Aerospace 3D Printing Market

Aerospace 3D Printing Market Size, Share & Trends Analysis by Offerings (Printers, Materials, Software and Services), by Printer Technology (Direct Metal Laser Sintering (DMLS), Fused Deposition Modeling (FDM), Continuous Liquid Interface Production (CLIP), Stereolithography (SLA), Selective Laser Sintering (SLS), Others), by Platform (Aircraft, UAVs, Spacecraft), by End-User (OEM, MRO), and Forecast Period (2025-2035)

Industry Overview

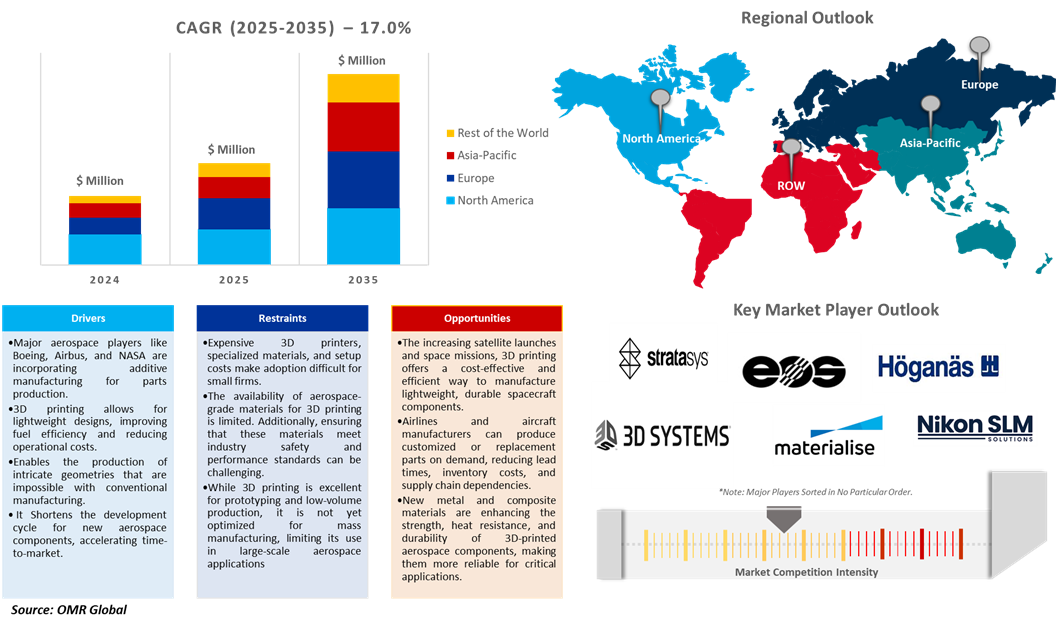

Aerospace 3D printing market size was $3.6 billion in 2024, and is projected to reach $20.2 billion in 2035, growing at a CAGR of 17.0% during the forecast period (2025-2035). 3D printing is used in the aerospace industry to build rockets and plane parts. This technology creates lighter, more durable, and cheaper components. It reduces the number of parts needed for assembly, making the vehicles lighter and more fuel-efficient. 3D printing is getting more popular in the aerospace industry. It helps make complex and lightweight components, improving fuel efficiency and cutting manufacturing costs. Also, it allows making parts that are hard or impossible to create using traditional methods. More aerospace companies are using 3D printing to simplify their production and create new designs. Space exploration companies such as NASA and other government organizations are focused on investing in 3D technology for space exploration programs. For instance, in December 2021, Fleet Space Technologies unveiled an entirely 3D-printed satellite as part of their new constellation, Alpha. It will provide sub-second latency, unlocking a cost-effective means to achieving unprecedented connectivity around the world. The International Journal of Aviation, Aeronautics, and Aerospace (IJAAA) anticipates further expansion of 3D printing, highlighting its potential for constructing celestial habitats and for the in-situ manufacturing of spacecraft and satellite components.

Market Dynamics

Increasing Adoption of Lightweight Materials and Cost-Efficiency

The need for lightweight parts in the aerospace industry is a major factor contributing to the growth of 3D printing solutions. The high-performance sectors such as automotive and aerospace, producing lightweight metal components act as a Holy Grail. As a result, manufacturers are constantly looking for new approaches to design and produce lighter metal components with improved part performance. For instance in November 2023, Markforged Releases Vega, an Ultra High Performance Material Designed for 3D Printing Aerospace Components on the FX20. It not only offers exceptional strength but also is expected to reduce weight, cost efficiency, and time savings. 3D printing technology, creates parts layer by layer, using material only where needed, requiring less material for production and thus bringing down the manufacturing cost. 3D printing makes complexity an advantage, opening the door to the affordable fabrication of intricate, lightweight metal parts. In addition to being cost-effective for creating lighter metal components, 3D printing is faster than other types of manufacturing processes. Additive manufacturing, a tool-less technology, directly produces parts from digital files, greatly speeding the manufacturing process.

Complex and Customized Component Production

3D printing enables the creation of highly complex and customized components that are difficult to manufacture. 3D printing technology simplifies parts by consolidating multiple components into a single, streamlined unit, reducing complexity, assembly time, and supply chain intricacy. The faster production capabilities of 3D printing, compared to traditional manufacturing methods, enable rapid prototyping and iteration of designs, enhancing the speed and efficiency of aircraft production. This is beneficial for producing low-volume, high-value aerospace components such as turbine blades, fuel nozzles, and satellite brackets. The aerospace industry has witnessed significant advancements in high-end polymers for 3D printing applications. These materials are designed to meet the stringent requirements of aerospace components, offering superior mechanical properties, chemical resistance, and high-temperature stability. Some of the most commonly used materials in aerospace 3D printing include high-performance polymers, flame-retardant polymers, thermoplastic composites, polymer matrix composites, and many more. The ability to produce parts on-demand also reduces reliance on traditional supply chains, making it easier to manufacture spare parts in remote locations, such as space stations or military bases.

Market Segmentation

- Based on the offerings, the market is segmented into Printers, Materials, Software, and Services.

- Based on the printer technology, the market is segmented into direct metal laser sintering (DMLS), fused deposition modeling (FDM), continuous liquid interface production (CLIP), stereolithography (SLA), selective laser sintering (SLS), and others.

- Based on the platform industry, the market is segmented into aircraft, UAVs, and spacecraft.

- Based on the end-user industry, the market is segmented into OEM and MRO.

3D Printing Aerospace

3D printing, or additive manufacturing, is a production technique that creates a three-dimensional object from a computer-aided design (CAD) file. The term covers several different processes, all involving one or more materials – most often plastic, metal, wax, or composite – being deposited layer by layer to build a shape. 3D printing technology helps the aerospace industry in various ways such as streamlining and simplifying the design workflow, producing lighter, stronger parts, consolidating multiple parts into one single part, minimizing waste of extremely expensive raw materials, accelerating time to market, improving cost and resource efficiency, and optimizes inventory and logistics. Aircraft manufacturers and suppliers are among the largest users of 3D printing. All the leading commercial aircraft makers (Airbus, Boeing, Bombardier, and Embraer) and engine suppliers (GE Aviation, Pratt & Whitney, Rolls-Royce, and Safran) have adopted 3D printing in their processes.

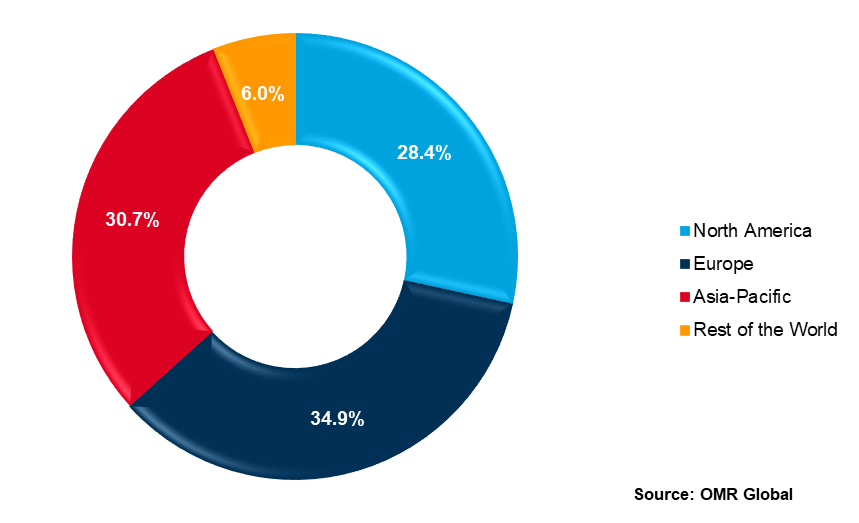

Regional Outlook

The global aerospace 3D Printing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold the largest share of the market across the globe, owing to industry trends such as Industry 4.0 and the increasing collaboration in various companies to enhance the printing ability of complex and lightweight materials.

North America Region Dominates the Market

North America holds the largest market share in aerospace 3D printing. The growing trend towards digitalization and industry 4.0 initiatives accelerates the adoption of additive manufacturing in the aerospace sector. This digital approach enhances collaboration between designers, engineers, and manufacturers, accelerating product development cycles and enabling faster time-to-market for new aircraft and spacecraft. North American aerospace companies embrace digital transformation, and additive manufacturing as an integral part of their strategy for achieving greater efficiency and competitiveness in the global market.

Distribution of Industrial AM System Installations As A Measure Of AM Technology Adoption

Market Players Outlook

The major companies serving the aerospace 3D printing market include Stratasys, 3D Systems Corporation, EOS GmbH, Materialise N.V., Nikon SLM Solutions AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In March 2025, Stratasys Ltd. announced the launch of AIS Antero 800NA and AIS Antero 840CN03 as validated materials for the Stratasys F900, marking a new milestone in qualified additive manufacturing for aerospace, defense, and other highly regulated industries. These new AIS advanced industrial solution materials were rigorously qualified in collaboration with leading organizations, including Northrop Grumman, Boeing, Blue Origin, Raytheon, Naval Air Systems Command (NAVAIR), and the National Institute for Aviation Research (NIAR), United States Air Force, BAE, and Stratasys Direct Manufacturing.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace 3D printing market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Aerospace 3D Printing Market Sales Analysis – Offerings | Printer Technology | Platform | End User | ($ Million)

• Aerospace 3D Printing Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot’s

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Aerospace 3D Printing Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Aerospace 3D Printing Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Aerospace 3D Printing Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Aerospace 3D Printing Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Aerospace 3D Printing Market Revenue and Share by Manufacturers

• Aerospace 3D Printing Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Stratasys, Ltd.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. 3D Systems Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. EOS GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Materialise N.V.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Nikon SLM Solutions AG.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Aerospace 3D Printing Market Sales Analysis by Offerings ($ Million)

5.1. Printers

5.2. Materials

5.3. Software and Services

6. Global Aerospace 3D Printing Market Sales Analysis by Printer Technology ($ Million)

6.1. Direct Metal Laser Sintering (DMLS)

6.2. Fused Deposition Modeling (FDM)

6.3. Continuous Liquid Interface Production (CLIP)

6.4. Stereolithography (SLA)

6.5. Selective Laser Sintering (SLS)

6.6. Others

7. Global Aerospace 3D Printing Market Sales Analysis by Platform ($ Million)

7.1. Aircraft

7.2. UAVs

7.3. Spacecraft

8. Global Aerospace 3D Printing Market Sales Analysis by End User ($ Million)

8.1. OEM

8.2. MRO

9. Regional Analysis

9.1. North American Aerospace 3D Printing Market Sales Analysis – Offerings | Printer Technology | Platform | End User | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Aerospace 3D Printing Market Sales Analysis – Offerings | Printer Technology | Platform | End User | Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Aerospace 3D Printing Market Sales Analysis – Offerings | Printer Technology | Platform | End User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Aerospace 3D Printing Market Sales Analysis – Offerings | Printer Technology | Platform | End User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Aidro s.r.l

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Desktop Metal, Inc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. ExOne Operating, LLC

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Formlabs Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. GKN Aerospace

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Höganäs AB

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Markforged, Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Materialise N.V.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. MT Aerospace

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Nikon SLM Solutions AG.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Norsk Titanium US Inc.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Proto Labs, Inc.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Renishaw plc.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Thales S.A.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Ultimaker B.V.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Velo3D, Inc.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. voxeljet AG

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

1. Global Aerospace 3D Printing Market Research And Analysis By Offerings, 2024-2035 ($ Million)

2. Global Aerospace 3D Printers Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Aerospace 3D Printing Material Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Aerospace 3D Printing Software And Services Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Aerospace 3D Printing Market Research And Analysis By Printer Technology, 2024-2035 ($ Million)

6. Global Direct Metal Laser Sintering Printing For Aerospace Market Research And Analysis By Region 2024-2035 ($ Million)

7. Global Fused Deposition Modeling For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Continuous Liquid Interface Production For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Stereolithography For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Selective Laser Sintering For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Aerospace 3D Printing On Others Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Aerospace 3D Printing Market Research And Analysis By Platform, 2024-2035 ($ Million)

13. Global Aircraft 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global UAVs 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Spacecraft 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Aerospace 3D Printing Market Research And Analysis By End User, 2024-2035 ($ Million)

17. Global 3D Printing For Aerospace OEM Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global 3D Printing For Aerospace MRO Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Aerospace 3D Printing Market Research And Analysis By Geography, 2024-2035 ($ Million)

20. North American Aerospace 3D Printing Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American Aerospace 3D Printing Market Research And Analysis By Offerings, 2024-2035 ($ Million)

22. North American Aerospace 3D Printing Market Research And Analysis By Printer Technology, 2024-2035 ($ Million)

23. North American Aerospace 3D Printing Market Research And Analysis By Platform, 2024-2035 ($ Million)

24. North American Aerospace 3D Printing Market Research And Analysis By End User, 2024-2035 ($ Million)

25. European Aerospace 3D Printing Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European Aerospace 3D Printing Market Research And Analysis By Offerings, 2024-2035 ($ Million)

27. European Aerospace 3D Printing Market Research And Analysis By Printer Technology, 2024-2035 ($ Million)

28. European Aerospace 3D Printing Market Research And Analysis By Platform, 2024-2035 ($ Million)

29. European Aerospace 3D Printing Market Research And Analysis By End User, 2024-2035 ($ Million)

30. Asia-Pacific Aerospace 3D Printing Market Research And Analysis By Country, 2024-2035 ($ Million)

31. Asia-Pacific Aerospace 3D Printing Market Research And Analysis By Offerings, 2024-2035 ($ Million)

32. Asia-Pacific Aerospace 3D Printing Market Research And Analysis By Printer Technology, 2024-2035 ($ Million)

33. Asia-Pacific Aerospace 3D Printing Market Research And Analysis By Platform, 2024-2035 ($ Million)

34. Asia-Pacific Aerospace 3D Printing Market Research And Analysis By End User, 2024-2035 ($ Million)

35. Rest Of The World Aerospace 3D Printing Market Research And Analysis By Country, 2024-2035 ($ Million)

36. Rest Of The World Aerospace 3D Printing Market Research And Analysis By Offerings, 2024-2035 ($ Million)

37. Rest Of The World Aerospace 3D Printing Market Research And Analysis By Printer Technology, 2024-2035 ($ Million)

38. Rest Of The World Aerospace 3D Printing Market Research And Analysis By Platform, 2024-2035 ($ Million)

39. Rest Of The World Aerospace 3D Printing Market Research And Analysis By End User, 2024-2035 ($ Million)

1. Global Aerospace 3D Printing Market Share By Offerings, 2024 Vs 2035 (%)

2. Global Aerospace 3D Printing Market Share By Printer Technology, 2024 Vs 2035 (%)

3. Global Aerospace 3D Printing Market Share By Platform, 2024 Vs 2035 (%)

4. Global Aerospace 3D Printing Market Share By End User, 2024 Vs 2035 (%)

5. Global Aerospace 3D Printing Market Share By Region, 2024 Vs 2035 (%)

6. Global Aerospace 3D Printers Market Share By Region, 2024 Vs 2035 (%)

7. Global Aerospace 3D Printing Material Market Share By Region, 2024 Vs 2035 (%)

8. Global Aerospace 3D Printing Software And Services Market Share By Region, 2024 Vs 2035 (%)

9. Global Aerospace 3D Printing Market Share By Printer Technology, 2024 Vs 2035 (%)

10. Global Direct Metal Laser Sintering Printing For Aerospace Market Share By Region, 2024 Vs 2035 (%)

11. Global Fused Deposition Modeling For Aerospace Market Share By Region, 2024 Vs 2035 (%)

12. Global Continuous Liquid Interface Production For Aerospace Market Share By Region, 2024 Vs 2035 (%)

13. Global Stereolithography For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

14. Global Selective Laser Sintering For Aerospace Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

15. Global Aerospace 3D Printing On Others Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

16. Global Aerospace 3D Printing Market Share By Platform, 2024 Vs 2035 (%)

17. Global Aircraft 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

18. Global UAVs 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

19. Global Spacecraft 3D Printing Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Aerospace 3D Printing Market Share By End User, 2024 Vs 2035 (%)

21. Global 3D Printing For Aerospace OEM Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

22. Global 3D Printing For Aerospace MRO Market Research And Analysis By Region, 2024-2035 ($ Million) (%)

23. US Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

24. Canada Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

25. UK Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

26. France Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

27. Germany Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

28. Italy Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

29. Spain Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

30. Russia Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

31. Rest Of Europe Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

32. India Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

33. China Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

34. Japan Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

35. South Korea Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

36. ASEAN Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

37. Australia and New Zealand Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

38. Rest Of Asia-Pacific Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

39. Latin America Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

40. Middle East And Africa Aerospace 3D Printing Market Size, 2024-2035 ($ Million)

FAQS

The size of the Aerospace 3D Printing market in 2024 is estimated to be around $3.6 billion.

North America holds the largest share in the Aerospace 3D Printing market.

Leading players in the Aerospace 3D Printing market include Stratasys, 3D Systems Corporation, EOS GmbH, Materialise N.V., Nikon SLM Solutions AG, and others

Aerospace 3D Printing market is expected to grow at a CAGR of 17.0% from 2025 to 2035.

Key factors driving the growth of the aerospace 3D printing market include the demand for lightweight, fuel-efficient components; cost-effective, on-demand manufacturing.