Digital Shipyard Market

Digital Shipyard Market Size, Share & Trends Analysis Report by Shipyard Type (Commercial, and Military), by Technology (AR/VR, Digital Twin & Simulation, Addictive Manufacturing, Artificial Intelligence & Big Data Analytics, Robotic Process Automation, Industrial Internet of Things (IIoT), Cybersecurity, Blockchain, and Cloud & Master Data Management), by Capacity (Large Shipyard, Medium Shipyard, and Small Shipyard), by End Use (Implementation, and Upgrades & Services) and by Process (Research & Development, Design & Engineering, Manufacturing & Planning, Maintenance & Support, Training & Simulation) Forecast Period (2025-2035)

Industry Overview

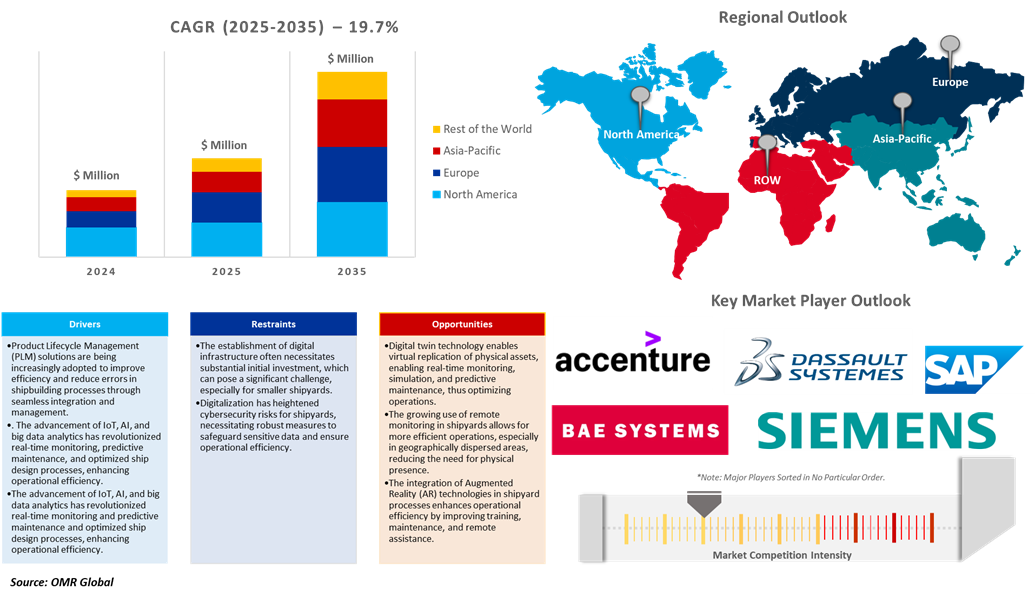

Digital shipyard market size will reach $12.3 billion in 2035 from $1.7 billion in 2024 and is projected to grow at a CAGR of 19.7% during the forecast period (2025-2035). Digital solutions are revolutionizing shipbuilding, naval modernization, international maritime trade, Industry 4.0, sustainability, and logistics. Digital twins and PLM software simplify design, minimize production defects, and speed up timelines. Nations such as the US, China, India, and the UK are investing in smart naval shipyards. Industry 4.0 technologies such as AI, IoT, robotics, and AR enhance productivity and quality control. Digital solutions assist in monitoring emissions and optimizing fuel efficiency.

Market Dynamics

Increased Maritime Trade

The increase in international maritime trade requires shipyards to expand and modernize through digitalization that reduces costs, simplifies construction, and improves operational availability. According to the United Nations Conference on Trade and Development (UNCTAD), the maritime trade volume is anticipated to grow at a yearly rate of 2% in 2024, with containerized trade expected to increase by 3.5%. From 2025 to 2029, total seaborne trade is projected to rise at an annual average rate of 2.4%, while containerized trade is predicted to grow by 2.7%. These projections are based on a forecasted GDP growth of 2.7% and merchandise trade growth of 3%.

Additionally, according to the United Nations Conference on Trade and Development (UNCTAD), the table highlights a uniform trend of expansion in world maritime trade, with seaborne trade overall to increase at an average annual rate of 2.4% during 2025-2029. Containerized commerce will expand at the rate of 2.7%, showing ongoing supply chain improvements. The most rapid growth is to take place in 2024, with containerized commerce expanding by 3.5%.

Integration of Advanced Technologies

The implementation of new technologies such as AI, IIoT, and 5G improves the gathering of real-time data, decision-making, and overall efficiency of operations, leading to market growth. For instance, in September 2024, ST Engineering launched an AI-driven smart Shipyard with the adoption of 5G facilities. The increased Tuas Yard in Singapore is expected to fulfill Navy requirements. The site facilitates investigation into new markets, including offshore renewables, and provides end-to-end services to domestic and foreign customers. In addition, the Gul Yard incorporates 5G-capable digital infrastructure based on domestically developed AI technology to enhance productivity in operations and conform to global efforts to suppress carbon emissions through the use of electric-powered automated guided vehicles, recycling systems, and renewable fuels such as ammonia, biofuel, hydrogen, and solar energy to minimize emissions by 2034.

Market Segmentation

- Based on the shipyard type, the market is segmented into commercial and military.

- Based on the technology, the market is segmented into AR/VR, digital twin & simulation, addictive manufacturing, artificial intelligence & big data analytics, robotic process automation, industrial internet of things (IIoT), cybersecurity, blockchain, and cloud & master data management.

- Based on the capacity, the market is segmented into large shipyards, medium shipyards, and small shipyards.

- Based on the end use, the market is segmented into implementation, and upgrades & services.

- Based on the process, the market is segmented into research & development, design & engineering, manufacturing & planning, maintenance & support, and training & simulation.

Artificial Intelligence (AI) & Big Data Analytics Segment to Lead the Market with the Largest Share

The digital shipyard sector uses AI and Big Data Analytics to revolutionize shipbuilding, maintenance, and operation. Its key functions include predictive maintenance, supply chain optimization, autonomous operations, digital twin technology, cybersecurity, workforce efficiency, and sustainability. AI-based systems additionally aid in fuel optimization and environmental compliance. The growth is being fueled by the adoption of digital shipyards with the introduction of AI-driven technologies that raise predictive powers and automate operations to fuel market development. For instance, in April 2024, HD Hyundai Group integrated AI technology into shipbuilding to accelerate digital transformation and secure original technologies for future ships and construction machinery. The company has consolidated its AI divisions into an AI center under the KSOE Future Technology Research Institute. The group aims to complete its Future of Shipyard project by 2030 includes the visible shipyard and connected and predictive optimized shipyard phases. The data platform enables AI to learn from shipbuilding data and make decisions on process management, aiming for a 30% productivity increase, 30% lead time improvement, and zero resource waste.

Commercial: A Key Segment in Market Growth

A commercial shipyard is an establishment that designs, constructs, maintains, repairs, and retrofits commercial ships, handling various types of container ships, tankers, bulk carriers, and passenger ships. Commercial shipyards play a critical role in shipbuilding, repair, maintenance, refurbishment, conversion projects, and decommissioning and recycling. It constructs new vessels, ensures compliance with regulations, enhances fuel consumption, retrofits existing vessels to new purposes, and scrums vessels in environmentally friendly ways upon reaching the end of their lives. It consolidates Industry 4.0 technologies such as IoT, AI, and digital twin, in ship building and maintenance towards greater efficiency, predictive maintenance, sustainability, and safety in rugged environments with digital models that may be utilized for simulation and defect identification in the design.

Regional Outlook

The global digital shipyard market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Government Investments & Modernization in Asia-Pacific

India's maritime fund is designed to push market growth by speeding up digital transformation in shipyards with smart infrastructure, predictive maintenance, and real-time monitoring systems.. For instance, in February 2025, India introduced a $2.9 billion maritime development fund to support its ship repair and building industry. The government provided 49% of the funds, while the balance came from ports and the private sector. The program looks forward to leveraging private investment, fuelling modernization, and pioneering green technology for increasing global competitiveness and cementing India's leadership as a shipping hub.

- In February 2025, India launched a strategic push for shipbuilding worth $3 billion with the creation of a Maritime Development Fund (MDF) with a corpus size of 2.87 million. The finance will come through 49% from the government, with the balance expected to come from the ports and the private sector. The Shipbuilding Financial Assistance Policy will be modified to address the disadvantages of cost with the large-sized ships being rated as infrastructure assets. The government has put forward regulatory simplification and tax incentives such as a ten-year fixed-rate subsidy to shipbuilding, basic customs duty exemption for shipbreaking extended, and rationalization of the customs tariff structure.

North America Region Dominates the Market with Major Share

North America holds a significant share owing to the Digital shipyards are integrating unmanned maritime technologies, focusing on designing, testing, and deploying autonomous naval systems, driving market growth. For instance, in June 2024, Hanwha Systems and Hanwha Ocean bought Philly Shipyard, an American shipbuilder that has produced half of the US Jones Act commercial ships since 2000. The deal is worth $100 million, seeking to increase Hanwha's global defense and shipbuilding businesses. The firm develops technologies for unmanned maritime systems and naval radars. It additionally manufactures low-carbon, high-tech ships.

Market Players Outlook

The major companies operating in the global digital shipyard market include Accenture, BAE Systems plc, Dassault Systèmes S.E., SAP SE, Siemens AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2024, South Korea's HD Hyundai Heavy Industries collaborated with Finnish shipping software firms NAPA and CADMATIC to create a next-generation ship design and information management solution. The partnership aims to improve shipbuilding efficiency, reduce costs, and enhance quality in complex projects. The platform enhances collaboration and improves information accessibility among shipyard departments. The project additionally helps HD Hyundai respond to the growing demand for energy-efficient designs and enable the delivery of next-generation vessels.

- In November 2022, Dassault and SHI collaborated to build a smart digital shipyard utilizing virtual twin technologies to support the digital transformation of the shipyard and its business initiatives. The smart yard aims to integrate automation, standardization, and AI as ways to improve scheduling and execution and speed up production and assembly. It helps to meet the demand for LNG carriers and enhance capacity while reducing delivery times. Advanced vessels can be designed for automation, safety, and control within the smart digital shipyard.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital shipyard market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Digital Shipyard Market Sales Analysis – Shipyard Type | Technology | Capacity | End Use| Process ($ Million)

• Digital Shipyard Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Digital Shipyard Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Digital Shipyard Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Digital Shipyard Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Digital Shipyard Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Digital Shipyard Market Revenue and Share by Manufacturers

• Digital Shipyard Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Accenture

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. BAE Systems plc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Dassault Systèmes S.E.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. SAP SE

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Siemens AG

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Digital Shipyard Market Sales Analysis by Shipyard Type ($ Million)

5.1. Commercial

5.2. Military

6. Global Digital Shipyard Market Sales Analysis by Technology ($ Million)

6.1. AR/VR

6.2. Digital Twin & Simulation

6.3. Addictive Manufacturing

6.4. Artificial Intelligence & Big Data Analytics

6.5. Robotic Process Automation

6.6. Industrial Internet of Things (IIoT)

6.7. Cybersecurity

6.8. Blockchain

6.9. Cloud & Master Data Management

7. Global Digital Shipyard Market Sales Analysis by Capacity ($ Million)

7.1. Large Shipyard

7.2. Medium Shipyard

7.3. Small Shipyard

8. Global Digital Shipyard Market Sales Analysis by End Use ($ Million)

8.1. Implementation

8.2. Upgrades & Services

9. Global Digital Shipyard Market Sales Analysis by Process ($ Million)

9.1. Research & Development

9.2. Design & Engineering

9.3. Manufacturing & Planning

9.4. Maintenance & Support

9.5. Training & Simulation

10. Regional Analysis

10.1. North American Digital Shipyard Market Sales Analysis – Shipyard Type| Technology| Capacity| End Use | Process |Country ($ Million)

• Macroeconomic Factors for North America

10.1.1. United States

10.1.2. Canada

10.2. European Digital Shipyard Market Sales Analysis – Shipyard Type| Technology| Capacity| End Use | Process |Country ($ Million)

• Macroeconomic Factors for Europe

10.2.1. UK

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. France

10.2.6. Russia

10.2.7. Rest of Europe

10.3. Asia-Pacific Digital Shipyard Market Sales Analysis – Shipyard Type| Technology| Capacity| End Use | Process |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

10.3.1. China

10.3.2. Japan

10.3.3. South Korea

10.3.4. India

10.3.5. Australia & New Zealand

10.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

10.3.7. Rest of Asia-Pacific

10.4. Rest of the World Digital Shipyard Market Sales Analysis – Shipyard Type| Technology| Capacity| End Use | Process |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

10.4.1. Latin America

10.4.2. Middle East and Africa

11. Company Profiles

11.1. Accenture

11.1.1. Quick Facts

11.1.2. Company Overview

11.1.3. Product Portfolio

11.1.4. Business Strategies

11.2. Altair Engineering Inc.

11.2.1. Quick Facts

11.2.2. Company Overview

11.2.3. Product Portfolio

11.2.4. Business Strategies

11.3. AVEVA?Group plc

11.3.1. Quick Facts

11.3.2. Company Overview

11.3.3. Product Portfolio

11.3.4. Business Strategies

11.4. BAE Systems plc

11.4.1. Quick Facts

11.4.2. Company Overview

11.4.3. Product Portfolio

11.4.4. Business Strategies

11.5. Damen Shipyards Group

11.5.1. Quick Facts

11.5.2. Company Overview

11.5.3. Product Portfolio

11.5.4. Business Strategies

11.6. Dassault Systèmes S.E.

11.6.1. Quick Facts

11.6.2. Company Overview

11.6.3. Product Portfolio

11.6.4. Business Strategies

11.7. Hexagon AB

11.7.1. Quick Facts

11.7.2. Company Overview

11.7.3. Product Portfolio

11.7.4. Business Strategies

11.8. IBASET INC.

11.8.1. Quick Facts

11.8.2. Company Overview

11.8.3. Product Portfolio

11.8.4. Business Strategies

11.9. IBM Corp.

11.9.1. Quick Facts

11.9.2. Company Overview

11.9.3. Product Portfolio

11.9.4. Business Strategies

11.10. InnovMarine Inc.

11.10.1. Quick Facts

11.10.2. Company Overview

11.10.3. Product Portfolio

11.10.4. Business Strategies

11.11. KRANENDONK Production Systems BV

11.11.1. Quick Facts

11.11.2. Company Overview

11.11.3. Product Portfolio

11.11.4. Business Strategies

11.12. Pemamek Ltd.

11.12.1. Quick Facts

11.12.2. Company Overview

11.12.3. Product Portfolio

11.12.4. Business Strategies

11.13. Rowse Ltd.

11.13.1. Quick Facts

11.13.2. Company Overview

11.13.3. Product Portfolio

11.13.4. Business Strategies

11.14. Festo Inc.

11.14.1. Quick Facts

11.14.2. Company Overview

11.14.3. Product Portfolio

11.14.4. Business Strategies

11.15. TE Connectivity Corp.

11.15.1. Quick Facts

11.15.2. Company Overview

11.15.3. Product Portfolio

11.15.4. Business Strategies

11.16. SAP SE

11.16.1. Quick Facts

11.16.2. Company Overview

11.16.3. Product Portfolio

11.16.4. Business Strategies

11.17. Siemens AG

11.17.1. Quick Facts

11.17.2. Company Overview

11.17.3. Product Portfolio

11.17.4. Business Strategies

11.18. Singapore Technologies Engineering Ltd.

11.18.1. Quick Facts

11.18.2. Company Overview

11.18.3. Product Portfolio

11.18.4. Business Strategies

11.19. thyssenkrupp AG

11.19.1. Quick Facts

11.19.2. Company Overview

11.19.3. Product Portfolio

11.19.4. Business Strategies

11.20. VoyageX AI

11.20.1. Quick Facts

11.20.2. Company Overview

11.20.3. Product Portfolio

11.20.4. Business Strategies

1. Global Digital Shipyard Market Research And Analysis By Shipyard Type, 2024-2035 ($ Million)

2. Global Commercial Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Military Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Digital Shipyard Market Research And Analysis By Technology, 2024-2035 ($ Million)

5. Global AR/VR For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Digital Twin & Simulation For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Addictive Manufacturing For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Artificial Intelligence & Big Data Analytics For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Robotic Process Automation For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Industrial Internet of Things (IIoT) For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Cybersecurity For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Blockchain For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Cloud & Master Data Management For Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Digital Shipyard Market Research And Analysis By Capacity, 2024-2035 ($ Million)

15. Global Large Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Medium Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Small Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Digital Shipyard Market Research And Analysis By End Use, 2024-2035 ($ Million)

19. Global Digital Shipyard For Implementation Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Digital Shipyard For Upgrades & Services Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Digital Shipyard Market Research And Analysis By Process, 2024-2035 ($ Million)

22. Global Digital Shipyard Research & Development Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Global Digital Shipyard Design & Engineering Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Digital Shipyard Manufacturing & Planning Market Research And Analysis By Region, 2024-2035 ($ Million)

25. Global Digital Shipyard Maintenance & Support Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Global Digital Shipyard Training & Simulation Market Research And Analysis By Region, 2024-2035 ($ Million)

27. Global Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

28. North American Digital Shipyard Market Research And Analysis By Country, 2024-2035 ($ Million)

29. North American Digital Shipyard Market Research And Analysis By Shipyard Type, 2024-2035 ($ Million)

30. North American Digital Shipyard Market Research And Analysis By Technology, 2024-2035 ($ Million)

31. North American Digital Shipyard Market Research And Analysis By Capacity, 2024-2035 ($ Million)

32. North American Digital Shipyard Market Research And Analysis By End Use, 2024-2035 ($ Million)

33. North American Digital Shipyard Market Research And Analysis By Process, 2024-2035 ($ Million)

34. European Digital Shipyard Market Research And Analysis By Country, 2024-2035 ($ Million)

35. European Digital Shipyard Market Research And Analysis By Shipyard Type, 2024-2035 ($ Million)

36. European Digital Shipyard Market Research And Analysis By Technology, 2024-2035 ($ Million)

37. European Digital Shipyard Market Research And Analysis By Capacity, 2024-2035 ($ Million)

38. European Digital Shipyard Market Research And Analysis By End Use, 2024-2035 ($ Million)

39. European Digital Shipyard Market Research And Analysis By Process, 2024-2035 ($ Million)

40. Asia-Pacific Digital Shipyard Market Research And Analysis By Country, 2024-2035 ($ Million)

41. Asia-Pacific Digital Shipyard Market Research And Analysis By Shipyard Type, 2024-2035 ($ Million)

42. Asia-Pacific Digital Shipyard Market Research And Analysis By Technology, 2024-2035 ($ Million)

43. Asia-Pacific Digital Shipyard Market Research And Analysis By Capacity, 2024-2035 ($ Million)

44. Asia-Pacific Digital Shipyard Market Research And Analysis By End Use, 2024-2035 ($ Million)

45. Asia-Pacific Digital Shipyard Market Research And Analysis By Process, 2024-2035 ($ Million)

46. Rest Of The World Digital Shipyard Market Research And Analysis By Region, 2024-2035 ($ Million)

47. Rest Of The World Digital Shipyard Market Research And Analysis By Shipyard Type, 2024-2035 ($ Million)

48. Rest Of The World Digital Shipyard Market Research And Analysis By Technology, 2024-2035 ($ Million)

49. Rest Of The World Digital Shipyard Market Research And Analysis By Capacity, 2024-2035 ($ Million)

50. Rest Of The World Digital Shipyard Market Research And Analysis By End-User, 2024-2035 ($ Million)

51. Rest Of The World Digital Shipyard Market Research And Analysis By Process, 2024-2035 ($ Million)

1. Global Digital Shipyard Market Research And Analysis By Shipyard Type, 2024 Vs 2035 (%)

2. Global Commercial Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

3. Global Military Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

4. Global Digital Shipyard Market Research And Analysis By Technology, 2024 Vs 2035 (%)

5. Global AR/VR For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

6. Global Digital Twin & Simulation For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

7. Global Addictive Manufacturing For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

8. Global Artificial Intelligence & Big Data Analytics For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

9. Global Robotic Process Automation For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

10. Global Industrial Internet of Things (IIoT) For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

11. Global Cybersecurity For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

12. Global Blockchain For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

13. Global Cloud & Master Data Management For Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

14. Global Digital Shipyard Market Research And Analysis By Capacity, 2024 Vs 2035 (%)

15. Global Large Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

16. Global Medium Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

17. Global Small Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

18. Global Digital Shipyard Market Research And Analysis By End Use, 2024 Vs 2035 (%)

19. Global Digital Shipyard For Implementation Market Share By Region, 2024 Vs 2035 (%)

20. Global Digital Shipyard For Upgrades & Services Market Share By Region, 2024 Vs 2035 (%)

21. Global Digital Shipyard Market Research And Analysis By Process, 2024 Vs 2035 (%)

22. Global Digital Shipyard Research & Development Market Share By Region, 2024 Vs 2035 (%)

23. Global Digital Shipyard Design & Engineering Market Share By Region, 2024 Vs 2035 (%)

24. Global Digital Shipyard Manufacturing & Planning Market Share By Region, 2024 Vs 2035 (%)

25. Global Digital Shipyard Maintenance & Support Market Share By Region, 2024 Vs 2035 (%)

26. Global Digital Shipyard Training & Simulation Market Share By Region, 2024 Vs 2035 (%)

27. Global Digital Shipyard Market Share By Region, 2024 Vs 2035 (%)

28. US Digital Shipyard Market Size, 2024-2035 ($ Million)

29. Canada Digital Shipyard Market Size, 2024-2035 ($ Million)

30. UK Digital Shipyard Market Size, 2024-2035 ($ Million)

31. France Digital Shipyard Market Size, 2024-2035 ($ Million)

32. Germany Digital Shipyard Market Size, 2024-2035 ($ Million)

33. Italy Digital Shipyard Market Size, 2024-2035 ($ Million)

34. Spain Digital Shipyard Market Size, 2024-2035 ($ Million)

35. Russia Digital Shipyard Market Size, 2024-2035 ($ Million)

36. Rest Of Europe Digital Shipyard Market Size, 2024-2035 ($ Million)

37. India Digital Shipyard Market Size, 2024-2035 ($ Million)

38. China Digital Shipyard Market Size, 2024-2035 ($ Million)

39. Japan Digital Shipyard Market Size, 2024-2035 ($ Million)

40. South Korea Digital Shipyard Market Size, 2024-2035 ($ Million)

41. ASEAN Digital Shipyard Market Size, 2024-2035 ($ Million)

42. Australia and New Zealand Digital Shipyard Market Size, 2024-2035 ($ Million)

43. Rest Of Asia-Pacific Digital Shipyard Market Size, 2024-2035 ($ Million)

44. Latin America Digital Shipyard Market Size, 2024-2035 ($ Million)

45. Middle East And Africa Digital Shipyard Market Size, 2024-2035 ($ Million)

FAQS

The size of the Digital Shipyard Market in 2024 is estimated to be around $1.7 billion.

North America holds the largest share in the Digital Shipyard Market.

Leading players in the DIGITAL SHIPYARD Market include Accenture, BAE Systems plc, Dassault Systèmes S.E., SAP SE, Siemens AG, among others.

Digital Shipyard Market is expected to grow at a CAGR of 19.7% from 2025 to 2035.

The Digital Shipyard Market is growing due to the adoption of IoT, AI, and digital twin technologies to improve shipbuilding efficiency and reduce operational costs.