Telecom Electronic Manufacturing Services Market

Telecom Electronic Manufacturing Services Market Size, Share & Trends Analysis Report by Service (Electronic Design & Engineering, Electronics Assembly, Electronic Manufacturing and Supply Chain Management).and by Application (Computing Devices & Equipment, Servers & Routers, RF & Microwave, Fiber Optic Devices, and Transceivers & Transmitters).Forecast Period (2024-2031).

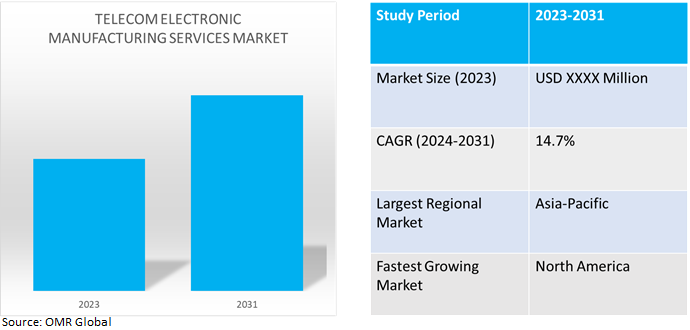

Telecom electronic manufacturing services market is anticipated to grow at a significant CAGR of 14.7% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for advanced telecom infrastructure, the widespread deployment of 5G technology, and a surge in outsourcing by telecom companies drive the growth of the market. According to the International Trade Administration (ITA), the global telecom services market continues to expand with the advent of 5G wireless networks that enable new applications in sectors such as healthcare, manufacturing, and transportation. By 2023, over 70.0% of the global will be connected to the internet by a mobile device, and there will be 14.7 billion machine-to-machine connections supporting applications like connected cars and smart home devices. The telecom services sector continues to experience consolidation as service providers merge vertically with each other and horizontally with media and entertainment companies, enabling them to market bundles of services to consumers.

Market Dynamics

Telecom OEMs Offer Customization and Flexibility

Telecom EMS suppliers are essential to the manufacturing and assembly of electrical devices and components. As technology develops rapidly, there is an increasing need for sophisticated and novel electronic items. Original equipment manufacturers (OEMs) looking for effective and affordable solutions in the production of electronics consider EMS providers to be crucial partners. In the telecom industry, OEM development relates to the joint efforts of manufacturers and telecom companies to provide specialized devices and equipment. These goods are designed, manufactured, and frequently tested by the original equipment manufacturer (OEM). In return, the telecom operator gains from promoting and offering these devices under its name.

Increasing Digitalization and Industry 4.0 Technologies

The increasing number of telecom OEM companies leverage industry 4.0 technologies to provide superior customer experiences, enhance customer satisfaction, and build customer loyalty. To increase productivity, customer satisfaction, and service delivery, the telecoms sector in particular is going through a significant transition as it implements new technologies like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). Customer demands are one of the factors driving the telecom industry's need for digital transformation. Consumers must have access to a wide range of web-connected mobile applications. These smartphone applications, which include social media and gaming apps, need a lot of data to operate rapidly. Digital transformation in the telecom industry is essential in this kind of situation. It enables telecom companies to use 5G technology to satisfy expanding client needs.

Market Segmentation

Our in-depth analysis of the global telecom electronic manufacturing services market includes the following segments by service and application.

- Based on service, the market is sub-segmented into electronic design & engineering, electronics assembly, electronic manufacturing, and supply chain management.

- Based on application, the market is sub-segmented into computing devices & equipment, servers & routers, RF & microwave, fiber optic devices, and transceivers & transmitters.

Electronic Manufacturing is Projected to Emerge as the Largest Segment

Based on the service, the global telecom electronic manufacturing services market is sub-segmented into platforms and services. Among these electronic manufacturing sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the increased demand for mobile phones and data-driven communication with advanced telecom devices and infrastructure. Furthermore, with advancements in high-speed broadband to create new jobs and help broadband service providers. For instance, in November 2023, Ciena®, a US-based networking systems, services, and software company, added domestic manufacturing through an expanded agreement with global diversified manufacturer Flex. Ciena begins production of the industry’s first pluggable optical line terminals (OLTs) as well as its optical network units (ONU) at a Flex factory in the US in mid-2024.

Servers & Routers Sub-segment to Hold a Considerable Market Share

Based on application, the global telecom electronic manufacturing services market is sub-segmented into computing devices & equipment, servers & routers, RF & microwave, fiber optic devices, and transceivers & transmitters. Among these, the servers & routers sub-segment is expected to hold a considerable share of the market.

The segmental growth is attributed to the increasing adoption of Servers and routers in the telecommunications business. Telecommunications servers are open, standards-based computing platforms that serve as a carrier-grade common platform for various communications applications. Server and router manufacturers may benefit from increased demand for IoT technology and 5G infrastructures, which could boost the growth of the telecom electronics manufacturing market. For instance, in March 2024, China Mobile and ZTE launched a computing-aware Traffic Steering (CATS) Router. With the real-time intelligent balancing mechanism, the CATS router can improve the overall utilization rate of multi-edge computing sites by more than 30.0%

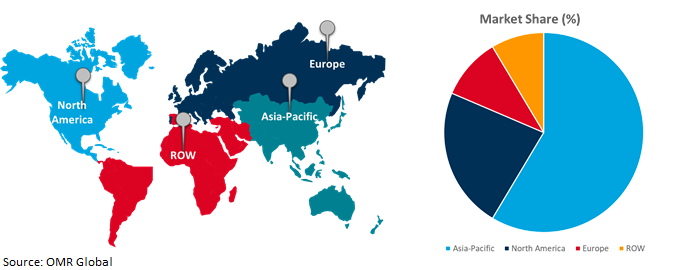

Regional Outlook

The global telecom electronic manufacturing services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption Telecom Electronic Manufacturing Services in North America

- The growing demand for smart devices and surging demand for green component manufacturing, accelerates the market for telecom electronic manufacturing services in the US, Canada, and Mexico.

- According to the National Association of Manufacturers (NAM), Manufacturers in the US account for 10.7% of the total output in the country, employing 8.4% of the workforce. Total output from manufacturing was $2.5 trillion in 2021. In addition, there were an average of 12.5 million manufacturing employees in the US in December 2021, with an average annual compensation of $95,990.0 in 2021.

Global Telecom Electronic Manufacturing Services Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to numerous prominent companies and telecom electronic manufacturing services providers. The growth is attributed to increasing remote working trends, households and individual customers purchased tablets and computers. Enterprises have heavily spent on their data center infrastructure (to ensure steady demand amid work-from-home and online dealings), and telecommunication service providers have been modernizing their infrastructure to cater to surging broadband contributing to the regional growth. According to Invest India, in May 2023, the country is rapidly becoming an electronics manufacturing hub, with the sector expected to rise to $300.0 billion by 2025-26. This growth can be attributed to the government's push to promote domestic electronics manufacturing, which has led to increased investment and the creation of new jobs.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global telecom electronic manufacturing services market include FLEX LTD., Hon Hai Precision Industry Co., Ltd., Jabil Inc., Sanmina Corp., and SIIX Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023,ABB Ltd. and China Telecom collaborated on a 5G network, industrial IoT, and connectivity technology, as well as cloud computing. The collaboration explores the extensive integration of process automation solutions and empowers multiple industries in China with digital transformation tools.

Recent Development

- In June 2023, Acquia, Inc. enhanced the capabilities of its market-leading digital experience platform, Acquia DXP, to create richer, more personalized experiences for customers. The platform provides a personalized customer experience and Creates responses to customer actions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telecom electronic manufacturing services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. FLEX LTD.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hon Hai Precision Industry Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Jabil Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sanmina Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Telecom Electronic Manufacturing Services Market by Services

4.1.1. Electronic Design & Engineering

4.1.2. Electronics Assembly

4.1.3. Electronic Manufacturing

4.1.4. Supply Chain Management

4.2. Global Telecom Electronic Manufacturing Services Market by Application

4.2.1. Computing Devices & Equipment

4.2.2. Servers & Routers

4.2.3. RF & Microwave

4.2.4. Fiber Optic Devices

4.2.5. Transceivers & Transmitters

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Benchmark Electronics, Inc.

6.2. Celestica Inc.

6.3. Creation Technologies Ltd.

6.4. Fabrinet Company Ltd.

6.5. Key Tronic Corp.

6.6. Kimball Electronics, Inc.

6.7. NEOTech

6.8. OSI Systems, Inc.

6.9. Plexus Corp.

6.10. Shenzhen Kaifa Technology Co., Ltd.

6.11. SIIX Corp.

6.12. SMTC Corp.

6.13. TT Electronics Plc

6.14. Universal Scientific Industrial (Shanghai) Co., Ltd.

6.15. Venture Corp. Ltd.

6.16. Zollner Elektronik AG

1. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

2. GLOBAL TELECOM ELECTRONIC DESIGN & ENGINEERING MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TELECOM ELECTRONIC ASSEMBLY MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL TELECOM ELECTRONIC SUPPLY CHAIN MANAGEMENT MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR COMPUTING DEVICES & EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR SERVERS & ROUTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR RF & MICROWAVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR FIBER OPTIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR TRANSCEIVERS & TRANSMITTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

18. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

2. GLOBAL TELECOM ELECTRONIC DESIGN & ENGINEERING MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TELECOM ELECTRONIC ASSEMBLY MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL TELECOM ELECTRONIC SUPPLY CHAIN MANAGEMENT MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR COMPUTING DEVICES & EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR SERVERS & ROUTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR RF & MICROWAVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR FIBER OPTIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES FOR TRANSCEIVERS & TRANSMITTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

18. EUROPEAN TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD TELECOM ELECTRONIC MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)