Surgical Dressing Market

Surgical Dressing Market Size, Share & Trends Analysis Report by Type (Collagen Dressings, Transparent Film Dressings, Alginate Dressings, Foam Dressings, Gauze Dressings, Silver Dressings, and Others), by Application (Cardiovascular Diseases (CVD), Diabetes Based Surgeries, Transplant Sites, Ulcers, and Burns), and by End-User (Hospitals, Ambulatory Surgery Centers, Specialty Clinics, and Home Healthcare) Forecast Period (2023-2030)

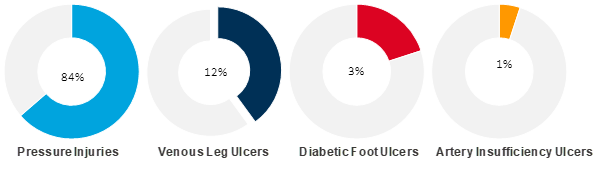

Surgical dressing market is anticipated to grow at a CAGR of 6.4% during the forecast period (2023-2030). The prevalence of chronic wounds, such as venous leg ulcers, pressure ulcers, and diabetic foot ulcers, is increasing challenges to wound care professionals, having a considerable impact on the growth of the surgical dressing industry. According to the Centers for Disease Control and Prevention (CDC), more than 37 million Americans have diabetes, and another 96 million adults in the US have a condition called prediabetes, which puts them at risk for type 2 diabetes. About 25% of individuals with diabetes mellitus have poor wound healing, which can lead to the removal of lower limbs and has significant financial and psychological consequences. The hyperglycemic environment encourages the growth of biofilms and makes it challenging to treat diabetic wounds. Diabetes can cause serious complications, including heart disease, kidney failure, and blindness. In October 2022, according to the report published by the Australian Department of Health and Aged Care, the department made a targeted investment of $1.20 million over three years from 2019-2021 for wound management. Chronic wounds are a significant problem in Australia, with an estimated 400,000 cases in hospital and residential care settings yearly.

Wound Type Prevalence in Hospital and Residential Care Settings in Australia, 2022 (%)

Source: Australian Department of Health and Aged Care

Furthermore, according to the National Institute of Health (NIH), chronic non-healing wounds (CNHW) are typically correlated with comorbidities such as diabetes, vascular deficits, hypertension, and chronic kidney disease. The result has increased the demand for surgical dressing. Furthermore, the rising number of food and drug administration (FDA) clearance also attributed to the increasing adoption of surgical dressing. In April 2023, 3M Health Care's innovative 3M™ Veraflo™ Therapy, with both 3M™ Veraflo™ Cleanse Choice Complete™ Dressing and 3M™ V.A.C. Veraflo Cleanse Choice™ Dressing, received the first-ever Food and Drug Administration (FDA) clearance for hydromechanical removal of infectious materials, non-viable tissue and wound debris which reduces the number of surgical debridement required, while promoting granulation tissue formation, creating an environment that promotes wound healing.

Segmental Outlook

The global surgical dressing market is segmented on the type, application, and end-user. Based on the type, the market is sub-segmented into collagen dressings, transparent film dressings, alginate dressings, foam dressings, gauze dressings, silver dressings, and others. Further, other types of surgical dressing include hydrogel dressings, composites dressings. Based on the application, the market is sub-segmented into cardiovascular diseases, diabetes-based surgeries, transplant sites, ulcers, and burns. Further, based on the end-user, the market is sub-segmented into hospitals, ambulatory surgery centers, specialty clinics and home healthcare. Among the type, the transparent film dressings sub-segment is anticipated to hold a considerable share of the market, owing to the maintaining wound moisture and reducing infection rates.

The Hospitals Sub-Segment is Anticipated to Hold a Considerable Share of the Global Surgical Dressing Market

Among the end-user, the hospitals sub-segment is expected to hold a considerable share of the global surgical dressing market. The segmental growth is attributed to the growing number of surgical procedures, increasing occurrence of diabetic foot ulcers, and rising number of hospitals. Hospitals provide services such as admitted patient care, including for elective surgery, emergency department care, and outpatient (non-admitted patient) care. As per the latest survey by the American Hospital Association (AH), the total number of hospitals in the US was counted ware 6,129 in 2023. Moreover, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia has increased. In In 2021–22, there were 11.6 million hospitalizations, covering 31.8 million days of patient care, 59.0% (6.8 million) of hospitalizations were in public hospitals, accounting for 68.0.% of days of patient care (21.7 million). There are 41.0% (4.8 million) of hospitalizations were in private hospitals, accounting for 32.0% of days of patient care (10.0 million). Thus, with a growing number of hospitals, and hospitalization cases, the segment is projected to grow significantly over the forecast period.

Regional Outlook

The global surgical dressing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Europe is anticipated to hold a prominent share of the market across the globe, owing to the increasing prevalence of diabetes, increasing R&D and growing medical tourism industry.

Global Surgical Dressing Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Surgical Dressing Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. China dominates the Asia-Pacific surgical dressing market followed by India, Japan, South Korea, and the rest of the Asia-Pacific economies. The surgical dressing market in China is experiencing growth owing to rising number of surgeries, rising number of cardiovascular disease-related surgeries, and increasing prevalence of chronic disorders, such as diabetes. According to the World Health Organization, China has the highest number of diabetic patients globally, with nearly 116 million active cases in 2019, and is expected to increase to 150 million by 2040. The estimated diabetes prevalence rate in China in 2009 was 3.9% and is projected to increase to 5.4% by 2030. The prevalence of diabetes in Chinese adults aged 20-79 years is projected to increase from 8.2% to 9.7% during 2020-2030. The expansion and emergence of the wound care management sector by Chinese players such as Winner Medical, Covalon, and others contribute to the market’s growth. For instance, in June 2022, Winner Medical displayed its latest and industry-leading advanced wound care solutions at the EWMA 2022 conference. At the conference, Winner Medical also launched a new product such as transparent film dressing, bordered silicone foam dressing with SAF and antibiosis series products and its new product, the CMC dressing. Winner Medical's wound care products have been widely used in more than 110 countries as primary solutions to provide wound management for acute and chronic wounds resulting from diabetes, immobility, and venous disease, as well as from traumatic injury, burns, invasive surgery, and other causes.

Market Players Outlook

The major companies serving the global surgical dressing market include 3M Co., ConvaTec Group Plc, Johnson & Johnson Services, Inc., Smith & Nephew Plc, Abigo Medical AB, B. Braun SE, Baxter Healthcare Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2022, Convatec Group Plc, a global medical solutions company focused on the management of chronic conditions, entered into a definitive agreement to acquire Triad Life Sciences Inc., a US-focused medical device company that develops biologically derived innovative products to address unmet clinical needs in surgical wounds, chronic wounds and burns.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global surgical dressing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ConvaTec Group Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Johnson & Johnson Services, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Smith & Nephew Plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Surgical Dressing Market by Type

4.1.1. Collagen Dressings

4.1.2. Transparent Film Dressings

4.1.3. Alginate Dressings

4.1.4. Foam Dressings

4.1.5. Gauze Dressings

4.1.6. Silver Dressings

4.1.7. Other (Hydrogel Dressings, Composites Dressings)

4.2. Global Surgical Dressing Market by Application

4.2.1. Cardiovascular Diseases (CVD)

4.2.2. Diabetes Based Surgeries

4.2.3. Transplant Sites

4.2.4. Ulcers

4.2.5. Burns

4.3. Global Surgical Dressing Market by End-User

4.3.1. Hospitals

4.3.2. Ambulatory Surgery Centers

4.3.3. Specialty Clinics

4.3.4. Home Healthcare

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abigo Medical AB

6.2. B. Braun SE

6.3. Baxter Healthcare Corp.,

6.4. Cardinal Health Inc.

6.5. Coloplast A/S

6.6. ConvaTec Group Plc

6.7. Derma Sciences Inc. (Integra LifeSciences)

6.8. Essity Aktiebolag AB,

6.9. Medline Industries Inc.

6.10. Medtronic Plc

6.11. Molnlycke Health Care AB

6.12. Molnlycke Health Care AB,

6.13. Narang Medical Ltd

6.14. Organogenesis Holdings Inc.,

6.15. Sanara MedTech, Inc.,

1. GLOBAL SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL COLLAGEN DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL TRANSPARENT FILM DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL ALGINATE DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL FOAM DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL GAUZE DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SILVER DRESSINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL OTHER TYPES OF SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY APPLIACTION, 2022-2030 ($ MILLION)

10. GLOBAL SURGICAL DRESSING FOR CARDIOVASCULAR DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL SURGICAL DRESSING FOR DIABETES BASED SURGERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL SURGICAL DRESSING FOR TRANSPLANT SITES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL SURGICAL DRESSING FOR ULCERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL SURGICAL DRESSING FOR BURNS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

16. GLOBAL SURGICAL DRESSING IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL SURGICAL DRESSING IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. GLOBAL SURGICAL DRESSING IN SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. GLOBAL SURGICAL DRESSING IN HOME HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. GLOBAL SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

21. NORTH AMERICAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. NORTH AMERICAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

23. NORTH AMERICAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. NORTH AMERICAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

25. EUROPEAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. EUROPEAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

27. EUROPEAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. EUROPEAN SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. ASIA-PACIFIC SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

33. REST OF THE WORLD SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

35. REST OF THE WORLD SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL SURGICAL DRESSING MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL COLLAGEN DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL TRANSPARENT FILM DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ALGINATE DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL FOAM DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL GAUZE DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SILVER DRESSINGS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL OTHER TYPES OF SURGICAL DRESSING MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SURGICAL DRESSING MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

10. GLOBAL SURGICAL DRESSING FOR CARDIOVASCULAR DISEASES MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL SURGICAL DRESSING FOR DIABETES BASED SURGERIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL SURGICAL DRESSING FOR TRANSPLANT SITES MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL SURGICAL DRESSING FOR ULCERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL SURGICAL DRESSING FOR BURNS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL SURGICAL DRESSING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022 VS 2030 (%)

16. GLOBAL SURGICAL DRESSING IN HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL SURGICAL DRESSING IN AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL SURGICAL DRESSING IN SPECIALTY CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL SURGICAL DRESSING IN HOME HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. GLOBAL SURGICAL DRESSING MARKET SHARE BY REGION, 2022 VS 2030 (%)

21. US SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

22. CANADA SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

23. UK SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

24. FRANCE SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

25. GERMANY SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

26. ITALY SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

27. SPAIN SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF EUROPE SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

29. INDIA SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

30. CHINA SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

31. JAPAN SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

32. SOUTH KOREA SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

33. REST OF ASIA-PACIFIC SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD SURGICAL DRESSING MARKET SIZE, 2022-2030 ($ MILLION)