Wireless Connectivity Market

Global Wireless Connectivity Market Size, Share & Trends Analysis Report by Technology (Wi-Fi, Bluetooth, Zigbee, Near Field Communication (NFC), Cellular Technologies, Global Navigation Satellite System (GNSS), and Others (Enocean, Z-Wave)), by Application(Consumer Electronics, Automotive & Transportation, Healthcare, Industrial, IT & Telecom, and Others), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for wireless connectivity is estimated to grow at a CAGR of 13.8% during the forecast period. The market is mainly driven due to the growing integration of IoT devices, growing internet penetration, technical advancement in telecommunication and high penetration of smartphones across the globe. At present, there are various types of IoT-based wearable devices are getting into the market. Fitness trackers, sensors, smartwatches, hearing aids, and pacemakers are the dominating wearable devices in wireless connectivity. In February 2019, Samsung introduces three new wearables such as galaxy wearables, galaxy watch active and galaxy fit/galaxy fit e for balanced and connected living. Galaxy buds have wireless charging and device to devise power-sharing and also get a quick charging boost on the go from Galaxy S10 which is the latest Samsung smartphone. Galaxy watch active has WPC-based (Wireless Power Consortium) wireless connectivity and galaxy fit/galaxy fit e has NFC (Near Field Communication) wireless connectivity for charging.

Segmental Outlook

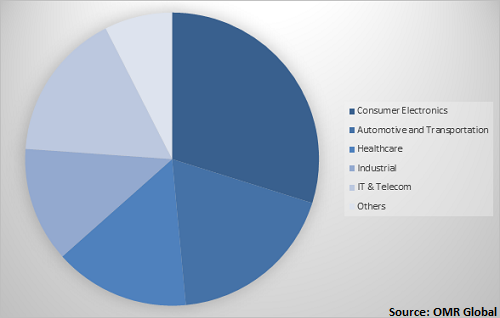

The global wireless connectivity market is segregated on the basis of technology and application. Based on the technology the global wireless connectivity market is classified into Wi-Fi, Bluetooth, ZigBee, near field communication (NFC), cellular technologies, global navigation satellite system (GNSS), and others (Enocean, Z-Wave). The Wi-Fi segment is projected to hold a significant share in the global wireless connectivity market owing to the growing application of Wi-Fi as a wireless connectivity solution in various sectors such as consumer and enterprise. On the basis of the application, the market is further segmented into consumer electronics, automotive and transportation, healthcare, industrial, IT & telecom and others (building automation).

Global Wireless Connectivity Market Share by Application, 2018(%)

Source: OMR Global

Global Wireless Connectivity Market To Be Driven By Consumer Electronics Application

Among applications, the consumer electronics segment projected to have considerable market growth in the global wireless connectivity market. The market segmentation for consumer electronic devices includes smartphones, laptops, desktops, and wearables. The major aspects that drive the growth of wireless connectivity for smartphones include the benefits that these chargers offer such as the safer way to power smartphone, puts less strain on charging port of a smartphone, and are easy to use. Moreover, Qi wireless charging pads are being installed at various places across the globe that makes it suitable to charge a smartphone at any place across the globe. Qi wireless charging has been adopted by many of the major smartphone manufacturers including Xiaomi, mPhone, Microsoft, Huawei, Google, Fujitsu, Samsung, Sony, LG, HTC, Huawei, Nokia, Motorola, Panasonic, and Blackberry among others. Some of the smartphone market players such as Xiaomi and Samsung are offering wireless connectivity for charging complementary to their main product offerings.

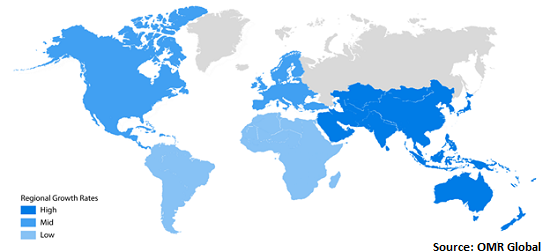

Regional Outlook

Geographically, the global wireless connectivity market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America is projected to have a significant market share in the global wireless connectivity market. The wireless connectivity market in North America is mainly driven by the contribution of major countries such as the US and Canada. The growing adoption of cloud-based services in these economies and developed IT infrastructure further provide significant growth to the wireless connectivity market. Moreover, adoption of advanced communication technologies such as 5G, rising demand for connected cars and others in these countries. Moreover, high internet penetration is one of the major factors that is augmenting market growth in North America. According to the ITU database in 2018, around 69.6 individuals using the internet per 100 inhabitants in North America.

Global wireless connectivity Market Growth, by Region 2019-2025

Asia-Pacific to hold a considerable growth in the global wireless connectivity market

Geographically, Asia-Pacific is projected to have a significant growth in the global wireless connectivity market. The market is mainly driven due to the increasing telecommunication infrastructure in the region, increasing smartphone sales, growing internet penetration, increasing other consumer electronic products and rising disposable income of people. The major countries which will have a significant market share during the forecast period are India, China, and Japan. China is the largest telecommunication market in terms of the user followed by India. Apart from those nations, South Korea, Australia, Thailand, and Indonesia will play a major contributor to the market. The major companies which are active in the mobile phone market are Apple, Samsung, Xiaomi, Oppo, Vivo, Huawei, Sony, and Lenovo.

Market Players Outlook

The key players in the wireless connectivity market contributing significantly by providing different technology of products and increasing their geographical presence across the globe. The key players of the market include Intel Corp., Qualcomm Technologies Inc., NXP Semiconductors, STMicroelectronics International N.V, Texas Instruments Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global wireless connectivity market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Intel Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Qualcomm Technologies Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. NXP Semiconductors

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. STMicroelectronics International N.V

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Texas Instruments Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Wireless Connectivity Market by Technology

5.1.1. Wi-Fi

5.1.2. Bluetooth

5.1.3. Zigbee

5.1.4. Near Field Communication (NFC)

5.1.5. Cellular Technologies

5.1.6. Global Navigation Satellite System (GNSS)

5.1.7. Others (Enocean, Z-Wave)

5.2. Global Wireless Connectivity Market by Application

5.2.1. Consumer Electronics

5.2.2. Automotive and Transportation

5.2.3. Healthcare

5.2.4. Industrial

5.2.5. IT & Telecom

5.2.6. Others (Building Automation)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ceva, Inc.

7.2. EnOcean GmbH

7.3. Espressif Systems Pte., Ltd.

7.4. Broadcom Inc.

7.5. Cypress Semiconductor Corp.

7.6. Intel Corp.

7.7. Microchip Technology Inc.

7.8. MediaTek Inc.

7.9. Murata Manufacturing Co., Ltd.

7.10. Nexcom International Co., Ltd.

7.11. Nordic Semiconductor

7.12. NXP Semiconductors

7.13. Peraso Technologies, Inc.

7.14. Qualcomm Technologies, Inc.

7.15. Renesas Electronics Corp.

7.16. STMicroelectronics International N.V.

7.17. Skyworks Solutions, Inc.

7.18. Texas Instruments Inc.

7.19. Quantenna Communications, Inc.

1. GLOBAL WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

2. GLOBAL WI-FI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL BLUETOOTH MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ZIGBEE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL NFC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL CELLULAR TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL GNSS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

10. GLOBAL WIRELESS CONNECTIVITY IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL WIRELESS CONNECTIVITY IN AUTOMOTIVE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL WIRELESS CONNECTIVITY IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL WIRELESS CONNECTIVITY IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL WIRELESS CONNECTIVITY IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL WIRELESS CONNECTIVITY IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. EUROPEAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

22. EUROPEAN WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. REST OF THE WORLD WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

27. REST OF THE WORLD WIRELESS CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL WIRELESS CONNECTIVITY MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

2. GLOBAL WIRELESS CONNECTIVITY MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL WIRELESS CONNECTIVITY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD WIRELESS CONNECTIVITY MARKET SIZE, 2018-2025 ($ MILLION)