Running Gear Market

Running Gear Market Size, Share & Trends Analysis Report By Product Type (Running Footwear, Running Apparel, Running Accessories, Fitness Trackers, and Others), By End-user (Men, Women, and Unisex), and By Distribution Channel (Sports Specialty Stores, Supermarkets and Hypermarkets, Online Stores, and Others) Forecast Period (2025-2035)

Industry Overview

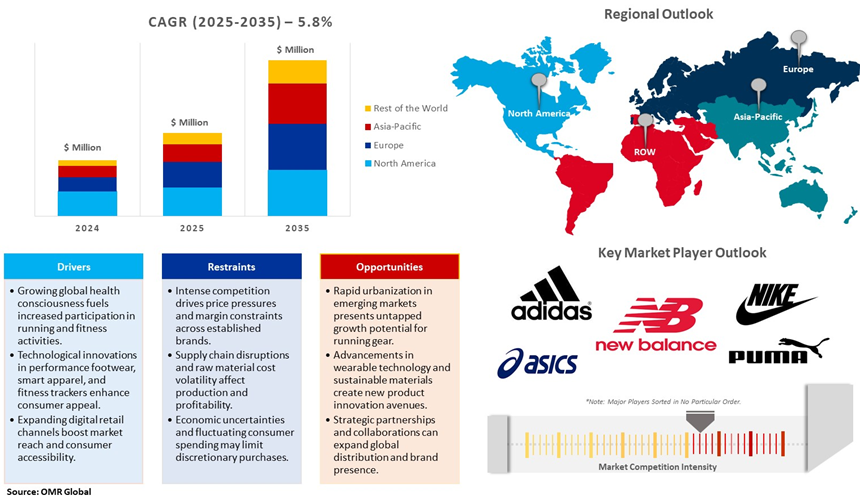

Running gear market was valued at $45.3 billion in 2024 and is projected to grow to $84.0 billion by 2035, registering a CAGR of 5.8% during the forecast period from 2025 to 2035. Running gears are several types of equipment that are used while running. Several products available for running include apparel, sensors, footwear, fitness trackers & wearables, and others. The major factor contributing to the growth of the global running gear market includes the rising inclination of people toward sports activities. Additionally, Running gear encloses essential equipment and apparel designed to enhance the running experience, including well-cushioned running shoes, moisture-wicking clothing, supportive accessories, and technological devices that track performance metrics, further supporting the running gear market.

Market Dynamics

Growing Health and Fitness Consciousness

The increasing awareness of health benefits associated with regular physical activity has driven individuals to adopt running as part of their fitness regimen. This trend was accelerated by the global COVID-19 pandemic, which highlighted the importance of maintaining good health and led to a surge in outdoor activities, such as gym closures and restricted indoor workout options. Running emerged as one of the most accessible forms of exercise during this period, contributing to market expansion for running gear products. Furthermore, Social media influencers and fitness-tracking apps also motivate consumers to participate in running challenges and share their achievements online, creating communities of runners who regularly invest in quality running gear to enhance their performance and experience.

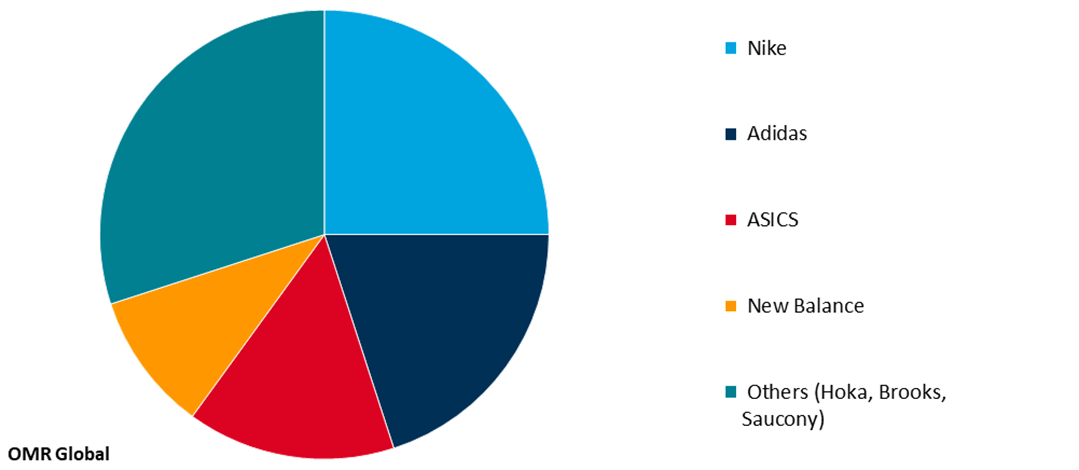

Running Footwear Market Share by Brands, 2024

Rising Sustainability Initiatives for the Running Gear Market

Simultaneously, Environmental consciousness has become a significant factor influencing purchasing decisions in the running gear market. Leading brands are responding to this consumer preference by adopting sustainable practices in their manufacturing processes. Companies such as Nike, with their "Move to Zero" initiative, aim to create products with minimal carbon and waste impact, and Adidas incorporates recycled ocean plastics in their Parley shoe collection Gear. These sustainability initiatives appeal to environmentally conscious consumers and also drive innovation in material science and manufacturing processes, leading to the development of high-performance, eco-friendly running gear products that maintain quality as well as reduce environmental impact.

Market Segmentation

- Based on the product type, the market is segmented into running footwear, running apparel, running accessories, fitness trackers, and others.

- Based on the end user, the market is segmented into men, women, and unisex.

- Based on the distribution channel, the market is segmented into sports specialty stores, supermarkets and hypermarkets, online stores, and others.

The Fitness Trackers Market Is Experiencing The Fastest Growth

Among the product types, fitness trackers are expected to hold a prominent market share in the market during the forecast period. The rising health issues among people are creating demand for fitness trackers as they provide a visual of progress and accomplishments each day. Fitness trackers are a popular way to keep track of progress, and wearers can track steps, calories, distance traveled, caloric intake, and even heart rate and sleep which is contributing to the market growth. This category includes GPS watches, heart rate monitors, and smart running insoles that provide performance metrics and training insights. The technological advancements in fitness trackers are expected to drive market growth during the forecast period. Brands such as Garmin, Apple, and Fitbit dominate this segment, continuously enhancing their offerings with advanced sensors, improved battery life, and sophisticated algorithms that deliver actionable training data, For instance, in January 2025, Amazfit, a health technology company, announced the launch of its latest lifestyle smartwatch, the Amazfit Active 2, a wearable that bridges elegance and functionality. It has Fitness and Wellness Features such as Over 160 sports modes, supported by 5 satellite systems, with the Wild.AI mini app and Zepp Coach Integration.

Regional Outlook

The global running gear market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

North American Region holds a Significant Share in the Global Running Gear Market

Among all regions, the North American region is expected to hold a significant share of the market. The growing public awareness of a healthy lifestyle due to increasing obesity is contributing to the demand for running gear products. Leading a healthy lifestyle can help people avoid getting serious illnesses and to avoid serious health issues. People are focusing on fitness centers, consulting services, and joining programs for weight loss, which is expected to create a positive impact on the running gear market. According to the Centers for Disease Control and Prevention (CDC), obesity is a complex health issue resulting from a combination of causes and individual factors such as behavior and genetics. Obesity is also associated with the leading causes of mortality in the US and globally, including diabetes, heart disease, stroke, and some types of cancer. Additionally, as per Sports ETA, the strength of the sports tourism sector, showcasing a direct spending impact of $52.2 billion, generated a total economic impact of $128 billion in the US.

Asia-Pacific Shows Highest Growth Rate

The Asia-Pacific region, particularly emerging countries such as China and India, represents the fastest-growing regional market. This growth is primarily driven by increasing health consciousness, rising disposable incomes, and growing participation in running events across densely populated countries like China, Japan, and India. Moreover, in China, the General Administration of Sport (GAS), The GAS is guided by the 14th Five-Year Plan for Sports Development (2021-2025), which seeks to build China into a global sports power. In 2023, the government spent $3.2 billion on sports. The GAS oversees 20 sports management centers (including sports federations), the National Training Bureau and national teams, and the Provincial Sports Commission, which includes Provincial Sports Academies or part-time sports schools.

Market Players Outlook

The major companies operating in the global running gear market include Adidas AG, ASICS America Corporation, Nike, Inc., Puma SE, and New Balance, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2025, Decathlon announced a partnership with Alex Sarr. Alex Sarr will collaborate with Decathlon’s R&D teams to develop and refine high-performance basketball shoes and apparel. This collaboration aims to push the boundaries of sports technology, ensuring athletes of all levels can benefit from the advancements made through Sarr’s feedback and on-court experiences.

- In December 2024, NIKE, Inc. and the NFL (National Football League) Extend their Longstanding Partnership till 2038. The renewed agreement commits both organizations to advance innovation, enhance player health and safety, and drive global growth and football development. Nike will continue to deliver high-performance products tailored to NFL athletes while supporting grassroots initiatives and international expansion.

- In September 2023, lululemon and Peloton announced a five-year global partnership that positions Peloton as the exclusive provider of digital fitness content for Lululemon, while Lululemon becomes Peloton's primary athletic apparel partner. The collaboration will connect global communities across markets such as the U.S., Canada, the U.K., Germany, and Australia by offering co-branded apparel and immersive fitness experiences.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global running gear market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Running Gear Market Sales Analysis – Product Type | End-User | Distribution Channel ($ Million)

• Running Gear Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Running Gear Industry Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Running Gear Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Running Gear Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Running Gear Market Revenue and Share by Manufacturers

• Running Gear Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Adidas AG

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. ASICS America Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Nike, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Puma SE

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. New Balance

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Running Gear Market Sales Analysis By Product Type ($ Million)

5.1. Running Footwear

5.2. Running Apparel

5.3. Running Accessories

5.4. Fitness Trackers

5.5. Others

6. Global Running Gear Market Sales Analysis By End-User ($ Million)

6.1. Men

6.2. Women

6.3. Unisex

7. Global Running Gear Market Sales Analysis By Distribution Channel ($ Million)

7.1. Sports Specialty Stores

7.2. Supermarkets and Hypermarkets

7.3. Online Stores

7.4. Others

8. Regional Analysis

8.1. North American Running Gear Market Sales Analysis – Product Type | End-User | Distribution Channel ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Running Gear Market Sales Analysis – Product Type | End-User | Distribution Channel ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Running Gear Market Sales Analysis – Product Type | End-User | Distribution Channel ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Running Gear Market Sales Analysis – Product Type | End-User | Distribution Channel ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Adidas AG

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Altra Running (VF Outdoor LLC)

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Anta Sports

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. ASICS Corporation

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Brooks Running (Berkshire Partners LLC)

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Columbia Sportswear

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Decathlon S.A. (Association Familiale Mulliez)

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Diadora S.p.A.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Fila Holdings Corp.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Hoka (Deckers Outdoor Corporation)

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Li-Ning Company Limited

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Lululemon Athletica Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Mizuno Corporation

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. New Balance Athletics, Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Nike, Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. On Holding AG

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Puma SE

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Reebok International Limited (ABG)

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Saucony (Wolverine World Wide, Inc.)

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Skechers U.S.A., Inc.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. The North Face, Inc. (VF Corporation)

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Under Armour, Inc.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

1. Global Running Gear Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Running Footwear Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Running Apparel Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Running Accessories Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Fitness Trackers Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Running Gear Products Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Running Gear Market Research And Analysis By End-User, 2024-2035 ($ Million)

8. Global Running Gear For Men Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Running Gear For Women Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Running Gear For Unisex Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Running Gear Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

12. Global Running Gear Via Sports & Specialty Stores Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Running Gear Via Supermarkets & Hypermarkets Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Running Gear Via Online Stores Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Running Gear Via Other Distribution Channels Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Running Gear Market Research And Analysis By Region, 2024-2035 ($ Million)

17. North American Running Gear Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Running Gear Market Research And Analysis By Product, 2024-2035 ($ Million)

19. North American Running Gear Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

20. European Running Gear Market Research And Analysis By Country, 2024-2035 ($ Million)

21. European Running Gear Market Research And Analysis By Product, 2024-2035 ($ Million)

22. European Running Gear Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

23. Asia-Pacific Running Gear Market Research And Analysis By Country, 2024-2035 ($ Million)

24. Asia-Pacific Running Gear Market Research And Analysis By Product, 2024-2035 ($ Million)

25. Asia-Pacific Running Gear Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

26. Rest Of The World Running Gear Market Research And Analysis By Country, 2024-2035 ($ Million)

27. Rest Of The World Running Gear Market Research And Analysis By Product, 2024-2035 ($ Million)

28. Rest Of The World Running Gear Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

1. Global Running Gear Market Share By Product, 2024-2035 (%)

2. Global Running Footwear Market Share By Region, 2024-2035 (%)

3. Global Running Apparel Market Share By Region, 2024-2035 (%)

4. Global Running Accessories Market Share By Region, 2024-2035 (%)

5. Global Fitness Trackers Market Share By Region, 2024-2035 (%)

6. Global Other Running Gear Products Market Share By Region, 2024-2035 (%)

7. Global Running Gear Market Share End-User, 2024-2035 ($ Million)

8. Global Running Gear For Men Market Share, 2024-2035 ($ Million)

9. Global Running Gear For Women Market Share, 2024-2035 ($ Million)

10. Global Running Gear For Unisex Market Share, 2024-2035 ($ Million)

11. Global Running Gear Market Share By Distribution Channel, 2024-2035 (%)

12. Global Running Gear Via Sports Specialty Stores Market Share By Region, 2024-2035 (%)

13. Global Running Gear Via Supermarkets & Hypermarkets Market Share By Region, 2024-2035 (%)

14. Global Running Gear Via Online Stores Market Share By Region, 2024-2035 (%)

15. Global Running Gear Via Other Distribution Channels Market Share By Region, 2024-2035 (%)

16. Global Running Gear Market Share By Region, 2024-2035 (%)

17. US Running Gear Market Size, 2024-2035 ($ Million)

18. Canada Running Gear Market Size, 2024-2035 ($ Million)

19. UK Running Gear Market Size, 2024-2035 ($ Million)

20. France Running Gear Market Size, 2024-2035 ($ Million)

21. Germany Running Gear Market Size, 2024-2035 ($ Million)

22. Italy Running Gear Market Size, 2024-2035 ($ Million)

23. Spain Running Gear Market Size, 2024-2035 ($ Million)

24. Rest of Europe Running Gear Market Size, 2024-2035 ($ Million)

25. India Running Gear Market Size, 2024-2035 ($ Million)

26. China Running Gear Market Size, 2024-2035 ($ Million)

27. Japan Running Gear Market Size, 2024-2035 ($ Million)

28. South Korea Running Gear Market Size, 2024-2035 ($ Million)

29. ASEAN Running Gear Market Size, 2024-2035 ($ Million)

30. Rest of Asia-Pacific Running Gear Market Size, 2024-2035 ($ Million)

31. Rest Of The World Running Gear Market Size, 2024-2035 ($ Million)

32. Latin America, Running Gear Market Size, 2024-2035 ($ Million)

33. Middle East and Africa Running Gear Market Size, 2024-2035 ($ Million)

FAQS

The size of the Running Gear market in 2024 is estimated to be around $45.3 billion.

Asia Pacific holds the largest share in the Running Gear market.

Leading players in the Running Gear market include Adidas AG, ASICS America Corporation, Nike, Inc., Puma SE, and New Balance, among others.

Running Gear market is expected to grow at a CAGR of 5.8% from 2025 to 2035.

Increasing health awareness, fitness trends, and demand for smart and sustainable athletic wear are driving the growth of the running gear market.