RFID Blood Monitoring Systems Market

RFID Blood Monitoring Systems Market Size, Share & Trends Analysis Report by Product (Systems and Tags) and by End-Use (Blood Banks and Hospital Blood Centers) Forecast Period (2024-2031)

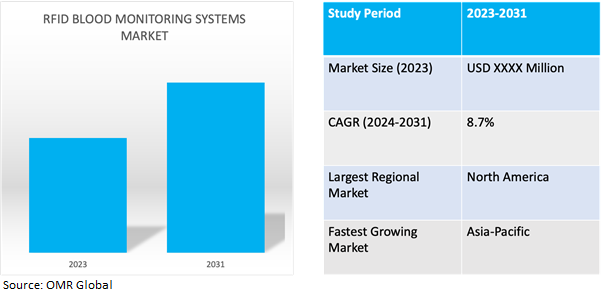

RFID blood monitoring systems market is anticipated to grow at a considerable CAGR of 8.7% during the forecast period (2024-2031). Radio-Frequency Identification (RFID) Blood Monitoring Systems is an electronic tool used in healthcare to track and manage blood products, ensuring their safe and effective use in hospitals, blood banks, and other healthcare facilities. Using electromagnetic fields for wireless communication, RFID technology is used to track and uniquely identify blood products.

Market Dynamics

Benefits of RFID Adoption in Healthcare to Drive Global Market

The growing awareness and adoption of RFID technology in healthcare settings are driven by various factors such as awareness campaigns, educational programs, and success stories that highlight RFID's benefits in improving patient safety and operational efficiency. Additionally, research studies, regulatory recommendations, and vendor marketing efforts play significant roles in promoting RFID technology. As healthcare facilities seek innovative solutions to address key challenges, RFID emerges as a valuable tool for enhancing patient care and optimising healthcare operations. For instance, in November 2022, Impinj unveiled two latest additions to its line of RFID tag chips that includes the M780 and M781 RAIN RFID chips. These new offerings, part of the Impinj M700 series and are designed to facilitate effective management of product shelf life, compliance with regulations, and waste reduction. The Impinj M780 chip comes equipped with 128-bit user memory and 496-bit electronic product code memory, while the Impinj M781 chip features 512-bit user memory and 128-bit electronic product code.

Technology Advancement to Offer Lucrative Opportunities to Global Market

The expansion of healthcare facilities along withtechnological advancements in RFID is anticipated to offer lucrative opportunities to the global market growth. Collaborations between public and private entities further drive expansion efforts, facilitating the modernization of healthcare services globally. For instance, in June 2023, Know Labs, the developer of non-invasive medical diagnostic technology unveiled the next stage in the development of its proprietary Bio-RFID technology – the Generation (Gen) 1 Device. Gen 1 incorporates Know Labs’ Bio-RFID sensor that has been proven as technically feasible and stable in delivering repeatable results in measuring blood glucose when used in a lab environment in a portable device.

Market Segmentation

Our in-depth analysis of the global RFID blood monitoring systems market includes the following segments by product and end-use:

- Based on product, the market is sub-segmented into systems and tags.

- Based on end-use, the market is sub-segmented into blood banks and hospital blood centres.

Tags is Projected to Emerge as the Largest Segment

Based on the product, the global RFID Blood Monitoring Systems market is sub-segmented into systems and tags. Among these, the tags sub-segment is expected to hold the largest share of the market. RFID tags are poised to dominate the global RFID blood monitoring systems market due to their efficiency, accuracy, and compliance benefits. These tags streamline tracking processes, automating identification and monitoring of blood products to ensure accurate data capture and real-time traceability throughout the supply chain and also integrate their capabilities with existing systems. The primary factor driving this growth is the increasing emphasis on patient safety and efficient healthcare management. RFID technology enhances traceability and automation, aiding healthcare facilities in complying with regulatory requirements, reducing errors, and minimizing blood-related complications.

Blood Banks Sub-segment to Hold a Considerable Market Share

The blood banks sub-segment is projected to hold a significant market share in the global RFID blood monitoring systems market due to its pivotal role in healthcare. RFID technology enhances efficiency and accuracy in blood inventory management within blood banks, reducing errors and ensuring proper handling of blood products. Compliance with stringent regulatory requirements is also facilitated by RFID systems, which offer real-time tracking and monitoring capabilities throughout the supply chain.

Integration with existing management systems further boosts operational efficiency. As blood banks prioritize safety, efficiency, and regulatory compliance, the adoption of RFID blood monitoring systems is expected to remain robust, consolidating the sub-segment's substantial market share.For instance, in December 2022, government hospitals introduced RFID technology to Monitor Blood Usageand ensure the availability of safe and sufficient blood supplies that has been developed at a cost of Rs.10 lakh ($1.2 million) and the system includes a registry and the Tamil Nadu Blood Donors app, that will comprehensively catalogue details of repeated voluntary blood donors along with their blood groups.

Regional Outlook

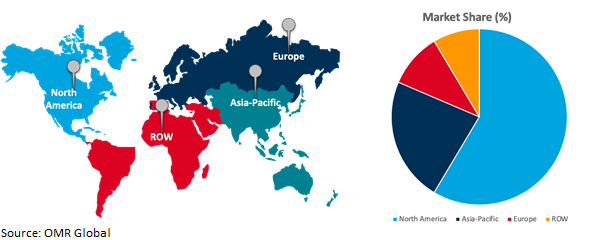

The global RFID blood monitoring systems market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia Pacific's Surge: Driving Investment in RFID Blood Monitoring Systems

Asia-Pacific countries are investing in the global RFID blood monitoring systems market due to rapid healthcare infrastructure expansion. With a focus on improving patient safety, healthcare efficiency, and regulatory compliance, RFID technology offers a solution for modernizing healthcare systems in the region. The diverse populations and unique challenges in blood management necessitate efficient tracking and monitoring of blood products throughout the supply chain. Additionally, the rising prevalence of chronic diseases and surgical procedures increases the demand for blood transfusions, further fueling the adoption of RFID blood monitoring systems.

Global RFID Blood Monitoring Systems Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its advanced healthcare infrastructure, stringent regulatory standards, and early adoption of technology. The region's high healthcare expenditure also enables investments in advanced solutions like RFID blood monitoring systems to enhance patient safety and operational efficiency. For instance, in May 2023, Know Labs, Inc. announced the results of a new study titled, that is Algorithm Refinement in the Non-Invasive Detection of Blood Glucose Using Know Labs’ Bio-RFID Technology that uses a light gradient-boosting machine (lightGBM) and learning model also improved the accuracy of Know Labs’ Bio-RFID sensor technology at quantifying blood glucose, demonstrating an overall Mean Absolute Relative Difference (MARD) of 12.9% that is within the range of FDA-cleared blood glucose monitoring devices.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global RFID Blood Monitoring Systemsmarket include Cardinal Health, Inc., RFID Global Solutions, SATO, and Nordic id among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2021, SATO introduced a novel UHF RFID Direct Thermal Wristband tailored for patient identification, verification, and tracking in hospital settings. Engineered with patient comfort in mind, SATO's wristband ensures optimal readability within hospital location systems. Addressing critical concerns, SATO offers a high-performance UHF RFID wristband alongside its compact 4-inch printer, the CT4-LX UHF. These components seamlessly integrate into comprehensive ID and tracking systems alongside third-party readers and antennas.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global RFID Blood Monitoring Systemsmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Avery dennison Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cardinal Health Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. B Medical Systems S. à r.l.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global RFID Blood Monitoring Systems Market by Product

4.1.1. Systems

4.1.2. Tags

4.2. Global RFID Blood Monitoring Systems Market by End-Use

4.2.1. Blood Banks

4.2.2. Hospital Blood Cente

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Biolog ID

6.2. InnerSpace

6.3. Logi Tag

6.4. Mediware Information System Inc. ( WellSky)

6.5. Mobile Aspects

6.6. Nordic ID (Brady Corporation)

6.7. RFID Global Solution, Inc.

6.8. S3Edge Solutions LLC

6.9. SATO VICINITY PTY LTD. (SATO Holdings Corp.)

6.10. Terso Solutions, Inc.

1. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RFID BLOOD MONITORING SYSTEMS TAGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

5. GLOBAL RFID BLOOD MONITORING SYSTEMS FOR BLOOD BANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALRFID BLOOD MONITORING SYSTEMS FOR HOSPITAL BLOOD CENTRES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. NORTH AMERICAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

9. NORTH AMERICAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

10. NORTH AMERICAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

11. EUROPEAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. EUROPEAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

13. EUROPEAN RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

14. ASIA-PACIFIC RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. ASIA-PACIFICRFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. ASIA-PACIFICRFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

17. REST OF THE WORLD RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. REST OF THE WORLD RFID BLOOD MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKETSHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL SRFID BLOOD MONITORING SYSTEMS MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL RFID BLOOD MONITORING SYSTEMS TAGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKET SHAREBY END-USE, 2023 VS 2031 (%)

5. GLOBAL RFID BLOOD MONITORING SYSTEMS FOR BLOOD BANKS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALRFID BLOOD MONITORING SYSTEMS FOR HOSPITAL BLOOD CENTRES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL RFID BLOOD MONITORING SYSTEMS MARKETSHARE BY REGION, 2023 VS 2031 (%)

8. US RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

9. CANADA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

10. UK RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

11. FRANCE RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

12. GERMANY RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

13. ITALY RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

14. SPAIN RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

15. REST OF EUROPE RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

16. INDIA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

17. CHINA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

18. JAPAN RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

19. SOUTH KOREA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF ASIA-PACIFIC RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

21. LATIN AMERICA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

22. MIDDLE EAST AND AFRICA RFID BLOOD MONITORING SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)