VRF AC System Market

VRF AC System Market Size, Share & Trends Analysis Report by Type (Heat Pump System and Heat Recovery System), By Components (Indoor Units, Outdoor Units), and by Application (Commercial, Residential, Industrial, Healthcare, and Education), Forecast Period (2025-2035)

Industry Overview

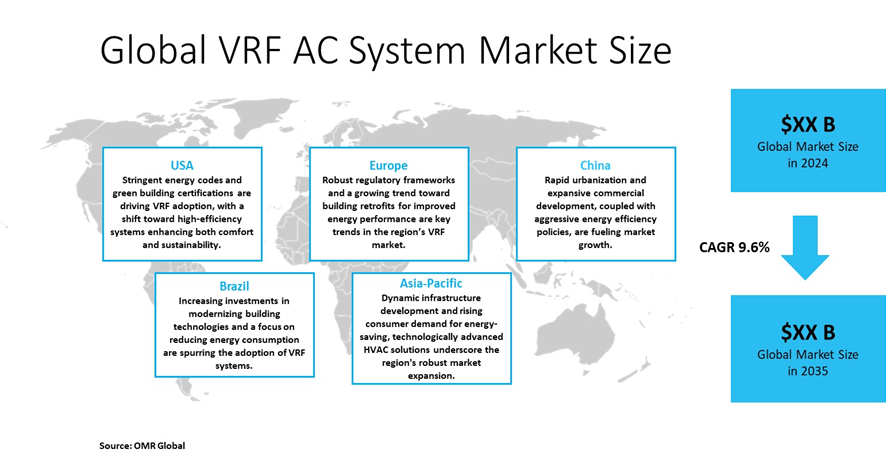

VRF AC system market was valued at $19.5 billion in 2024 and is projected to grow to $53.2 billion with a CAGR of 9.6% during the forecast period (2025–2035). The key factors that are increasing the growth of the variable refrigerant flow AC market such as increasing demand for energy-efficient heating, ventilation, and air conditioning (HVAC), and the growth of various industries, including construction and manufacturing. Furthermore, initiatives are taken by the government to ease the foreign direct investment (FDI) standards in the real estate sector, the enlargement of open network compatibility, and the polarization of VRF designed for cold regions are also estimated to be the major factors that are significantly contributing towards the growth of the market. Additionally, the growing distribution of VRF AC systems in high-rise buildings is expected to provide profitable opportunities to the players that are operating in the VRF systems market.

Market Dynamics

Increasing Demand for VRF AC Systems in Smart Commercial Infrastructure

The increasing demand for VRF AC Systems in high-rise buildings, and new commercial developments, particularly in densely populated urban centers, require flexible and scalable (Heating, ventilation, and air conditioning) HVAC solutions. Reassembling older buildings with modern VRF systems is also escalating this market, owing to the flexibility, with the low utility cost benefits that are being offered by these systems. To fulfill the various needs of multiple tenants, VRF systems provide control and flexibility in the installation process by removing the need for water piping. Many of the specialized instrument manufacturers have brought in user-friendly control systems with LCD touch screens that combine central air conditioning along with VRF to control central air conditioning systems. Additionally, these systems integrate with IoT platforms for real-time energy monitoring and predictive maintenance. For instance, Mitsubishi Electric Multi VRF systems offer cloud-based management such as MELCloud, enabling remote control across commercial spaces.

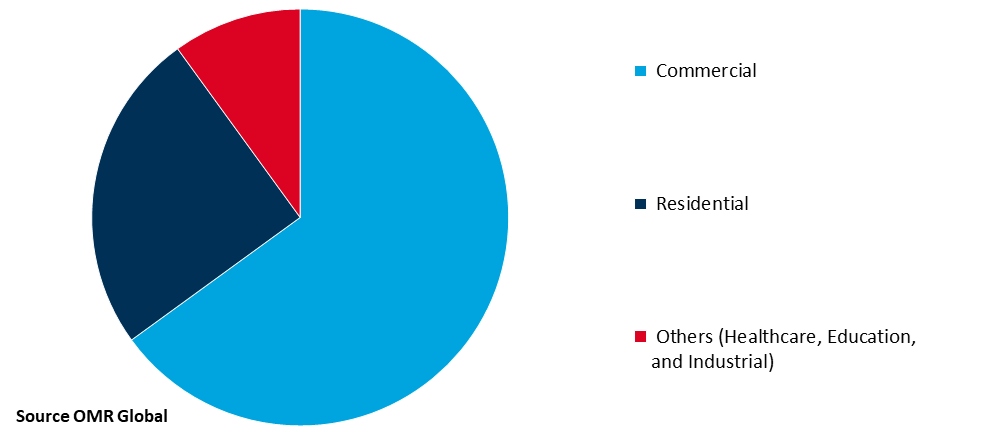

VRF AC System Market Share by Applications, 2024

Rising Demand for Energy-Efficient HVAC Solutions

Simultaneously, the global push toward sustainability and energy conservation has significantly supported the adoption of VRF AC systems. VRF technology offers superior energy performance through variable-speed compressors, heat recovery capabilities, and precise zonal control. According to the U.S. Energy Information Administration’s (EIA) new standards established in 2023, residential air conditioning systems have a minimum seasonal energy efficiency ratio (SEER) of 14, Higher SEER ratings are recognized as indicators of more energy-efficient equipment, reflecting advancements in technology aimed at reducing energy use. Also, the Kigali Amendment which focuses on achieving global temperature stabilization by reducing the production and consumption of (Hydrofluorocarbons) HFCs, further supports the VRF AC system market.

Market Segmentation

- Based on the type, the market is segmented into heat pump systems and heat recovery systems.

- Based on the components, the market is segmented into indoor units and outdoor units.

- Based on the application, the market is segmented into commercial, residential, industrial, healthcare, and education.

Commercial Segment to Dominate the Market

Growing demand in the commercial segment is expected to hold the largest market share during the forecast period. VRF AC systems are particularly suitable for commercial spaces such as offices, hotels, retail stores, hypermarkets, supermarkets, and healthcare facilities owing to their ability to provide individualized comfort control for multiple zones, also optimizing energy efficiency. The growing demand for green building certifications and workplace comfort further supports the adoption of VR AC systems in this segment. Commercial buildings often have varying occupancy patterns and diverse cooling needs across different areas, making VRF's zonal control capability especially valuable.

Residential Segment to Witness Fastest Growth

The residential segment is expected to highest growth rate during the forecast period. Increasing disposable income, growing awareness about energy efficiency, and the desire for premium cooling solutions are driving the adoption of VRF systems in high-end residential buildings and multi-family housing projects. The ability of VRF systems to provide customized cooling for different rooms, combined with their quiet operation and aesthetic appeal, makes them increasingly popular among homeowners looking for comfort and energy savings.

Regional Outlook

The global VRF AC System is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is Expected to Significantly Contribute to the Growth of the VRF AC System Market

The Asia-Pacific region is expected to witness significant growth opportunities for the market. Rising urbanization and increasing awareness regarding energy-efficient air conditioners are driving the demand. Additionally, hot and humid climatic conditions, along with an air quality index that is becoming poor, are supporting the growth of the market. Japan is expected to be one of the leading countries in the region due to the advent of new systems such as variable refrigerant volume (VRV) or Variable Refrigerant Flow (VRF). This system has also been distributed and utilized across the Asia-Pacific region. The system uses R-410-A as the refrigerant to overcome the problem related to ozone depletion.

Market Players Outlook

The major companies operating in the global VRF AC system market include Carrier Global Corp., Daikin Industries, Ltd., Fujitsu General Limited, Mitsubishi Electric Corp., and LG Electronics, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In August 2024, Trane Technologies announced a new GEN Elite C Series VRF system, a cooling-only Variable Refrigerant Flow (VRF) system. This system offers high efficiency, precise temperature control, stable performance, and a flexible design, making it an ideal solution for a wide range of commercial buildings, including offices, hospitals, retail spaces, and more.

- In February 2023, LG Electronics announced the launch of the new Multi Vi, a (VRF) solution equipped with the company’s highly evolved AI engine, Suitable for mid- to high-rise buildings, such as offices, schools, shopping malls, apartment buildings, and hotels, the energy-efficient Multi Vi comes with a range of differentiated, smart features that help reduce energy consumption and deliver a more comfortable indoor environment.

- In April 2022, Samsung India announced the launch of its new DVM S2 Variable Refrigerant Flow (VRF) outdoor air conditioning unit that works with indoor AC units to provide wind-free cooling for the room by WindFree technology eliminates harsh cold drafts and disperses air through 23,000 micro holes at a speed of 0.15 m/s that helps in creating a still air environment.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global VRF AC system market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global VRF AC System Market Sales Analysis – Type | Components | Application ($ Million)

• VRF AC System Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key VRF AC System Industry Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global VRF AC System Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global VRF AC System Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – VRF AC System Market Revenue and Share by Manufacturers

• VRF AC System Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Carrier Global Corp.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Daikin Industries Ltd.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Fujitsu General Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Mitsubishi Electric Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. LG Electronics Co. Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global VRF AC System Market Sales Analysis By Type ($ Million)

5.1. Heat Pump System

5.2. Heat Recovery System

6. Global VRF AC System Market Sales Analysis By Components ($ Million)

6.1. Indoor Units

6.2. Outdoor Units

7. Global VRF AC System Market Sales Analysis By Application ($ Million)

7.1. Commercial

7.2. Residential

7.3. Industrial

7.4. Healthcare

7.5. Education

8. Regional Analysis

8.1. North American VRF AC System Market Sales Analysis – Type | Components | Application ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European VRF AC System Market Sales Analysis – Type | Components | Application ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific VRF AC System Market Sales Analysis – Type | Components | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World VRF AC System Market Sales Analysis – Type | Components | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Aermec S.p.A. (Giordano Riello International Group)

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. AUX Group (Ningboauxelectricco., Ltd.)

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Blue Star Limited

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Bosch Thermotechnology Corp.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Carrier Global Corp.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Chigo (BGR GROUP)

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. C.R. Wolfe Heating Corp

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Daikin Industries, Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Dunham Bush

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Fujitsu General Limited

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Glen Dimplex Deutschland GmbH

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Haier Inc. (Haier Group)

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Hisense (Qingdao Hisense HVAC Equipment Co., Ltd.)

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.14. Johnson Controls - Hitachi Air Conditioning Company

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Lennox International Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. LG Electronics Co. Ltd.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Midea Global

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Mitsubishi Electric Corp.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. NIBE Group

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Panasonic (Panasonic Holdings Corporation)

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Rheem Manufacturing Company

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Samsung HVAC, LLC.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Systemair AB

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Trane Technologies Company, LLC

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Voltas (TATA Enterprise)

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

1. Global VRF AC System Market Research And Analysis By Type, 2024-2035, ($ Millions)

2. Global Heat Pump System Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Heat Recovery System Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global VRF AC System Market Research And Analysis By Component, 2024-2035 ($ Million)

5. Global Indoor Units VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Outdoor Units VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global VRF AC System Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Commercial VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Residential VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Industrial VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Healthcare VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Education VRF AC System Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American VRF AC System Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American VRF AC System Market Research And Analysis By Type, 2024-2035 ($ Million)

15. North American VRF AC System Market Research And Analysis By Component Type, 2024-2035 ($ Million)

16. North American VRF AC System Market Research and Analysis By Application, 2024-2035 ($ Million)

17. European VRF AC System Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European VRF AC System Market Research And Analysis By Type, 2024-2035 ($ Million)

19. European VRF AC System Market Research And Analysis By Component Type, 2024-2035 ($ Million)

20. European VRF AC System Market Research And Analysis By Application, 2024-2035 ($ Million)

21. Asia-Pacific VRF AC System Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific VRF AC System Market Research and Analysis By Type, 2024-2035 ($ Million)

23. Asia-Pacific VRF AC System Market Research and Analysis By Component Type, 2024-2035 ($ Million)

24. Asia-Pacific VRF AC System Market Research and Analysis By Application, 2024-2035 ($ Million)

25. Rest Of The World VRF AC System Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Rest Of The World VRF AC System Market Research And Analysis By Type, 2024-2035 ($ Million)

27. Rest Of The World VRF AC System Market Research And Analysis By Component Type, 2024-2035 ($ Million)

28. Rest Of The World VRF AC System Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global VRF AC System Market Share By Type, 2024 Vs 2035 (%)

2. Global Heat Pump System Market Share By Region, 2024 Vs 2035 (%)

3. Global Heat Recovery System Market Share By Region, 2024 Vs 2035 (%)

4. Global VRF AC System Market Share By Component, 2024 Vs 2035 (%)

5. Global Indoor Units VRF AC System Market Share By Region, 2024 Vs 2035 (%)

6. Global Outdoor Units VRF AC System Market Share By Region, 2024 Vs 2035 (%)

7. Global VRF AC System Market Share By Application, 2024 Vs 2035 (%)

8. Global Commercial VRF AC System Market Share By Region, 2024 Vs 2035 (%)

9. Global Residential VRF AC System Market Share By Region, 2024 Vs 2035 (%)

10. Global Industrial VRF AC System Market Share By Region, 2024 Vs 2035 (%)

11. Global Healthcare VRF AC System Market Share By Region, 2024 Vs 2035 (%)

12. Global Education VRF AC System Market Share By Region, 2024 Vs 2035 (%)

13. Global VRF AC System Market Share By Country, 2024 Vs 2035 (%)

14. US VRF AC System Market Size, 2024-2035 ($ Million)

15. Canada VRF AC System Market Size, 2024-2035 ($ Million)

16. UK VRF AC System Market Size, 2024-2035 ($ Million)

17. France VRF AC System Market Size, 2024-2035 ($ Million)

18. Germany VRF AC System Market Size, 2024-2035 ($ Million)

19. Italy VRF AC System Market Size, 2024-2035 ($ Million)

20. Spain VRF AC System Market Size, 2024-2035 ($ Million)

21. Russia VRF AC System Market Size, 2024-2035 ($ Million)

22. Rest Of Europe VRF AC System Market Size, 2024-2035 ($ Million)

23. India VRF AC System Market Size, 2024-2035 ($ Million)

24. China VRF AC System Market Size, 2024-2035 ($ Million)

25. Japan VRF AC System Market Size, 2024-2035 ($ Million)

26. Australia And New Zealand VRF AC System Market Size, 2024-2035 ($ Million)

27. ASEAN Economies VRF AC System Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific VRF AC System Market Size, 2024-2035 ($ Million)

29. Latin America VRF AC System Market Size, 2024-2035 ($ Million)

30. Middle East And Africa VRF AC System Product Market Size, 2024-2035 ($ Million)

FAQS

The size of the VRF AC System market in 2024 is estimated to be around $19.5 billion.

Asia Pacific holds the largest share in the VRF AC System market.

Leading players in the VRF AC System market include Carrier Global Corp., Daikin Industries, Ltd., Fujitsu General Limited, Mitsubishi Electric Corp., and LG Electronics, among others.

VRF AC System market is expected to grow at a CAGR of 9.6% from 2025 to 2035.

Rising demand for energy-efficient HVAC solutions, smart controls, and rapid urban infrastructure growth are driving the VRF AC system market.