Wireless Testing Market

Wireless Testing Market Size, Share & Trends Analysis Report by Offering (Equipment and Services).by Connectivity Technology (5G, Wi-Fi Bluetooth, GPS/GNSS, 2G/3G, and 4G/LTE).and by Application (Consumer Electronics, Automotive, IT & Telecommunication, Energy & Power, Aerospace & Defense, Industrial, and Others).Forecast Period (2024-2031).

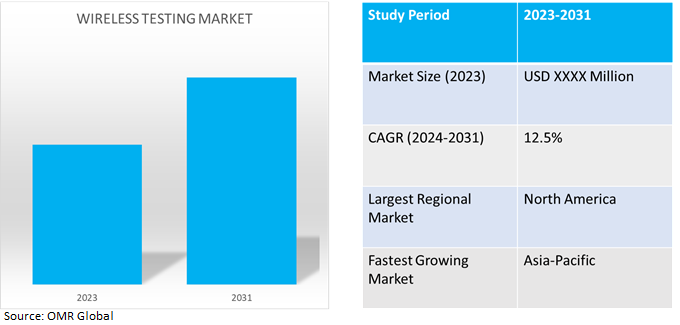

Wireless testing market is anticipated to grow at a significant CAGR of 12.5% during the forecast period (2024-2031). The market growth is attributed to the growing demand for end-to-end testing to ensure seamless operation globally driving the growth of the market. The end-to-end testing finds any flaws or problems that might occur when various application components communicate with one another. End-to-end testing verifies that all parts function cohesively to satisfy user expectations by testing the complete system. According to the Institute of Electrical and Electronics Engineers (IEEE), by 2025, it is predicted there will be 55.7 billion connected devices globally, 75.0% of which will be connected to an Internet of Things (IoT) platform. The wireless connectivity market is poised to reach $157.0 billion by 2027, driven by wearable devices, smart home technology, and cloud service models, all working with IoT devices.

Market Dynamics

Growing Demand for (Over-the-Air) OTA Testing To Assess Performance

The increasing demand for IoT applications requires high connectivity for M2M communication, which has given rise to OTA testing services for LTE-A, LTE-M, and 5G pre-compliant testing. Manufacturers may verify and improve the performance of their wireless devices in real-world situations by using over-the-air (OTA) testing to make sure the products stand according to user expectations, regulatory requirements, and strict quality standards. By using this kind of testing, producers can find and fix problems with signal strength, interference, antenna design, and network compatibility, which eventually results in the development of wireless products that are more competitive and dependable. To evaluate the radiated performance of multiple input multiple output (MIMO) devices, several over-the-air (OTA) test techniques have been developed.

Growing Adoption of Artificial Intelligence and Machine Learning Techniques

Artificial intelligence (AI) and machine learning (ML) are recognized as the key technologies required to allow the next generation of wireless communications when 6G development got underway. AI potentially solved some of the more difficult technological problems the industry was now encountering. However, much like with many emerging technologies, government, industry, commerce, and academics must work closely together to make AI suitable for mobile communications. When devices compete for network resources and the number of users and applications in a wireless system grows constantly, designs that were previously understood by human-based rules—linear patterns—become insufficient. However, AI techniques are more capable than human-based approaches at solving non-linear issues as they can automatically and effectively extract any pattern.

Market Segmentation

Our in-depth analysis of the global wireless testing market includes the following segments by offering, connectivity technology, and application.

- Based on offering, the market is sub-segmented into equipment and services.

- Based on connectivity technology, the market is sub-segmented into 5G, Wi-Fi Bluetooth, GPS/GNSS, 2G/3G, and 4G/LTE.

- Based on application, the market is sub-segmented into consumer electronics, automotive, IT & telecommunication, energy & power, aerospace & defense, industrial and others (medical devices).

5G is Projected to Emerge as the Largest Segment

Based on the connectivity technology, the global wireless testing market is sub-segmented into 5G, Wi-Fi Bluetooth, GPS/GNSS, 2G/3G, and 4G/LTE.Among these5G, the sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes increased demand for testing the performance, speed, and reliability of 5G connections. This included testing for latency, throughput, coverage, and network slicing capabilities. The goals of 5G wireless technology are to provide more users with more consistent user experiences, ultra-low latency, vast network capacity, faster multi-GBPSpeak data speeds, and increased reliability. For instance, in February 2024, Cisco and DISH Wireless partnered to enhance the performance of the boost wireless cloud-native 5G network, automating the distribution of network traffic to accelerate the delivery of new enterprise services, increase network flexibility and scale, and improve operational efficiencies.

IT & Telecommunication Sub-segment to Hold a Considerable Market Share

Based on application, the global wireless testing market is sub-segmented into consumer electronics, automotive, IT & telecommunication, energy & power, aerospace & defense, industrial and others (medical devices).Among these, the IT & telecommunication sub-segment is expected to hold considerable share of the market. The segmental growth is attributed to the increasing demand for wireless testing in IT & telecommunications to ensure the development of high-performance products and improved customer experience. For instance, in February 2024, Round Rock, Texas and Espoo, Finland – Dell Technologies and Nokia, announced a strategic partnership to use each company’s expertise and industry solutions, including infrastructure solutions from Dell and private wireless connectivity from Nokia, to advance open network architectures in the telecom ecosystem and private 5G use cases among businesses.

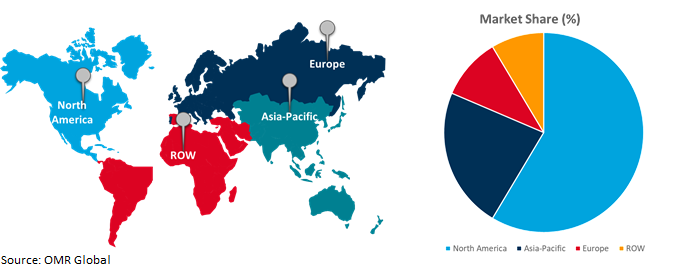

Regional Outlook

The global wireless testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Wireless Testing in Asia-Pacific

- In emerging like China and India, the use of wireless testing is rapidly utilized for connectivity, power consumption, data integrity, and resilience to interference.

- In July 2023, the Ministry of Communications, launched Bharat 6G alliance to drive innovation and collaboration in next-generation wireless technology. Under DCIS (Digital Communication Innovation Square), 66 Startups and MSMEs Together under the Telecom Technology Development Fund (TTDF) scheme.

Global Wireless Testing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and wireless testing providers in the region. The growth is mainly attributed to the growing adoption of long-term evolution and advanced wireless testing technologies, resulting in a higher demand for wireless testing products contributing the regional growth. Governments are investing in programs to encourage wireless testing, which is expected to boost the growth of the wireless testing market. For instance, in February 2024, the National Telecommunications and Information Administration (NTIA) invested $42.0 million in public wireless supply chain innovation funds. The fund provides a consortium of US carriers, foreign carriers, universities, and equipment suppliers to establish a testing, evaluation, and R&D center in the Dallas Technology Corridor and a satellite facility in the Washington, D.C. area.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global wireless testing market include Eurofins Scientific SE, Intertek Group plc, Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co KG, and Teradyne Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2023, Kyndryl and Nokia collaborated to expand the global network and edge computing alliance. The three-year agreement extends plans to co-innovate and accelerate deployment of flexible, reliable, and secure LTE and 5G private wireless connectivity services and Industry 4.0 solutions

Recent Development

- In February 2024, Samsung announced to continue Open RAN leadership with participation in the National Telecommunications and Information Administration (NTIA) Wireless Innovation Fund set to advance interoperability, performance, and security. The federal government's objective is tofostera vibrant and secure ecosystem of network technology that adheres to open and standardized interfaces in wireless networks.

- In June 2023, Anritsu Corp. extended its range of test solutions for manufacturing wireless communications devices. The Universal Wireless Test Set MT8870A / MT8872A supports Wi-Fi 7 TRX tests by software options of the WLAN 802.11be TX Measurement MX887034A and WLAN 802.11be Waveforms MV887034A.

- In June 2022, Qualcomm acquired Cellwize to accelerate 5G adoption and Spur Network Infrastructure Innovation at the Edge. Cellwize’s 5G network deployment, automation, and management software platform capabilities further strengthen Qualcomm Technologies’ 5G infrastructure solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global wireless testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Eurofins Scientific SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Intertek Group plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Teradyne Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Wireless Testing Market by Offering

4.1.1. Equipment

4.1.2. Services

4.2. Global Wireless Testing Market by Connectivity Technology

4.2.1. 5G

4.2.2. Wi-Fi Bluetooth

4.2.3. GPS/GNSS

4.2.4. 2G/3G

4.2.5. 4G/LTE

4.3. Global Wireless Testing Market by Application

4.3.1. Consumer Electronics

4.3.2. Automotive

4.3.3. IT & Telecommunication

4.3.4. Energy & Power

4.3.5. Aerospace & Defense

4.3.6. Industrial

4.3.7. Others (Medical Devices)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Anritsu Corp.

6.2. Bureau Veritas

6.3. Cetecom Advanced GmbH

6.4. DEKRA

6.5. EM Topco Ltd. (Element Materials Technology)

6.6. EXFO Inc.

6.7. Keysight Technologies, Inc.

6.8. NTS - National Technical Systems

6.9. Resillion

6.10. Rohde & Schwarz GmbH & Co KG

6.11. SGS SA

6.12. Spirent Communications plc

6.13. TÜV NORD GROUP

6.14. TÜV Rheinland AG

6.15. TÜV SÜD

6.16. UL LLC.

6.17. VIAVI Solutions Inc.

1. GLOBAL WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

2. GLOBAL WIRELESS TESTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL WIRELESS TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL 5G WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL WI-FI BLUETOOTH WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL GPS/GNSS WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL 2G/3G WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL 4G/LTE WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL WIRELESS TESTING FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL WIRELESS TESTING FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL WIRELESS TESTING FOR IT & TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL WIRELESS TESTING FOR ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL WIRELESS TESTING FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL WIRELESS TESTING FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL WIRELESS TESTING FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

21. NORTH AMERICAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TECHNOLOGY, 2023-2031 ($ MILLION)

22. EUROPEAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

24. EUROPEAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TECHNOLOGY, 2023-2031 ($ MILLION)

25. EUROPEAN WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TECHNOLOGY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

32. REST OF THE WORLD WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TECHNOLOGY, 2023-2031 ($ MILLION)

33. REST OF THE WORLD WIRELESS TESTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL WIRELESS TESTING MARKET SHARE BY OFFERING, 2023 VS 2031 (%)

2. GLOBAL WIRELESS TESTING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL WIRELESS TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL WIRELESS TESTING MARKET SHARE BY CONNECTIVITY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL 5G WIRELESS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL WI-FI BLUETOOTH WIRELESS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL GPS/GNSS WIRELESS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL 2G/3G WIRELESS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL 4G/LTE WIRELESS TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL WIRELESS TESTING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL WIRELESS TESTING FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL WIRELESS TESTING FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL WIRELESS TESTING FOR IT & TELECOMMUNICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL WIRELESS TESTING FOR ENERGY & POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL WIRELESS TESTING FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL WIRELESS TESTING FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL WIRELESS TESTING FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

20. UK WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA WIRELESS TESTING MARKET SIZE, 2023-2031 ($ MILLION)