White Oil Market

White Oil Market Size, Share & Trends Analysis Report, By Application (Plastics & Polymers, Personal Care & Cosmetics, Pharmaceuticals, Food Industry, and Others) and Forecast 2019-2025

The global white oil market is estimated to grow at a CAGR of 3% during the forecast period. The major factors contributing to the growth of the market include significant demand for process oil in the personal care and pharmaceutical industry and the rising demand for white oil in the food industry. White mineral oil is significantly used in several food processes, primarily in the production of lubricating oil utilized by the producers of food & drinks. In the food industry, white oil is used in food packing materials, bakery pan oil, greasers and food-grade lubricants.

Further, during the food processing and packaging stage, highly refined petroleum-based products can be used as food additives and release agents. Several benefits make white oils ideal for the food industry. White oils are colorless petroleum-derived mineral oils from non-carcinogenic LBOs (Lubricant Base Oils), which are further highly refined to achieve extremely low levels of aromatics to eliminate color and improve stability. White oils offer moisture barrier and lubricating properties and are generally not allergenic. Therefore, it is being significantly used in food processing and food packaging applications as a food additive or plastics for food contact, which, in turn, drives the growth of the white oil industry.

Segmentation

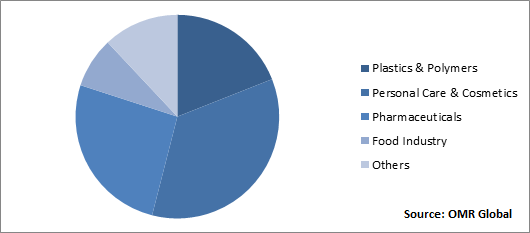

The global white oil market is segmented on the basis of application and regional outlook. Based on application, the market is divided into plastics & polymers, personal care & cosmetics, pharmaceuticals, food industry, and others. White oil is personal care & cosmetics is expected to hold a significant share in 2018, owing to its application as an active ingredient during the processing of baby oils, topical skin care body lotions, moisturizing creams, petroleum jellies, cosmetics, and hair care products. In addition, white oil is hydrophobic in nature owing to which it is used for manufacturing water-resistant creams.

Global White Oil Market Share by Application, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global white oil market. Based on the availability of data, information related to products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Sinopec Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Exxon Mobil Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Fuchs Petrolub SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. HollyFrontier Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Nynas AB

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Recent Developments

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global White Oil Market by Application

5.1.1. Plastics & Polymers

5.1.2. Personal Care & Cosmetics

5.1.3. Pharmaceuticals

5.1.4. Food Industry

5.1.5. Others (Textile and Animal Feed)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Apar Industries Ltd.

7.2. ATDM Co., Ltd.

7.3. C.J. Robinson Co.

7.4. Calumet Specialty Products Partners, L.P.

7.5. Eastman Chemical Co.

7.6. Exxon Mobil Corp.

7.7. Fuchs Petrolub SE

7.8. Hansen & Rosenthal KG

7.9. HollyFrontier Corp.

7.10. Kerax Ltd.

7.11. Lodha International LLP

7.12. Morris Lubricants Ltd.

7.13. Nynas AB

7.14. Panama Petrochem Ltd.

7.15. Renkert Oil, Inc.

7.16. Sasol Ltd.

7.17. Savita Oil Technologies Ltd.

7.18. Seojin Chemical Co., Ltd.

7.19. Shell International B.V

7.20. Sinopec Corp.

7.21. Total Group

1. GLOBAL WHITE OIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL WHITE OIL IN PLASTICS & POLYMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL WHITE OIL IN PERSONAL CARE & COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL WHITE OIL IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL WHITE OIL IN FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL WHITE OIL IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL WHITE OIL MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN WHITE OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN WHITE OIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

10. EUROPEAN WHITE OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. EUROPEAN WHITE OIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. ASIA-PACIFIC WHITE OIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. ASIA-PACIFIC WHITE OIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. REST OF THE WORLD WHITE OIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL WHITE OIL MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL WHITE OIL MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

5. UK WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD WHITE OIL MARKET SIZE, 2018-2025 ($ MILLION)