Rising Sports Injuries, Coupled with Technical Advances and FDA approvals, Fuel Suture Anchor Devices Market Growth

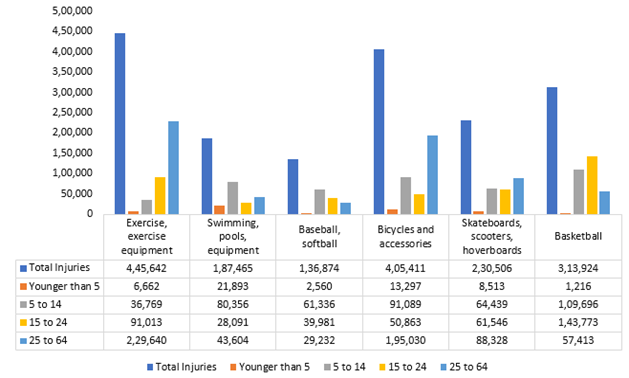

The global suture anchor devices market is anticipated to grow at a considerable CAGR of 4.3% during the forecast period (2023-2030). Over the years, osteoarthritis has become more common globally. According to the Arthroscopy, Sports Medicine, and Rehabilitation, cartilage injuries incidents were 11, at 0.08 per 1,000 GE. The surge in sports-related injuries globally is set to contribute to the demand for suture anchor devices. According to the National Safety Council (NSC), in 2022 exercise equipment accounted for an estimated 445,642 injuries, which increased from 409,224 injuries in 2021. Highest injury rates in 15- to 24-year-olds, nearly double males (2,373,621) than females (1,257,781), 91% treated in emergency departments and released.

Browse the full report description of “Suture Anchor Devices Market Size, Share & Trends Analysis Report by Material Type (Metallic Suture Anchor, Bio-Absorbable Suture Anchor, and Others), by Product (Absorbable, and Non-Absorbable), by Tying Type (Knotted Suture Anchors, and Knotless Suture Anchors), by End-Use (Hospitals, Clinics, and Ambulatory Surgical Centers), Forecast Period (2024-2031)” at https://www.omrglobal.com/industry-reports/suture-anchor-devices-market

Sports Injuries by Number of Injuries, 2022

Source: Insurance Information Institute

As a result of these factors, major players in this market are making significant investments in R&D, resulting in a strong pipeline of products based on various approaches to suture anchor devices. In August 2022, OSSIO, Inc., an orthopedic fixation technology company, launched and first commercial use of OSSIOfiber® Suture Anchors in the US, expanding patient access to the company’s growing portfolio of bio-integrative implants for use in foot/ankle, shoulder, knee, hand/wrist, and elbow surgery. Further, the rising number of FDA approvals are also contributed to propel the adoption of Suture Anchor Devices. In June 2022, Anika Therapeutics Inc., received FDA 510(k) clearance of the X-Twist knotless fixation system for soft tissue repairs in the shoulder, foot and ankle and other extremities. The X-Twist system was the platform of knotless suture anchors with multiple fixation options for patients undergoing soft tissue repairs, such as rotator cuff repair.

Market Coverage

• The market number available for – 2023-2031

• Base year- 2023

• Forecast period- 2024-2031

• Segment Covered-

o By Material Type

o By Product

o By Tying Type

o By End-user

• Regions Covered-

o North America

o Europe

o Asia-Pacific

o Rest of the World

• Competitive Landscape- includes Arthrex, Inc., ConMed Corp., Johnson and Johnson (DePuy Synthes, Inc.), Smith & Nephew plc, and others.

Key questions addressed by the report

- What is the market growth rate?

- Which segment and region dominate the market in the base year?

- Which segment and region will project the fastest growth in the market?

- Who is the leader in the market?

- How players are addressing challenges to sustain growth?

- Where is the investment opportunity?

Global Suture Anchor Devices Market Report Segment

By Material Type

- Metallic Suture Anchor

- Bio-Absorbable Suture Anchor

- Others (PEEK Suture Anchor Devices)

By Product

- Absorbable

- Non-Absorbable

By Tying Type

- Knotted Suture Anchors

- Knotless Suture Anchors

By End-Use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Global Suture Anchor Devices Market Report Segment by Region

North America

• United States

• Canada

Europe

• UK

• Germany

• Italy

• Spain

• France

• Rest of Europe

Asia-Pacific

• China

• India

• Japan

• South Korea

• Rest of Asia-Pacific

Rest of the World

• Latin America

• Middle East & Africa

To learn more about this report request a sample copy @ https://www.omrglobal.com/request-sample/suture-anchor-devices-market