Preimplantation Genetic Testing Market

Preimplantation Genetic Testing Market Size, Share & Trends Analysis Report by ProcedureType (Preimplantation Genetic Screening and Preimplantation Genetic Diagnosis), by Technology (Next-Generation Sequencing, Polymerase Chain Reaction, Fluorescence In Situ Hybridization, Comparative Genomic Hybridization and Single-Nucleotide Polymorphism), by Product (Reagents and Consumables, Instruments and Software and Services) by Application (Aneuploidy, Structural Chromosomal Abnormalities, Single Gene Disorders, X-Linked Disorders, HLA Typing and Gender Identification) and by End-User (Fertility Clinics, Hospitals and Diagnostic Laboratories) Forecast Period (2024-2031)

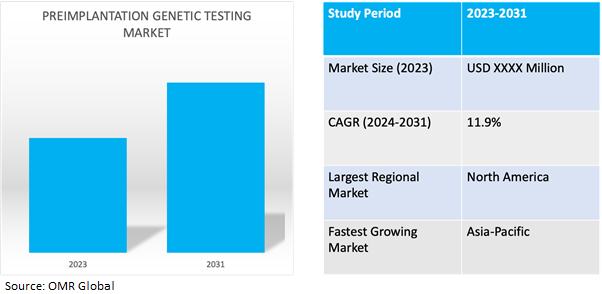

Preimplantation genetic testing market is anticipated to grow at a significant CAGR of 11.9% during the forecast period (2024-2031). Preimplantation genetic testing is a process used during in vitro fertilization (IVF) to screen embryos for genetic abnormalities before they are implanted into the uterus. This screening helps identify embryos that are free from certain genetic disorders or chromosomal abnormalities, allowing healthcare providers to select the healthiest embryos for implantation.

Market Dynamics

Significance of PGT in Enhancing Family Health

The increasing prevalence of genetic disorders including genetic mutations inherited from parents or occurring spontaneously, global aeging population growth, environmental influences such as toxins or radiation, and advancements in diagnostic technologies facilitating earlier detection. Concurrently, the rising demand for Assisted Reproductive Technologies (ART) stems from factors such as increasing infertility rates, changing societal norms, and technological advancements making ART more accessible. These trends intertwine to heighten the importance of PGT in the healthcare landscape, as it offers a proactive approach to identifying and mitigating genetic risks during fertility treatments, addressing the needs of individuals and couples seeking to build healthy families. For instance, in April 2022, Illumina extends financial support to a leading German hospital to enhance the diagnosis of genetic diseases in critically ill children, aiming to elevate diagnostic efficacy and patient care standards.

Rising Demand and Accessibility of Assisted Reproductive Technologies (ART)

The rising demand for Assisted Reproductive Technologies (ART) attributed to the increasing infertility rates globally driving global market. ART procedures, including in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI), have become more accessible and affordable due to advancements in technology and expanded availability.

Market Segmentation

Our in-depth analysis of the global preimplantation genetic testing market includes the following segments by procedure type, technology, product, application and end-user:

- Based on procedure type, the market is sub-segmented into preimplantation genetic screening and preimplantation genetic diagnosis.

- Based on technology, the market is sub-segmented into next-generation sequencing, polymerase chain reaction, fluorescence in situ hybridization, comparative genomic hybridization and single-nucleotide polymorphism.

- Based on product, the market is sub-segmented into reagents and consumables, instruments and software and services.

- Based on application, the market is sub-segmented into aneuploidy, structural chromosomal abnormalities, single gene disorders, x-linked disorders, HLA typing and gender identification.

- Based on end-users, the market is sub-segmented into fertility clinics, hospitals and diagnostic laboratories.

Software and Services is Projected to Emerge as the Largest Segment

Based on the product, the global preimplantation genetic testing market is sub-segmented into reagents and consumables, instruments and software and services. Among these, the software and services sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing adoption of advanced genetic screening technologies. These technologies enhance the accuracy and efficiency of PGT procedures, improving the success rates of in vitro fertilization (IVF) treatments. With rising awareness of genetic disorders and infertility, there's a growing demand for PGT services, prompting healthcare providers to invest in sophisticated software platforms and services.

Polymerase Chain Reaction Sub-segment to Hold a Considerable Market Share

The Polymerase Chain Reaction (PCR) sub-segment is poised to hold a significant market share in the Global PGT Market due to its high accuracy, sensitivity, and wide applicability in genetic testing. With established reliability and versatility, PCR is well-suited for various PGT applications, including PGT-A, PGT-M, and PGT-SR. Additionally, advancements in PCR technology have led to automated platforms capable of high-throughput processing, improving workflow efficiency in PGT procedures. Despite requiring initial investment, PCR offers cost-effective solutions for genetic testing, making it accessible to healthcare providers and fertility clinics worldwide. Overall, the combination of accuracy, reliability, automation capabilities, and cost-effectiveness positions PCR as a key player in the PGT market, retaining a considerable market share.

Regional Outlook

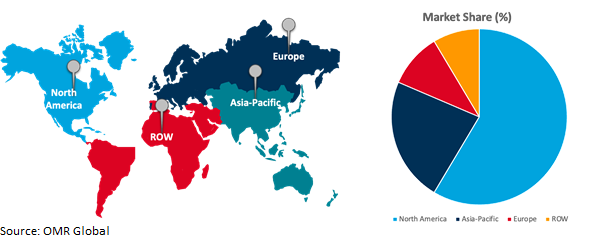

The global preimplantation genetic testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Exhibit the Highest CAGR in the Global Market

Asia-Pacific region is witnessing rapid growth due to the rising infertility rates, attributed to changing lifestyles and delayed childbearing. Growing awareness and acceptance of PGT and ART procedures are encouraging more individuals and couples to seek advanced fertility treatments. Moreover, significant investments in healthcare infrastructure and technological advancements have expanded access to PGT services, supported by government initiatives and policies promoting reproductive health. Rising disposable incomes and advancements in PGT technologies, such as next-generation sequencing (NGS), further contribute to the regional market growth. For instance, in November 2021, Peking Jabrehoo Med Tech Co. Ltd. obtained marketing authorization from the National Medical Products Administration (NMPA) in China for its preimplantation genetic testing for aneuploidy.

Global Preimplantation Genetic Testing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the advanced healthcare infrastructure, including top-tier fertility clinics and genetic testing laboratories, facilitating the seamless integration of PGT technologies into clinical practice. High healthcare expenditure enables widespread access to PGT services and supports ongoing research and development. Technological advancements, such as next-generation sequencing (NGS), enhance the accuracy and efficiency of genetic testing procedures. Stringent regulatory frameworks and reimbursement policies ensure quality standards and financial coverage for patients, fostering confidence among healthcare providers and patients alike.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global preimplantation genetic testing market include F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Labcorp, Agilent Technologies, Inc., Invicta Genetics and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2021, Vitrolifehas acquired Igenomix, a renowned entity based in Spain, specializing in reproductive genetic testing services for IVF clinics. This acquisition underscores Vitrolife's commitment to augmenting its portfolio and global presence, while also fortifying its position as a leader in providing innovative solutions to enhance fertility treatment outcomes.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global preimplantation genetic testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. F. Hoffmann-La Roche Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Thermo Fisher Scientific Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Labcorp

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Preimplantation Genetic Testing Market by Procedure Type

4.1.1. Preimplantation Genetic Screening

4.1.2. Preimplantation Genetic Diagnosis

4.2. Global Preimplantation Genetic Testing Market by Technology

4.2.1. Next-Generation Sequencing

4.2.2. Polymerase Chain Reaction

4.2.3. Fluorescence In Situ Hybridization

4.2.4. Comparative Genomic Hybridization

4.2.5. Single-Nucleotide Polymorphism

4.3. Global Preimplantation Genetic Testing Market by Product

4.3.1. Reagents and Consumables

4.3.2. Instruments

4.3.3. Software and Services

4.4. Global Preimplantation Genetic Testing Market by Application

4.4.1. Aneuploidy

4.4.2. Structural Chromosomal Abnormalities

4.4.3. Single Gene Disorders

4.4.4. X-Linked Disorders

4.4.5. HLA Typing

4.4.6. Gender Identification

4.5. Global Preimplantation Genetic Testing Market by End-User

4.5.1. Fertility Clinics

4.5.2. Hospitals

4.5.3. Diagnostic Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middel East & Africa

6. Company Profiles

6.1. Abbott Laboratories (Abbott.)

6.2. Agilent Technologies, Inc.

6.3. Beijing Genomics Institute (BGI Group)

6.4. Bioarray S.L.

6.5. California Pacific Medical Center (Indian Health Center of Santa Clara Valley)

6.6. Coopersurgical (CooperSurgical Inc.)

6.7. Genea Pty Ltd.

6.8. Illumina

6.9. Invicta Genetics

6.10. Invitae Corp.

6.11. Laboratory Corporation of America Holdings (Labcorp)

6.12. Natera

6.13. Oxford Gene Technology

6.14. PerkinElmer Inc.

6.15. Progenesis Fertility Center

6.16. Quest Diagnostics Incorporated

6.17. Reproductive Genetic Innovations, LLC

6.18. Scigene

6.19. YikonGenomics

1. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PROCEDURE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PREIMPLANTATION GENETIC SCREENINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PREIMPLANTATION GENETIC DIAGNOSISMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL NEXT-GENERATION SEQUENCING PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALPOLYMERASE CHAIN REACTION BASED PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FLUORESCENCE IN SITU HYBRIDIZATION BASED PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL COMPARATIVE GENOMIC HYBRIDIZATION BASED PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COMPARATIVE GENOMIC HYBRIDIZATION BASED PREIMPLANTATION GENETIC TESTING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

11. GLOBAL REAGENTS AND CONSUMABLES IN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INSTRUMENTS IN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SOFTWARE AND SERVICES IN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. GLOBAL PREIMPLANTATION GENETIC TESTING FOR ANEUPLOIDYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL PREIMPLANTATION GENETIC TESTING FOR STRUCTURAL CHROMOSOMAL ABNORMALITIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL PREIMPLANTATION GENETIC TESTING FOR SINGLE GENE DISORDERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL PREIMPLANTATION GENETIC TESTING FOR X-LINKED DISORDERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL PREIMPLANTATION GENETIC TESTING FOR HLA TYPINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL PREIMPLANTATION GENETIC TESTING FOR GENDER IDENTIFICATIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. GLOBAL PREIMPLANTATION GENETIC TESTING FOR FERTILITYCLINICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL PREIMPLANTATION GENETIC TESTING FOR HOSPITALSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL PREIMPLANTATION GENETIC TESTING FOR DIAGNOSTIC LABORATORIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. NORTH AMERICAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. NORTH AMERICAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PROCEDURE TYPE, 2023-2031 ($ MILLION)

28. NORTH AMERICAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

29. NORTH AMERICAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PRODUCT,2023-2031 ($ MILLION)

30. NORTH AMERICAN PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

31. NORTH AMERICAN PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

32. EUROPEAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. EUROPEAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PROCEDURE TYPE, 2023-2031 ($ MILLION)

34. EUROPEAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

35. EUROPEAN PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

36. EUROPEAN PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

37. EUROPEAN PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

38. ASIA-PACIFIC PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

39. ASIA-PACIFICPREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PROCEDURE TYPE, 2023-2031 ($ MILLION)

40. ASIA-PACIFICPREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

41. ASIA-PACIFICPREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

42. ASIA-PACIFICPREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

43. ASIA-PACIFICPREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

44. REST OF THE WORLD PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

45. REST OF THE WORLD PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PROCEDURE TYPE, 2023-2031 ($ MILLION)

46. REST OF THE WORLD PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

47. REST OF THE WORLD PREIMPLANTATION GENETIC TESTINGMARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

48. REST OF THE WORLD PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

49. REST OF THE WORLD PREIMPLANTATION GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKETSHARE BY PROCEDURE TYPE, 2023 VS 2031 (%)

2. GLOBAL PREIMPLANTATION GENETIC SCREENING MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PREIMPLANTATION GENETIC DIAGNOSIS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKET SHAREBY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL NEXT-GENERATION SEQUENCING BASED PREIMPLANTATION GENETIC TESTINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALPOLYMERASE CHAIN REACTION BASED PREIMPLANTATION GENETIC TESTINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL FLUORESCENCE IN SITU HYBRIDIZATION BASED PREIMPLANTATION GENETIC TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL COMPARATIVE GENOMIC HYBRIDIZATION BASED PREIMPLANTATION GENETIC TESTING FOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PREIMPLANTATION GENETIC TESTING FOR SINGLE-NUCLEOTIDE POLYMORPHISMMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKET SHAREBY PRODUCT, 2023 VS 2031 (%)

11. GLOBAL REAGENTS AND CONSUMABLES IN PREIMPLANTATION GENETIC TESTINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INSTRUMENTS INPREIMPLANTATION GENETIC TESTINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SOFTWARE AND SERVICES IN PREIMPLANTATION GENETIC TESTINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

15. GLOBAL PREIMPLANTATION GENETIC TESTING FOR ANEUPLOIDYMARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL PREIMPLANTATION GENETIC TESTING FOR STRUCTURAL CHROMOSOMAL ABNORMALITIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL PREIMPLANTATION GENETIC TESTING FOR SINGLE GENE DISORDERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL PREIMPLANTATION GENETIC TESTING FOR X-LINKED DISORDERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL PREIMPLANTATION GENETIC TESTING FOR HLA TYPINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL PREIMPLANTATION GENETIC TESTING FOR GENDER IDENTIFICATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL PREIMPLANTATION GENETIC TESTING MARKET SHAREBY END-USER, 2023 VS 2031 (%)

22. GLOBAL PREIMPLANTATION GENETIC TESTING FOR FERTILITY CLINICSMARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL PREIMPLANTATION GENETIC TESTING FOR HOSPITALSMARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL PREIMPLANTATION GENETIC TESTING FOR DIAGNOSTIC LABORATORIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL PREIMPLANTATION GENETIC TESTINGMARKETSHARE BY REGION, 2023 VS 2031 (%)

26. US PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

27. CANADA PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

28. UK PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

29. FRANCE PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

30. GERMANY PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

31. ITALY PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

32. SPAIN PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF EUROPE PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

34. INDIA PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

35. CHINA PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

36. JAPAN PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

37. SOUTH KOREA PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

38. REST OF ASIA-PACIFIC PREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

39. LATIN AMERICAPREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)

40. MIDDLE EAST AND AFRICAPREIMPLANTATION GENETIC TESTINGMARKET SIZE, 2023-2031 ($ MILLION)