Quantum Cryptography Market

Global Quantum Cryptography Market Size, Share & Trends Analysis Report, By Component (Solutions and Services), By Application (Application Security, Network Security, and Others), By Vertical (BFSI, Telecom & IT, Government and Defense, Retail, Healthcare, and Others) and Forecast, 2020-2026

The global quantum cryptography market is estimated to witness potential growth during the forecast period. The major factors contributing to the market growth include rising investment in cybersecurity and increasing adoption of advanced security solutions. The governments across the countries are suffering from the increasing number of cyberattacks in several sectors including military, government, and BFSI. The increasing internet penetration, technological advancement and the rising adoption of IoT devices in varied domain creates significant demand for cybersecurity. The rise in internet penetration also creates concerns about cyber-attacks. According to the Australian Cyber Security Centre (ACSC) survey, in 2016, around 90% of the organizations faced some form of attempted or successful cybersecurity compromise in 2016.

An estimated 60% of the organizations have experienced tangible impacts on their businesses due to these attacks. However, the survey had shown that 71% of the organizations reported a cybersecurity incident response plan which was more than 60% in 2015. It shows the awareness among the organizations towards cybersecurity that drives the cybersecurity market in Australia. In 2016, the Australian Government launched the Cyber Security Strategy which comprises investments of over $230 million across five action themes up to 2020. This includes a cyber smart nation, global responsibility and influence, stronger cyber defenses, growth and innovation, global responsibility and influence, and national cyber partnership.

This investment complements the significant investment in cybersecurity outlined in 2016, Defence White Paper, boosting Defence cyber capabilities by $400 million over the next decade. This leads to increasing demand for quantum cryptography, also referred to as quantum encryption, that employs quantum mechanics principles for encryption of messages in a way that it is unreadable by anyone outside of the intended recipient. A quantum computer is used to conduct these activities, which have a huge computing power for data encryption and decryption. It creates secure communication by offering security-based on physics fundamental laws rather than computing technologies or mathematical algorithms used today. However, some quantum cryptography systems are vulnerable to hacking, which in turn, is a major restricting factor for the market growth. Advances in quantum cryptography are expected to offer an opportunity for the global quantum cryptography market.

Market Segmentation

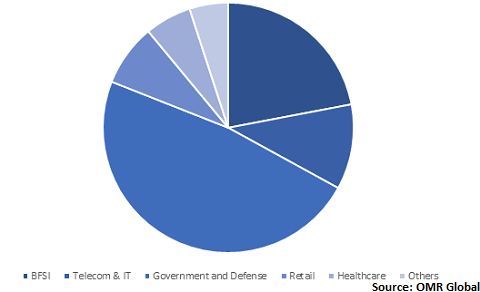

The global quantum cryptography market is classified into the component, application, and vertical. Based on the component, the market is classified into solutions and services. Based on application, the market is classified into application security, network security, and others. Based on vertical, the market is classified into BFSI, telecom & IT, government and defense, retail, healthcare, and others.

BFSI is anticipated to witness significant growth in the market during the forecast period

Banks are one of the major targets of hackers. The banks are constantly facing security threats, with customers having money stolen from their accounts. Increasing demand for online banking has increased the need for cybersecurity. Therefore, banks are actively working to safeguard sensitive data which generates at every point in the process, whether through apps, mobile devices or with their internal network or through websites. They are also focusing on increasing levels of protection to databases with the transaction and key customer details that the criminals are looking for and to protect themselves against financial crashes and market vulnerability.

Quantum cryptography will allow banks to transfer data which is nearly unhackable over a quantum network. It uses a system known as quantum key distribution (QKD) which ensures encrypted messages and its keys are transmitted separately. Barclays and JP Morgan Chase (JPMC) are among the banks that are experimenting with quantum computing to improve performance modeling and accelerate risk mitigation.

Global Quantum Cryptography Market Share by Vertical, 2019 (%)

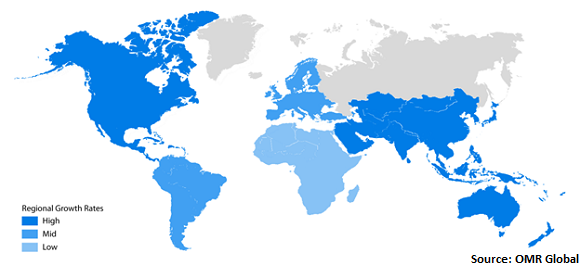

Regional Outlook

Geographically, the market is segmented into four regions including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America is expected to hold a considerable share in the market owing to the increasing spending on cybersecurity in the region. In the President’s Budget of 2019, $15 billion is intended for cybersecurity-related tasks, which is a $583.4 million (4.1%) rise from 2018. In particular, the Department of Defense (DOD) reported $8.5 billion in 2019 for cybersecurity funding, a rise of $340 million (4.2%) from 2018. This significant rise in cybersecurity is encouraging the demand for quantum cryptography tools and funding opportunity for quantum technologies in the region.

Global Quantum Cryptography Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include SK Telecom Co., Ltd., Qubitekk, Inc., Infineon Technologies AG, IBM Corp., and NEC Corp. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in May 2020, SK Telecom and ID Quantique declared the first 5G smartphone globally equipped with a Quantum Random Number Generator (QRNG) chipset. This QRNG chipset has been integrated into the ‘Galaxy A Quantum’, a custom edition of the Samsung Galaxy A71 5G smartphone commercialized by SK Telecom.

SK Telecom, Samsung, and ID Quantique collaborated to launch a custom edition of the Galaxy A71 5G – the Galaxy A Quantum, first QRNG-powered 5G smartphone. QRNG chips are used as an advanced security tool designed for the protection of consumers’ sensitive information. The launch of Galaxy A Quantum will allow consumers to experience the benefits of quantum security technologies and utilize selected services in a safe and secure manner by generating true random numbers that cannot be hacked.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global quantum cryptography market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. SK Telecom Co., Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Qubitekk, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Infineon Technologies AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. IBM Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. NEC Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Quantum Cryptography Market by Component

5.1.1. Solutions

5.1.2. Services

5.2. Global Quantum Cryptography Market by Application

5.2.1. Application Security

5.2.2. Network Security

5.2.3. Others

5.3. Global Quantum Cryptography Market by Vertical

5.3.1. BFSI

5.3.2. Telecom & IT

5.3.3. Government and Defense

5.3.4. Retail

5.3.5. Healthcare

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AUREA Technology

7.2. Crypta Labs

7.3. D-Wave Systems Inc.

7.4. Hewlett-Packard Development Company, L.P. (HP)

7.5. IBM Corp.

7.6. ID Quantique SA (SK Telecom Co., Ltd.)

7.7. Infineon Technologies AG

7.8. Isara Corp.

7.9. MagiQ Technologies, Inc.

7.10. Microsoft Corp.

7.11. Mitsubishi Electric Corp.

7.12. NEC Corp.

7.13. NuCrypt, LLC

7.14. PQ Solutions Ltd.

7.15. Quantum Xchange

7.16. QuantumCTek Co., Ltd.

7.17. Qubitekk, Inc.

7.18. QuintessenceLabs Pty. Ltd.

7.19. Qunu Labs Pvt.LTD

7.20. qutools GmbH

7.21. Toshiba Corp.

1. GLOBAL QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

2. GLOBAL QUANTUM CRYPTOGRAPHY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL QUANTUM CRYPTOGRAPHY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL QUANTUM CRYPTOGRAPHY IN APPLICATION SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL QUANTUM CRYPTOGRAPHY IN NETWORK SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL QUANTUM CRYPTOGRAPHY IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

9. GLOBAL QUANTUM CRYPTOGRAPHY IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL QUANTUM CRYPTOGRAPHY IN TELECOM & IT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL QUANTUM CRYPTOGRAPHY IN GOVERNMENT & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL QUANTUM CRYPTOGRAPHY IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL QUANTUM CRYPTOGRAPHY IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL QUANTUM CRYPTOGRAPHY IN OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

18. NORTH AMERICAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. NORTH AMERICAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

20. EUROPEAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

22. EUROPEAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. EUROPEAN QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

28. REST OF THE WORLD QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

29. REST OF THE WORLD QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. REST OF THE WORLD QUANTUM CRYPTOGRAPHY MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL QUANTUM CRYPTOGRAPHY MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

2. GLOBAL QUANTUM CRYPTOGRAPHY MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL QUANTUM CRYPTOGRAPHY MARKET SHARE BY VERTICAL, 2019 VS 2026 (%)

4. GLOBAL QUANTUM CRYPTOGRAPHY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

7. UK QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD QUANTUM CRYPTOGRAPHY MARKET SIZE, 2019-2026 ($ MILLION)