Solid State Drive Market

Solid State Drive Market Size, Share & Trends Analysis Report by Interface (Serial ATA (SATA), Peripheral Component Interconnect Express (PCIe), and Non-Volatile Memory Express (NVME)), by Form Factor (2.5-inch, 3.5-inch, Next Generation Form Factor 2 (M.2), U.2 Small Form Factor (U.2), U.2/SFF 8639, and FHHL/HHHL), by Technology (NAND Flash Memory, Three Dimensional CrossPoint (3D XPoint) Memory, and Zigzag NAND (Z-NAND) Flash Memory), and by End-User (Consumer Electronics, Data Centers, Enterprise IT, and Automotive) Forecast Period (2023-2030)

Solid State Drive market is anticipated to grow at a CAGR of 16.48% during the forecast period (2023-2030). A solid-state drive (SSD) is a computer storage device that uses flash memory to store data. SSDs are non-volatile, meaning they retain data even when power is removed. The growing demand in the increase of high-performance computing devices is one of the key factors for the growth of the market. High Performance Computing (HPC) devices are used for a variety of demanding tasks, such as scientific research, engineering simulations, and video editing. These tasks require fast access to large amounts of data, which SSDs can provide. SSDs are also more reliable than traditional hard disk drives (HDDs), which is important for HPC applications where downtime can be costly. SSD manufacturers are constantly developing new technologies to improve the performance, reliability, and durability of their products. This is being driven in part by the growing demand for HPC devices, which require the highest possible performance and reliability.

Gaming laptops and workstations are two of the most popular types of HPC devices. These devices require fast and reliable storage to handle the demanding requirements of modern games and software applications. SSDs are the preferred choice of storage for gaming laptops and workstations due to their superior performance and reliability. Data centers are another major driver of the demand for SSDs. Data centers are used to store and process large volumes of data for a variety of applications, such as cloud computing, social media, and e-commerce. SSDs are used in data centers to improve performance, reduce latency, and increase storage density.

Segmental Outlook

The global Solid State Drive market is segmented on the interface, form factor, technology, and end-user. Based on the interface, the market is sub-segmented into serial ata (sata), peripheral component interconnect express (pcie), and non-volatile memory express (nvme). Based on the form factor, the market is sub-segmented into 2.5-inch, 3.5-inch, next generation form factor 2 (m.2), u.2 small form factor (u.2), u.2/sff 8639, and fhhl/hhhl. Based, on the basis of technology, the market is sub-segmented into nand flash memory, three dimensional crosspoint (3d xpoint) memory, and zigzag nand (z-nand) flash memory. Further based on, end-user, the market is sub-segmented into consumer electronics, data centers, enterprise it, and automotive.

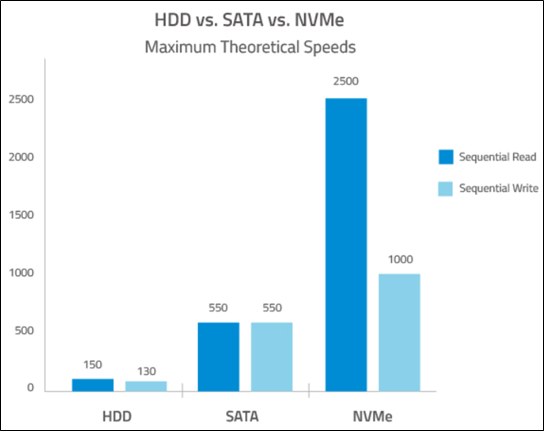

Above figure is depicting the difference between the speeds of read and write of different types of SSD’s and HDD.

The SATA Sub-Segment is Anticipated to Hold a Considerable Share of the Global Solid State DriveMarket

Among the interface, the SATA sub-segment is expected to hold a considerable share of the global solid state drive market. There are mainly 4 reasons that the SATA SSD’s contributed to the major market share. SATA SSDs are the most affordable type of SSD, making them accessible to consumers and businesses alike. PCIe and NVMe SSDs are more expensive, making them less attractive to budget-conscious buyers. SATA SSDs are compatible with most laptops, desktops, and other devices that use traditional hard disk drives. PCIe and NVMe SSDs require specialized hardware, which can limit their compatibility. SATA SSD technology has been around for longer than PCIe and NVMe SSD technology. This means that SATA SSDs are more mature and reliable. PCIe and NVMe SSDs are still relatively new, and they have not yet reached the same level of maturity and reliability as SATA SSDs. SATA SSDs offer good performance for most applications. They are faster than traditional hard disk drives, but they are not as fast as PCIe and NVMe SSDs. For most consumers and businesses, the performance of SATA SSDs is sufficient.

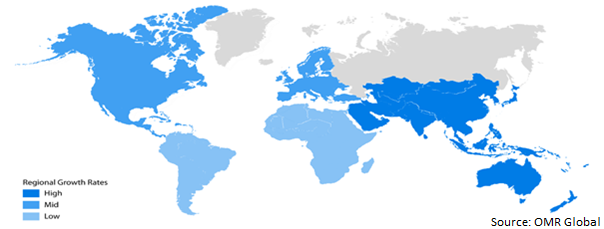

Regional Outlook

The global Solid State Drive market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold a prominent share of the market across the globe, owing to the high concentration of the market solution vendors including Samsung Electronics, Western Digital Corp., and Micron Technology, Inc. which combines about 70 percent of the whole market.

Global Solid State Drive Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Solid State Drive Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. This rapid growth of this region has various reasons. The IT and data center markets in the Asia Pacific region are growing rapidly, driven by the growth of the digital economy and the increasing adoption of cloud computing. This is driving the demand for SSDs, which are used in high-performance computing and data storage applications. The Asia Pacific region is experiencing rapid urbanization and rising disposable incomes. This is leading to an increase in the demand for consumer electronics, such as laptops, smartphones, and tablets. These devices are increasingly using SSDs, which offer better performance and durability than traditional hard disk drives. Governments in the Asia Pacific region are investing heavily in the IT and data center sectors. This is driving the demand for SSDs in government applications, such as e-governance, smart cities, and national security.

Market Players Outlook

The major companies serving the Solid State Drive market include Kioxia Singapore Pte. Ltd., Micron Technology, Inc., Seagate Technology LLC, Samsung Electronics., Western Digital Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2023, Micron Technology, Inc. expanded its portable SSD portfolio by launching it’s two new products namely the Crucial X9 Pro Portable SSD and Crucial X10 Pro. The 2 launched products were both water and dust-resistant.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Solid State Drive market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Kioxia Singapore Pte. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Micron Technology, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Samsung Electronics

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Seagate Technology LLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Western Digital Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

1.1. Key Strategy Analysis

4. Market Segmentation

4.1. Global Solid State Drive Market by Interface

4.1.1. Serial ATA (SATA)

4.1.2. Peripheral Component Interconnect Express (PCIe)

4.1.3. Non-Volatile Memory Express (NVME)

4.2. Global Solid State Drive Market by Form Factor

4.2.1. 2.5-inch

4.2.2. 3.5-inch

4.2.3. Next Generation Form Factor 2 (M.2)

4.2.4. U.2 Small Form Factor (U.2)

4.2.5. U.2/SFF 8639

4.2.6. FHHL/HHHL

4.3. Global Solid State Drive Market by Technology

4.3.1. NAND Flash Memory

4.3.2. Three Dimensional CrossPoint (3D XPoint) Memory

4.3.3. Zigzag NAND (Z-NAND) Flash Memory

4.4. Global Solid State Drive Market by End-User

4.4.1. Consumer Electronics

4.4.2. Data Centers

4.4.3. Enterprise IT

4.4.4. Automotive

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADATA Technology Co., Ltd.

6.2. CORSAIR MEMORY, Inc.

6.3. CrossBar, Inc.

6.4. Fujitsu Limited

6.5. G.SKILL International Enterprise Co., Ltd.

6.6. Intel Corporation

6.7. Kingston Technology Company, Inc.

6.8. Lexar Co., Ltd.

6.9. LITE-ON Technology Corp.

6.10. Marvell Technology, Inc.

6.11. Mushkin Enhanced MFG.

6.12. NetApp, Inc.’s

6.13. Phison Electronic Corp.

6.14. PNY Technologies Inc.

6.15. Silicon Motion Technology Corp.

6.16. SK hynix Co., Ltd.

6.17. Transcend Information. Inc.

1. GLOBAL SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY INTERFACE, 2023-2030 ($ MILLION)

2. GLOBAL SATA SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY REGION,2023-2030 ($ MILLION)

3. GLOBAL PCIE SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

4. GLOBAL NVME SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

5. GLOBAL SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2023-2030 ($ MILLION)

6. GLOBAL SOLID STATE DRIVE IN 2.5-INCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

7. GLOBAL SOLID STATE DRIVE IN 3.5-INCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

8. GLOBAL SOLID STATE DRIVE IN M.2 MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

9. GLOBAL SOLID STATE DRIVE IN U.2 MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

10. GLOBAL SOLID STATE DRIVE IN U.2/SFF 8639 MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

11. GLOBAL SOLID STATE DRIVE IN FHHL/HHHL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

12. GLOBAL SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

13. GLOBAL SOLID STATE DRIVE BY NAND FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

14. GLOBAL SOLID STATE DRIVE BY 3D XPOINT MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

15. GLOBAL SOLID STATE DRIVE BY Z-NAND FLASH MEMORY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

16. GLOBAL SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

17. GLOBAL SOLID STATE DRIVE FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

18. GLOBAL SOLID STATE DRIVE FOR DATA CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

19. GLOBAL SOLID STATE DRIVE FOR ENTERPRISE IT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

20. GLOBAL SOLID STATE DRIVE FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

21. GLOBAL SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2030 ($ MILLION)

22. NORTH AMERICAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2030 ($ MILLION)

23. NORTH AMERICAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY INTERFACE, 2023-2030 ($ MILLION)

24. NORTH AMERICAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2023-2030 ($ MILLION)

25. NORTH AMERICAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

26. NORTH AMERICAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

27. EUROPEAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2030 ($ MILLION)

28. EUROPEAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY INTERFACE, 2023-2030 ($ MILLION)

29. EUROPEAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2023-2030 ($ MILLION)

30. EUROPEAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

31. EUROPEAN SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

32. ASIA-PACIFIC SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2030 ($ MILLION)

33. ASIA-PACIFIC SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY INTERFACE, 2023-2030 ($ MILLION)

34. ASIA-PACIFIC SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2023-2030 ($ MILLION)

35. ASIA- PACIFIC SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

36. ASIA-PACIFIC SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

37. REST OF THE WORLD SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2030 ($ MILLION)

38. REST OF THE WORLD SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY INTERFACE, 2023-2030 ($ MILLION)

39. REST OF THE WORLD SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY FORM FACTOR, 2023-2030 ($ MILLION)

40. REST OF THE WORLD SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

41. REST OF THE WORLD SOLID STATE DRIVE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

1. GLOBAL SOLID STATE DRIVEMARKET SHARE BY INTERFACE, 2023 VS 2030 (%)

2. GLOBAL SATA SOLID STATE DRIVE MARKET SHARE BY REGION, 2023 VS 2030 (%)

3. GLOBAL PCIE SOLID STATE DRIVE MARKET SHARE BY REGION, 2023 VS 2030 (%)

4. GLOBAL NVME SOLID STATE DRIVE MARKET SHARE BY REGION, 2023 VS 2030 (%)

5. GLOBAL SOLID STATE DRIVE MARKET SHARE BY FORM FACTOR, 2023 VS 2030 (%)

6. GLOBAL SOLID STATE DRIVE IN 2.5-INCH MARKET SHARE BY REGION, 2023 VS 2030 (%)

7. GLOBAL SOLID STATE DRIVE IN 3.5-INCH MARKET SHARE BY REGION, 2023 VS 2030 (%)

8. GLOBAL SOLID STATE DRIVE IN M.2 MARKET SHARE BY REGION, 2023 VS 2030 (%)

9. GLOBAL SOLID STATE DRIVE IN U.2 MARKET SHARE BY REGION, 2023 VS 2030 (%)

10. GLOBAL SOLID STATE DRIVE IN U.2/SFF 8639 MARKET SHARE BY REGION, 2023 VS 2030 (%)

11. GLOBAL SOLID STATE DRIVE IN FHHL/HHHL MARKET SHARE BY REGION, 2023 VS 2030 (%)

12. GLOBAL SOLID STATE DRIVE MARKET SHARE ANALYSIS BY TECHNOLOGY, 2023-2030 ($ MILLION)

13. GLOBAL SOLID STATE DRIVE BY NAND FLASH MEMORY MARKET SHARE BY REGION, 2023 VS 2030 (%)

14. GLOBAL SOLID STATE DRIVE BY 3D XPOINT MEMORY MARKET SHARE BY REGION, 2023 VS 2030 (%)

15. GLOBAL SOLID STATE DRIVE BY Z-NAND FLASH MEMORY MARKET SHARE BY REGION, 2023 VS 2030 (%)

16. GLOBAL SOLID STATE DRIVE MARKET SHARE ANALYSIS BY END-USER, 2023-2030 ($ MILLION)

17. GLOBAL SOLID STATE DRIVE FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2030 (%)

18. GLOBAL SOLID STATE DRIVE FOR DATA CENTERS MARKET SHARE BY REGION, 2023 VS 2030 (%)

19. GLOBAL SOLID STATE DRIVE FOR ENTERPRISE IT MARKET SHARE BY REGION, 2023 VS 2030 (%)

20. GLOBAL SOLID STATE DRIVE FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2030 (%)

21. GLOBAL SOLID STATE DRIVE MARKET SHARE BY REGION, 2023 VS 2030 (%)

22. US SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

23. CANADA SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

24. UK SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

25. FRANCE SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

26. GERMANY SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

27. ITALY SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

28. SPAIN SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

29. REST OF EUROPE SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

30. INDIA SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

31. CHINA SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

32. JAPAN SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

33. SOUTH KOREA SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

34. REST OF ASIA-PACIFIC SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)

35. REST OF THE WORLD SOLID STATE DRIVE MARKET SIZE, 2023-2030 ($ MILLION)