy Information Administration (EIA), the global energy demand is expected to reach 681 quadrillions BTU by the year 2040. The increasing demand for natural gas production and supply globally to gain a reduction in carbon emission is demanding the need for pipeline security systems. According to the American Petroleum Institute, the US has over 190,000 miles of liquid petroleum pipelines. The efficient monitoring and control of this massive oil pipeline network is required which in turn drives the global market growth.

Growing Expansion of Pipeline Networks

With the increasing expansion of pipeline networks globally, especially in developing economies, the demand for pipeline security systems is also growing. According to the National Institute of Health (gov.) in August 2023, the aging and development of the globe's pipeline network has placed more regulatory pressure on pipeline safety and dependability. The Pipeline and Hazardous Materials Safety Administration (PHMSA) reports that there have been 1,052 excavation damage occurrences in the US, resulting in 1.5 billion in economic loss and 183 fatalities. The pipeline infrastructure needs to be timely and continuously inspected to maintain high standards of safety, dependability, and compliance with national and state regulatory requirements. Such a regulatory framework further supports global market growth

Market Segmentation

Our in-depth analysis of the global pipeline security system market includes the following segments by product and solution:

- Based on product, the market is sub-segmented into natural gas, crude oil, and hazardous liquid pipelines/ chemicals

- Based on solution, the market is sub-segmented into SCADA systems, perimeter security/ intruder detection systems, industrial control systems security, video surveillance & GIS mapping, and pipeline monitoring

SCADA Holds a Major Share in the Global Market

Based on the solution, the global pipeline security system market is sub-segmented into SCADA systems, perimeter security/ intruder detection systems, industrial control systems security, video surveillance & GIS mapping, and pipeline monitoring. SCADA system holds a major share based on the solution. Supervisory control and data acquisition (SCADA) is a system that uses technology hardware and software to monitor and control oil and gas pipelines. SCADA systems use sensors to monitor parameters like pressure, flow rate, temperature, and level. The growing demand for monitoring pipelines to find any leak or break is a key contributor to the high share of this market segment.

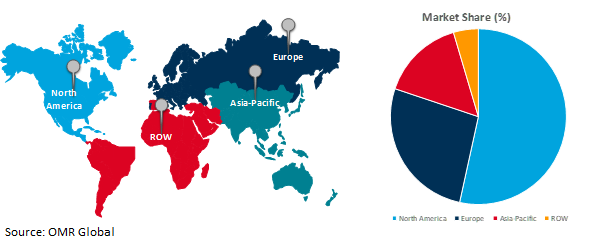

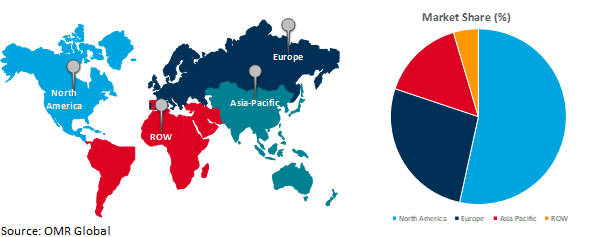

Regional Outlook

The global pipeline security system market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

High Investment in Pipeline Network across Asia-Pacific

- China is home to the largest pipeline networks in various stages of development, including the Anhui Gas Pipeline Network and the Guizhou Gas Pipeline Network. Through its 14th Five-Year Plan, the republic intends to double the length of gas transmission pipelines by 2025, largely through expanding provincial networks.

- In January 2024, India Launched Bidding Process for Key Gas Pipeline to Landlocked Kashmir Valley. The 325-kilometer pipeline, estimated to cost billions, will introduce clean-burning natural gas to the valley, connecting to a 175-kilometer pipeline under construction by GAIL, aimed to revolutionize energy access and supply.

Global Pipeline Security System Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share owing to high investment in the security of oil & gas pipelines. The presence of long gas pipelines along with increasing investment in the development of new pipelines is further aiding the regional market share. Global Energy Meter Europe Gas Tracker shows that as of the end of February 2022, the EU was planning a 24.9% capacity increase to 160.2 billion cubic meters per year (bcm/y). The estimated cost of this expansion is €26.4 billion ($27.8 billion) (€14.1 billion ($14.8 billion) for new gas import pipelines, and €12.3 billion ($12.9 billion) for new LNG import terminals). 16 gas pipelines under construction amount to a total length of 3,200 kilometers (km) and cost of €6.5 billion ($6.8 billion). Of this, €2.1 billion (2.2 billion) is allocated to the 613-km Baltic Pipe Project, which is set to increase gas import capacity into the EU by 10 bcm/y from January 1, 2023. There are four LNG import terminals/terminal expansions under construction in the EU with a known capacity of 4.3 bcm/y and costing €987 million.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global pipeline security system market include ABB Ltd., General Electric Company, Honeywell International Inc., Rockwell Automation, Inc., and Schneider Electric among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, GPT Industries launched a remote pipeline monitoring system, Iso-Smart. the Iso-Smart is a customer-recommended solution for checking Cathodic Protection, Isolation, Bond currents, and more remotely. It uses True RMS technology, and features cellular LTE connectivity, a rechargeable battery, and an intuitive dashboard.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pipeline security system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Rockwell Automation Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Pipeline Security System Market by Product

4.1.1. Natural Gas

4.1.2. Crude Oil

4.1.3. Hazardous Liquid Pipelines/ Chemicals

4.2. Global Pipeline Security System Market by Solution

4.2.1. SCADA System

4.2.2. Perimeter Security/ Intruder Detection System

4.2.3. Industrial Control Systems Security

4.2.4. Video Surveillance & GIS Mapping

4.2.5. Pipeline Monitoring

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Cisco Systems Inc.

6.2. Emerson Electric Co.

6.3. Huawei Technologies Co. Ltd

6.4. ORBCOMM Inc.

6.5. PERMA-PIPE International Holdings, Inc.

6.6. PSI Software SE

6.7. Pure Tech Codex Pvt. Ltd.

6.8. QinetiQ Group

6.9. ROSEN Swiss AG

6.10. Schneider Electric

6.11. Siemens AG

6.12. TechnipFMC plc

6.13. Thales SA

6.14. TransCanada PipeLines Ltd.

6.15. Yokogawa Electric Corp.

1. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL NATURAL GAS PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CRUDE OIL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HAZARDOUS LIQUID PIPELINES/ CHEMICALS PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

6. GLOBAL PIPELINE SECURITY SYSTEM IN SCADA SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PIPELINE SECURITY SYSTEM FOR PERIMETER SECURITY/ INTRUDER DETECTION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PIPELINE SECURITY SYSTEM FOR INDUSTRIAL CONTROL SYSTEMS SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PIPELINE SECURITY SYSTEM FOR VIDEO SURVEILLANCE & GIS MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PIPELINE SECURITY SYSTEM FOR PIPELINE MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

14. NORTH AMERICAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

15. EUROPEAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. EUROPEAN PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION , 2023-2031 ($ MILLION)

21. REST OF THE WORLD PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. REST OF THE WORLD PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

1. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL NATURAL GAS PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL CRUDE OIL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL HAZARDOUS LIQUID PIPELINES/ CHEMICALS PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023 VS 2031 (%)

6. GLOBAL PIPELINE SECURITY SYSTEM FOR SCADA SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL PIPELINE SECURITY SYSTEM FOR PERIMETER SECURITY/ INTRUDER DETECTION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL PIPELINE SECURITY SYSTEM FOR INDUSTRIAL CONTROL SYSTEMS SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL PIPELINE SECURITY SYSTEM FOR VIDEO SURVEILLANCE & GIS MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL PIPELINE SECURITY SYSTEM FOR PIPELINE MONITORINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL PIPELINE SECURITY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

14. UK PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

26. THE MIDDLE EAST & AFRICA PIPELINE SECURITY SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)