Zero-Trust Security Market

Global Zero-Trust Security Market Size, Share & Trends Analysis Report by Deployment Type (Cloud Based, On-Premises), by Industry (Banking, Financial Services, and Insurance, Government and Defense, IT and Telecommunications, Retail and E-Commerce, Energy and Utilities, Healthcare, and Others) Forecast Period 2025-2035

The global zero-trust security market is projected to grow at a considerable CAGR of 20% during the forecast period (2020-2026). Zero-trust security is a technology that requires strict identity verification for every person and device accessing critical content including those within and outside the network. The growing concern for data theft and data breaches is one of the major factors creating the demand for zero-trust security which is a high-end security solution. BFSI, retail & e-commerce, and IT & Telecom industry are actively implementing this technology to maintain their diverse security systems which in turn is further anticipated to flourish the growth of this market across the globe.

Furthermore, the presence of stringent government regulations such as the Sarbanes Oxley Act of 2002 (SOX) and Gramm-Leach-Bliley (GLB) Act plays a significant role in promoting the adoption of zero-trust security across the globe. All such acts mandate securities firms and financial institutions to implement stringent regulations to protect the privacy of consumer data by establishing a program, which assessed risks pertaining to the data and offers protection against threats. Therefore, the presence of such stringent government regulations across the globe is expected to promote the market growth of the global zero trust security market.

The global zero-trust security market is classified on the basis of deployment type, and industry. Based on the deployment type, the market is segmented into cloud-based and on-premises. Based on the deployment type, the on-premises segment is anticipated to hold considerable market share. Cloud-based is anticipated to showcase considerable growth based on deployment type. The growing adoption of the cloud-based model owing to its embedded benefits is a key factor contributing to the growth of this market segment. Based on industry, the market is segmented into banking, financial services, and insurance, government and defense, IT and telecommunications, retail and e-commerce, energy and utilities, healthcare, and others.

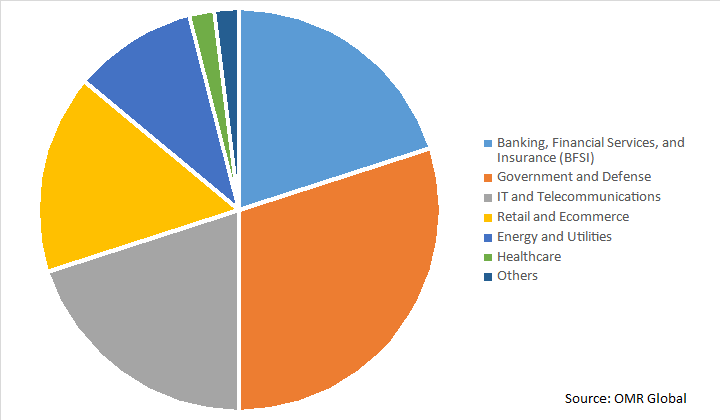

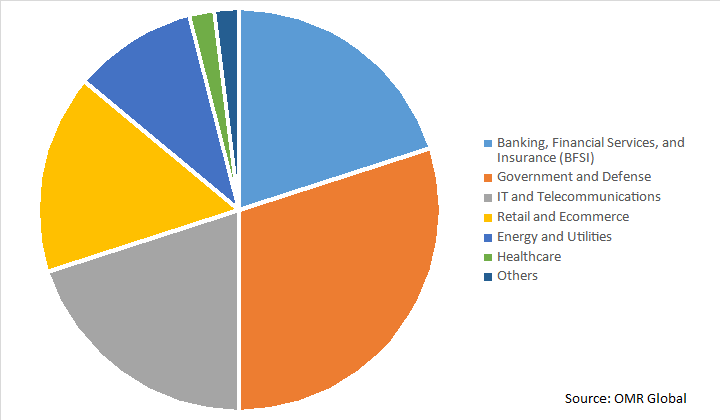

BFSI to be considerable segment based on industry

The critical nature of the organizational data, infrastructure, and assets of this industry is a key factor promoting the use of zero-trust security solutions. BFSI sector creates significant demand for proactive security and highly intelligent solutions that can benefit to identify everything ranging from crime to customer retention issues. Therefore, this sector focuses on technology such as zero-trust security solutions to secure the critical data, so that they can prevent gaps in security, which could negatively affect their revenues, operating costs, and adherence to industry regulations, reputation and much more.

Global Zero-Trust Security Market Share by Industry, 2019 (%)

Regional Outlook

The global zero-trust security market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a considerable market share during the forecast period. The growing adoption of zero-trust security by the various end-use industries such as IT & Telecomm, healthcare, retail, and BFSI among others to deal with security concerns is a major factor to drive the growth of the market in the US. The rapidly growing number of data breaches in the US is anticipated to further promote the deployment of zero-trust security solutions over the forecast period. According to the report of the Identity Theft Resource Centre (ITRC), a total of 1,244 data breaches were recorded in the country, in 2018.

Global Zero-Trust Security Market Growth, by Region 2020-2026

Asia-Pacific to exhibit considerable growth during the forecast period 2020-2026

Asia-Pacific is estimated to witness significant growth in the market during the forecast period owing to the increasing presence of multinational companies coupled with increasing government initiatives in the region. Furthermore, the rising awareness of zero-trust security solutions and the availability of the zero-trust security in the emerging countries of this region is again creating the demand for the zero-trust security market.

Market Players Outlook

The major players of the zero-trust security market include IBM Corp., Microsoft Corp., Cisco Systems, Inc., VmWare, Inc., Google LLC, Akamai Technologies, Inc., and Broadcom, Inc. These players are actively adopting different growth strategies such as new product launch, partnerships, collaboration, and mergers and acquisition among others to remain competitive in the market place. In June 2020, Yellowfin International had released version 9.2 with capabilities that transform embedded BI and analytical app development. In addition, the company has expanded its integrated set of embedded tools to facilitate the users in creating compelling zero trust security experiences for its customers with a minimum amount of effort and coding. Yellowfin components are fully extensible to meet developers’ needs.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global zero-trust security market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cisco Systems Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. VmWare Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Microsoft Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Google LLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Zero-Trust Security Market by Deployment Type

5.1.1. Cloud-Based

5.1.2. On-Premise

5.2. Global Zero-Trust Security Market by Industry

5.2.1. Banking, Financial Services, and Insurance(BFSI)

5.2.2. Government and Defense

5.2.3. IT and Telecommunications

5.2.4. Retail and Ecommerce

5.2.5. Energy and Utilities

5.2.6. Healthcare

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Akamai Technologies, Inc.

7.2. Blackberry, Ltd.

7.3. Broadcom, Inc. (Symantec Corp.)

7.4. Centrify Corp.

7.5. Check Point Software Technologies, Ltd.

7.6. Cisco Systems, Inc.

7.7. Cloudflare, Inc.

7.8. Cyxtera Technologies, Inc.

7.9. Forcepoint

7.10. Fortinet, Inc.

7.11. Google,LLC

7.12. Heimdal Security A/S

7.13. IBM Corp.

7.14. Microsoft Corp.

7.15. Okta, Inc.

7.16. Palo Alto Networks, Inc.

7.17. Secret Double Octopus

7.18. Sophos Group, PLC

7.19. VmWare, Inc.

1. GLOBAL ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CLOUD-BASED ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ON-PREMISE ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

5. GLOBAL BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL GOVERNMENT AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL IT AND TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL RETAIL AND ECOMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ENERGY AND UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

15. EUROPEAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2019-2026 ($ MILLION)

22. REST OF THE WORLD ZERO-TRUST SECURITY MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL ZERO-TRUST SECURITY MARKET SHARE BY DEPLOYMENT TYPE, 2019 VS 2026 (%)

2. GLOBAL ZERO-TRUST SECURITY MARKET SHARE BY INDUSTRY, 2019 VS 2026 (%)

3. GLOBAL ZERO-TRUST SECURITY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ZERO-TRUST SECURITY MARKET SIZE, 2019-2026 ($ MILLION)