US Frozen Pizza Market

US Frozen Pizza Market Size, Share & Trends Analysis Report by Product (Regular, Premium, AND Gourmet), by Crust Type (Thin Crust, Thick Crust, and Stuffed Crust), by Category (Vegetarian, Non-Vegetarian, and Vegan), and by Distribution Channel (Retail and Food Service Chain), Forecast Period (2026-2035)

Industry Overview

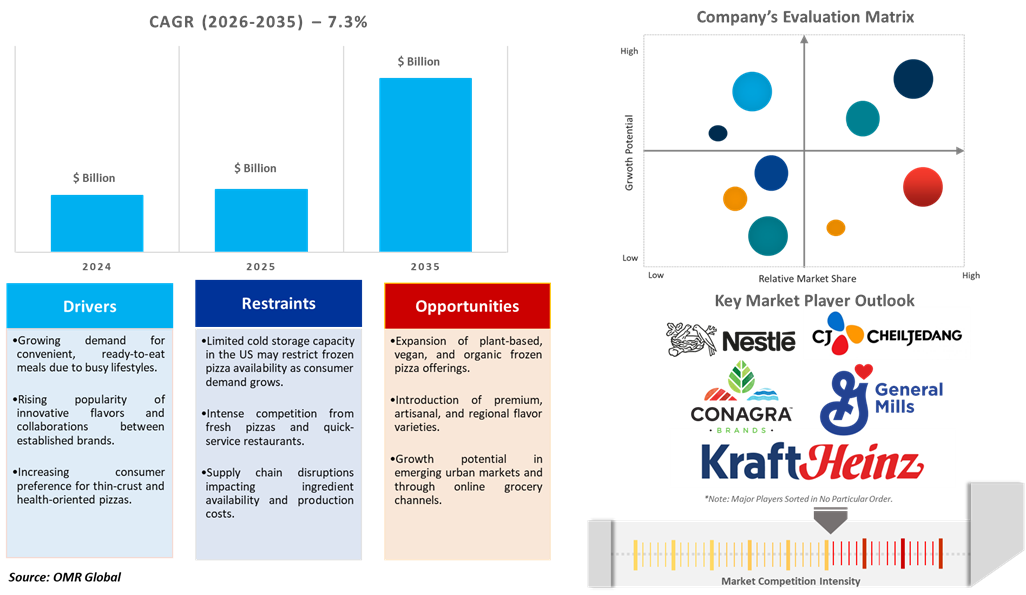

US frozen pizza market was valued at $7,085 million in 2025 and is projected to reach $14,255 million by 2035, growing at a CAGR of 7.3% during the forecast period (2026–2035). The frozen pizza market in the US is experiencing steady growth owing to rising consumption of frozen foods and changing consumer preferences for easy-to-prepare, ready-to-eat meals. Busy lifestyles and limited cooking time have made frozen foods a practical option for many households, with longer shelf life adding to their appeal. According to the 2023 Power of Frozen in Retail report by the American Frozen Food Institute (AFFI) and the Food Industry Association (FMI), frozen food sales reached $74.2 billion. A consumer survey in the same report shows that buyers value frozen foods for convenience, time savings, and reliable taste. Pizza remains one of the most popular items in the frozen food aisle. Its role as a familiar comfort food and its ease of preparation make it a preferred choice across age groups. Its main appeal is its role as a quick and practical meal, especially for busy individuals and families with limited cooking time.

Market Dynamics

Rising Demand for Healthier Frozen Pizza Alternatives

In the US, there has been a growing demand among consumers for healthier frozen pizza options, driven by an increasing number of health-conscious individuals. Consumers are seeking products that are organic, gluten-free, high in protein, and made with cleaner, higher-quality ingredients. In response, brands are expanding their offerings with formulations such as organic, plant-based, and gluten-free pizzas, positioning themselves as a superior alternative to traditional options.

- In October 2024, Daiya launched an updated plant-based pizza line during National Pizza Month. They upgraded their bakery facility to enhance production capacity and product quality. The new pizzas are now sold in major retailers in the US. The updated plant-based pizzas by Daiya include a gluten-free crust that is lighter and crispier. The new cheese blend, made with Daiya Oat Cream blend, replicates traditional dairy cheese texture and melt using plant-based cultures.

Collaborations and Flavor Innovation Driving Market Growth

Collaborations between established brands are increasingly shaping the US frozen pizza market by introducing unique flavor experiences that appeal to a wide range of consumers. These Collaborations leverage multiple brands to create unique products and drive growth in the frozen pizza market.

- In February 2025, DiGiorno and Hidden Valley Ranch collaborated on two new ranch-infused pizzas: Spicy Rancheroni Thin Crust and Chicken Bacon Ranch Stuffed Crust. The DiGiorno Spicy Rancheroni pizza offers a spicy buffalo-style Hidden Valley Ranch sauce with pepperoni, mozzarella, jalapeños, and ranch seasoning on a thin crust. The Chicken Bacon Ranch Stuffed Crust pizza features grilled chicken, bacon, and ranch sauce on a bacon and cheese stuffed crust with ranch seasoning.

Market Segmentation

- Based on the product, the market is segmented into regular, premium, and gourmet.

- Based on the crust type, the market is segmented into thin crust, thick crust, and stuffed crust.

- Based on the category, the market is segmented into vegetarian, non-vegetarian, and vegan.

- Based on the distribution channel, the market is segmented into retail and food service chains.

Thin-Crust Segment Experiencing Rapid Growth in the US Frozen Pizza Market

In the U.S., thin-crust pizzas have grown in popularity and are among the most preferred crust types for consumers. To meet evolving taste preferences, manufacturers are introducing new recipes and innovative thin-crust variations, offering distinctive textures and flavors.

- In May 2025, Palermo Villa, Inc. and Cheez-It partnered to bring Cheez-It Frozen Pizza. It has a 12-inch ultra-thin and crispy crust with Original Cheez-It flavor, real cheese, and various pizza toppings. The pizza is currently stocked at select retailers like Kroger, Ahold, HEB, Winn-Dixie, Wegman’s, and Food City nationwide.

- In April 2024, DiGiorno, a Nestlé SA pizza brand, introduced Thin & Crispy Stuffed Crust pizza with 2.5 feet of cheese. The new pizza comes with three flavors: Thin & Crispy STUFFED Crust Pepperoni and Sausage, Margherita, and Pepperoni with Mike's Hot Honey for a sweet and spicy kick.

Retail Channel: A Key Segment in Market Growth

Retail channels continue to dominate the US frozen pizza market, supported by well-established consumer shopping habits and the strong distribution reach of supermarkets, hypermarkets, and convenience stores. Their dominance is being strengthened by new product introductions through these outlets.

- For Instance, in September 2024, PORTA expanded its presence in the US by launching Roman-style frozen pizzas across more than 1,000 stores, including Whole Foods, Sprouts, and select natural retailers. PORTA’s handmade pizzas, which are flash frozen to preserve authentic flavors, aim to deliver restaurant-quality Italian pizza directly to consumers through retail channels.

Market Players Outlook

The major companies operating in the US frozen pizza market include Nestlé S.A., CJ CheilJedang Corp., Conagra Brands, Inc., General Mills Inc., Kraft Heinz Company, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In May 2025, Wegmans Food Markets introduced Amore Roman-style frozen pizzas, the first in the US. Its crust is made in Italy from wheat and rice flour and fermented for 24 hours for a light, crispy texture.

- In September 2024, Bernatello’s Foods introduced Sweetee-Pie Dessert Pizzas in Apple, Cinnamon, Cherry, and Blueberry Streusel flavors. These pizzas offer a unique twist with a sweet biscuit-style crust, real fruit toppings, and frosting.

- In April 2024, Newman's Own, Inc. introduced six new salad dressings and frozen pizza products. The company introduced Sourdough Crust Frozen Pizzas with thick crust options like Uncured Pepperoni & Ricotta, Meatball, and Five Cheese. They also offer Stone-Fired Crust Frozen Pizzas imported from Italy, featuring Italian Salami and Roasted Garlic & Mushroom options.

- In June 2022, General Mills acquired TNT Crust, a frozen pizza crust manufacturer. The acquisition includes three manufacturing facilities in Green Bay, Wisconsin, and St. Charles, Missouri.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the US frozen pizza market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Report Summary

- Current Industry Analysis and Growth Potential Outlook

- US Frozen Pizza Market Sales Analysis – Product | Crust Type | Category | Distribution Channel ($ Million)

- Research Methodology

- Primary Research Approach

- Secondary Research Approach

- Market Snapshot

- Market Overview and Insights

- Scope of the Study

- Analyst Insight & Current Market Trends

- Key Frozen Pizza Industry Trends

- Market Recommendations

- Market Determinants

- Market Drivers

- Drivers For the US Frozen Pizza Market: Impact Analysis

- Market Pain Points and Challenges

- Restraints For the US Frozen Pizza Market: Impact Analysis

- Market Opportunities

- Opportunities for the US Frozen Pizza Market: Impact Analysis

- Market Drivers

- Competitive Landscape

- Competitive Dashboard – US Frozen Pizza Market Revenue and Share by Manufacturers

- Frozen Pizza Product Comparison Analysis

- Top Market Player Ranking Matrix

- Key Company Analysis

- Nestlé USA

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- CJ CheilJedang Corp.

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Conagra Brands, Inc.

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- General Mills Inc.

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Kraft Heinz Company

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Nestlé USA

- Top Winning Strategies by Market Players

- Merger and Acquisition

- Product Launch

- Partnership and Collaboration

- US Frozen Pizza Market Sales Analysis by Product ($ Million)

- Regular

- Premium

- Gourmet

- US Frozen Pizza Market Sales Analysis by Crust Type ($ Million)

- Thin Crust

- Thick Crust

- Stuffed Crust

- US Frozen Pizza Market Sales Analysis by Category ($ Million)

- Vegetarian

- Non-Vegetarian

- Vegan

- US Frozen Pizza Market Sales Analysis by Distribution Channel ($ Million)

- Retail

- Food Service Chain

- Company Profiles

- Amy’s Kitchen, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Banza LLC

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Bernatello’s Pizza, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- California Pizza Kitchen, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Cappello’s

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CAULIPOWER, LLC

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CJ CheilJedang Corp.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CLO-CLO Vegan Foods, LLC

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Conagra Brands, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Daiya Foods, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- August Oetker Nahrungsmittel KG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Frozen Specialties Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- General Mills Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Gino's East

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Home Run Inn, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Kraft Heinz Company

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- McCain Foods Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Milton’s Baking Company

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Miracapo Pizza Company

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Nestlé S.A.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Newman’s Own, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Palermo Villa, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Porta

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Richelieu Foods, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Rich Products Corp.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Schwan’s Company (Freschetta/Tony’s/Red Baron/Hearth & Fire Pizza)

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Simply Good Foods Company (Quest Nutrition, LLC)

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Wegmans Food Markets

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Amy’s Kitchen, Inc.

1. US Frozen Pizza Market Share by Product, 2025 Vs 2035 (%)

2. US Regular Frozen Pizza Market Share, 2025 Vs 2035 (%)

3. US Premium Frozen Pizza Market Share, 2025 Vs 2035 (%)

4. US Gourmet Frozen Pizza Market Share, 2025 Vs 2035 (%)

5. US Frozen Pizza Market Share by Crust Type, 2025 Vs 2035 (%)

6. US Thin Crust Frozen Pizza Market Share, 2025 Vs 2035 (%)

7. US Thick Crust Frozen Pizza Market Share, 2025 Vs 2035 (%)

8. US Stuffed Crust Frozen Pizza Market Share, 2025 Vs 2035 (%)

9. US Frozen Pizza Market Share by Category, 2025 Vs 2035 (%)

10. US Vegetarian Frozen Pizza Market Share, 2025 Vs 2035 (%)

11. US Non-Vegetarian Frozen Pizza Market Share, 2025 Vs 2035 (%)

12. US Vegan Frozen Pizza Market Share, 2025 Vs 2035 (%)

13. US Frozen Pizza Market Share by Distribution Channel, 2025 Vs 2035 (%)

14. US Frozen Pizza Distribution Via Retail Market Share, 2025 Vs 2035 (%)

15. US Frozen Pizza Distribution Via Food Service Chains Market Share, 2025 Vs 2035 (%)

FAQS

The size of the US Frozen Pizza Market in 2025 is estimated to be around $7,085 million.

Leading players in the US Frozen Pizza Market include Nestlé S.A., CJ CheilJedang Corp., Conagra Brands, Inc., General Mills Inc., Kraft Heinz Company, among others.

US Frozen Pizza Market is expected to grow at a CAGR of 7.3% from 2026 to 2035.

Rising demand for convenient ready-to-eat meals, product innovation with premium and healthier options, and expanding retail availability are key factors driving the US frozen pizza market growth.