Train Communication Gateway Systems Market

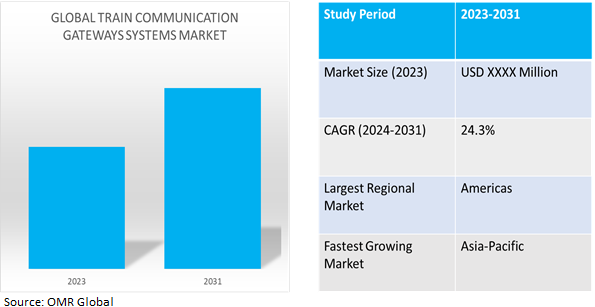

Train Communication Gateway Systems Market Size, Share & Trends Analysis Report Product Type (Wire Train Bus Gateways, Multifunction Vehicle Bus (MVB) Gateway, and Others), by Connectivity (Global System for Mobile Communications - Railway (GSM-R), Wi-Fi, Terrestrial Trunked Radio (TETRA), and Others), and by Application (Passenger Train and Freight Train) Forecast Period (2024-2031)

Train communication gateway systems market is anticipated to grow at a CAGR of 24.3% during the forecast period (2024-2031). Train communication gateway (TCG) facilitate communication between train subsystems, ensuring dependable and safe functioning of complex systems such as propulsion, brakes, signaling, and passenger information systems.

Market Dynamics

Growing demand for high-speed internet access

The demand for improved communication gateway systems among train operators is increasing owing to the rapid development of 5G wireless technology. For instance, in July 2021, Router Family for Railway Technology Offered a New Wireless 5G Gateway. This gateway offered five slots for 5G/LTE and Wi-Fi module combinations and 2 Gb Ethernet interfaces, enhancing connectivity and performance. It meets German railway standard EN 50155 and can operate in temperatures ranging from -40°C to +70°C.

Furthermore, the implementation of 5G technology in train communication systems has the potential to revolutionize operations by enabling high-speed data transfer, real-time video streaming, and enhanced AR capabilities. This promises to enhance connection and provide operators and passengers with new services. According to the European Commission & Europe's Rail Joint Undertaking, in 2022 February, the integration of advanced telecommunication technologies in the rail sector aligns with the goals of the European Green Deal, which aims for climate neutrality by 2050. These technologies, such as LEO constellations such as Starlink and OneWeb, offer impressive performance in terms of visibility, service connectivity, and traffic capacities, allowing them to effectively manage large amounts of data, including video data applications, in future railway scenarios.

Increased Need for Effective Transportation Solutions

Efficient transportation solutions are essential in urban areas for congestion reduction, carbon emissions reduction, and improved quality of life. Advanced communication technologies in the rail industry drive this demand. According to the United Nations in May 2018, by 2030, it is estimated that 60% of the world's population will be residing in urban areas. Smart cities, which utilize IoT technology to manage various aspects such as transportation, medical services, utilities, and agriculture, are seen as promising solutions to the challenges posed by rapid urbanization.

Furthermore, the continuous advancements in IoT technology, such as enhanced connectivity, sensors, and data analytics, are producing IoT solutions more accessible and practical across various industries. According to Internet of Things (IoT) Analytics, in May 2023, there was an 18% increase in global IoT connections in 2022, delivering the total number of active IoT endpoints to $14.3 billion. Assessing the prospects to 2023, it is projected that the global number of connected IoT devices experienced a 16% growth, reaching $16.7 billion active endpoints. Although the growth rate of IoT device connections is expected to continue expanding in the coming years.

Market Segmentation

Our in-depth analysis of the global train communication gateway systems market includes the following segments by product type, connectivity, and application:

- Based on product type, the market is sub-segmented into wire train bus gateways, MVB gateways, and others (ethernet train backbone gateways, integrated gateways).

- Based on the solution, the market is augmented into the global system for mobile communications-railway (GSM-R), Wi-Fi, TETRA, and others (satellite communication and NFC).

- Based on technology, the market is sub-segmented into passenger trains and freight trains.

Passenger train is Projected to Emerge as the Largest Segment

Based on the type, the train communication gateway systems market is sub-segmented into passenger trains and freight trains. Among these, the passenger train sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for smooth passenger connectivity, including access to onboard services, entertainment, and real-time information, necessitates robust TCGS infrastructure, leading to market growth.. For instance, in October 2023, Paytm launched guaranteed seat assistance ensuring confirmed seat booking on trains. The passengers can book tickets through 'Guaranteed Seat Assistance', providing alternative options to address unavailability and extended waitlists, enhancing convenience and choice.

Wi-Fi Sub-segment to Hold a Considerable Market Share

The increasing demand for reliable connectivity in rail journeys necessitates the provision of free high-speed Wi-Fi, TCGS, that facilitates smoth communication between trains, stations, and backend systems.. According to the ET Government, in March 2023, As part of the Digital India initiative, Indian Railways has successfully implemented free high-speed Wi-Fi service at a total of 6,108 stations across its network. This service aims to enhance the convenience and connectivity for passengers throughout their journey.

- In September 2023, Icomera Unveiled the X7 Mobile Connectivity & Applications Router. The Icomera's X7 router offered a robust centralized connectivity platform, supporting various resource-intensive applications such as Passenger Wi-Fi, Onboard Infotainment, and Digital Video Surveillance & Analytics.

Regional Outlook

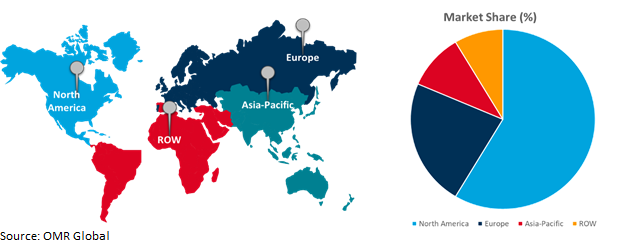

The global train communication gateway systems market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

The initiative aims to promote innovation in train control systems in the Asia-Pacific region

The goals of indigenous train control systems are primarily to increase rail operations' dependability, efficiency, and safety. Integrating with these systems requires the ability to monitor and communicate in real time. As a result, companies and governments are launching new and innovative systems to meet these growing demands. For instance, in February 2023, Delhi Metro launched its first-ever indigenously developed train control & supervision system. The Indian government has developed i-ATS, a metro rail transit system, through a joint effort between DMRC and Bharat Electronics Limited under the 'Make in India' and 'Aatmanirbhar Bharat' initiatives.

Global Train Communication Gateway Systems Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the growing demand for consumer preference for sustainable transportation, particularly rail services, which has been influenced by environmental consciousness. Train communication gateway systems facilitate these activities by providing reliable, efficient, and sustainable rail operations. According to the US Environmental Protection Agency (.gov) and Sources of Greenhouse Gas Emissions,in Feburary 2024, in June 2023, transportation is essential for human, goods, and service mobility, but challenges persist, including one billion individuals living far from accessible roads and causing deaths. Transportation contributes 16% of global greenhouse gas emissions and $15 billion annually. In the US, transportation contributes 29% of 2019 total emissions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the global train communication gateway systems market includes Alstom SA, Bombardier Inc., Cisco Systems, Inc., Huawei Technologies Co. Ltd., Siemens AG, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Siemens Mobility acquired Italian technology which provides unique algorithms for Traffic Management Systems (TMS) based on mathematical optimization methods and operations research. The acquisition strengthens Siemens Mobility's position as a leading supplier of software solutions to rail customers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global train communication gateway systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Alstom SA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bombardier Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cisco Systems, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Train Communication Gateway Systems Market by Product Type

4.1.1. Wire Train Bus Gateways

4.1.2. Multifunction Vehicle Bus (MVB) Gateway

4.1.3. Others (Ethernet Train Backbone Gateways, Integrated Gateways)

4.2. Global Train Communication Gateway Systems Market by Connectivity

4.2.1. Global System for Mobile Communications - Railway (GSM-R)

4.2.2. Wi-Fi

4.2.3. Terrestrial Trunked Radio (TETRA)

4.2.4. Others (Satellite Communication and Near Field Communication (NFC))

4.3. Global Train Communication Gateway Systems Market by Application

4.3.1. Passenger train

4.3.2. Freight train

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advantech Co., Ltd.

6.2. CAF, Construcciones y Auxiliar de Ferrocarriles, S.A.

6.3. CommScope, Inc.

6.4. Hitachi Rail STS S.p.A.

6.5. Knorr-Bremse AG

6.6. LILEE Systems, Ltd.

6.7. Mitsubishi Electric Corp.

6.8. MITSUBISHI HEAVY INDUSTRIES ENGINEERING, LTD.

6.9. Nokia Corp.

6.10. Nomad Digital

6.11. Rajant Corp.

6.12. Thales Group

6.13. Toshiba Corp.

6.14. Wabtec Corp.

1. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL WIRE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MULTIFUNCTION VEHICLE BUS (MVB) TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHER PRODUCT TYPE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL TRAIN COMMUNICATION MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

6. GLOBAL GSM-R BASED TRAIN COMMUNICATION GATEWAY SYSTEMS RAILWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL WIFI BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TERRESTRIAL TRUNKED RADIO BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OTHER CONNECTIVITY BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS FOR PASSENGER TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS FOR FREIGHT TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

21. EUROPEAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL WIRE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL MULTIFUNCTION VEHICLE BUS (MVB) TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER PRODUCT TYPE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023 VS 2031 (%)

6. GLOBAL GSM-R BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL WIFI BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL TERRESTRIAL TRUNKED RADIO BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL OTHER CONNECTIVITY BASED TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS FOR PASSENGER TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS FOR FREIGHT TRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. US TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA PIPELINE TRAIN COMMUNICATION GATEWAY SYSTEMS MARKET SIZE, 2023-2031 ($ MILLION)