Acrylic Resins Market

Global Acrylic Resins Market Size, Share & Trends Analysis Report, By Type (Acrylate, Methacrylate, and Hybrid), By Application (Paints and Coatings, Plastics, Construction, Textile, Consumer Goods, Adhesives, and Others) and Forecast, 2020-2026

The global acrylic resins market is estimated to grow at a CAGR of nearly 4.0% during the forecast period. The major factors contributing to the market growth include significant application in paints and coatings and emerging infrastructure development projects. In the coatings industry, coatings using acrylic resins is considered as the major polymer technology. Acrylics have applications in special-purpose coating, architectural coatings, and product finishes for automotive (OEM) and refinish. These resins are especially based on methacrylate and acrylate monomers that offer better weather resistance, retention of gloss and color in exterior applications, and resistance to hydrolysis.

Owing to their performance and versatility, acrylic coatings have a potential share in all coatings. It can be thermoset or thermoplastic and are used in radiation-curable, organic solvent born, and waterborne coatings. Generally, thermoplastic acrylic polymers contain excellent properties such as superior durability. Thermoplastic resins normally utilize methyl methacrylate in polymers to offer excellent exterior durability and toughness. Acrylic can work in combination with a range of monomers to offer increased adhesion to metal. Several acrylic resins may also comprise other vinyl monomers including vinyl acetate or styrene, particularly for cost reduction.

Acrylic resins used in restorative dentistry are renowned denture base material, as it possesses good optical properties and has small solubility in body fluids. However, its mechanical properties are limited, and thus acrylic resins need several reinforcement methods of which one can be used in different types of fibers. Solvent-borne paints are the major application areas of acrylic resins developed by solution polymerization. Further, acrylic polymer offer paints excellent stain, chemical, and weather resistance that provides durable high gloss and bright finishes. It is also significantly used in paints for construction materials, home appliances, and metals such as plastics for automobiles. Therefore, increasing residential and commercial construction is also a major factor in encouraging the demand for acrylic resins. However, the availability of other potential alternatives is a major restraining factor for the market growth.

Market Segmentation

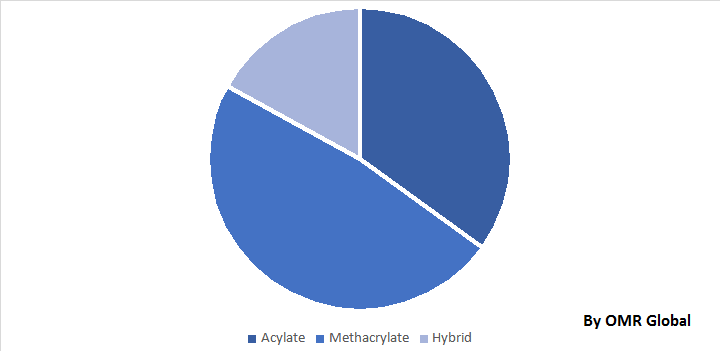

The global acrylic resins market is segmented based on type and application. Based on type, the market is segmented into acrylate, methacrylate, and hybrid. Based on application, the market is classified into paints and coatings, plastics, construction, textile, consumer goods, adhesives, and others.

Methacrylates Contribute to a Potential Share in the Market

Methacrylates are utilized as building blocks for the production of a comprehensive range of polymers. Such polymers are then utilized in components or raw materials for the production of a broad range of objects or formulations that people use in everyday life, in which hardness, stability, scratch resistance, and durability are required. Therefore, methacrylate monomers have extensive applications in the electronics sector for the production of reliable products with everyday use. Laser discs, DVD, and compact discs are all produced from polymers developed with methacrylic monomers. These are significantly used in coatings of the printed circuit board (conformal coatings) that offers enhanced resistance to attack, thus extending their service life.

Methacrylate polymers are also used significantly in medical and dental applications where stability and purity are important. Methacrylate polymers are utilized in the production of a comprehensive range of medical equipment such as artificial heart valves, baby incubators, intravenous tubing connectors, filter housings, medical pump, even artificial eyeballs, and more. These polymers are also used by dental technicians for the production of dental prosthetics, dentures, and bridges and to develop artificial teeth in an industrial process. Methacrylate monomers are also applied in the cement that is utilized in the white dental fillings and during hip replacements. The methacrylates demand continues to increase in the medical field, owing to the growing importance of drug-releasing coatings.

Global Acrylic Resins Market Share by Type, 2019 (%)

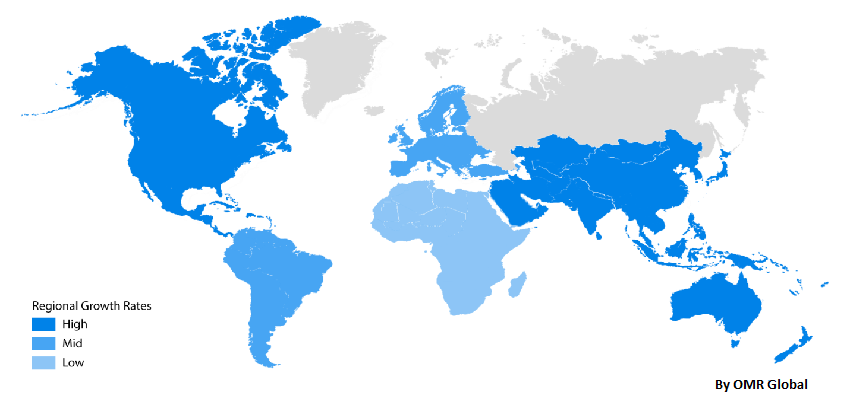

Regional Outlook

Geographically, in 2019, Asia-Pacific contributes to a potential share in the market. Increasing residential and commercial construction coupled with rising urbanization have led the demand for acrylic resins for paints and coatings applications. Acrylic resins are extremely resistant to weather and light and remain breathable, which makes it suitable for application in wall or façade paints. Acrylic resins are used along with water-repellent silicone resins for exterior facades. Other applications comprise metal, plastic, or wood coatings. Europe is also expected to witness significant growth in the market owing to the significant automobile production coupled with the presence of major automobile companies including BMW Group, Daimler, Fiat Chrysler, and more in the region.

Global Acrylic Resins Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include BASF SE, Arkema S.A., Evonik Industries AG, The Dow Chemical Co., and Mitsui Chemicals, Inc. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in March 2019, Arkema S.A. launched ENCOR 601 acrylic latex for applications in low volatile organic compounds (VOCs) masonry coating applications. This new resin is properly formulated and offers excellent surfactant leaching resistance, which enables to reduce the possibility of stain formation and other undesired impacts in a finished coating.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global acrylic resins market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Arkema S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Evonik Industries AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. The Dow Chemical Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mitsui Chemicals, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Acrylic Resins Market by Type

5.1.1. Acrylate

5.1.2. Methacrylate

5.1.3. Hybrid

5.2. Global Acrylic Resins Market by Application

5.2.1. Paints and Coatings

5.2.2. Plastics

5.2.3. Construction

5.2.4. Textile

5.2.5. Consumer Goods

5.2.6. Adhesives

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Air Products and Chemicals, Inc.

7.2. Arkema S.A.

7.3. Asahi Kasei Corp.

7.4. BASF SE

7.5. Cargill, Inc.

7.6. DIC Corp.

7.7. Eastman Chemical Co.

7.8. Evonik Industries AG

7.9. Henkel AG & Co. KGaA

7.10. Hexion Inc.

7.11. Hitachi Chemical Co., Ltd.

7.12. Kamsons Chemicals Pvt. Ltd.

7.13. Mitsubishi Chemical Corp.

7.14. Mitsui Chemicals, Inc.

7.15. Nippon Shokubai Co., Ltd.

7.16. Novozymes A/S

7.17. Solvay S.A.

7.18. Sumitomo Chemical Co., Ltd.

7.19. The Dow Chemical Co.

1. GLOBAL ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ACRYLATE RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL METHACRYLATE RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HYBRID RESINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL ACRYLIC RESINS IN PAINTS AND COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ACRYLIC RESINS IN PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ACRYLIC RESINS IN CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ACRYLIC RESINS IN TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ACRYLIC RESINS IN CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ACRYLIC RESINS IN ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL ACRYLIC RESINS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. EUROPEAN ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

23. REST OF THE WORLD ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. REST OF THE WORLD ACRYLIC RESINS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL ACRYLIC RESINS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL ACRYLIC RESINS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL ACRYLIC RESINS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ACRYLIC RESINS MARKET SIZE, 2019-2026 ($ MILLION)