Tankless Water Heater Market

Global Tankless Water Heater Market Size, Share & Trends Analysis Report by Product Type (Electric Water Heater and Gas Water Heater), by Application (Residential and Commercial) and Forecast 2020-2026

The global tankless water heater market is projected to have a considerable CAGR of 8.2% during the forecast period. The market is mainly driven by the growing demand for tankless water heater in various residential and commercial sectors due to various benefits over the storage-tank water heater. The tankless water heater 8%-34% more efficient than storage water heaters. They could save $100 or more annually with an ENERGY STAR qualified tankless water heater and have lower operating costs. Moreover, these water heaters significantly reduce standby losses, which in turn, makes them an energy-efficient substitute to conventional water heaters. According to the US Department of Energy (DOE), a gas-fired tankless water heater has the ability to save nearly $108 per year, whereas, an electric model can save up to $44 per year from the electricity bill. Therefore, the tankless water heaters can significantly reduce home energy consumption and can aid customers in saving utility costs thus creating demand in various sector applications.

Segmental Outlook

The global tankless water heater market is segmented based on product type and application. Based on the product type, the market is further classified into an electric water heater and gas water heater. The gas water heater segment is projected to have significant growth during the forecast period. The increasing demand for gas tankless water heaters is due to the factor that gas tankless water heater is more efficient than conventional gas water heaters. Moreover, energy is not lost during the storage as a continuous supply of hot water is maintained which is another factor driving the market of gas tankless water heaters. On the basis of application, the market is further segregated into residential and commercial.

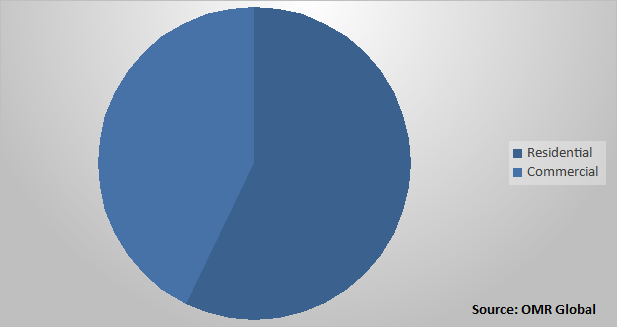

Global Tankless Water Heater Market Share by Application, 2019(%)

Global tankless water heater market to be driven by residential application

Among the application, the residential segment held a significant share in the market in the global tankless water heater market. There are several utilities that are offering rebates for encouraging residential users to adopt energy-efficient water heaters. For instance, Alliant Energy, a public utility holding company in the US offers a rebate up to $350 for electric heat pump water heaters for residential users. Moreover, the utility companies and organizations are offering rebates for several energy-efficient water heaters. Moreover, the government is working towards encouraging consumers to use energy-efficient water heaters that can support to save energy. In this context, EPA’s Energy Program is intended to save energy and protecting the environment and they recommended the use of a gas water heater. The use of ENERGY STAR heat pump water heater can save a family of four nearly $330 annually on its electricity bills rather than using a standard electric water heater.

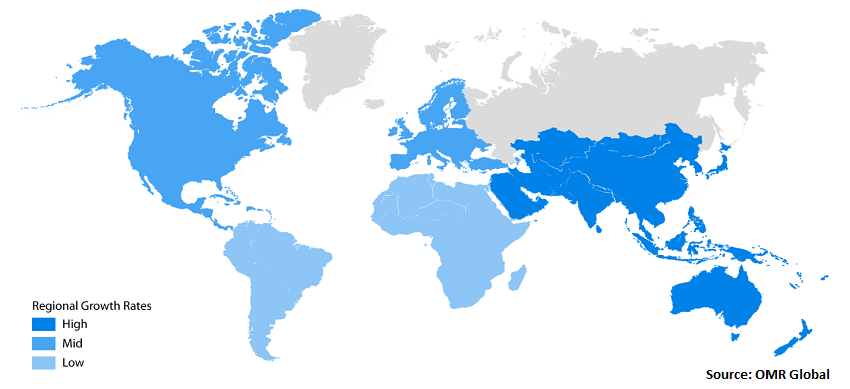

Regional Outlook

Geographically, the global tankless water heater market is further classified into North America, Europe, Asia-Pacific, and the Rest of the World. North America has significant growth in the global tankless water heater market. The advancement of tankless water heater for various application in North America such as the US and Canada coupled with the integration of tankless water heater systems in the commercial sector further making a considerable contribution towards the market in the region

Global Tankless Water Heater Market Growth, by Region 2020-2026

Asia-Pacific to hold a considerable share in the global tankless water heater market

Geographically, Asia-Pacific is projected to hold a significant market share in the global tankless water heater market during the forecast period. Major economies that are anticipated to contribute to the Asia-Pacific tankless water heater market include China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising demand for tankless water heater in the residential and commercial sectors coupled with rising disposable income in emerging economies. Moreover, a growing urban population coupled with industrialization raises the installation of the water heating solutions in urban areas. According to the world bank data, in 2017 China's urban population was accounted for 57.9% of the total population from 56.7% of the total population in 2016.

Market Players Outlook

The key players in the tankless water heater market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include A.O. Smith Corp., Robert Bosch GmbH, Haier electronics group Co., Ltd., Havells India Ltd., General Electric Co., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tankless water heater market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. A.O. Smith Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Robert Bosch GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Haier electronics group Co., Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Havells India Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. General Electric Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Tankless Water Heater Market by Product Type

5.1.1. Electric Water Heater

5.1.2. Gas Water Heater

5.2. Global Tankless Water Heater Market by Application

5.2.1. Residential

5.2.2. Commercial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. A.O. Smith Corp.

7.2. Ariston Thermo SpA

7.3. ATC Electrical and Mechanical, Ltd.

7.4. Atmor

7.5. Bajaj Electricals Ltd.

7.6. Bradford White Corp.

7.7. Crompton Greaves Consumer Electricals Ltd.

7.8. General Electric Co.

7.9. Haier Electronics Group Co., Ltd.

7.10. Havells India Ltd.

7.11. Navien Inc.

7.12. NORITZ Corp.

7.13. Robert Bosch GmbH

7.14. Rheem Manufacturing Company, Inc.

7.15. Rinnai Corp.

7.16. Racold Thermo Pvt. Ltd.

7.17. Stiebel Eltron, Inc.

7.18. Venus home appliance

1. GLOBAL TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ELECTRIC WATER HEATER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GAS WATER HEATER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL TANKLESS WATER HEATER IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL TANKLESS WATER HEATER IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. EUROPEAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. REST OF THE WORLD TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD TANKLESS WATER HEATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL TANKLESS WATER HEATER MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL TANKLESS WATER HEATER MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL TANKLESS WATER HEATER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

6. UK TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD TANKLESS WATER HEATER MARKET SIZE, 2019-2026 ($ MILLION)