Advanced Process Control (APC) Market

Global Advanced Process Control (APC) Market Size, Share & Trends Analysis Report, By Type (Advanced Regulatory Control, Inferential Control, Compressor Control, Sequential Control, and Multivariable Model Predictive Control), By End-User Industry (Pharmaceutical, Oil and Gas, Energy and Power, Chemical, Food and Beverage, Petrochemical, and Others) and Forecast, 2020-2026

The global advanced process control (APC) market is estimated to grow at a CAGR of nearly 9.5% during the forecast period. The major factors contributing to the market growth including rising automation across industries and rising oil and gas industry. The governments across the countries are working towards the integration of advanced solutions and modernizing industrial infrastructure. In May 2015, the Chinese government introduced Made in China (MIC) 2025 initiative which comprises a range of state-backed programs that aims to accelerate productivity, modernize the Chinese economy, and make innovations in industrial processes.

The MIC 2025 plan signifies that the country’s manufacturing sector is large, however, it lacks in quality of industrial infrastructure, innovation capacity, degree of digitalization, and the effectiveness of resource utilization. Under the plan, the Chinese government seeks to carry out the task of upgrade infrastructure and leverage technological developments. MIC 2025 aims to move China in the manufacturing value chain through smart manufacturing and advanced manufacturing technologies. The increasing focus on advances in industrial facilities is expected to emerge the adoption of APC solutions for an increased level of automation and optimization of steam power in industrial plants.

APC comprises model-based software which is used to direct the industrial process operations and is usually known as model predictive control or multivariable predictive control (MPC). Improved operational efficiency or improvements in production are the major driving forces for implementing these technologies in industrial applications. Advanced combustion control can be utilized to increase the thermal efficiency of individual boilers and decrease emission generation from industrial facilities. Therefore, APC could prove to be a feasible alternative to meet environmental regulations on greenhouse gas (GHG) emissions while enhancing steam, heat, and power output without a considerable process overhaul. Several manufacturing industries, such as pulp and paper, chemicals, and refining have started integration of distributed control systems (DCS) with plant subsystems to enhance overall efficiency and leveraging the productivity. This, in turn, is contributing to the demand for APC technologies to control large, complex, and geographically distributed applications in industrial processes.

Market Segmentation

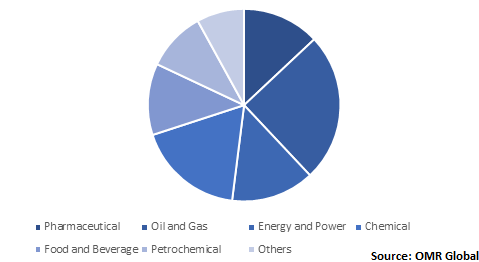

The global APC market is segmented based on the type and end-user industry. Based on type, the market is classified into advanced regulatory control, inferential control, compressor control, sequential control, and multivariable model predictive control. Based on end-user industry, the market is classified into pharmaceutical, oil and gas, energy and power, chemical, food and beverage, petrochemical, and others.

APC finds its significant application in the oil and gas industry

APC is estimated to significantly increase in the oil and gas industry coupled with the increasing implementation of digital solutions for operational efficiency and stay competitive in the industry. Oil and gas industry facing a severe shortage of skilled professionals as operators with 25 to 30 years of experience are retiring and freshers are taking their place. A DCS can support to reduce these challenges owing to the high-performance human-machine interface (HMI) capabilities that can offer critical information to new workers and guides the workers to take right decisions in diverse production or maintenance circumstances.

This is achieved with the use of situational-awareness methods and allowing ensure the graphic screen designs increase the operators’ focus and response time. This, in turn, enhanced process visibility, improved safety, and better decision making. In addition, multivariable predictive controllers (MPC) are ideal for operations with space constraints and need significant interaction between variables. As a result, it is being significantly used in offshore facilities as it has space constraints that limit the design of separation equipment. BP has successfully implemented APC on its offshore manufacturing facilities at or near the prevailing conditions to leverage the production.

Global APC Market Share by End-User Industry, 2019 (%)

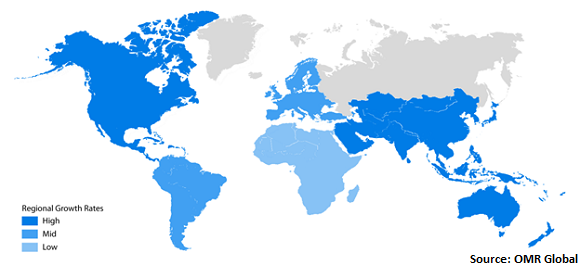

Regional Outlook

The global APC market is segmented based on regions including North America, Europe, Asia-Pacific and Rest of the World (RoW). North America APC market is being driven by the increasing focus on the integration of advanced technologies and increasing demand for energy-efficient technologies coupled with the rising demand for electricity in the region. In 2019, Europe APC market has experienced significant growth owing to the increasing implementation of APC in the oil and gas industry. For instance, MOL Group, an oil and gas company based in Hungary, used APC technology at its gas distillation plant in Algyõ, Hungary. It is supporting AOL to reduce annual energy costs.

Global APC Market Growth, by Region 2020-2026

Market Players Outlook

Some crucial players operating in the market include ABB Ltd., Schneider Electric SE, Emerson Electric Co., Yokogawa Electric Corp., and Siemens AG. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in April 2019, Siemens AG launched a new DCS named Simatic PCS neo that leverages web technologies to offer improved scalability, usability, and collaboration. The platform offers an open and flexible architecture that combines modular engineering with support for the open module type packages (MTP) standard. The scalability of the system allows utilization of control technology ranging from small process modules up to large plants. Simatic PCS neo runs on the current PSC 7 hardware platform, which is the most attractive feature for current customers. This eliminates the need to design and fix novel process control hardware.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global APC market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Schneider Electric SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Emerson Electric Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Yokogawa Electric Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global APC Market by Type

5.1.1. Advanced Regulatory Control

5.1.2. Inferential Control

5.1.3. Compressor Control

5.1.4. Sequential Control

5.1.5. Multivariable Model Predictive Control

5.2. Global APC Market by End-User Industry

5.2.1. Pharmaceutical

5.2.2. Oil and Gas

5.2.3. Energy and Power

5.2.4. Chemical

5.2.5. Food and Beverage

5.2.6. Petrochemical

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Honeywell International Inc.

7.3. Emerson Electric Co.

7.4. General Electric Co.

7.5. Siemens AG

7.6. Schneider Electric SE

7.7. Aspen Technology, Inc.

7.8. Rockwell Automation, Inc.

7.9. Onto Innovation Inc.

7.10. Yokogawa Electric Corp.

7.11. Azbil Corp.

7.12. FLSmidth A/S

7.13. GEA Group AG

7.14. ANDRITZ AG

7.15. engineo GmbH

1. GLOBAL APC MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ADVANCED REGULATORY CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL INFERENTIAL CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL COMPRESSOR CONTROL MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

5. GLOBAL SEQUENTIAL CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MULTIVARIABLE MODEL PREDICTIVE CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL APC MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

8. GLOBAL APC IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL APC IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL APC IN ENERGY AND POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL APC IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL APC IN FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL APC IN PETROCHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL APC IN OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL APC MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN APC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN APC MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. NORTH AMERICAN APC MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

19. EUROPEAN APC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN APC MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. EUROPEAN APC MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC APC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC APC MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC APC MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

25. REST OF THE WORLD APC MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD APC MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL APC MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL APC MARKET SHARE BY END-USER INDUSTRY, 2019 VS 2026 (%)

3. GLOBAL APC MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US APC MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA APC MARKET SIZE, 2019-2026 ($ MILLION)

6. UK APC MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE APC MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY APC MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY APC MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN APC MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE APC MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA APC MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA APC MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN APC MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC APC MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD APC MARKET SIZE, 2019-2026 ($ MILLION)