Acrylic Acid Market

Global Acrylic Acid Market Size, Share & Trends Analysis Report By Type (Acrylate Esters, Glacial Acrylic Acid, and Others), By Application (Surfactants, Organic Chemicals, Adhesives & Sealants, Textiles, Water Treatment, Others) Forecast Period 2022-2028

The global market for acrylic acid is projected to have a considerable CAGR of around 5.1% during the forecast period. Acrylic acid is an organic molecule and the simplest of unsaturated acids. Acrylic acid is used mainly in the formation of polymers. Its uses include adhesives, paints, polishes, plastics, coatings, and elastomers. Additionally, acrylic acid is used in the production of hygienic medical products, detergents, and wastewater treatment chemicals. Stringent regulations regarding the manufacture of lightweight vehicles have also increased the use of advanced adhesive materials, which results in growth for the acrylic acid market. Moreover, due to increased industrial and construction activities, the paints and coatings industry has seen strong growth around the globe, particularly in South Asia and East Asia. Governments in emerging economies such as China and India are increasingly investing in infrastructure, which is a major driver of demand for paints and coatings, contributing to increased demand for acrylic acid from the paints and coatings industry. In addition, the use of acrylic acid for coatings in textiles is propelling the demand for acrylic acid in the textile industry.

Impact of COVID-19 on acrylic acid market

The COVID-19 pandemic has had a negative impact on the market. The interruptions in the value chain have restricted the availability of raw materials, which has hampered market growth and hindered the development of end-use industries. According to International Finance Corporation, the COVID-19 outbreak is forecasted to slow down investments in the water sector globally. As a result, demand for water treatment chemicals is expected to drop in the water sector, negatively impacting the glacial acrylic acid market. However, effective steps made by organizations such as the Industrial Fabrics Association International, are likely to enhance the textile sector, which will boost demand for the glacial acrylic acid market.

Segmental Outlook

The global acrylic acid market is segmented based on types, and applications. Based on the types, the market is further classified into acrylate esters, glacial acrylic acid, and others. Further, based on the application the market is classified into surfactants, organic chemicals, adhesives & sealants, textiles, water treatment, others.

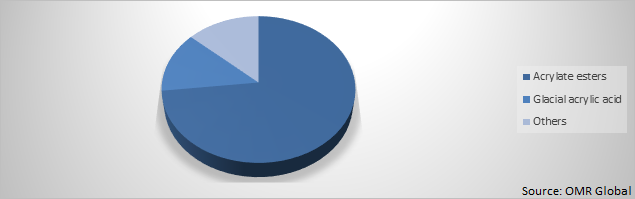

Global Acrylic Acid Market Share by types, 2021(%)

The Acrylate Esters Segment is Considered the Dominating Segment in the Global Acrylic Acid Market.

Among types, the acrylate esters segment is estimated as dominating segment during the forecast period. Acrylic esters are used in many industries for various applications in diapers & training pants, adhesives & sealants, surface coatings, textiles, and many other applications. High thermal stability and oil resistance are the key characteristics of acrylic esters. Its non-toxic quality is one of the factors for its growing popularity in a variety of industries. It's also used to make industrial polymers' building blocks. Factors such as the increasing demands for coatings in the construction industry, the rapid development of butyl acrylates, the growing acceptance of acrylate esters for the production of adhesives, the rising demand for water-based coatings, the growing demand for super-absorbent polymers, are expected to boost the growth of the acrylic ester market in the forecast period.

Regional Outlook

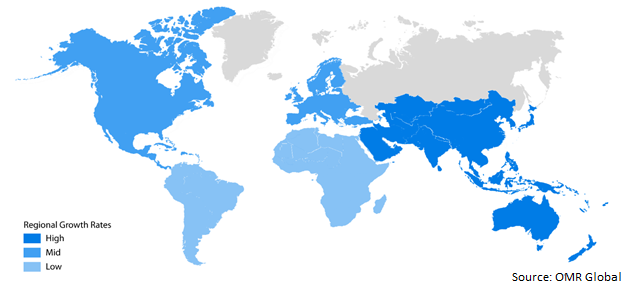

Geographically, the global Acrylic Acid market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is projected to have a significant CAGR in the Acrylic Acid market. The growth is driven by the expected growth in industries like construction, personal care products, and paints (coating), which use acrylic acid and its derivatives in their products. The region is also the largest exporter of the material, with surplus supply being shipped to Europe, the Middle East and Africa, and Latin America to the expanding demand from industries such as acrylate esters and consumer packaged goods.

Global Acrylic Acid Market Growth, by region 2022-2028

Asia-Pacific to Hold a Considerable CAGR in the global Acrylic Acid market

Geographically, Asia-Pacific is projected to hold a significant share in global acrylic acid market led by increased acrylic ester demand due to the rapid industrialization and infrastructure development particularly in China and India. According to the National Growth and Reform Commission and the Ministry of Transport of China, the Chinese government wanted to create infrastructure on 30,000 km of railways and 30,000 km of expressways in line with the 13th five-year plan (2016-2020). Further, the Indian government has set a $1.4 trillion infrastructure target for the next five years, with $120.5 trillion reserved for the growth of 27 industrial groups, while the indigenous railways received $10.33 billion allocation in the Union Budget 2020-21. Hence, all these factors will propel the growth of the acrylic acid market in the forecast period.

Market Players Outlook

The key players in the acrylic acid market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include BASF SE, China Petroleum & Chemical Corporation (SINOPEC), Arkema, and Mitsubishi Chemical Corp among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In August 2021, BASF and SINOPEC will further expand their Verbund site operated by BASF-YPC Co., Ltd. It includes the capacity expansion of several downstream chemical plants, including a new tert-butyl acrylate plant to support the growing Chinese market. The partners will expand the production capacities of propionic acid, propionic aldehyde, and others to build a new tert-butyl acrylate plant. The tert-butyl acrylate plant will be an extension to the downstream using acrylic acid. Tert-butyl acrylate (TBA) is an acrylic acid ester for manufacturing polymers and is used as a feedstock for syntheses. As a specialty chemical, it is used in paper sizing and emulsion applications.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Acrylic Acid market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Acrylic Acid Industry

• Recovery Scenario of Global Acrylic Acid Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Acrylic Acid Market by Type

5.1.1. Acrylate Esters

5.1.2. Glacial Acrylic Acid

5.1.3. Others

5.2. Global Acrylic Acid Market by End-Use

5.2.1. Surfactants

5.2.2. Organic Chemicals

5.2.3. Adhesives & Sealants

5.2.4. Textiles

5.2.5. Water Treatment

5.2.6. Others (Personal Care Products)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arkema SA

7.2. BASF SE

7.3. China Petroleum & Chemical Corp

7.4. Evonik Industries

7.5. Formosa Plastics Corp

7.6. Hexion Inc

7.7. Kao Corporation

7.8. LG Chem Ltd.

7.9. Merck KGaA

7.10. Mitsubishi Chemical Holdings Corp.

7.11. Nippon Shokubai Co. Ltd

7.12. PJSC Sibur Holding

7.13. Procter Gamble Co

7.14. Sanyo Chemical Industries, Ltd

7.15. Sasol Ltd

7.16. SDP Global Co., Ltd.

7.17. Shanghai Huayi Acrylic Acid Co. Ltd

7.18. SIBUR International GmbH

7.19. The DOW Chemical Company

7.20. The Lubrizol Corp

1. GLOBAL ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ACRYLATE ESTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL GLACIAL ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

6. GLOBAL ACRYLIC ACID FOR SURFACTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ACRYLIC ACID FOR ORGANIC CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ACRYLIC ACID FOR ADHESIVES & SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ACRYLIC ACID FOR TEXTILES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ACRYLIC ACID FOR WATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ACRYLIC ACID FOR OTHER END-USE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

16. EUROPEAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

22. REST OF THE ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD ACRYLIC ACID MARKET RESEARCH AND ANALYSIS BY END-USE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ACRYLIC ACID MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ACRYLIC ACID MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL ACRYLIC ACID MARKET, 2021-2028 (%)

4. GLOBAL ACRYLIC ACID MARKET SHARE BY TYPES, 2021 VS 2028 (%)

5. GLOBAL ACRYLIC ACID MARKET SHARE BY END-USE, 2021 VS 2028 (%)

1. GLOBAL ACRYLATE ESTERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

2. GLOBAL GLACIAL ACRYLIC ACID MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL OTHER ACRYLIC ACID MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL ACRYLIC ACID FOR SURFACTANTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL ACRYLIC ACID FOR ORGANIC CHEMICALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL ACRYLIC ACID FOR ADHESIVES & SEALANTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ACRYLIC ACID FOR TEXTILES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL ACRYLIC ACID FOR WATER TREATMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL ACRYLIC ACID FOR OTHER END-USE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. US ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

7. CANADA ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

8. UK ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

9. FRANCE ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

10. GERMANY ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

11. ITALY ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

12. SPAIN ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

13. ROE ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

14. INDIA ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

15. CHINA ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

16. JAPAN ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

17. ASEAN ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

18. SOUTH KOREA ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF ASIA-PACIFIC ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD ACRYLIC ACID MARKET SIZE, 2021-2028 ($ MILLION)