Skateboard Shoes Market

Skateboard Shoes Market Size, Share & Trends Analysis Report, By Type (Cupsole Shoes and Vulcanized Sole Shoes), By Application (Men and Women) Forecast Period (2025-2035)

Industry Overview

Skateboard shoe market is anticipated to reach $3.1 billion in 2035 from $1.9 billion in 2024, witnessing a CAGR of 4.3% during the forecast period (2025-2035). Globally demand for skateboard shoes is seeing rapid growth with the rising popularity of street culture and extreme sports among young people. Companies are emphasizing high-technology designs with improved grip, strength, and ankle support to appeal to leisure users as well as professional skaters. In addition, social networking sites have added the appeal and visibility of the products by amplifying the fame of the skate legends. Global fashion houses and skate shoe companies are teaming up to expand market reach. New opportunities for businesses are being made through urbanization and the expansion of recreational sports in emerging countries.

Market Dynamics

Revival of Retro and Chunky Skate Styles

Skateboard shoes with bulky, chunky designs reminiscent of early 2000s design are highly in comeback mode. This style is part of a larger trend towards nostalgia, as consumers are buying clothing and footwear that transports them back to the past. Vans and Nike SB, among other companies, are revisiting classic lines such as the Old Skool and Dunk Low with padded collars, fat soles, and long-lasting materials appropriate for both skateboarding and general wear. This resurgence is enjoyed not just by experienced skateboarders but also reaches out to the new generation fond of the old-school look.

Emphasis on Sustainability and Eco-Friendly Materials

The skateboard shoe business is witnessing more customer choices owing to environmental awareness. As a result, companies are adopting green manufacturing practices. It involves exploring new avenues such as foams composed of algae and using recycled materials such as recycled rubber and natural cotton. Vans and Nike are among the companies that have established programs to lower waste and encourage environmentally friendly products. Such a move not only considers environmental needs but also echoes what consumers increasingly expect in what they buy – namely, sustainable and ethical.

Market Segmentation

- Based on the type, the market is segmented into cupsole soles and vulcanized soles.

- Based on the end-user, the market is segmented into men and women.

Vulcanized Sole Shoes Segment to Lead the Market with the Largest Share

The expansion in the skateboard shoe industry, especially in the vulcanized sole category, is owing to numerous factors. The shoes provide a better board feel and flexibility, thus being a favorite for professional and amateur skaters. They are light, enhancing performance and allowing for improved control and trick execution. Vulcanized shoes are also generally cheaper, and this makes them attractive to more individuals. The sleek look also suits streetwear fashion, making there be more demand. Material longevity continues to improve with innovations by firms to increase product life. Influence by skate culture and social media has also contributed to visibility.

Men: A Key Segment in Market Growth

Beyond increasing urban living standards and sports trends, more men buy skateboard shoes. Skateboard culture is growing increasingly popular for men as an activity and an outlet for their expression. Specialty shoes, are good to wear, grippy, and durable, and are thus needed more. Influencer marketing and streetwear collaborations have also boosted the popularity of these shoes with male audiences. Additionally, most brands are placing a lot of emphasis on aesthetics and technical aspects that appeal to males. The incorporation of skate culture in mainstream fashion has also helped fuel this trend. Retailers are broadening their product offerings to accommodate the changing demands of male skateboarders.

Regional Outlook

The global skateboard shoes market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Growing Mainstreaming Of Skateboarding As Part of Youth Culture in Europe

European market growth for skateboard shoes is spurred by the increasing mainstreaming of skateboarding as part of youth culture. Urban governments in many countries are making investments in urban sports facilities and skate parks, promoting increased participation by the local community. Increased demand for skateboarding shoes has also emerged as a result of a greater focus on showcasing individuality with fashion. Niche businesses and boutiques are fueling consumers' wants by producing merchandise aimed at an entire region. European shoppers also are finding a greater voice demanding more eco-friendly, sustainable shoes. Brand stories are also being enriched by collaborations between shoe manufacturers and local artists. Distribution channels are being expanded to reach more of the market with specialty sports retailers and lifestyle retailers.

North America Region Dominates the Market with Major Share

The growth of the North American skateboard shoe market has been driven by a series of dynamic factors. The demand for skateboarding among youths has exploded with urban lifestyles and fashion culture. The appeal of extreme sports and its promotion at international events such as the Olympics also increased demand. Additionally, the proliferation of e-commerce sites increased access to niche footwear. Brands are putting more emphasis on partnerships with professional skateboarders and streetwear brands, making them more marketable. Innovation in shoe design through technology is enhancing comfort and durability, drawing both athletes and recreational users. Moreover, the region's high retail infrastructure is conducive to widespread distribution of the product.

Market Players Outlook

The major companies operating in the global skateboard shoe market include ADIDAS AG, Emerica, Lakai Footwear Ltd, New Balance Athletics, Inc., NIKE, Inc., Vans, C1RCA Footwear, DC Shoes, and PUMA SE, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In September 2023, Nike SB introduced its skateboard shoes in the Leo Baker partnership. The Nike SB React Leo is a gender-neutral shoe that blends durability with modern technology. To accomplish this, the Nike SB React Leo features a rich leather upper that's overlaid with suede in high-wear areas to offer further durability.

- In June 2023, Skateboard GB announced a partnership with Tanzania. Supported by investment through UK Sport’s International Partnerships Programme (IPP), the project started with a visit this week by a Skateboard GB delegation to Tanzania to deliver a coach education program. A comprehensive development programme for skateboarding in the country and other African nations, while promoting its potential for inclusion in future Commonwealth Games.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global skateboard shoes market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Skateboard Shoes Market Sales Analysis – Type | End-User| ($ Million)

• Skateboard Shoes Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Skateboard Shoes Industry Trends

2.2.2. Market Recommendations

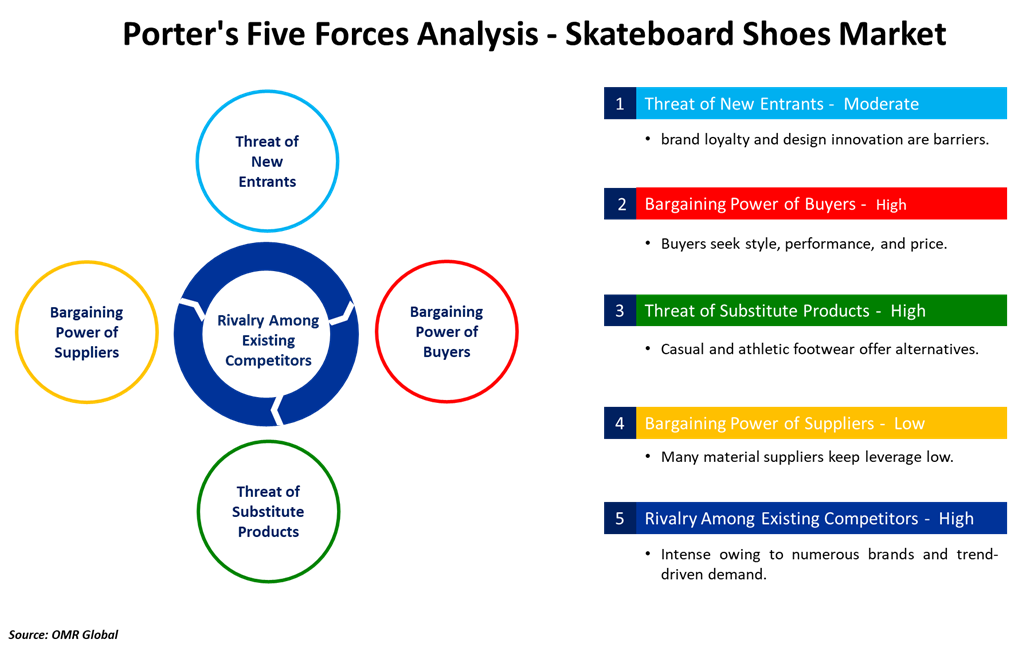

2.3. Porter's Five Forces Analysis for the Skateboard Shoes Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Skateboard Shoes Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Skateboard Shoes Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Skateboard Shoes Market Revenue and Share by Manufacturers

• Skateboard Shoes Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Adidas AG

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. New Balance Athletics, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. NIKE, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Vans, A VF Company

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Skateboard Shoes Market Sales Analysis by Type ($ Million)

5.1. Cupsole Shoes

5.2. Vulcanized Sole Shoes

6. Global Skateboard Shoes Market Sales Analysis by End-User ($ Million)

6.1. Men

6.2. Women

7. Regional Analysis

7.1. North American Skateboard Shoes Market Sales Analysis – Type | End-User | Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Skateboard Shoes Market Sales Analysis – Type |End-User | Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Skateboard Shoes Market Sales Analysis – Type |End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Skateboard Shoes Market Sales Analysis – Type | End-User | Country ($ Million)

• Macroeconomic Factors for Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. 2HEX

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Adidas AG

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. ASICS America Corp.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. C1RCA Footwear

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Cariuma

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Converse

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. DC Shoes, LLC

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Dekline Footwear

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. DVS Shoes Co., Inc.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Emerica

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. éS Skateboarding

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Etnies

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Fallen Footwear

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Globe International

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Hirolas

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Lakai Footwear Ltd.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Last Resort AB

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. LazerXTech

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Levi Strauss & Co.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. LI NING CO., LTD.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. LIEKICK

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Native Canada Footwear Ltd.

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. New Balance Athletics, Inc.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. NIKE, Inc.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Osiris Shoes

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

8.26. PUMA SE

8.26.1. Quick Facts

8.26.2. Company Overview

8.26.3. Product Portfolio

8.26.4. Business Strategies

8.27. SAOLA SAS

8.27.1. Quick Facts

8.27.2. Company Overview

8.27.3. Product Portfolio

8.27.4. Business Strategies

8.28. Vans, A VF Company

8.28.1. Quick Facts

8.28.2. Company Overview

8.28.3. Product Portfolio

8.28.4. Business Strategies

8.29. Vivobarefoot Ltd.

8.29.1. Quick Facts

8.29.2. Company Overview

8.29.3. Product Portfolio

8.29.4. Business Strategies

8.30. World Industries

8.30.1. Quick Facts

8.30.2. Company Overview

8.30.3. Product Portfolio

8.30.4. Business Strategies

8.31. Xtep International Holdings Ltd.

8.31.1. Quick Facts

8.31.2. Company Overview

8.31.3. Product Portfolio

8.31.4. Business Strategies

1. Global Skateboard Shoes Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Skateboard Cupsole Shoes Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Skateboard Vulcanized Sole Shoes Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Skateboard Shoes Market Research And Analysis By End-User, 2024-2035 ($ Million)

5. Global Skateboard Shoes For Men Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Skateboard Shoes For Women Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Skateboard Shoes Market Research And Analysis By Region, 2024-2035 ($ Million)

8. North American Skateboard Shoes Market Research And Analysis By Country, 2024-2035 ($ Million)

9. North American Skateboard Shoes Market Research And Analysis By Type, 2024-2035 ($ Million)

10. North American Skateboard Shoes Market Research And Analysis By End-User, 2024-2035 ($ Million)

11. European Skateboard Shoes Market Research And Analysis By Country, 2024-2035 ($ Million)

12. European Skateboard Shoes Market Research And Analysis By Type, 2024-2035 ($ Million)

13. European Skateboard Shoes Market Research And Analysis By End-User, 2024-2035 ($ Million)

14. Asia-Pacific Skateboard Shoes Market Research And Analysis By Country, 2024-2035 ($ Million)

15. Asia-Pacific Skateboard Shoes Market Research And Analysis By Type, 2024-2035 ($ Million)

16. Asia-Pacific Skateboard Shoes Market Research And Analysis By End-User, 2024-2035 ($ Million)

17. Rest Of The World Skateboard Shoes Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Rest Of The World Skateboard Shoes Market Research And Analysis By Type, 2024-2035 ($ Million)

19. Rest Of The World Skateboard Shoes Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Skateboard Shoes Market Share By Type, 2024 Vs 2035 (%)

2. Global Skateboard Cupsole Shoes Market Share By Region, 2024 Vs 2035 (%)

3. Global Skateboard Vulcanized Sole Shoes Market Share By Region, 2024 Vs 2035 (%)

4. Global Skateboard Shoes Market Share By End-User, 2024 Vs 2035 (%)

5. Global Skateboard Shoes For Men Market Share By Region, 2024 Vs 2035 (%)

6. Global Skateboard Shoes For Women Market Share By Region, 2024 Vs 2035 (%)

7. Global Skateboard Shoes Market Share By Region, 2024 Vs 2035 (%)

8. US Skateboard Shoes Market Size, 2024-2035 ($ Million)

9. Canada Skateboard Shoes Market Size, 2024-2035 ($ Million)

10. UK Skateboard Shoes Market Size, 2024-2035 ($ Million)

11. France Skateboard Shoes Market Size, 2024-2035 ($ Million)

12. Germany Skateboard Shoes Market Size, 2024-2035 ($ Million)

13. Italy Skateboard Shoes Market Size, 2024-2035 ($ Million)

14. Spain Skateboard Shoes Market Size, 2024-2035 ($ Million)

15. Russia Skateboard Shoes Market Size, 2024-2035 ($ Million)

16. Rest Of Europe Skateboard Shoes Market Size, 2024-2035 ($ Million)

17. India Skateboard Shoes Market Size, 2024-2035 ($ Million)

18. China Skateboard Shoes Market Size, 2024-2035 ($ Million)

19. Japan Skateboard Shoes Market Size, 2024-2035 ($ Million)

20. South Korea Skateboard Shoes Market Size, 2024-2035 ($ Million)

21. Australia and New Zealand Skateboard Shoes Market Size, 2024-2035 ($ Million)

22. ASEAN Economies Skateboard Shoes Market Size, 2024-2035 ($ Million)

23. Rest Of Asia-Pacific Skateboard Shoes Market Size, 2024-2035 ($ Million)

24. Latin America Skateboard Shoes Market Size, 2024-2035 ($ Million)

25. Middle East And Africa Skateboard Shoes Market Size, 2024-2035 ($ Million)

FAQS

The size of the Skateboard Shoes market in 2024 is estimated to be around $1.9 billion.

North America holds the largest share in the Skateboard Shoes market.

Leading players in the Skateboard Shoes market include ADIDAS AG, Emerica, Lakai Footwear Ltd, New Balance Athletics, Inc., NIKE, Inc., Vans, C1RCA Footwear, DC Shoes, and PUMA SE, among others.

Skateboard Shoes market is expected to grow at a CAGR of 4.3% from 2025 to 2035.

The primary driver fueling the skateboard shoes market is the surge in skateboarding culture and streetwear appeal, coupled with continuous innovations in shoe durability and performance.