1,2-Pentanediol Market

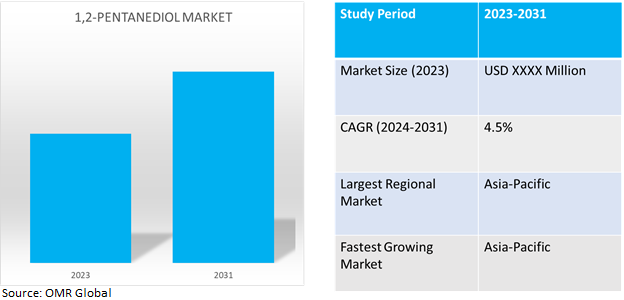

1,2-Pentanediol Market Size, Share & Trends Analysis Report by Type (Bio-Based, and Petro-Based). by Grade (Industrial Grade, and Cosmetic Grade). and by Application (Pesticide Intermediates, Cosmetics, and Others). Forecast Period (2024-2031).

1,2-pentanediol market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). 1,2-pentanediol is an intermediate chemical for active ingredients. It is commonly used as a solvent, humectant, and antimicrobial agent in personal care products, pharmaceuticals, and industrial applications having excellent solubility in water and organic solvents, making it a versatile ingredient in formulations.

Market Dynamics

Rising Disposable Income

The 1,2-pentanediol industry has seen a positive upward trend due to rising disposable income, especially in developing countries instigating demand and increased spending on cosmetics and personal care products. According to India Consumer Sentiment Index (CSI) by Axis My India survey,overall household spending has increased for 58.0% of families, indicating a positive trend in consumption. Spending on essential items, such as personal care and household items, has increased for 49.0% of families. This reflects a growing emphasis on self-care and maintaining a comfortable living environment. With a surge in spending on essentials, the net score of personal care products rise to +34, indicating favorable sentiment among consumers.

Growing Pharmaceuticals Industry

1,2-pentanediol is utilized as a chemical intermediate in the synthesis of various drugs. It is also used as a co-solvent and as a stabilizer in liquid formulations. Furthermore, rising demand for pharmaceutical medications in both established and developing economies is helping to drive the market expansion of chemicals. According to Germany's trade and investment,in 2021, the German pharmaceutical market grew faster than the German economy with industry sales increasingby 5.4%, reaching $60.1 billion. Whereas, the pharmaceutical industry in Germany invested over $9.2 billion in R&Dmore than in any other European country. The German pharmaceutical sector shows the highest research intensity among all major German industries with about 11.1% of revenues reinvested in internal R&D projects in 2020 and the total research intensity reaching 16.0%.

Market Segmentation

Our in-depth analysis of the global 1,2-pentanediol market includes the following segments by grade and application:

- Based on grade, the market is bifurcated into industrial grade, and cosmetic grade.

- Based on application, the market is sub-segmented into pesticide intermediates, cosmetics, and others.

Bio-based remains to become the Largest Sub-Segment

Based on the type, the global 1,2-pentanediol market is sub-segmented into subscription and pay-as-per-use models. The bio-based 1,2-pentanediol market has a positive outlook contributed by government regulations to create sustainable chemical alternatives to currentcarbon emitting sources. Various governments globally have shifted toward sustainable processes and raw materials for the production of necessary products instigating more actions in the future.

Cosmetic Grade Holds Substantial Market Share

Cosmetic grade sub-segment is in demand attributing to the rising emphasis on skin careby individuals. Products such as lotions, moisturizers, and sunscreens demand have exponentially increased over recent years due to increasing awareness regarding skin care routines and products. Therefore, basic personal care and dermatological skin care products are expected to drive demand for the sub-segment.

Cosmetics Sub-Segment is Expected to Dominate 1,2-Pentanediol Market

In the cosmetic industry, it serves as a humectant and solvent in skincare and personal care products, improving moisture retention and enhancing product texture. However,there is a constant demand for dermatological ailment products such as protective creams, serums, lip creams, and others, due to the rising number of non-hazardous skin diseases globally. For instance, as per the American Association of Dermatology, skin disease costs the US healthcare system $75.0 billion in medical, preventative, and prescription and non-prescription drug costs.

Regional Outlook

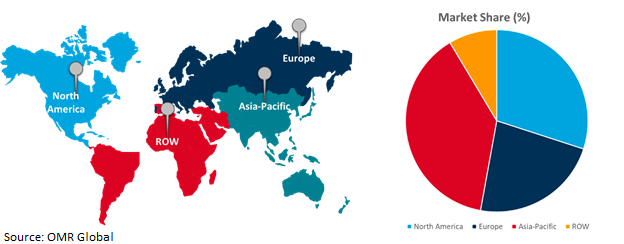

The global1,2-pentanediol market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global 1,2-Pentanediol Market Growth by Region 2024-2031

Asia-Pacific to Dominate Global B 1,2-Pentanediol Market

Asia-Pacific is anticipated to dominate the global 1,2-pentanediol market attributed togrowing disposable income, growing investment in specialty chemicals, government support for manufacturing businesses, major manufacturers in the region, and rising consumption in pharmaceuticals, personal care, and agrochemical industry, For instance, US, Japan, and China. India accounts for 16-18% of the world's production of dyestuffs and dye intermediates. India’s agrochemicals export was estimated to be at $1.7 billion from April 2023 to September 2023 (Provisional). Indian colorantindustry has emerged as a key player with a global market share of 15.0%. The country’s chemicals industry is de-licensed, except for a few hazardous chemicals. India has traditionally been a world leader in generics and biosimilars and a major Indian vaccine manufacturer, contributing more than 50.0% of the global vaccine supply. India holds a strong position in exports and imports of chemicals at a global level and ranks 14th in exports and 8th in imports at the global level (excluding pharmaceuticals). From April 2023 to September 2023 (provisional), India's dye exports (Dyes and Dye Intermediates) totaled $929.0 million.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global 1,2-pentanediol market include BASF SE, UBE Corp., ShandongYuanli Science and Technology Co., Ltd., Zhejiang Boadge Chemical Co. Ltd., and Hefei tnj chemical industry Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2022, UBE Corporation (announced that the company has completed the transfer of all shares of API Corporation (APIC) wholly owned by Life Science Institute, Inc. a Mitsubishi Chemical Group Company,UBE and APIC will make maximum use of both companies’ resources in the areas of manufacturing, R&D, and quality control to establish a high-quality and stable supply system to provide customers with reliable products.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 1,2-pentanediol market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hefei tnj Chemical Industry Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Shandong Yuanli Science and Technology Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. UBE Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Zhejiang Boadge Chemical Co. Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global 1, 2-Pentanediol Marketby Grade

4.1.1. Industrial Grade

4.1.2. Cosmetic Grade

4.2. Global 1, 2-Pentanediol Marketby Application

4.2.1. Cosmetic

4.2.2. Pesticide Intermediates

4.2.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Cefa Cilinas Biotics Pvt Ltd.

6.2. Evonik Industries AG

6.3. Home Sunshine Pharmaceutical Technology Co., Ltd.

6.4. Huangshan Basihui Chemical Auxiliary Co. Ltd.

6.5. Jiangsu First ChemicalManufacture Co., Lltd.

6.6. Macsen Laboratories

6.7. Minasolve

6.8. Ningbo Inno Pharmchem Co., Ltd.

6.9. Santa CruzBiotechnology, Inc.

6.10. Simson Pharma Ltd.

6.11. Sisco Research Laboratories Pvt. Ltd.

6.12. Tokyo Chemical Industry Co., Ltd

6.13. VWR International, LLC.

6.14. Xinxiang Jujing Chemical Co., Ltd.

6.15. Zhejiang Realsun Chemical Co., Ltd.

1. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

2. GLOBAL INDUSTRIAL GRADE 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALCOSMETIC GRADE 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS IN COSMETICS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS IN PESTICIDE INTERMEDIATESBY REGION, 2023-2031 ($ MILLION)

7. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS IN OTHER APPLICATION BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSISBY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

11. NORTH AMERICAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. EUROPEAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

14. EUROPEAN 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY GRADE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD 1, 2-PENTANEDIOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL 1, 2-PENTANEDIOL MARKET SHARE BY GRADE, 2023 VS 2031 (%)

2. GLOBAL INDUSTRIAL GRADE 1, 2-PENTANEDIOL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL COSMETIC GRADE 1, 2-PENTANEDIOL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 1, 2-PENTANEDIOL MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL 1, 2-PENTANEDIOL MARKET SHARE IN COSMETICS BY REGION, 2023 VS 2031 (%)

6. GLOBAL 1, 2-PENTANEDIOL MARKET SHARE IN PESTICIDE INTERMEDIATESBY REGION, 2023 VS 2031 (%)

7. GLOBAL 1, 2-PENTANEDIOL MARKET SHARE IN OTHER APPLICATIONS BY REGION, 2023 VS 2031 (%)

8. GLOBAL 1, 2-PENTANEDIOL MARKETSHARE BY REGION, 2023 VS 2031 (%)

9. US 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

11. UK 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)

23. THE MIDDLE EAST AND AFRICA 1, 2-PENTANEDIOL MARKET SIZE, 2023-2031 ($ MILLION)