Tannin Market

Tannin Market Size, Share & Trends Analysis Report by Source (Plants and Brown Algae), by Product (Hydrolysable, Non-hydrolysable and Phlorotannins), and by Application (Leather Tanning, Wine Production, Wood Adhesives and Anti-corrosive Primers) Forecast Period (2024-2031)

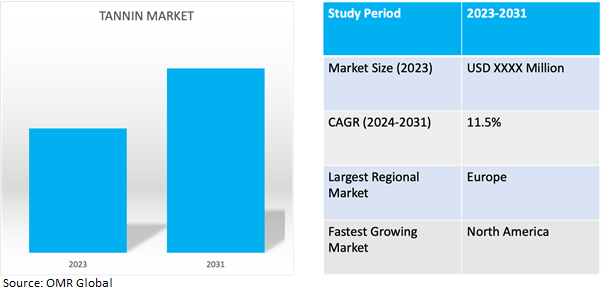

Tannin market is anticipated to grow at a significant CAGR of 11.5% during the forecast period (2024-2031). Tannin is a type of organic substance found in various plants, particularly in bark, leaves, and fruit skins.

Market Dynamics

Growing Applictaion in End-User Industries

Industry application involves tailoring products, technologies, or solutions to meet the distinct needs of businesses within specific sectors that start with understanding industry requirements through research and analysis, followed by the development of customized solutions. Once implemented, these solutions are continuously optimized to ensure they remain effective. Compliance with regulations is essential. Successful industry applications deliver tangible benefits such as enhanced efficiency, reduced costs, and improved competitiveness, driving innovation within the industry. For instance, in September 2022, Ingevity Corp. completed the acquisition of Tannin Corp., a prominent producer of grape seed and oak tannins, from Sensient Technologies Corp. This strategic move is anticipated to bolster Ingevity Corporation's standing as a premier global supplier of tannins, while simultaneously broadening its product offerings in the food and beverage sector.

Food and Beverage to Offer Lucrative Growth Opportunities

The food and beverage industry is a multifaceted sector encompassing the production, processing, distribution, and sale of food and drink products globally that includes agriculture, livestock farming, fishing, and aquaculture, raw ingredients like grains, fruits, vegetables, and meats are sourced. These ingredients undergo processing and manufacturing processes such as milling, cooking, and packaging to create a diverse array of consumer-ready products like baked goods, dairy items, beverages, and ready-to-eat meals. Efficient distribution and logistics networks ensure these products reach retailers, wholesalers, foodservice establishments, and consumers through various channels including supermarkets, restaurants, and online platforms.

Market Segmentation

Our in-depth analysis of the global tannin market includes the following segments by source, product, and application:

- Based on source, the market is sub-segmented into plants and brown algae.

- Based on product, the market is sub-segmented into hydrolysable, non-hydrolysable and phlorotannins.

- Based on application, the market is sub-segmented into leather tanning, wine production, wood adhesives and anti-corrosive primers.

Brown Algae is Projected to Emerge as the Largest Segment

Based on the source, the global tannin market is sub-segmented into plants and brown algae. Among these, the brown algae sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand across various industries, including leather tanning, wine production, wood adhesives, pharmaceuticals, and more. Tannins play a crucial role in these sectors, contributing to processes such as tanning hides, clarifying beverages, improving wood adhesion, and providing health benefits in pharmaceuticals.

Leather Tanning Sub-segment to Hold a Considerable Market Share

The leather tanning sub-segment commands a substantial market share due to its deep-rooted historical significance and wide-ranging application in leather tanning processes. Tannins play a crucial role in preserving and enhancing the quality of leather, making them indispensable in industries such as footwear, apparel, automotive, and furniture. With the increasing demand for leather goods globally and a growing preference for natural and sustainable materials, the demand for high-quality tannins derived from plant sources continues to rise. Manufacturers prioritize the use of premium-grade tannins to ensure the production of superior-quality leather products. For instance, in August 2023, TANAC unveiled its latest innovation, the Green-Line premium line, offering a sustainable and high-performance alternative for leather treatment processes that utilize natural bases derived from vegetable tannin extracts, aligning with the growing global focus on environmental preservation.

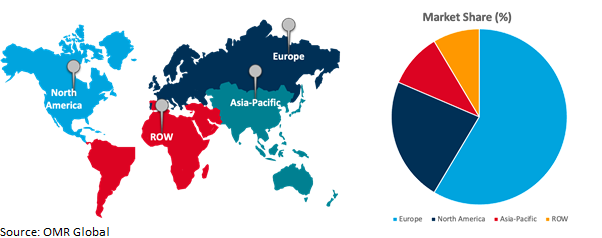

Regional Outlook

The global tannin market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Tannins' Impact on North American Industries

The North American region is is driven by the increased demand across industries such as leather tanning, wine production, wood adhesives, and pharmaceuticals. Technological advancements in extraction techniques have made tannin production more efficient, contributing to its availability in the region and also shifting consumer preferences towards natural and sustainable products boosting the demand for tannins derived from plant sources. For instance, Tannin Corp., a distinguished entity in the tannin sector, has expanded its operations through various subsidiaries, including Tannin Mexico and Marden-Wild, headquartered in Canada. These entities collectively constitute the leading provider of wet-end chemicals across North America. They specialize in the production and distribution of an extensive array of products essential in leather manufacturing, including tanning oils, fatty liquors, resins, and waxes. This strategic expansion aims to enhance the company's offerings and maintain its commitment to delivering high-quality solutions to the industry.

Global Tannin Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share due to its utilizing tannins in various industries, particularly in the leather industry, where tannins are crucial for tanning hides and producing high-quality leather products and also European countries have well-established wine and beer industries, where tannins are used for clarification and flavour enhancement. For instance, in May 2022, Borregaard ASA announced a strategic collaboration with Tannins Unlimited Ltd., a renowned provider of quebracho tannins, aimed at distributing the latter's tannin products across Europe. This partnership marks a significant expansion of Borregaard ASA's presence in the European market and offers its clientele an extended portfolio of tannin solutions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global tanninmarket includePolson Ltd., Ajinomoto Co., Inc., ESSECO Srl, Sisco Research Laboratories Pvt. Ltd., Laffort and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in 2021, Evonik Industries AG initiated a strategic partnership with Rajulene GmbH, a German firm specializing in natural plant extracts, aiming to jointly innovate and advance product development within the realm of plant-derived tannins.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tanninmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ajinomoto Co., Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ESSECO Srl

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Polson Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Tannin Market by Source

4.1.1. Plants

4.1.2. Brown algae

4.2. Global Tannin Market by Product

4.2.1. Hydrolysable

4.2.2. Non-hydrolysable

4.2.3. Phlorotannins

4.3. Global Tannin Market by Application

4.3.1. Leather Tanning

4.3.2. Wine Production

4.3.3. Wood Adhesives

4.3.4. Anti-corrosive Primers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ever s.r.l.

6.2. Forestal Mimosa Ltd.

6.3. Indena S.p.A.

6.4. Jyoti Chemicals

6.5. Jyoti Dye Chem Agency

6.6. Laffort

6.7. MAGANLAL SHIVRAM AND CO.

6.8. MIMOSA EXTRACT COMPANY(PTY) LTD (Mimosa)

6.9. NaturalSpecialities

6.10. S.A. Ajinomoto OmniChem N.V.

6.11. SILVATEAM

6.12. Sisco Research Laboratories Pvt. Ltd.

6.13. TANAC

6.14. TaninSevnica

6.15. Tannin Corp.

6.16. UCL Company (Pty) Ltd.

6.17. W. ULRICH GmbH

6.18. Zhushan County Tianxin Medical & Chemical Co., Ltd.

1. GLOBAL TANNIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL PLANTS BASED TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BROWN ALGAE BASED TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TANNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

5. GLOBAL HYDROLYSABLE TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NON-HYDROLYSABLE TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PHLOROTANNINS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TANNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL TANNIN FOR LEATHER TANNING TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TANNIN FOR WINE PRODUCTION TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TANNIN FOR WOOD ADHESIVES TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TANNIN FOR ANTI-CORROSIVE PRIMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN TANNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TANNIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN TANNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. NORTH AMERICAN TANNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

18. EUROPEAN TANNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN TANNIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

20. EUROPEAN TANNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. EUROPEAN TANNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC TANNIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFICTANNIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

24. ASIA-PACIFICTANNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. ASIA-PACIFICTANNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD TANNIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD TANNIN MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD TANNIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. REST OF THE WORLD TANNIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL TANNIN MARKETSHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL PLANTS BASED TANNIN MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BROWN ALGAE BASED TANNIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TANNIN MARKET SHAREBY PRODUCT, 2023 VS 2031 (%)

5. GLOBAL HYDROLYSABLE TANNIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALNON-HYDROLYSABLE TANNIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PHLOROTANNINS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL TANNIN MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL TANNIN FOR LEATHER TANNING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL TANNIN FOR WINE PRODUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL TANNIN FOR WOOD ADHESIVES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TANNIN FOR ANTI-CORROSIVE PRIMERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL TANNIN MARKETSHARE BY REGION, 2023 VS 2031 (%)

14. US TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

16. UK TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC TANNIN MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICATANNIN MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICATANNIN MARKET SIZE, 2023-2031 ($ MILLION)