Track and Trace Solutions Market

Track and Trace Solutions Market Size, Share & Trends Analysis Report by Product (Hardware Systems and Software Solutions), by Technology (Barcode and RFID), by Application (Serialization Solutions and Aggregation Solutions), and by End-User (Pharmaceutical & Biotechnology Companies, Medical Device Companies, and Others) Forecast Period (2022-2028)

Track and trace solutions market is anticipated to grow at a significant CAGR of 16.5% during the forecast period. The key factors that are contributing to the market growth include favorable government intervention and stringent regulations and criteria for serialization implementation. Governments across the globe are working on various amendments and to approve specific laws for the implementation of serialization to ensure supply chain efficiency. Europe is the country where the implementation of track and trace solutions is mandatory throughout the supply chain in every sector. For instance, in May 2021, the Europe Medical Device sector developed a new set of regulations EU-MDR Regulation that aims to improve the safety and performance of medical devices throughout their lifecycle. Moreover, Brazil will join Russia, the EU, and many other countries in mandating serialization in its pharma supply chain in April 2022.

Moreover, in the US batch-level tracking has been mandatory since January 2015. However, high cost and the timeframe for serialization and aggregation implementation are major factors hindering market growth. Whereas, to fight or combat counterfeiting and identify massive product items, an automatic solution, and non-line-of-sight capabilities are creating opportunities for market growth.

Segmental Outlook

The global track and trace solutions market is segmented based on the product, technology, application, and end-user. Based on product, the market is sub-segmented into hardware systems and software solutions. Based on the technology, the market is bifurcated into barcode and RFID. Based on the application, the market is sub-divided into serialization solutions and aggregation solutions. Based on the end-user, the market is sub-divided into pharmaceutical & biotechnology companies, medical device companies, and others. Among the products segment, the software sub-segment is anticipated to hold a prominent share in the market owing to the increasing adoption of track and trace solutions in several industries such as pharmaceuticals, biopharmaceuticals, and medical devices. The software used in track and trace solutions are used to continuously manage all the manufacturing facilities, product lines, case and bundle tracking, and warehousing and shipping.

Among the application segment, the serialization sub-segment is expected to hold a prominent share in the market due to the growing requirement for the implementation of serialization solutions by government regulations, managing product recalls, and new developments in serialization solutions. It is a widely used step to comply with new ePedigree regulations which are crucially required for product traceability during the supply chain. Government bodies, federal agencies, and others are moving and adopting measures to decrease product diversion is a factor that drives segmental growth in the market. With the increasing need for track and trace activities across the globe owing to the rising involvement of companies operating the market are contributing with new and innovative launches. For instance, Mettler-Toledo PCE has launched a new Integrated Mark & Verify systems and software that assist pharmaceutical manufacturers to fulfill their increasing product safety and compliance requirements. The company has made it easier to integrate code marking and verification capabilities into its production lines. These newly launched Mark & Verify systems enable the printing and verification of 1D and 2D codes and alphanumeric text including those which are used for accurate identification of individual products (serialization) and those aggregated into containers such as cases or pallets.

Regional Outlooks

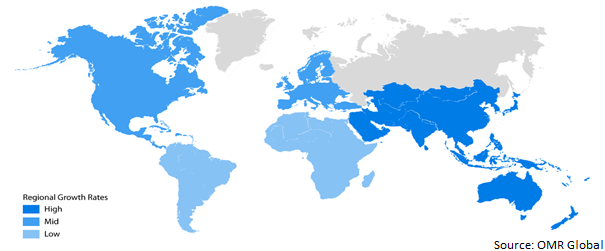

The global track and trace solutions market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America is anticipated to hold a prominent share in the market due to the well-established healthcare infrastructure and early adoption of new technologies.

Global Track and Trace Solutions Market Growth, by Region 2022-2028

The Asia-Pacific Region is Fastest Growing in the Global Track and Trace Solutions Market

The region is anticipated to witness the fastest growth in the market due to increasing regulatory requirements in the healthcare sector to comply with manufacturing and distribution practices. In the region, the growing number of pharmaceutical and biotechnology companies, and the economic development in emerging countries such as India and China are the major factors that are impacting positive growth and increasing the demand for track and trace solutions market. Rising production volumes of food and pharmaceutical products and supply chain, and growing government support to increase foreign direct investment are driving market growth further. Moreover, companies operating in the market are focusing on several strategies such as acquisition, mergers, and product launches, among others. driving the market growth. For instance, in February 2022, BKS Textiles in partnership with Haelixa launched a track & trace solution for organic cotton products named Organitrack. This new tracker is tagged with Haelixa's DNA markers. It provides forensic proof of the authenticity of the fiber and this is GOTS approved and compatible with Standard 100 by Oeko-Tex.

Market Players Outlook

The major companies serving the global track and trace solutions market include ACG, Antares Vision S.p.A., Axway Group, Robert Bosch GmbH, ThinkCurve Technologies, Videojet Technologies Inc., and Zebra Technologies Corp., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in January 2021, Serai launched a traceability solution that allows apparel businesses to track cotton and other raw materials. This new solution is used to trace order flow throughout the supply chain, manage supply chain risks and collect data for compliance needs. This solution is customizable and able to accommodate the requirements of each company.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global track and trace solutions market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Antares Vision S.p.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Axway Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robert Bosch GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Seidenader Vision GmbH

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Track and Trace Solutions Market by Product

4.1.1. Hardware Systems

4.1.2. Software Solutions

4.2. Global Track and Trace Solutions Market by Technology

4.2.1. Barcode

4.2.2. RFID

4.3. Global Track and Trace Solutions Market by Application

4.3.1. Serialization Solutions

4.3.2. Aggregation Solutions

4.4. Global Track and Trace Solutions Market by End-User

4.4.1. Pharmaceutical & Biotechnology Companies

4.4.2. Medical Device Companies

4.4.3. Others (Food and Beverage, and Consumer Packaged Goods)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ACG

6.2. Adents International

6.3. Aparito Ltd.

6.4. Bar Code India Ltd.

6.5. Holostik

6.6. Jekson Vision

6.7. Kezzler AS

6.8. Körber Pharma GmbH

6.9. Laetus GmbH

6.10. Markem-Imaje Group

6.11. Nupac

6.12. Optel Vision Inc.

6.13. rfxcel Corp

6.14. Sea Vision S.r.l.

6.15. SAP

6.16. Sys-Tech Solutions, Inc.’s

6.17. ThinkCurve Technologies

6.18. TraceLink Inc.

6.19. Uhlmann

6.20. Videojet Technologies Inc.

6.21. VISIOTT Technologie GmbH

6.22. WIPOTEC-OCS GmbH

6.23. Zebra Technologies Corp.

6.24. ZETES INDUSTRIES

1. GLOBAL TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL HARDWARE SYSTEMS IN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SOFTWARE SOLUTIONS IN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

5. GLOBAL TRACK AND TRACE SOLUTIONS BY BARCODE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL TRACK AND TRACE SOLUTIONS BY RFID MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL TRACK AND TRACE SERIALIZATION SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL TRACK AND TRACE AGGREGATION SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

11. GLOBAL TRACK AND TRACE SOLUTIONS FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL TRACK AND TRACE SOLUTIONS FOR MEDICAL DEVICE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL TRACK AND TRACE SOLUTIONS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

17. NORTH AMERICAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

20. EUROPEAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. EUROPEAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

23. EUROPEAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. EUROPEAN TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

30. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

32. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

34. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL TRACK AND TRACE SOLUTIONS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL HARDWARE SYSTEMS IN TRACK AND TRACE SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL SOFTWARE SOLUTIONS IN TRACK AND TRACE SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL TRACK AND TRACE SOLUTIONS MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

5. GLOBAL TRACK AND TRACE SOLUTIONS BY BARCODE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL TRACK AND TRACE SOLUTIONS BY RFID MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL TRACK AND TRACE SOLUTIONS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL TRACK AND TRACE SERIALIZATION SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL TRACK AND TRACE AGGREGATION SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL TRACK AND TRACE SOLUTIONS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

11. GLOBAL TRACK AND TRACE SOLUTIONS FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL TRACK AND TRACE SOLUTIONS FOR MEDICAL DEVICE COMPANIES MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL TRACK AND TRACE SOLUTIONS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL TRACK AND TRACE SOLUTIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

17. UK TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD TRACK AND TRACE SOLUTIONS MARKET SIZE, 2021-2028 ($ MILLION)