Substation Battery Market

Global Substation Battery Market Size, Share & Trends Analysis Report, By Battery Type (Nickel Cadmium Battery, Lead Acid Battery, Sealed Lead Acid Battery, Vented Lead Acid Battery, and Others), By Application (Residential and Commercial, Industrial, Utilities, and Others), Forecast (2021-2027).

The global substation battery market is anticipated to grow at a significant CAGR of nearly 9.8% during the forecast period. The major factors that drive the growth of the market include the implementation of e-mobility across the globe for public transportation, and promoting e-vehicle along with building battery charging station infrastructure is projected to drive the substation battery market. For instance, in January 2022, IREDA launched a new program to promote the manufacture and deployment of infrastructure for emerging technologies, charging infrastructure, and green mobility in this project substation battery is required. Hence lead to market growth.

Another factor includes the increasing prevalence of power failure in substations is boosting the demand for substation batteries, which in turn will offer robust opportunities for the market over the forecast period. For instance, as per the NITI Aayog 2021 report, In Delhi, TPDDL has installed a 10 MWh battery bank commissioned by AES and Mitsubishi in 2019 at the substation level.125 the battery bank is capable of applications ranging from peak load management, frequency regulation to system flexibility. It allows to balance distributed energy resources including RTS. Moreover, the battery life can be drastically reduced in a short period. However, the low usable capacity of the substation batteries acts as a market challenge.

Impact of COVID-19 Pandemic on Global Substation Battery Market

The COVID-19 pandemic had disrupted the manufacturing operations of various industries across the globe, including the power industry. The COVID-19 pandemic is also impacted the nuclear power availability in Europe as well as other regions, which had drastically reduced the demand for substation batteries. Also, the automotive industry and building industry halted their production and construction activities due to the COVID-19 pandemic. Therefore, the demand for substation batteries was adversely affected by the COVID-19 pandemic. As the COVID-19 situation normalizes, the substation battery market started recovery as industrial operations were normalized after the recovery.

Segmental Outlook

The global substation battery market is segmented based on battery type, and application. Based on the battery type, the market is segmented into the nickel-cadmium battery, lead-acid battery, sealed lead acid battery, vented lead-acid battery, and others. Based on the application, the market is sub-segmented into the residential and commercial, industrial, utilities, and others.

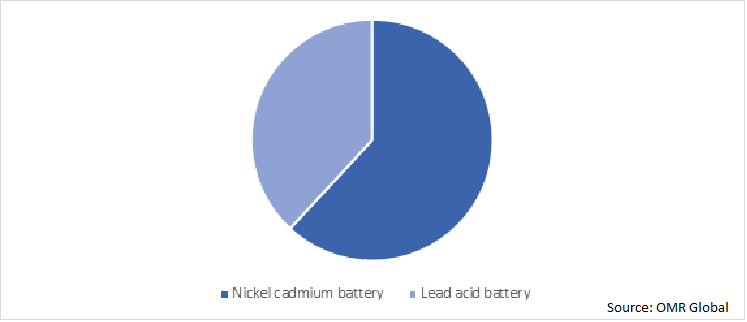

Global Substation Battery Market Share by battery Type, 2020 (%)

Lead Acid Battery Type Segment Holds the Prominent Share in the Global Substation Battery Market.

Based on the battery type, the lead-acid battery holds the major share in 2020. One of the major factors that drive the lead-acid battery segmental growth is the increasing use of lead-acid batteries for energy storage. The power companies in this market are preferring lithium-ion (li-ion) batteries for grid stabilization over more conventional energy storage systems due to their high energy density, and lightweight properties. For instance, the Hornsdale Power Reserve in Southern Australia is one of the largest lithium-ion battery storage facilities across the globe and it is built by Tesla, which is used to stabilize the electricity grid from the energy received from a nearby wind farm. The battery system also powers over 30,000 homes in the region.

Regional Outlook

The global Substation Battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

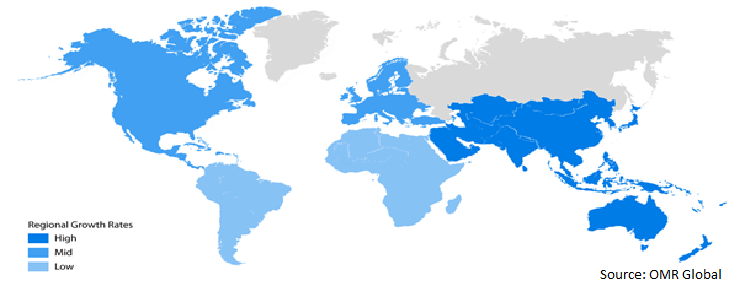

Global Substation Battery Market Growth by Region, 2021-2027

Asia-Pacific Region Dominates the Global Substation Battery Market.

Asia-Pacific region dominates the substation battery market due to the rising industrialization in developing countries such as China, and India. The industrial and commercial & residential sectors, along with the transportation sector is growing in this region, proved to be the major consumers of these battery systems. For instance, as per the report of International Trade Administration data 2021, As of April 30, 2021, India’s installed capacity stood at 383 GW with coal dominating with 55% of the mix. However, coal’s share is declining as the supply of renewable energy, in particular solar, increases. Once a government-led sector, power generation is realizing increased participation from the private sector, which made a 46.83% contribution to India’s installed power generation capacity in 2020.

Additionally, the Asia Pacific region is expected to lead the market during the forecast period. China, Singapore, South Korea, Japan, and India are considered the main industrial hubs, and offer tremendous growth opportunities for the lead-acid battery market in this region due to the factor that includes the construction of an intelligent substation increases the reliability of power supply, reducing operations, and maintenance cost promote the application of intelligent transformers, intelligent high voltage switching, and other auxiliary intelligent equipment. It is also conducive to the development of related equipment manufacturing.

Market Players Outlook

The major companies serving the global Substation Battery market include Johnson Controls Inc.GS Yuasa., Robert Bosch GmbH, Exide Technologies, and Saft Groupe S.A. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships and collaborations, and geographical expansion, to stay competitive in the market. For instance, in October 2018, SolarEdge Technologies acquired Kokam the South Korean manufacturer of lithium-ion battery cells, battery packs, and energy storage systems. As per the SolarEdge, about 75% of equity shares were bought for approximately $88 million.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Substation Battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Substation Battery Market

• Recovery Scenario of Global Substation Battery Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Exide Technologies

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. GS Yuasa International Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Saft Groupe SAS

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Robert Bosch GmbH

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Johnson Controls

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Substation Battery Market by Battery Type

4.1.1. Nickel Cadmium Battery

4.1.2. Lead Acid Battery

4.1.3. Sealed Lead Acid Battery

4.1.4. Vented Lead Acid Battery

4.1.5. Others

4.2. Global Substation Battery Market by Application

4.2.1. Residential and Commercial

4.2.2. Industrial

4.2.3. Utilities

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Storage Battery Systems, LLC

6.2. Tesla

6.3. HBL Power Systems Ltd.

6.4. Amara Raja Group.

6.5. EnerSys

6.6. Luminous Power Technologies. Ltd.

6.7. Trojan Battery Company

6.8. SolarEdge Technologies

1. GLOBAL SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL NICKEL CADMIUM BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL LEAD ACID BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SEALED LEAD ACID BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL VENTED LEAD ACID BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHERS BATTERY TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

8. GLOBAL SUBSTATION BATTERY FOR RESIDENTIAL AND COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL SUBSTATION BATTERY FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL SUBSTATION BATTERY FOR UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SUBSTATION BATTERY FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

15. NORTH AMERICAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

16. EUROPEAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

18. EUROPEAN SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

22. REST OF THE WORLD SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. REST OF THE WORLD SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2020-2027 ($ MILLION)

24. REST OF THE WORLD SUBSTATION BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SUBSTATION BATTERY MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SUBSTATION BATTERY MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL SUBSTATION BATTERY MARKET, 2021-2027 (%)

4. GLOBAL SUBSTATION BATTERY MARKET SHARE BY BATTERY TYPE, 2020 VS 2027 (%)

5. GLOBAL NICKEL CADMIUM BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL LEAD ACID BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL SEALED LEAD ACID BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL VENTED LEAD ACID BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL SUBSTATION BATTERY FOR OTHER BATTERY TYPE

10. GLOBAL SUBSTATION BATTERY MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

11. GLOBAL SUBSTATION BATTERY FOR RESIDENTIAL AND COMMERCIAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL SUBSTATION BATTERY FOR INDUSTRIAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL SUBSTATION BATTERY FOR UTILITIES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL SUBSTATION BATTERY FOR OTHER APPLICATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL SUBSTATION BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. US SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

17. CANADA SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

18. UK SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

19. FRANCE SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF EUROPE SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

24. INDIA SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD SUBSTATION BATTERY MARKET SIZE, 2020-2027 ($ MILLION)