Surge Arrester Market

Surge Arrester Market Size, Share & Trends Analysis Report by Voltage (Low Voltage, Medium Voltage, High Voltage), by Application (Industrial, Commercial, Residential), and by Class (Distribution Class, Intermediate Class, Station Class) Forecast Period (2023-2030)

Surge arrester market is anticipated to grow at a CAGR of 4.8% during the forecast period (2023-2030). A surge arrester is a protective device used for mitigating voltage surges in electrical systems. Its core function is to redirect excess electrical energy, safeguarding sensitive equipment from potential damage. Key advantages of using surge arresters include efficient voltage absorption and dissipation, ensuring the reliability of connected devices. Globally, the growing demand for surge arresters is driven by factors such as increased reliance on electronic devices across sectors, rising occurrences of severe weather events, and technological advancements integrating surge protection solutions. As industries are focusing on safeguarding their electrical infrastructure, the surge arrester market will continue to grow globally. Additionally, the priority to secure an uninterrupted power supply further contributes to the heightened demand for surge arresters.

Segmental Outlook

The global surge arrester market is segmented by voltage, application, and class. By voltage, the market is sub-segmented into low voltage, medium voltage, and high voltage. By application, the market is sub-segmented into Industrial, commercial, and residential applications. By class, the market is sub-segmented into distribution class, intermediate class, and station class. Among all segments, the demand for surge arresters is expected to grow in industrial applications. As per the 2022 report by the World Manufacturing Foundation, the manufacturing industry represents 17% of the global Gross Domestic Product (GDP). Industries are increasingly adopting sophisticated electronic equipment and automation technologies such as Internet of Things (IoT) devices, making them more vulnerable to voltage surges that can disrupt operations and damage critical machinery. As industrial processes become more digitized, the need for robust protection against transient voltage events is becoming essential which is driving demand for surge arresters. Additionally, with a growing awareness of the financial implications associated with disruptions and the need to improve operational efficiency, industries are prioritizing the implementation of surge protection measures as part of their overall risk management strategies. In summary, the surge in demand for surge arresters in the industrial sector is driven by the imperative to safeguard critical equipment, maintain operational continuity, and minimize economic losses stemming from potential voltage surges.

The Demand for Surge Arrester is Expected to Grow Significantly in Residential Applications

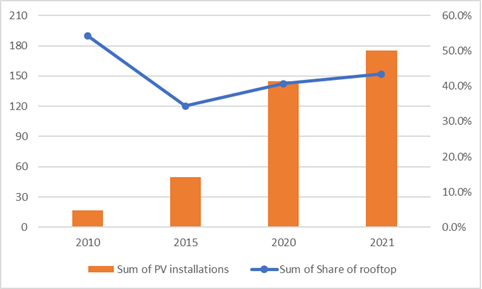

Globally, the ownership of electronic devices and home appliances is significantly growing such as smartphones, computers, smart appliances, and home automation systems among others which also drive demand for surge arresters to prevent damage from power surges and fluctuations. Additionally, the growing adoption of residential renewable energy resources and smart home technologies such as IoT devices are further driving demand for surge arresters in residential applications. According to the 2022 report by the International Energy Agency, Next to utility-scale installations, distributed applications on buildings are contributing significantly to Photovoltaic (PV) use of around 40% globally. The number of households relying on solar PV will grow from 25 million in 2022 to more than 100 million by 2030 in the Net Zero Emissions by 2050 Scenario.

Annual solar PV installations and share by segmentation, 2000-2021

Source: International Energy Agency

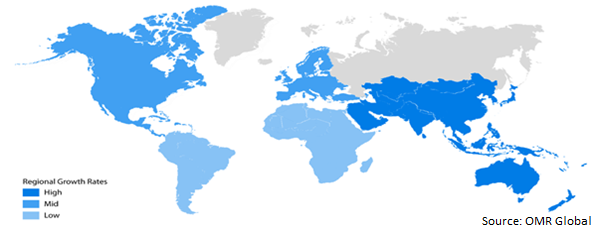

Regional Outlook

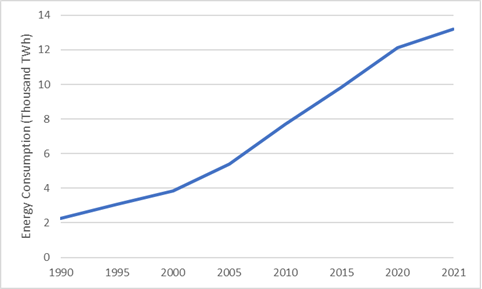

The global Surge arrester market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among regions, the Asia Pacific region is expected to be the fastest growing region for the surge arrester market owing to rapid urbanization and industrialization which leads to growing demand for electricity, growing investments in renewable energy production both at rooftop and industrial scale, rising awareness for power quality issues among populations. According to the International Renewable Energy Agency (IRENA), the region accounts for more than half of global energy consumption, with 85% of that regional consumption sourced from fossil fuels. Electrification rates have improved substantially over the past decade and the regional electrification rate reached 96.84 % in 2020. Also, growing energy consumption and production in the region drive demand for surge arresters. As per data from IEA, the total electricity consumption in the region has grown from 12,140.8 TWh to 13,203.5 TWh between 2020 to 2021. Also, as per IRENA, the electricity generation in the region has grown from 3.1 million GWh to 3.4 million GWh between 2020 to 2021. Also, growing investments in renewable energy generation by regional countries, and growing demand for consumer electronics contribute to the growth of the surge arrester market. According to the International Energy Agency (IEA), India's installed renewable energy capacity reached 174 GW in 2023 and is expected to grow up to 280 GW by 2025. Overall, as the regional industrial and energy sector is growing at a rapid scale, the regional surge arrester market is also expected to grow in Asia Pacific.

Electricity consumption, Asia Pacific 1990-2021

Source: IEA

Global Surge Arrester Market Growth by Region 2023-2030

The European Region Contributes the Highest in The Global Surge Arrester Market

The European region contributes the highest to the global surge arrester market due to its high electrification rate, focus on renewable energy production, growing energy demand, and regulatory environment, which emphasizes safety standards and the protection of electronic infrastructure. For instance, The CFPA Europe guideline No 4:2013 N emphasizes the use of surge arresters to protect electronic equipment and prevent damage from power surges and fluctuations. With growing energy needs and regulatory compliance, energy companies in the region are focusing on safeguarding their electrical infrastructure. For instance, in May 2023, The Energy Community Secretariat, jointly led by the European Commission, disclosed that approximately €3.6 million ($3.9 million) from the funds allocated to the Ukraine Energy Support Fund in Q1 2023 has been utilized for critical repairs in energy infrastructure. The Fund has acquired essential equipment, including welding machines, circuit breakers, twelve current transformers, and wires. Furthermore, purchases totaling €119.2 million ($130.5 million) are in advanced procurement stages, covering items such as power transformers, vehicle lifts, circuit breakers, switches, disconnectors, surge arresters, batteries, mobile cranes, steam turbines, and excavators. Also, the growing use of electronic devices for commercial and residential purposes is driving demand for surge arresters in the region. As per data from Eurostat, The number of electronics on the EU market increased by more than 85% between 2013-2021.

Market Players Outlook

The major companies serving the global surge arrester market are HAKEL spol. s r.o., Emerson Electric Co., General Electric Company (GE), and Hitachi Ltd among others. The market players are focusing on R&D and market expansion for business growth and staying competitive. For instance, in November 2023, in June 2023, Littelfuse, Inc. launched the NEMA-style Surge Protective Device (SPDN) series to safeguard equipment from transient overvoltage events lasting micro-seconds and help mitigate costly damage and downtime.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the surge arrester market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.3. CG Power & Industrial Solutions Ltd

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Eaton Corporation PLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global surge arrester market by voltage

4.1.1. Low Voltage

4.1.2. Medium Voltage

4.1.3. High Voltage

4.2. Global surge arrester market by application

4.2.1. Industrial

4.2.2. Commercial

4.2.3. Residential

4.3. Global surge arrester market by class

4.3.1. Distribution Class

4.3.2. Intermediate Class

4.3.3. Station Class

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Emerson Electric Co.

6.2. General Electric Company (GE)

6.3. HAKEL spol. s r.o.

6.4. Hitachi Ltd

6.5. Hubbell Incorporated

6.6. Lamco Industries Pvt Ltd

6.7. Legrand S.A

6.8. Leviton Manufacturing Co., Inc.

6.9. MEIDENSHA CORPORATION

6.10. Mitsubishi Electric Corporation

6.11. NGK INSULATORS, LTD.

6.12. Raycap Inc.

6.13. Schneider Electric SE

6.14. Siemens AG

6.15. TE Connectivity Corporation

6.16. Toshiba Corporation

6.17. Vertiv Group Corp.

1. GLOBAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2022-2030 ($ MILLION)

2. GLOBAL LOW VOLTAGE SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MEDIUM VOLTAGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HIGH VOLTAGE SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL INDUSTRIAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL COMMERCIAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL RESIDENTIAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY CLASS, 2022-2030 ($ MILLION)

10. GLOBAL DISTRIBUTION CLASS SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL INTERMEDIATE CLASS SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL STATION CLASS SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY CLASS, 2022-2030 ($ MILLION)

18. EUROPEAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2022-2030 ($ MILLION)

20. EUROPEAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. EUROPEAN SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY CLASS, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY CLASS, 2022-2030 ($ MILLION)

26. REST OF THE WORLD SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

27. REST OF THE WORLD SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

29. REST OF THE WORLD SURGE ARRESTER MARKET RESEARCH AND ANALYSIS BY CLASS, 2022-2030 ($ MILLION)

1. GLOBAL SURGE ARRESTER MARKET SHARE BY VOLTAGE, 2022 VS 2030 (%)

2. GLOBAL LOW VOLTAGE SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL MEDIUM VOLTAGE SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL HIGH VOLTAGE SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SURGE ARRESTER MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

6. GLOBAL INDUSTRIAL SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL COMMERCIAL SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL RESIDENTIAL SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SURGE ARRESTER MARKET SHARE BY CLASS, 2022 VS 2030 (%)

10. GLOBAL DISTRIBUTION CLASS SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL INTERMEDIATE CLASS SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL STATION CLASS SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL SURGE ARRESTER MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. US SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

16. UK SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD SURGE ARRESTER MARKET SIZE, 2022-2030 ($ MILLION)