Test Phantoms Market

Global Test Phantoms Market Size, Share & Trends Analysis Report by Product Type (X-Ray Phantoms, Ultrasound Phantoms, Nuclear Imaging Phantoms, MRI Phantoms, and Others) Forecast Period (2022-2028)

The global test phantoms market is anticipated to grow at a considerable CAGR of 6.7% during the forecast period. There is an emerging focus on the advances and development of diagnostic imaging techniques coupled with the rising prevalence of chronic diseases such as cancer, CVD, and others. As per the World Health Organization (WHO), in 2020, there were nearly 2.3 million new cancer incidences reported in the US. Additionally, in 2020, there were 274,364 new cancer incidences reported in Canada. The rising prevalence of cancer is primarily driving innovations in diagnostic imaging modalities such as MRI, CT scan, X-ray, ultrasound, and others. This contributes to the development of phantoms that are used in medical imaging modalities to support and ensure the accurate evaluation of cancer, brain injury and condition, medical implants, and other conditions.

Impact of COVID-19 Pandemic on Global Test Phantoms Market

The COVID-19 pandemic resulted in an increased demand for medical imaging phantoms. Healthcare entities have increasingly accelerated the adoption of medical imaging and imaging analytics for the improvement of COVID-19 detection and prevention. In August 2020, the National Institutes of Health (NIH) launched the Medical Imaging and Data Resource Center (MIDRC), which will utilize artificial intelligence (AI) and medical imaging to enhance COVID-19 detection and treatment. This effort will gather a large repository of COVID-19 chest images, allowing researchers to evaluate both lung and cardiac tissue data, ask critical research questions, and develop predictive COVID-19 imaging signatures that can be delivered to healthcare providers. This, in turn, has led to an increased demand for phantoms during the pandemic as it is used to evaluate, analyze, and tune the performance of various imaging devices. The phantom is a specially designed object that is scanned or imaged under the equipment during the diagnostic test.

Segmental Outlook

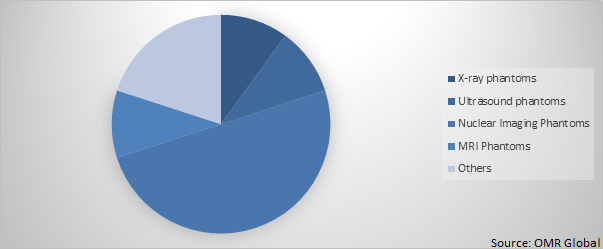

Based on product type, the market is segmented into x-ray phantoms, ultrasound phantoms, nuclear imaging phantoms, MRI phantoms, and others (radionuclide and specimen imaging). Among these, the nuclear imaging phantoms segment of the market is anticipated to hold a major market share in the test phantom market.

Global Test Phantoms Market Share by Product Type, 2021 (%)

Nuclear Imaging Phantoms Segment is Anticipated to Hold a Prominent Share in The Test Phantoms Market

Based on product type, the market is segmented into x-ray phantoms, ultrasound phantoms, nuclear imaging phantoms, MRI phantoms, and others (radionuclide and specimen imaging). Among these, nuclear imaging phantoms are expected to hold a prominent share in the market. Rising demand for nuclear imaging such as positron emission computed tomography (PET) and single-photon emission computed tomography (SPECT) imaging has been witnessed in the US as it is safe, painless, and cost-efficient. Nuclear medicine offers the potential to detect disease in its earliest stage, normally earlier symptoms occur. It determines the cause of the medical condition based on the function of the bone, organ, or tissue. As a result, nuclear medicine is different from ultrasound, x-ray, or any other diagnostic test as these diagnostic imaging systems are used to identify the presence of disease based on structural appearance. It becomes a major choice when physicians need to gather information that is unavailable or too risky to get while using other diagnostic imaging tests.

Regional Outlooks

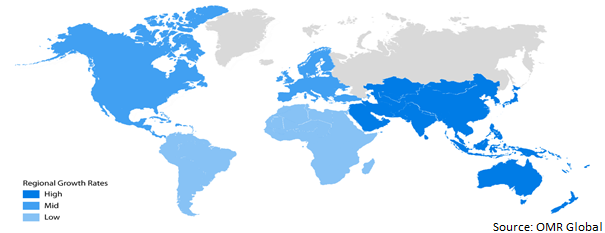

The global test phantoms market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, France, Spain, Germany, and the Rest of Europe), Asia-Pacific (India, Japan, China, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). Asia-Pacific is anticipated to hold a prominent share in the global test phantoms market. The growth in the test phantom market in Asia-Pacific is attributed to an increase in healthcare expenditure by the government and private organizations and an upsurge in the demand for diagnostic procedures.?

Global Test Phantoms Market Growth, by Region 2022-2028

North America is Projected to Have a Prominent Share in the Global Test Phantoms Market

North America is anticipated to exhibit the highest growth in the global test phantoms market. The US is the largest market for test phantoms. The growth of this market is primarily driven by the growing prevalence of heart disease, cancer, chronic lung disease, and kidney disorders among others. The significant amount of R&D spending for new diagnostics, product approvals and new launches, and high awareness among the population for the early diagnosis of disease are some other factors driving the growth of the regional market. Heart disease is the leading cause of mortalities for men, women, and people of most racial and ethnic groups in the US. Every 36 seconds 1 mortality is caused in the US from cardiovascular disease. The high prevalence of heart diseases across the country has created the demand for diagnostic devices such as X-ray machines, ultrasound, and MRI machines across the US which in turn is anticipated to drive the growth of the US test phantom market.

Market Players Outlook

The key players operating in the global test phantoms market include 3-Dmed., Biodex Medical Systems, Inc., Mirion Technologies (Capintec) Inc., IBA Dosimetry GMBH, and True Phantom Solutions Inc. among others. These market players are adopting various growth strategies such as technological advancement, partnerships, collaborations, mergers & acquisitions among others to sustain a strong position in the market. For an instance, in May 2021, Standard Imaging Inc. announced that Constancy Check Phantom is now available. This phantom allows easy constancy checks without the need for a radiation source while saving on time and cost. Additionally, the Constancy Check Phantom provides Medical Physicists, with an easy way to check the response of thimble-type ionization chambers.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global test phantoms market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Test Phantoms Industry

• Recovery Scenario of Global Test Phantoms Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Test Phantoms Market by Product Type

4.1.1. X-ray Phantoms

4.1.2. Ultrasound Phantoms

4.1.3. MRI Phantoms

4.1.4. Nuclear Imaging

4.1.5. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3-Dmed

6.2. Biodex Medical Systems, Inc.

6.3. Mirion Technologies (Capintec) Inc.

6.4. IBA Dosimetry GMBH

6.5. True Phantom Solutions Inc.

6.6. Standard Imaging Inc.

6.7. Fluke Corp.

6.8. Kyoto Kagaku Co., Ltd.

6.9. Leeds Test Objects Ltd.

6.10. Modus Medical Devices

6.11. PTW-Freiburg

6.12. Pure Imaging Phantoms

1. GLOBAL TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE , 2021-2028 ($ MILLION)

2. GLOBAL X-RAY PHANTOMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ULTRASOUND PHANTOMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MRI PHANTOMS MARKET RESEARCH AND ANALYSIS BY SIZE, 2021-2028 ($ MILLION)

5. GLOBAL NUCLEAR IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OTHER TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

8. NORTH AMERICAN TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

10. EUROPEAN TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. EUROPEAN TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

12. ASIA-PACIFIC TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. ASIA-PACIFIC TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

14. REST OF THE WORLD TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. REST OF THE WORLD TEST PHANTOMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL TEST PHANTOMS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TEST PHANTOMS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL TEST PHANTOMS MARKET, 2022-2028 (%)

4. GLOBAL TEST PHANTOMS MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

5. GLOBAL X-RAY PHANTOM MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ULTRASOUND PHANTOM MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL MRI PHANTOMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL NUCLEAR IMAGING SYSTEM MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL TEST PHANTOMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

13. UK TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD TEST PHANTOMS MARKET SIZE, 2021-2028 ($ MILLION)