Shipbuilding Market

Shipbuilding Market Size, Share & Trends Analysis Report by Type (Bulk Carriers, Oil Tankers, Container Ships, Passenger Ships, and Other Types), and by End-User (Transport, Military) Forecast Period (2025-2035)

Industry Overview

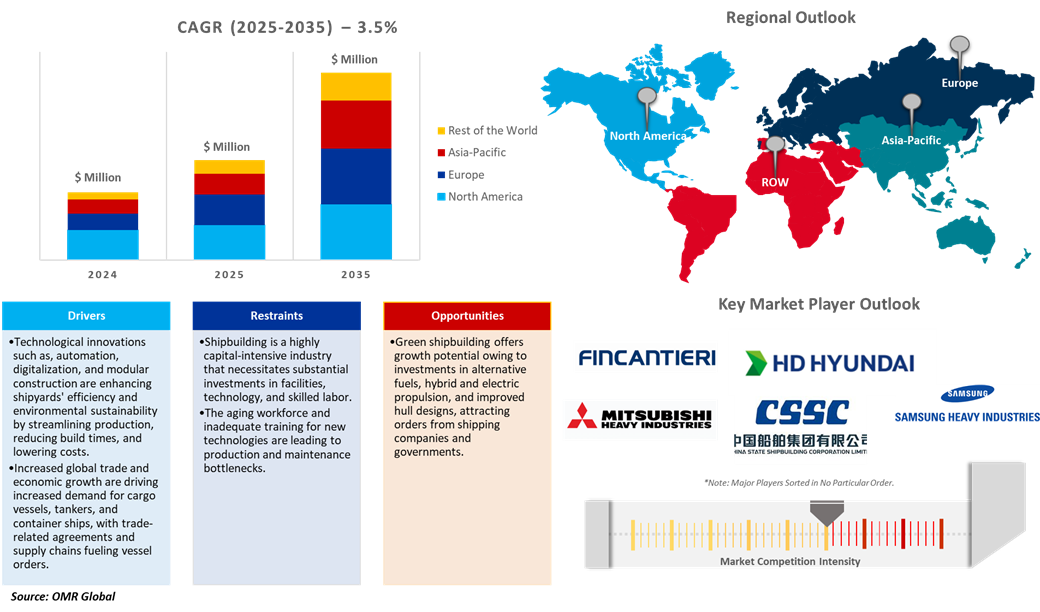

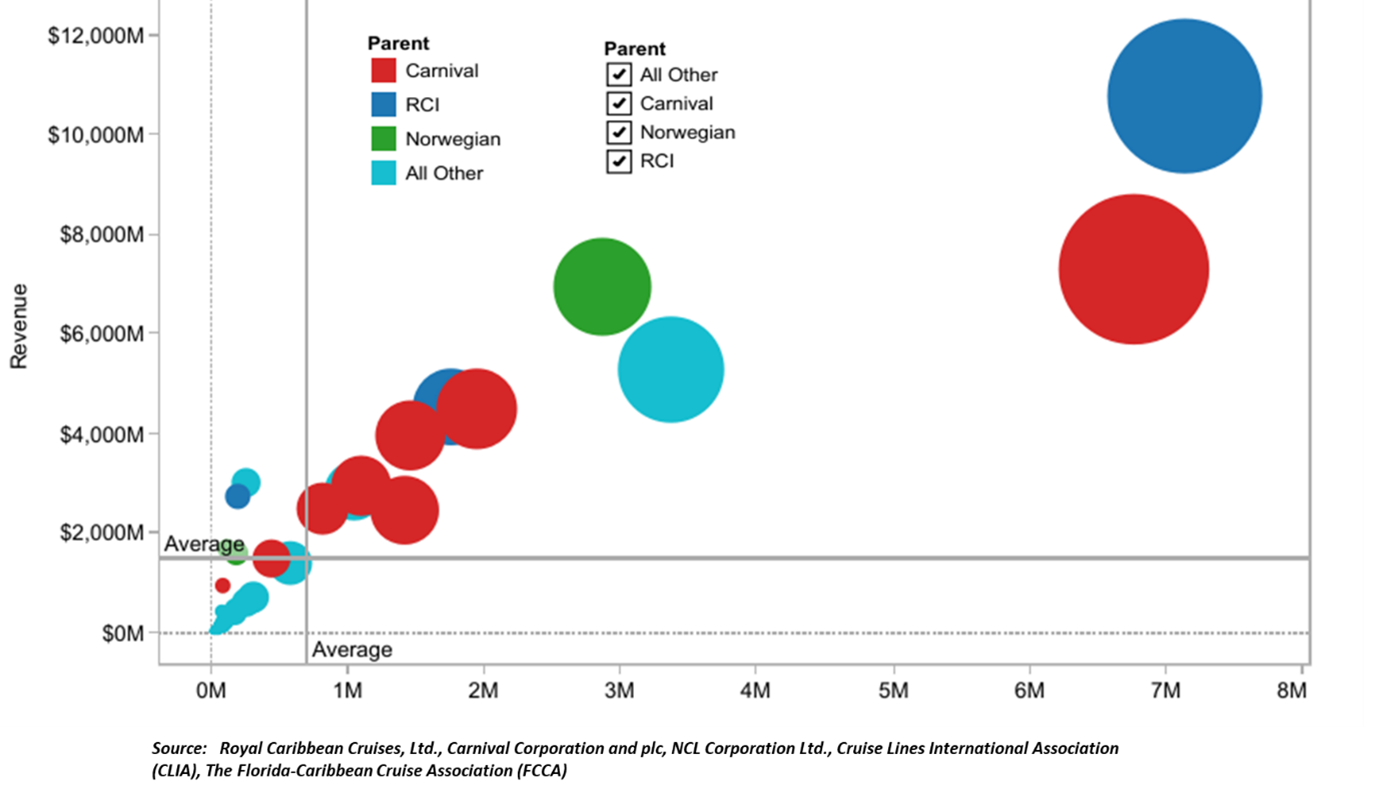

Shipbuilding market was valued at $148.0 billion in 2024 and is growing at a CAGR of 3.5% over the forecast period (2025–2035), reaching a projected market size of $215.2 billion by 2035. The market size is projected to reach $215.2 billion in 2035. The growth of global trade, environmental legislation, defense expansion, offshore energy initiatives, technology growth, fleet renewal, and government stimulus is fueling the demand for cargo and container ships. Growing seaborne commerce spurs the demand for cargo and container ships while rising geopolitical tensions spur defense spending and demand for submarines, destroyers, and aircraft carriers. Technological growth comprises smart ship technology, automation of shipyards, and additive manufacturing. The cruise industry is additionally picking up, and fleet renewal and aging ships require more replacements. In 2025, global ocean cruise line revenue from ticket and onboard spending is estimated at $72.5 billion (a 7.7% increase over 2024) with 33.7 million annualized passengers carried (a 4.9% increase over 2024).

Market Dynamics

Expansion of International Trade

The increasing global volume of trades requires effective shipping of cargo, which escalates the use of ships such as tankers, bulk carriers, and container ships. For instance, in June 2024, Hanwha Ocean and Hanwha Systems acquired Philly Shipyard. The acquisition invested $100 million to enlarge Hanwha's international defense and shipbuilding business, such as building technology for unmanned maritime systems, naval radar, and sensors for Manned and Unmanned Teaming missions.

Technological Advancements

Technological innovation in shipyards, such as digitalization, automation, and smart manufacturing, is improving vessel quality, enhancing productivity, and lowering operational costs, boosting market growth. For instance, in July 2024, Shipbuilding invested $691.8 million to increase the capacity of its Taizhou, Jiangsu province, production facility to meet increasing demand for new building orders. The project involved the construction of a new energy smart shipbuilding project in the Jingjiang Economic and Technological Development Zone, with smart manufacturing factories, an air pressure station, a liquid oxygen gasification station, an LNG gasification station, gantry cranes, a large-size dry dock, an inland terminal, and other auxiliary facilities. New Times Shipbuilding currently has one 500,000 tons-class, one 300,000 tons-class, and one 100,000 tons-class dry dock, three large-size outfitting docks, and an orderbook of 104 ships, guaranteeing activity until 2028.

Market Segmentation

- Based on the type, the market is segmented into bulk carriers, oil tankers, container ships, passenger ships, and other types.

- Based on the end-user, the market is segmented into transport and military.

Transport Segment to Lead the Market with the Largest Share

Transportation is an essential function in shipbuilding, facilitating effective transportation of raw materials and components to shipyards. Contemporary shipyards use digital technologies and sophisticated transport systems to improve assembly accuracy and speed. The innovations lead to cost savings and improved efficiency. Vessels, once constructed, play multiple functions, such as container ships, LNG carriers, cruise liners, and offshore ships. Hull designs with integration, environmentally friendly propulsion, and automation technology serve to satisfy operational efficiency and environmental laws.

Container Ships: A Key Segment in Market Growth

Container vessels are designed to transport bulk quantities of standard containers in a simple and easy loading, unloading, and switching process between modes of transport. It plays an essential role in global commerce, integration with intermodal transport, cost savings, and flexibility. Sophisticated container handling, navigation technology, and fuel efficiency innovations have made them more efficient and environmentally friendly, meeting international standards.

Regional Outlook

The global shipbuilding market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Integration of Advanced Manufacturing Techniques in Asia-Pacific

The integration of advanced manufacturing techniques, automation, and digitalization in shipyards is essential for enhancing productivity, meeting safety and environmental standards, and driving market growth. According to the Government of India, in February 2025, the Union Budget proposed the establishment of a Maritime Development Fund (MDF) worth $3 billion to support India's maritime sector. The fund provided financial assistance through equity or debt securities, with the government contributing 49%. The fund aims to boost Indian-flagged ships' share in global cargo volume to 20% by 2047. By 2030, the MDF aims to generate up to $1.8 billion in investment in the shipping sector. The scheme provided direct capital support, including breakwater and capital dredging, and proposed a 10-year rent holiday for land. The allocation of $732 million supported existing shipyards in upgrading and automating operations.

North America Region Dominates the Market with Major Share

North America holds a significant share owing to the US trade growth driving demand for commercial shipbuilding, prompting shipbuilders to modernize their fleets to meet the increasing demand for efficient vessels. According to the US Naval Institute, for the years 2024-30, planned shipbuilding aims for a fleet of 381 ships, necessitating an annual investment of $34 billion to $36 billion and the availability of shipyards equipped to construct these vessels.

Global Cruise Line Market Share, Revenue Vs Passenger, 2025

Further, the cruise industry has made a stronger post-pandemic recovery than other travel sectors, with cruise demand outpacing hotel demand growth for the past two years. In America, AAA forecasts that 19 million will take ocean cruises in 2025, marking a 4.5% increase from 2024, when 18.2 million embarked on cruise vacations. This year is on track to be the third consecutive year of record-breaking cruise passenger numbers.

Market Players Outlook

The major companies operating in the global shipbuilding market include Fincantieri S.p.A., Hanwha Group, HD Hyundai, Mitsubishi Heavy Industries, Ltd., China State Shipbuilding Corporation, China Shipbuilding Industry Corporation, Austal USA, Samsung Heavy Industries, and Ulstein Group ASA, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In November 2024, India introduced a new shipbuilding incentive program to boost its shipbuilding industry from 22nd to the top tier by 2030 and five by 2047. The Ministry of Ports, Shipping, and Waterways (MoPSW) is focusing on sustainability and providing 30% financial assistance for ships running on green fuels and 20% for those with electric or hybrid propulsion systems, aligning with the nation's Maritime India Vision 2030 and Maritime Amrit Kaal Vision 2047.

- In November 2024, India initiated a $3.6 billion Maritime Development Fund to stimulate the shipbuilding and repair sector, as part of a $1.8 billion five-year investment strategy aimed at revolutionizing the nation's ports industry.

- In October 2023, Mitsubishi Shipbuilding launched a ceremony for the FUJITRANS Corp.-ordered new roll-on/roll-off vessel FUGAKU MARU. The 165-meter-long, 27.6-meter-wide vessel has a gross tonnage of 13,000 and can carry up to 50 trailer chassis and 1,511 passenger vehicles. Its fuel efficiency was enhanced with a vertical stem in the bow, high-performance propellers, and low-friction paint.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global shipbuilding market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Shipbuilding Market Sales Analysis – Type| End User| ($ Million)

• Shipbuilding Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Shipbuilding Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Shipbuilding Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Shipbuilding Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Shipbuilding Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Shipbuilding Market Revenue and Share by Manufacturers

• Shipbuilding Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. FINCANTIERI S.p.A.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. HD HYUNDAI

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Mitsubishi Heavy Industries, Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. China State Shipbuilding Corporation

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. China Shipbuilding Industry Corporation

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Shipbuilding Market Sales Analysis by Type ($ Million)

5.1. Bulk Carriers

5.2. Oil Tankers

5.3. Container Ships

5.4. Passenger Ships

5.5. Other Types

6. Global Shipbuilding Market Sales Analysis by End User ($ Million)

6.1. Transport

6.2. Military

7. Regional Analysis

7.1. North American Shipbuilding Market Sales Analysis – Type| End User| Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Shipbuilding Market Sales Analysis – Type| End User| Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Shipbuilding Market Sales Analysis – Type| End User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Shipbuilding Market Sales Analysis – Type| End User| |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Austal USA

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. China State Shipbuilding Corporation

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. China Shipbuilding Industry Corporation

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Cochin Shipyard Ltd.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Damen Shipyards Group

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Fincantieri S.p.A.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. General Dynamics National Steel & Shipbuilding Co. (NASSCO)

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Hanwha Corporation

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. HD HYUNDAI

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Hilti India Pvt. Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. HYDAC International GmbH

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Imabari Shipbuilding Co., Ltd.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Korea Shipbuilding & Offshore Engineering Co., Ltd.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. MEYER WERFT GmbH

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Mitsubishi Heavy Industries, Ltd.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Naval Group

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Oshima Shipbuilding Co., Ltd.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Samsung Heavy Industries

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Seatrium Ltd.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Shanghai Waigaoqiao Shipbuilding Co., Ltd.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. SYM Naval

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. ThyssenKrupp AG

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. Tsuneishi Shipbuilding Co., Ltd.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Ulstein Group ASA

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Zamil Offshore

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

1. Global Shipbuilding Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Bulk Carriers Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Oil Tankers Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Container Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Passenger Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Types Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Shipbuilding Market Research And Analysis By End User, 2024-2035 ($ Million)

8. Global Shipbuilding For Transport Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Shipbuilding For Military Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American Shipbuilding Market Research And Analysis By Country, 2024-2035 ($ Million)

12. North American Shipbuilding Market Research And Analysis By Type, 2024-2035 ($ Million)

13. North American Shipbuilding Market Research And Analysis By End User, 2024-2035 ($ Million)

14. European Shipbuilding Market Research And Analysis By Country, 2024-2035 ($ Million)

15. European Shipbuilding Market Research And Analysis By Type, 2024-2035 ($ Million)

16. European Shipbuilding Market Research And Analysis By End User, 2024-2035 ($ Million)

17. Asia-Pacific Shipbuilding Market Research And Analysis By Country, 2024-2035 ($ Million)

18. Asia-Pacific Shipbuilding Market Research And Analysis By Type, 2024-2035 ($ Million)

19. Asia-Pacific Shipbuilding Market Research And Analysis By End User, 2024-2035 ($ Million)

20. Rest Of The World Shipbuilding Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Rest Of The World Shipbuilding Market Research And Analysis By Type, 2024-2035 ($ Million)

22. Rest Of The World Shipbuilding Market Research And Analysis By End User, 2024-2035 ($ Million)

1. Global Shipbuilding Market Research And Analysis By Type, 2024 Vs 2035 (%)

2. Global Bulk Carriers Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

3. Global Oil Tankers Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

4. Global Container Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

5. Global Passenger Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

6. Global Other Types Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

7. Global Shipbuilding Market Research And Analysis By End User, 2024 Vs 2035 (%)

8. Global Shipbuilding For Transport Market Share By Region, 2024 Vs 2035 (%)

9. Global Shipbuilding For Military Market Share By Region, 2024 Vs 2035 (%)

10. Global Shipbuilding Market Share By Region, 2024 Vs 2035 (%)

11. US Shipbuilding Market Size, 2024-2035 ($ Million)

12. Canada Shipbuilding Market Size, 2024-2035 ($ Million)

13. UK Shipbuilding Market Size, 2024-2035 ($ Million)

14. France Shipbuilding Market Size, 2024-2035 ($ Million)

15. Germany Shipbuilding Market Size, 2024-2035 ($ Million)

16. Italy Shipbuilding Market Size, 2024-2035 ($ Million)

17. Spain Shipbuilding Market Size, 2024-2035 ($ Million)

18. Russia Shipbuilding Market Size, 2024-2035 ($ Million)

19. Rest Of Europe Shipbuilding Market Size, 2024-2035 ($ Million)

20. India Shipbuilding Market Size, 2024-2035 ($ Million)

21. China Shipbuilding Market Size, 2024-2035 ($ Million)

22. Japan Shipbuilding Market Size, 2024-2035 ($ Million)

23. South Korea Shipbuilding Market Size, 2024-2035 ($ Million)

24. ASEAN Shipbuilding Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Shipbuilding Market Size, 2024-2035 ($ Million)

26. Rest Of Asia-Pacific Shipbuilding Market Size, 2024-2035 ($ Million)

27. Latin America Shipbuilding Market Size, 2024-2035 ($ Million)

28. Middle East And Africa Shipbuilding Market Size, 2024-2035 ($ Million)

FAQS

The size of the Shipbuilding market in 2024 is estimated to be around $148.0 billion.

North America holds the largest share in the Shipbuilding market.

Leading players in the Shipbuilding market include Fincantieri S.p.A., Hanwha Group, HD Hyundai, Mitsubishi Heavy Industries, Ltd., China State Shipbuilding Corporation, China Shipbuilding Industry Corporation, Austal USA, Samsung Heavy Industries, and Ul

Shipbuilding market is expected to grow at a CAGR of 3.5% from 2025 to 2035.

The Shipbuilding Market is growing due to rising global seaborne trade, demand for eco-friendly vessels, and modernization of aging fleets.