Smart Meters Market

Global Smart Meters Market Size, Share & Trends Analysis Report by Product Type (Smart Gas Meters, Smart Electric Meters, Smart Water Maters), By Technology (AMI and AMR), By Application (Residential, Commercial, and Industrial) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for smart meters is projected to have considerable CAGR of around 7.5% during the forecast period. The market growth mainly backed by the increasing inclination towards smart meters in place of conventional meters due to various advantages, such as theft detection and leakage management further raises the demand for smart meters across the globe. The smart meters provides theft and accurate billing and enhanced customer services by the integration of AMI systems. Along with that, the growth is attributed to increasing penetration of smart meters in the near future, owing to government regulation and initiatives, rising demand for utility management, and rising urbanization in emerging economies such as India and China. Additionally, smart meters support in-house displays, keeping the consumers informed about the energy used by them in real-time. Some of the smart meters offer remote access to various utility's control center and consumers can pay bills through mobile app syncing. Therefore growing penetration of smartphone also projected to provide significant opportunity to the market.

Segmental Outlook

The global smart meters market is segmented based on product type, technology, and application. Based on the product type, the market is further classified into smart gas meters, smart electric meters, smart water maters. The smart electric segment is projected to have considerable share owing to the growing demand of smart grid solutions in industrial and commercial applications. Moreover, the increasing deployment of smart electric meters in Europe and North America further contribute in the growth of the segmental market. Based on technology the market for smart meters further segregated into advanced metering infrastructure (AMI) and automated meter reading (AMR). The AMI segment is projected to hold significant share in the global smart meters market. The On the basis of application the market is further segregated into residential, commercial and industrial.

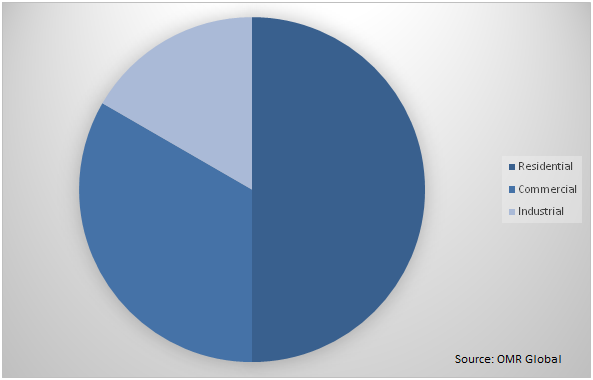

Global Smart Meters Market Share by Application, 2019 (%)

Global Smart Meters Market to be driven by residential application

Among application, the residential segment held a considerable share in the market owing to increasing government initiatives to adopt smart solutions in order to improve the efficiency of utilities such as gas water and electricity. For instance, the US government aims to install smart gas meter in every household across the country by 2020. Also, the government of India has taken initiatives to replace the existing LPG connections with piped natural gas (PNG) in combination with smart meters in the identified areas which will help in developing localities as modern. The smart PNG meter that is being used by the government of India is aiding in the process of obtaining the consumed gas unit readings over the period of time using advance online reporting and easy access to the billing systems. Further, the rising consumer awareness for reducing energy usage is another major factor raising the demand of smart meters in the residential sector.

Regional Outlook

Geographically, the global smart meters market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America and Europe have considerabl market share in the global smart meters market. North America is the home of the largest companies in terms of revenue which include Landis+Gyr AG, Diehl Stiftung & Co. KG, Honeywell International Inc., Itron Inc., Suntront Tech Co., Ltd., Aclara Technologies LLC, and Apator SA among others. These companies are the key players contributing to the smart meters market and their presence is estimated to fuel the growth of the market. The government-driven initiatives to offer smart solutions in utility supply are further fueling the market growth in the region. In Europe, regional directives and national regulations are the key factors to drive the growth of the smart meters market.

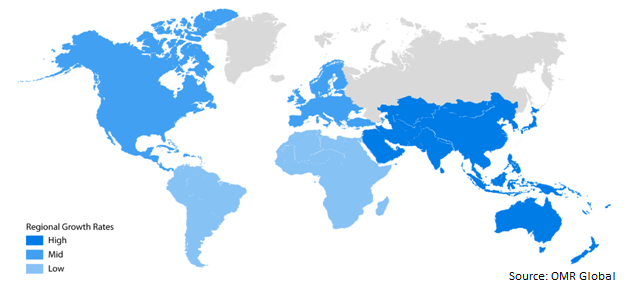

Global Smart Meters Market Growth, by Region 2020-2026

Asia-Pacific to hold a considerable growth in the global smart meters market

Geographically, Asia-Pacific is projected to hold a significant market growth in the global smart meters market during the forecast period. Major economies which are anticipated to contribute to Asia-Pacific smart meters market are China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising smart city projects and partnerships for the development of smart meters. As per the data published by the German Asia-Pacific Business Association in March 2019, the Chinese government is pushing the development of smart cities counting around 500 pilot projects. Apart from these, a significant partnership for the development of smart meters is further strengthening the market growth in the region. For instance, in May 2019, Semtech Corp., a supplier of analog and mixed-signal semiconductors products partnered with Goldcard Smart Group Co., Ltd., a provider of smart public utility solutions in China, to support gas utilities to optimize their operations.

Market Players Outlook

The key players in the smart meters market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Eaton Corp., Honeywell International, Inc., Landis+Gyr AG, Schneider Electric SE, Siemens AG and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart meters market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Eaton Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Honeywell International, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Landis+Gyr AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Schneider Electric SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global smart meters Market by Product Type

5.1.1. Smart Gas Meters

5.1.2. Smart Electric Meters

5.1.3. Smart Water Maters

5.2. Global smart meters Market by Technology

5.2.1. Advanced Metering Infrastructure (AMI)

5.2.2. Automated Meter Reading (AMR)

5.3. Global smart meters Market by Application

5.3.1. Residential

5.3.2. Commercial

5.3.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India 6.3.3. Japan 6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aclara Technologies LLC

7.2. Apator SA

7.3. Badger Meter, Inc.

7.4. Diehl Stiftung& Co. KG

7.5. Eaton Corp.

7.6. EDMI Ltd.

7.7. Flonidan A/S

7.8. General Electric Co.

7.9. Holley Technology UK Ltd.

7.10. Honeywell International, Inc.

7.11. Itron Inc.

7.12. Jabil Inc.

7.13. Kamstrup A/S

7.14. Landis+Gyr AG

7.15. QMC Inc.

7.16. Raychem RPG

7.17. Sensirion AG

7.18. Siemens AG

7.19. Schneider Electric SE

7.20. SIT S.p.A

7.21. SmartMeterQ Srl

7.22. Suntront Tech Co., Ltd.

7.23. Wasion Holdings Ltd.

7.24. Xylem Inc.

7.25. Zenner International GmbH & Co. KG

1. GLOBAL SMART METERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL SMART GAS METERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SMART ELECTRIC METERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SMART WATER METERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL SMART METERS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

6. GLOBAL AMI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AMR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL SMART METERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. GLOBAL SMART METERS IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SMART METERS IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL SMART METERS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL SMART METERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN SMART METERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN SMART METERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN SMART METERS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN SMART METERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN SMART METERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN SMART METERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. EUROPEAN SMART METERS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

20. EUROPEAN SMART METERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC SMART METERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC SMART METERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC SMART METERS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC SMART METERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD SMART METERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD SMART METERS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

27. REST OF THE WORLD SMART METERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL SMART METERS MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL SMART METERS MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL SMART METERS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL SMART METERS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD SMART METERS MARKET SIZE, 2019-2026 ($ MILLION)