Swappable Electric Vehicle Battery Market

Swappable Electric Vehicle Battery Market Size, Share & Trends Analysis Report by Battery Type (Lead Acid, Lithium-ion and Others), by Station Type (Automated and Manual), and by Vehicle Type (two-wheeler, three-wheeler and four-wheeler), Forecast Period (2023-2030)

Swappable electric vehicle battery market is anticipated to grow at an exponential CAGR of 24.2% during the forecast period (2023-2030). Swappable electric vehicle battery refers to battery that can be quickly and easily removed from an electric vehicle (EV) and replaced with a fully charged one. This contrasts with conventional EV batteries, which are typically fixed in place and require hours to be charged. Swappable batteries also have the potential to reduce the cost of EV charging infrastructure. Setting up and maintaining a network of conventional EV charging stations can be expensive, but swappable battery stations require less upfront investment and can serve a larger number of vehicles. This makes swappable battery technology a more cost-effective solution for expanding EV charging infrastructure, particularly in densely populated urban areas.

In October 2022, Contemporary Amperex Technology Co., Limited, SAIC, a car manufacturer in China, and two oil companies, China National Petroleum (CNPC) and Sinopec, collaborated to establish a joint venture to promote electric vehicles with replaceable batteries. SAIC intends to produce vehicles that can support battery-swapping for multiple brands. The joint venture, named Shanghai JienengZhidian New Energy Technology, planned to build roughly 40 battery-swapping stations in major cities such as Beijing, Shanghai, Shenzhen, and Guangzhou in 2022. The objective is to operate approximately 300 of these stations by the end of 2023 and around 3,000 by 2025. Such developments are anticipated to promote the growth of the global market.

Segmental Outlook

The global swappable electric vehicle battery market is segmented on the battery type, station type, and vehicle type. Based on the battery type, the market is sub-segmented intolead acid, lithium-ion and others. Based on station type, the market is sub-segmented into automated and manual. Based on the vehicle type, the market is sub-segmented into two-wheeler, three-wheeler, and four-wheeler. Among the vehicle type, the two-wheeler sub-segment is anticipated to hold a considerable share of the market, owing to increasing popularity of electric vehicles. Additionally, strategic initiatives by the key market players such as product launch of swappable battery for two-wheelers are further fueling the segmental market growth.

In November 2022, Honda Motor Co. Ltd. began selling its battery swapping station, Honda Power Pack Exchanger e, in Japan. The battery charging station can charge many battery pack units simultaneously and allow smooth battery swapping for electric motorcycle users.

Lithium-Ion Sub-Segment is anticipated to Hold a Considerable Share of the Global Swappable Electric Vehicle Battery Market

Among the battery type, the lithium-ion sub-segment is expected to hold a considerable share of the global swappable electric vehicle battery market. This segmental growth is attributed to several factors such as batteries have become popular in electric vehicles due to their rechargeable feature. Compared to lead-acid batteries, they offer several advantages such as being significantly lighter by 50.0% to 60.0% in weight and having a higher energy density, which allows battery manufacturers to reduce the battery pack's overall and size save space. Lithium-ion batteries are preferred by electric vehicle manufacturers as they are efficient and can be fully charged within a short span of one to three hours. With these benefits, the adoption of lithium-ion swappable batteries by electric vehicle manufacturers has been increasing rapidly. Looking towards, the market demand in January 2022, Geely and Lifan announced a joint venture called Maple to release “Maple 60S”, the first smart battery-swappable electric car.

Regional Outlook

The global swappable electric vehicle battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Europe is anticipated to hold a prominent share of the market across the globe, owing to rising government measures aimed at promoting sustainability, curbing greenhouse gas emissions and growing importance of energy storage and growing potential for battery recycling in the region. For instance, in May 2023, two years after announcing an initial partnership to implement EV battery swap stations together, NIO and Shell have opened their first station in Europe. NIO Netherlands shared news of swap station opening in Europe. According to NIO, the initial station is in Harmelen, Netherlands. Although NIO now has 16 battery swap stations in Europe till date, this is the first one co-developed and implemented along with its partner in Shell. Separately from the gas guzzler, NIO also currently operates 8 EV charging stations and its current EU network offers drivers access to over 400,000 third-party chargers.

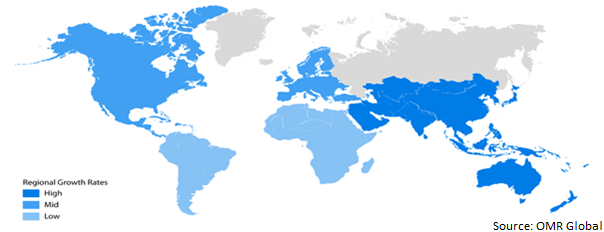

Global Swappable Electric Vehicle Battery Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Swappable Electric Vehicle Battery Market

Among all regions, the Asia-Pacific is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to several factors such as, growing consumer acceptance for EVs, government support and incentives and reduced charging infrastructure costs. Hence, the market players are continuously working on strategic development such as, partnerships, merger and acquisitions, and product launch to stay competitive in the market. For instance, in November 2023, India's Oil and Gas major, Hindustan Petroleum Corporation Limited (HPCL) has signed an agreement with Taiwan-based battery-swapping solutions provider, Gogoro to roll out battery-swapping stations across India. Through the latest partnership, HPCL aims to address challenges related to range anxiety, rapid refueling, safety, and affordability as electric vehicle adoption picks up in India. HPCL has more than 21,000 retail outlets across the country.

Market Players Outlook

The major companies serving the swappable electric vehicle battery market include Contemporary Amperex Technology Co., Ltd, NIO Inc., Gogoro Inc., Silence Urban Ecomobility, and Mobility Pvt Ltd. among others.. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2023, Nio has partnered with State-owned Changan Automobile on developing battery-swapping technology, marking the first cooperation for Nio in its five years of investing in battery-swapping services. This collaboration will assist the formulation of standards for swappable batteries, build and share the battery swapping network, develop swappable vehicles and establish a battery asset management mechanism.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global swappable electric vehicle battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Gogoro Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NIO Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mobility Pvt Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Swappable Electric Vehicle Battery Market by Battery Type

4.1.1. Lead Acid

4.1.2. Lithium-Ion

4.1.3. Other (Nickel-Metal Hydride, Sodium Ion)

4.2. Global Swappable Electric Vehicle Battery Market by Station type

4.2.1. Automated

4.2.2. Manual

4.3. Global Swappable Electric Vehicle Battery Market by Vehicle type

4.3.1. Two-wheeler

4.3.2. Three-wheeler

4.3.3. Four-wheeler

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aulton New Energy Automotive Technology Co., Ltd.

6.2. BattSwap Inc.

6.3. Bounce infinity

6.4. Contemporary Amperex Technology Co., Ltd.

6.5. Esmito Solutions Pvt Ltd.

6.6. Honda Motor Co., Ltd.

6.7. IMMOTOR

6.8. KWANG YANG MOTOR CO., LTD.

6.9. NUMOCITY

6.10. Okinawa Autotech International Pvt. Ltd.

6.11. ONiON Mobility

6.12. Silence Urban Ecomobility

6.13. SUN MOBILITY

6.14. Swap Energi Indonesia

1. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL LEAD ACID SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL LITHIUM-ION SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

4. GLOBAL OTHER SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

5. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2022-2030 ($ MILLION)

6. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY IN AUTOMATED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY IN MANUAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

9. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR TWO-WHEELER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR THREE-WHEELER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR FOUR-WHEELER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. NORTH AMERICAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2022-2030 ($ MILLION)

15. NORTH AMERICAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

17. EUROPEAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. EUROPEAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2022-2030 ($ MILLION)

19. EUROPEAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

21. ASIA- PACIFIC SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. ASIA- PACIFIC SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. REST OF THE WORLD SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

1. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY BATTERY TYPE, 2022 VS 2030 (%)

2. GLOBAL LEAD ACID SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL LITHIUM-ION SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL OTHER SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY STATION TYPE, 2022 VS 2030 (%)

6. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY IN AUTOMATED MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY IN MANUAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY VEHICLE TYPE, 2022 VS 2030 (%)

9. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR TWO-WHEELER MANUFACTURER MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR THREE-WHEELER MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY FOR FOUR-WHEELER MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. US SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

14. CANADA SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

15. UK SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

18. ITALY SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

19. SPAIN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF EUROPE SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

21. INDIA SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

22. CHINA SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

23. JAPAN SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

24. SOUTH KOREA SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD SWAPPABLE ELECTRIC VEHICLE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)