Waste to Energy Market

Waste-to-Energy Market Size, Share & Trends Analysis Report by Application (Electricity and Heat), by Technology (Thermochemical and Biochemical), and by Waste type (Municipal Solid Waste, Process Waste, Agricultural Waste, and Others) Forecast Period (2025-2035)

Industry Overview

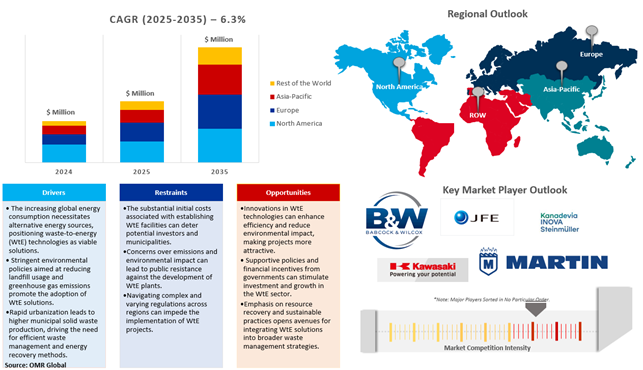

Waste-to-Energy market was valued at $44.3 billion in 2024 and is projected to reach $78.1 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035. Waste to Energy (WtE), also known as energy from waste, uses thermochemical and biochemical technologies to recover energy from urban waste, producing electricity, steam, and fuels. These new technologies can reduce the original waste volume by 90%, depending on the composition and use of outputs. WtE plants offer two significant benefits environmentally safe waste management and disposal and clean electric power generation. The growing use of WtE as a method to dispose of solid and liquid wastes and produce electricity has dramatically reduced the environmental impacts of municipal solid waste management, including emissions of greenhouse gases. In 2023, the United States operated approximately 60 Waste-to-Energy (WtE) plants, generating around 14,000 gigawatt-hours (GWh) of electricity annually this makes less than 1% of all the electricity produced in the U.S.

Market Dynamics

Increasing Waste Generation and Environmental Concerns

The increasing generation of Waste worldwide is a major driver for the growth of the waste-to-energy technology market industry. As populations grow and economies develop, so does the amount of Waste produced. This Waste can hurt the environment, polluting the air, water, and land. Waste-to-energy (WtE) technologies offer a way to reduce the environmental impact of Waste by converting it into energy. By incinerating Waste or using other thermal processes, WtE technologies can generate Electricity, heat, or steam.

This can help to reduce the reliance on fossil fuels and reduce greenhouse gas emissions. Additionally, WtE technologies can help reduce the amount of waste that is sent to landfills, which can conserve valuable land resources and reduce the risk of contamination

Technological Advancements

Technological advancements are significantly propelling the growth of the Waste-to-Energy (WtE) industry. Innovations have led to the development of more efficient and cost-effective WtE technologies, making investments in such projects increasingly viable for businesses and governments. Additionally, improvements in emissions control technologies are mitigating the environmental impact of WtE facilities. For instance, modern incinerator designs now incorporate advanced emission controls that significantly reduce toxic pollution. Enhanced energy recovery methods, such as cogeneration—which utilizes leftover steam for heating buildings—have also improved efficiency.

Market Segmentation

- Based on the application, the market is segmented into electricity and heat.

- Based on the technology, the market is segmented into thermochemical and biochemical.

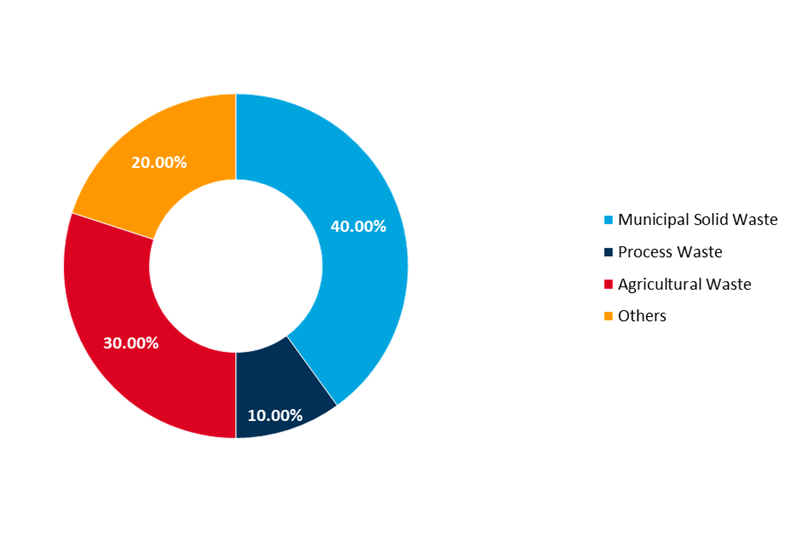

- Based on the waste type, the market is segmented into municipal solid waste, process waste, agricultural waste, and others.s.

Municipal Solid Waste: A Key Driver in the Global Waste-to-Energy Market

Among the waste types, the municipal solid waste sub-segment is expected to hold a prominent share of the global waste-to-energy technologies market across the globe, owing to the large volume of waste generated across the globe and the need for sustainable waste management solutions. In addition, the global population's growth, urbanization, and changing consumption patterns have resulted in a significant increase in municipal solid waste generation. Waste-to-energy technologies offer an efficient and sustainable solution to manage and convert this waste into valuable energy resources. An enabling atmosphere for waste-to-energy technology has been created by stringent environmental rules and policies that aim to reduce landfill trash and mitigate greenhouse gas emissions. Governments all over the world are encouraging the adoption of these technologies through encouraging policies and financial incentives.

The US Department of Energy (DOE) announced nearly $34 million in funding for 11 projects that will support high-impact research and development to improve and produce biofuels, biopower, and bioproducts. These biomass resources, otherwise known as feedstocks, can be produced by municipal solid waste (MSW) streams and algae and converted into low-carbon fuels that can significantly contribute to the decarbonization of transportation sectors that face barriers to electrification, such as aviation and marine.

Global Waste-to-Energy Market Share by Waste Type, 2024 (%)

Agricultural Waste in the Clean Energy Transition

Agricultural waste such as crop stalks, husks, and animal manure provide major potential for renewable energy generation. Using biomass not only helps to reduce environmental pollution and landfill use but also decreases dependence on fossil fuels. Importantly, it creates an additional source of income for farmers. By seeing these benefits, several governments around the world have launched initiatives to tap into this. In the United States, the Department of Agriculture (USDA) and the Department of Energy (DOE) launched a joint initiative in February 2024 to help farmers adopt renewable technologies, including small-scale wind and waste-to-energy systems, aimed at lowering energy costs and boosting farm incomes. In India, the Ministry of New and Renewable Energy (MNRE) is running the Waste to Energy Programmed (2021–2026), which supports projects that generate biogas, bio-CNG, and electricity from agricultural and other organic waste. Meanwhile, the European Union is supporting projects like ALFA, which promotes biogas production from livestock farms to increase renewable energy use and reduce emissions from untreated animal waste. These initiatives reflect a growing global commitment to transforming agricultural waste into a valuable, sustainable energy resource.

Regional Outlook

The global waste-to-energy market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific region is expected to hold a prominent growth over the forecast period owing to the increasing waste generation along with supportive government policies and a growing focus on renewable energy.

North America Region Dominates the Market with Major Share

North America is anticipated to cater to prominent growth over the forecast period owing to favorable government policies, advanced technology adoption, energy security goals, and organic waste valorization. Advanced waste-to-energy technologies include advanced incineration systems, anaerobic digestion with biogas recovery, and thermal gasification. These technologies offer higher efficiency, lower emissions, and improved waste treatment capabilities. In this region, the governments have implemented stringent waste management regulations and environmental policies. These initiatives promote the adoption of waste-to-energy technologies as an environmentally friendly alternative to landfilling. In March 2024, the US Department of Energy’s Bioenergy Technologies Office (BETO) and Vehicle Technologies Office (VTO) launched the Waste Analysis and Strategies for Transportation End-Uses funding initiative. With up to $17.5 million in support, the program aims to help communities develop cost-effective waste-to-energy solutions, particularly focused on converting organic waste into clean transportation fuels. This effort supports local clean energy goals and improved waste management practices.

Market Players Outlook

The major companies serving the global waste-to-energy technologies market include Veolia Environnement S.A., Hitachi Zosen Inova Steinmüller GmbH, JFE Engineering Corporation, Babcock & Wilcox Enterprises, Inc., and Kawasaki Heavy Industries, Ltd. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In April 2025, Frontier a coalition that includes Stripe, Google, and Salesforce—invested nearly $32 million in a Norwegian project to capture carbon dioxide emissions from burning household waste in Oslo. The initiative aims to remove 100,000 metric tons of CO? between 2029 and 2030 by capturing emissions from waste incineration and storing them under the North Sea. This project could serve as a model for similar waste-to-energy carbon capture efforts across Europe.

- In April 2025, New Haven received a $3.3 million state grant to expand organic waste composting efforts. The project includes constructing a co-collection facility to process food waste into compost and biogas, aiming to reduce methane emissions and improve air quality.

- In January 2025 Sydney-based startup Arc Ento Tech secured $5 million funding to establish three waste-to-energy plants at landfill sites across Sydney. The company utilizes biological methods, employing black soldier flies to convert organic waste into insect meal and fertilizer, and mechanical processes to transform plastics and non-digestible organics into refuse-derived reductant (RDR), a sustainable alternative to coking coal.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global waste-to-energy market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Waste to Energy Market Sales Analysis – Application | Technology | Waste Type ($ Million)

• Waste to Energy Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Waste to Energy Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Waste to-Energy Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Waste to Energy Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Waste to Energy Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Waste to Energy Market Revenue and Share by Manufacturers

• Waste to Energy Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Babcock & Wilcox Enterprises, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. JFE Engineering Corporation

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Hitachi Zosen Inova Steinmüller GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Kawasaki Heavy Industries, Ltd.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Veolia Environnement SA

4.2.5.1. Quick Facts

4.2.5.2. Company Overview

4.2.5.3. Product Portfolio

4.2.5.4. Business Strategies

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Waste to Energy Market Sales Analysis by Application ($ Million)

5.1. Electricity

5.2. Heat

6. Global Waste to Energy Market Sales Analysis by Technology ($ Million)

6.1. Thermochemical

6.2. Biochemical

7. Global Waste to Energy Market Sales Analysis by Waste Type ($ Million)

7.1. Municipal Solid Waste

7.2. Process Waste

7.3. Agricultural Waste

7.4. Others

8. Regional Analysis

8.1. North American Waste to Energy Market Sales Analysis – Application | Technology | Waste Type | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Waste to Energy Market Sales Analysis Application | Technology | Waste Type |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Waste to Energy Market Sales Analysis – Application | Technology | Waste Type |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Waste to Energy Market Sales Analysis – Application | Technology | Waste Type |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. A2A S.p.A.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Babcock & Wilcox Enterprises, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Casella Waste Systems

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. china everbright limited

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. China Jinjiang Environment Holding Co. Ltd

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Energos AS

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Hitachi Zosen Inova Steinmüller GmbH

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. JFE Engineering Corporation

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Kanin Energy

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Kawasaki Heavy Industries, Ltd.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Keppel Seghers

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Martin GmbH

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Mitsubishi Heavy Industries Ltd

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Ormat Technologies, Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Reworld Waste, LLC.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Suez Group

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Veolia Environnement SA

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Xcel Energy Inc.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

1. Global Waste-To-Energy Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global Waste To Electricity Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Waste To Heat Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Waste-To-Energy Technologies Market Research And Analysis By Technology, 2024-2035 ($ Million)

5. Global Thermochemical Waste-To-Energy Technologies Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Biochemical Waste-To-Energy Technologies Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Waste-To-Energy Technologies Market Research And Analysis By Waste Type, 2024-2035 ($ Million)

8. Global Waste-To-Energy Technologies For Municipal Solid Waste Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Waste-To-Energy Technologies For Process Waste Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Waste-To-Energy Technologies For Agricultural Waste Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Waste-To-Energy Technologies For Other Wastes Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Waste-To-Energy Technologies Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Waste-To-Energy Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Waste-To-Energy Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

15. North American Waste-To-Energy Technologies Market Research And Analysis By Technology, 2024-2035 ($ Million)

16. North American Waste-To-Energy Technologies Market Research And Analysis By Waste Type, 2024-2035 ($ Million)

17. European Waste-To-Energy Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Waste-To-Energy Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

19. European Waste-To-Energy Technologies Market Research And Analysis By Technology, 2024-2035 ($Million)

20. European Waste-To-Energy Technologies Market Research And Analysis By Waste Type, 2024-2035 ($ Million)

21. Asia-Pacific Waste-To-Energy Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific Waste-To-Energy Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Asia-Pacific Waste-To-Energy Technologies Market Research And Analysis By Technology, 2024-2035 ($ Million)

24. Asia-Pacific Waste-To-Energy Technologies Market Research And Analysis By Waste Type, 2024-2035 ($ Million)

25. Rest Of The World Waste-To-Energy Technologies Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Rest Of The World Waste-To-Energy Technologies Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Rest Of The World Waste-To-Energy Technologies Market Research And Analysis By Technology, 2024-2035 ($ Million)

28. Rest Of The World Waste-To-Energy Technologies Market Research And Analysis By Waste Type, 2024-2035 ($ Million)

1. Global Waste-To-Energy Technologies Market Share By Application, 2024 Vs 2035 (%)

2. Global Waste To Electricity Market Share By Region, 2024 Vs 2035 (%)

3. Global Waste To Heat Market Share By Region, 2024 Vs 2035 (%)

4. Global Waste-To-Energy Technologies Market Share By Technologies, 2024 Vs 2035 (%/)

5. Global Thermochemical Waste-To-Energy Technologies Market Share By Region, 2024 Vs 2035 (%)

6. Global Biochemical Waste-To-Energy Technologies Market Share By Region, 2024 Vs 2035 (%)

7. Global Waste-To-Energy Technologies Market Share By Waste Type, 2024 Vs 2035 (%)

8. Global Waste-To-Energy Technologies For Municipal Solid Waste Market Share By Region, 2024 Vs 2035 (%)

9. Global Waste-To-Energy Technologies For Process Waste Market Share By Region, 2024 Vs 2035 (%)

10. Global Waste-To-Energy Technologies For Agricultural Waste Market Share By Region, 2024 Vs 2035 (%)

11. Global Waste-To-Energy Technologies For Other Wastes Market Share By Region, 2024 Vs 2035 (%)

12. Global Waste-To-Energy Technologies Market Share By Region, 2024 Vs 2035 (%)

13. Us Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

14. Canada Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

15. Uk Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

16. France Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

17. Germany Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

18. Italy Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

19. Spain Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

20. Rest Of Europe Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

21. India Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

22. China Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

23. Japan Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

24. South Korea Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

26. ASEAN Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

27. Rest Of Asia-Pacific Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

28. Rest Of The World Waste-To-Energy Technologies Market Size, 2024-2035 ($ Million)

FAQS

The size of the Waste to Energy market in 2024 is estimated to be around $44.3 billion.

North America holds the largest share in the Waste to Energy market.

Leading players in the Waste to Energy market include Veolia Environnement S.A., Hitachi Zosen Inova Steinmüller GmbH, JFE Engineering Corporation, Babcock & Wilcox Enterprises, Inc., and Kawasaki Heavy Industries, Ltd. and others.

Waste to Energy market is expected to grow at a CAGR of 6.3% from 2025 to 2035.

Rising waste generation, stricter environmental rules, and demand for renewable energy drive the Waste to Energy market growth.