Advanced Driver-Assistance Systems (ADAS) Market

Advanced Driver-Assistance Systems (ADAS) Market Size, Share & Trends Analysis Report, By Technology (Camera, LiDAR, Radar, Wi-Fi), By System (Adaptive Cruise Control, Intelligent Park Assist, Electronic Stability Control, Automatic Emergency Braking, Blind Spot Detection, Driver Monitoring System, Forward Collision Warning, Lane Departure Warning, Night Vision System, Pedestrian Detection System, Other), By Type (Two-Wheeler, Passenger Cars, Commercial Vehicle, and Construction Equipments) and Forecast, 2020-2026

The global ADAS market is expected to grow at a significant CAGR during the forecast period. ADAS is a rapidly emerging technology and is expected to find a significant growth in the automotive industry to increase safety, comfort, and tracking. Major factors augmenting the growth of the market include the high number of road accidents globally. Most of the road accidents involve human errors which can be reduced by the use of the ADAS system. Due to this, a number of government regulations are introduced in favor of ADAS. For instance, the individual New Car Assessment Program (NCAP) has been introduced by various countries such as Euro NCAP, Chinese C-NCAP, ASEAN NCAP other than Global NCAP. Earlier the technology was employed for high-end cars to provide better comfort. With the increasing focus on safety, the market potential for ADAS has been extended to mid-range cars as well. A major restraint to the market is the additional cost associated with the ADAS. Moreover, the trade war between major automotive export countries such as the US & China, and Japan and South Korea are is also expected to increase the manufacturing cost of the component, which will increase the market value.

Segmental Outlook

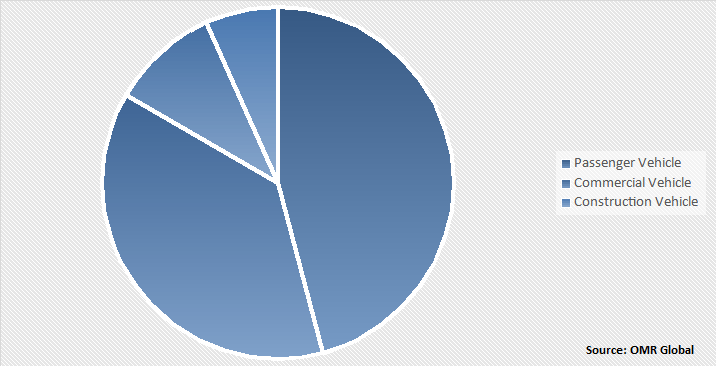

The ADAS market is segmented on the basis of technology, system, and vehicle type. By technology, the market is segmented into Cameras, LiDAR, Radar, and Wi-Fi. All these find a significant application in a vehicle. LiDAR technology is widely adopted for the self-driving vehicle by companies such as Google (Waymo) and Tesla, which is expected to provide a significant market growth to the segment. Radar technology is widely used for a short distance and will find significant growth due to the shift from 20s GHz technology to 70s GHz technology in the upcoming period. By vehicle type, the market is segmented into two-wheelers, passenger cars, commercial vehicles, and construction equipment. The passenger vehicle segment is expected to have a major market share along with a considerable growth rate during the forecast period.

By system, the market is divided into Adaptive Cruise Control, Intelligent Park Assist, Electronic Stability Control, Automatic Emergency Braking, Blind Spot Detection, Driver Monitoring System, Forward Collision Warning, Lane Departure Warning, Night Vision System, Pedestrian Detection System, and Others. Among these, Adaptive cruise control, Electronic stability system, and Intelligent Park Assist are expected to have a major market during the forecast period. Regulations related to these technologies have been already introduced in various economies including the US, and European countries.

Automotive Radar Market Share by Vehicle Type, 2019 (%)

Regional Outlook

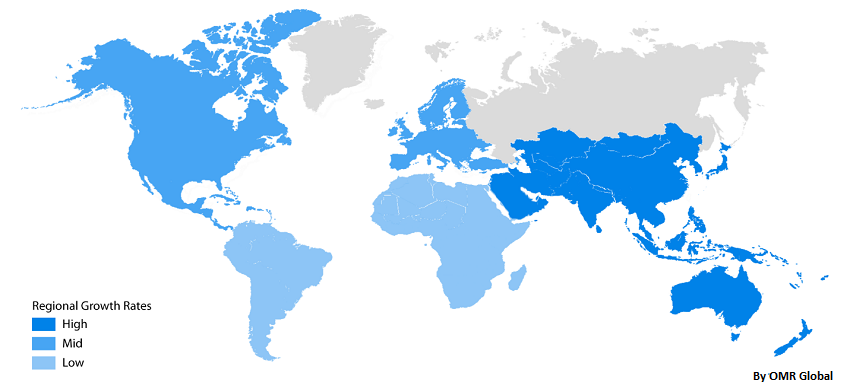

The market is geographically segmented into North America (the US and Canada), Europe (UK, Germany, Italy, Spain, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), and the Rest of the World (RoW). North America and Europe are expected to have a major market share during the forecast period. High disposable income, cohesive government regulation, and awareness of the people towards road safety are some of the major factors augmenting the market in these regions. However, developing economies such as India and China will provide significant growth to the Asia-Pacific market.

ADAS Market Growth, by Region 2019-2025

Market Players Outlook

The major players that contribute to the growth of the market include Aptiv PLC, Continental AG, Hyundai Mobis Co. Ltd., Robert Bosch GmbH, Valeo SA, and others. These market players are contributing to the market by adopting various market approaches including product launch and approvals, merger and acquisition, partnerships and collaborations, and others for gaining a strong position in the market. Along with this, government organization is also significantly contributing to various project related to self-driving and other ADAS projects.

For instance, in October 2019, Waymo and Renault worked in the Ile-de-France region to find the possibilities of creating an autonomous transportation route between Charles de Gaulle airport and La Défense. The route is the initial phase to provide additional transportation options for tourists and international visitors for the Paris Olympic Games 2024. The region is expected to invest $110 million to develop autonomous vehicle infrastructure. It will significantly create the demand for the ADAS system in the vehicles which will augment the demand for a high range radar system in the country.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ADAS market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight& Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Aptiv PLC

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Continental AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Hyundai Mobis Co Ltd

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Robert Bosch GmbH

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Valeo SA

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. ADAS Market by Technology

5.1.1. Camera

5.1.2. LiDAR

5.1.3. Radar

5.1.4. WiFi

5.2. Global ADAS Market by System

5.2.1. Adaptive Cruise Control (ACC)

5.2.2. Intelligent Park Assist (IPA)

5.2.3. Electronic Stability Control (ESC)

5.2.4. Automatic Emergency Braking (AEB)

5.2.5. Blind Spot Detection (BSD)

5.2.6. Driver Monitoring System (DMS)

5.2.7. Forward Collision Warning (FCW)

5.2.8. Lane Departure Warning (LDW)

5.2.9. Night Vision System (NVS)

5.2.10. Pedestrian Detection System (PDS)

5.2.11. Other (Cross Traffic Alert, Road Sign Recognition, Adaptive Front Light)

5.3. Global ADAS Market by Vehicle Type

5.3.1. Two-Wheeler

5.3.2. Passenger Cars

5.3.3. Commercial Vehicle

5.3.4. Construction Equipments

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AImotive GmbH

7.2. Aisin Seiki Co., Ltd

7.3. Ambarella Inc

7.4. Aptiv PLC

7.5. Autoliv Inc

7.6. Blackberry Ltd.

7.7. Cognitive Technologies Inc.

7.8. Continental AG

7.9. Denso Corp.

7.10. Ficosa International SA

7.11. HELLA GmbH & Co. KGaA

7.12. Hitachi Automotive Systems, Ltd.

7.13. Hyundai Mobis Co Ltd

7.14. Infineon Technologies AG

7.15. Intel Corp.

7.16. Magna International Inc.

7.17. NVIDIA Corp

7.18. Robert Bosch GmbH

7.19. Samsung Electronics Co., Ltd.

7.20. Valeo SA

7.21. Velodyne Lidar

7.22. ZF Friedrichshafen AG

1. GLOBAL ADAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

2. GLOBAL CAMERA MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

3. GLOBAL LIDAR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

4. GLOBAL RADAR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

5. GLOBAL WIFI MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

6. GLOBAL ADAS MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

7. GLOBAL ADAPTIVE CRUISE CONTROL MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. GLOBAL INTELLIGENT PARK ASSIST MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

9. GLOBAL ELECTRONIC STABILITY CONTROL MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. GLOBAL AUTOMATIC EMERGENCY BRAKING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. GLOBAL BLIND SPOT DETECTION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. GLOBAL DRIVER MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. GLOBAL FORWARD COLLISION WARNING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. GLOBAL LANE DEPARTURE WARNING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. GLOBAL NIGHT VISION SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. GLOBAL PEDESTRIAN DETECTION SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

17. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

18. GLOBAL ADAS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

19. GLOBAL ADAS IN TWO-WHEELER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

20. GLOBALADAS IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

21. GLOBAL ADAS IN COMMERCIAL VEHICLE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

22. GLOBAL ADAS IN CONSTRUCTION EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

23. NORTH AMERICAN ADAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. NORTH AMERICAN ADAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

25. NORTH AMERICAN ADAS MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

26. NORTH AMERICAN ADAS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

27. EUROPEAN ADAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. EUROPEAN ADAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

29. EUROPEAN ADAS MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

30. EUROPEAN ADAS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC ADAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC ADAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC ADAS MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

34. ASIA-PACIFIC ADAS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

35. REST OF THE WORLD ADAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

36. REST OF THE WORLD ADAS MARKET RESEARCH AND ANALYSIS BY SYSTEM, 2019-2026 ($ MILLION)

37. REST OF THE WORLD ADAS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL ADAS MARKET SHARE BY TECHNOLOGY, 2019 VS 2026(%)

2. GLOBAL ADAS MARKET SHARE BY SYSTEM, 2019 VS 2026(%)

3. GLOBAL ADAS MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026(%)

4. GLOBAL ADAS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026(%)

5. US ADAS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA ADAS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK ADAS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE ADAS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY ADAS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY ADAS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN ADAS MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE ADAS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA ADAS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA ADAS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN ADAS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC ADAS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD ADAS MARKET SIZE, 2019-2026 ($ MILLION)