Ornithopter Drone Market

Ornithopter Drone Market Size, Share & Trends Analysis Report By Technology (Autonomous Ornithopters, Semi-Autonomous Ornithopters, and Remotely Piloted Ornithopters) and By Application (Military & Defense, Agriculture & Precision Farming, Environmental Monitoring & Wildlife Research, and Entertainment & Education) Forecast Period (2025-2035)

Industry Overview

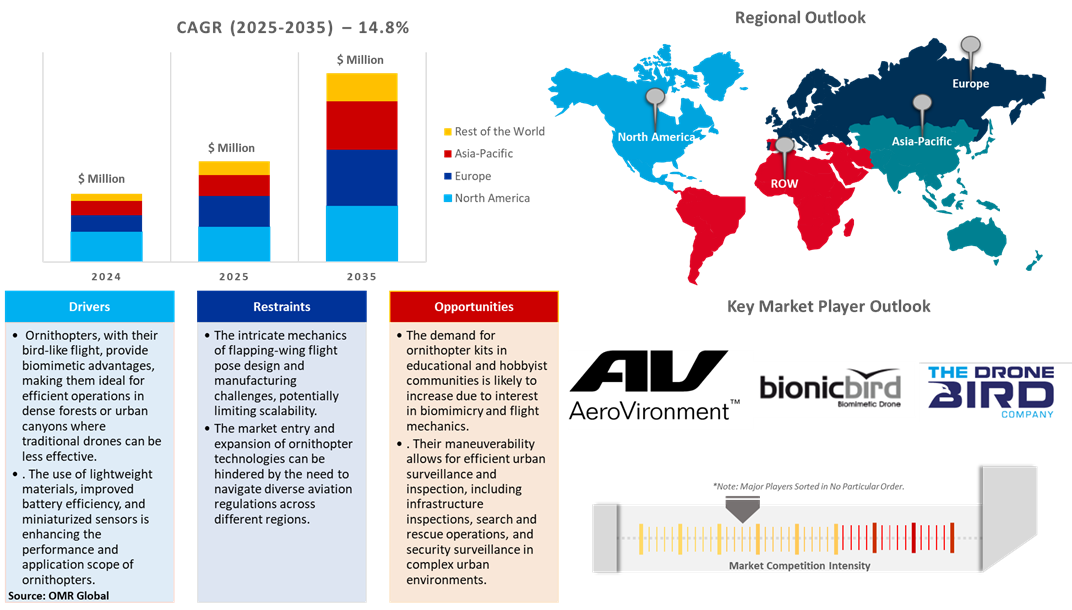

Global ornithopter drone market is growing at a CAGR of 14.8% from 2025 to 2035. Ornithopters are versatile tools for defense, agriculture, and environmental monitoring owing to their silent flight, gentle dynamics, minimal noise, and advancements in AI and lightweight materials. Technological innovation in drones, incorporating biological flight patterns and advanced stealth features, is driving market expansion beyond civilian use, focusing on military, defense, and security sectors globally. For instance, in May 2025, China unveiled invisible drones that mimic bird flight dynamics, enabling them to evade detection by humans and conventional radar systems. These ornithopters, additionally known as bird-mimicking drones, are designed for reconnaissance, infiltration, and direct engagement roles. It is developed in various avian forms, including magpies, seagulls, hawks, and eagles, each tailored to specific operational profiles. The smallest variant, resembling a magpie, weighs 90 grams and can be hand-launched. Larger models, such as the seagull and eagle variants, carry heavier payloads and extended endurance.

Market Dynamics

Demand for Covert Surveillance Solutions

Ornithopters, a bird-shaped drone with small size, are increasingly popular in the military drone industry due to their stealthy nature. Biomimetic drones are the ones that replicate bird and insect flight patterns, offering camouflage in the visual domain and low radar signatures, making them suitable for special operations. For instance, in August 2024, China showcased new biomimetic drones disguised as birds during a shooting competition. The drone, a miniature biomimetic ornithopter, flies by flapping wings such as birds and insects. Despite its realistic appearance, ornithopters perform poorly in endurance, payload, and range but can be easily concealed, making them ideal for covert reconnaissance by special operations forces.

Bird Control Around Airports

Ornithopters, designed to resemble predator birds, are used near airports to reduce the risk of bird strikes by scaring away flocks, and their realistic movements and flight patterns are contributing to increased market demand. For instance, in October 2022, Beihang-developed unmanned ornithopter set a Guinness Record for the longest flight duration, demonstrating potential applications in Mars exploration, airport bird repelling, and near-space aircraft study. The ornithopter's complicated mechanism requires demanding mechanical systems, making it difficult for an artificial flapping wing to achieve flying. The discovery of the record is a result of rapid advancements in aviation technology, that has made flapping wing research a hot topic in recent years.

Market Segmentation

- Based on the technology, the market is segmented into autonomous ornithopters, semi-autonomous ornithopters, and remotely piloted ornithopters.

- Based on the application, the market is segmented into military & defense, agriculture & precision farming, environmental monitoring & wildlife research, and entertainment & education.

Military & Defense: A Key Segment in Market Growth

Military demand for stealth reconnaissance is increasing due to increased investment in next-generation surveillance technologies such as ornithopters for visual and acoustic camouflage in urban or forested areas. For instance, in March 2024, China developed a bird-like ornithopter with significant military and civilian applications. The Small Falcon ornithopter mimics bird flapping, can fold its wings, adjust the flapping speed, and lock its wings for glides. Its design, optimized through computational fluid dynamics simulations and wind tunnel tests, offers high agility and bird-like flying movements. The Small Falcon has potential in military reconnaissance, ecological monitoring, and environmental protection.

Regional Outlook

The global ornithopter drone market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Demand for Precision Medicine in Asia-Pacific

The market growth is attributed to increased awareness, early detection, and technological advancements in diagnostics and treatment. For instance, in February 2024, AIIMS Delhi introduced Mohs micrographic surgery, an advanced technique for treating skin cancer, marking a significant development in India's healthcare sector. The surgery involves layer-by-layer removal of cancerous tissue, preserving healthy tissue, and reducing the chance of recurrence. The facility, supported by six surgeons and three technicians from the USA, offers world-class care without international travel.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the ornithopter drones' market growth is primarily driven by their flapping-wing mechanism, which is utilized in military, law enforcement, and search-and-rescue operations. For instance, in January 2023, the Aeromodelling Club of the Indian Institute of Technology Guwahati (IIT-G) developed smart drones, including warehouse drones for warehouse management, reaper drones for military and law enforcement, and an ornithopter designed for surveillance in tight spaces. The club is currently in an advanced stage of manufacturing these drones, with calibration testing for the reaper drone and Raven, an indigenously developed VTOL-capable fixed-winged aircraft.

Market Players Outlook

The major companies operating in the global ornithopter drone market include AeroVironment, Inc., Bionic Bird, and The Drone Bird Co. among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

In August 2024, China developed bird-shaped reconnaissance drones as part of its Pigeon Program, aiming to blend into urban environments without arousing suspicion. The drones, indistinguishable from living birds, flap their wings and fly naturally. The Chinese "Pigeon" drone, powered by a lithium battery, can remain airborne for an hour and a half, demonstrating China's advancements in biomimetic drones. This development is part of China's Pigeon Program, a technological innovation.

In August 2022, NIT-Rourkela alumni secured a patent for their invention, a flapping wing Ornithopter (UAV), which mimics the complex flapping motion of a bird. This innovative drone could find applications in defense espionage, surveillance, aerial surveillance, farm and airfield protection, data collection, and forecasting. The Ornithopter's agility, lightweight design, and optimized energy consumption make it a promising solution to existing UAV issues.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ornithopter drone market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Ornithopter Drone Market Sales Analysis – Technology| Application ($ Million)

• Ornithopter Drone Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Ornithopter Drone Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Ornithopter Drone Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Ornithopter Drone Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Ornithopter Drone Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For Global Ornithopter Drone Market: Impact Analysis

4. Competitive Landscape

4.1. Key Company Analysis

4.2. AeroVironment, Inc.

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Bionic Bird (XTIM SAS)

4.3.1. Overview

4.3.2. Product Portfolio

4.3.3. Financial Analysis (Subject to Data Availability)

4.3.4. SWOT Analysis

4.3.5. Business Strategy

4.4. The Drone Bird Co. (AERIUM Analytics B.V.)

4.4.1. Overview

4.4.2. Product Portfolio

4.4.3. Financial Analysis (Subject to Data Availability)

4.4.4. SWOT Analysis

4.4.5. Business Strategy

4.5. Key Strategy Analysis

5. Market Segmentation

5.1. Global Ornithopter Drone Market by Technology

5.1.1. Autonomous Ornithopters

5.1.2. Semi-Autonomous Ornithopters

5.1.3. Remotely Piloted Ornithopters

5.2. Global Ornithopter Drone Market by Application

5.2.1. Military & Defense

5.2.2. Agriculture & Precision Farming

5.2.3. Environmental Monitoring & Wildlife Research

5.2.4. Entertainment & Education

6. Regional Analysis

6.1. North American Ornithopter Drone Market Sales Analysis – Technology| Application| Country ($ Million)

• Macroeconomic Factors for North America

6.1.1. United States

6.1.2. Canada

6.2. European Ornithopter Drone Market Sales Analysis – Technology| Application | Country ($ Million)

• Macroeconomic Factors for Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific Ornithopter Drone Market Sales Analysis – Technology| Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. South Korea

6.3.4. India

6.3.5. Australia & New Zealand

6.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

6.3.7. Rest of Asia-Pacific

6.4. Rest of the World Ornithopter Drone Market Sales Analysis – Technology| Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

6.4.1. Latin America

6.4.2. Middle East and Africa

7. Company Profiles

7.1. AeroVironment, Inc.

7.1.1. Quick Facts

7.1.2. Company Overview

7.1.3. Product Portfolio

7.1.4. Business Strategies

7.2. Bionic Bird (XTIM SAS)

7.2.1. Quick Facts

7.2.2. Company Overview

7.2.3. Product Portfolio

7.2.4. Business Strategies

7.3. Festo Corporation

7.3.1. Quick Facts

7.3.2. Company Overview

7.3.3. Product Portfolio

7.3.4. Business Strategies

7.4. Flapper s.r.o.

7.4.1. Quick Facts

7.4.2. Company Overview

7.4.3. Product Portfolio

7.4.4. Business Strategies

7.5. MukikiM

7.5.1. Quick Facts

7.5.2. Company Overview

7.5.3. Product Portfolio

7.5.4. Business Strategies

7.6. The Drone Bird Co. (AERIUM Analytics B.V.)

7.6.1. Quick Facts

7.6.2. Company Overview

7.6.3. Product Portfolio

7.6.4. Business Strategies

7.7. Zing Toys

7.7.1. Quick Facts

7.7.2. Company Overview

7.7.3. Product Portfolio

7.7.4. Business Strategies

List not exhaustive

1. Global Ornithopter Drone Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Autonomous Ornithopter Drone Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Semi-Autonomous Ornithopter Drone Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Remotely Piloted Ornithopter Drone Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Ornithopter Drone Market Research And Analysis By Application, 2024-2035 ($ Million)

6. Global Ornithopter Drone In Military & Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Ornithopter Drone In Agriculture & Precision Farming Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Ornithopter Drone In Environmental Monitoring & Wildlife Research Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Ornithopter Drone In Entertainment & Education Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Ornithopter Drone Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American Ornithopter Drone Market Research And Analysis By Technology, 2024-2035 ($ Million)

12. North American Ornithopter Drone Market Research And Analysis By Application, 2024-2035 ($ Million)

13. European Ornithopter Drone Market Research And Analysis By Country, 2024-2035 ($ Million)

14. European Ornithopter Drone Market Research And Analysis By Technology, 2024-2035 ($ Million)

15. European Ornithopter Drone Market Research And Analysis By Application, 2024-2035 ($ Million)

16. Asia-Pacific Ornithopter Drone Market Research And Analysis By Country, 2024-2035 ($ Million)

17. Asia-Pacific Ornithopter Drone Market Research And Analysis By Technology, 2024-2035 ($ Million)

18. Asia-Pacific Ornithopter Drone Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Rest Of The World Ornithopter Drone Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Rest Of The World Ornithopter Drone Market Research And Analysis By Technology, 2024-2035 ($ Million)

21. Rest Of The World Ornithopter Drone Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Ornithopter Drone Market Share By Technology, 2024 Vs 2035 (%)

2. Global Autonomous Ornithopter Drone Market Share By Region, 2024 Vs 2035 (%)

3. Global Semi-Autonomous Ornithopter Drone Market Share By Region, 2024 Vs 2035 (%)

4. Global Remotely Piloted Ornithopter Drone Market Share By Region, 2024 Vs 2035 (%)

5. Global Ornithopter Drone Market Share By Application, 2024 Vs 2035 (%)

6. Global Ornithopter Drone In Military & Defense Market Share By Region, 2024 Vs 2035 (%)

7. Global Ornithopter Drone In Agriculture & Precision Farming Market Share By Region, 2024 Vs 2035 (%)

8. Global Ornithopter Drone In Environmental Monitoring & Wildlife Research Market Share By Region, 2024 Vs 2035 (%)

9. Global Ornithopter Drone In Entertainment & Education Market Share By Region, 2024 Vs 2035 (%)

10. Global Ornithopter Drone Market Share By Region, 2024 Vs 2035 (%)

11. US Ornithopter Drone Market Size, 2024–2035 ($ Million)

12. Canada Ornithopter Drone Market Size, 2024–2035 ($ Million)

13. UK Ornithopter Drone Market Size, 2024–2035 ($ Million)

14. France Ornithopter Drone Market Size, 2024–2035 ($ Million)

15. Germany Ornithopter Drone Market Size, 2024–2035 ($ Million)

16. Italy Ornithopter Drone Market Size, 2024–2035 ($ Million)

17. Spain Ornithopter Drone Market Size, 2024–2035 ($ Million)

18. Russia Ornithopter Drone Market Size, 2024–2035 ($ Million)

19. Rest of Europe Ornithopter Drone Market Size, 2024–2035 ($ Million)

20. India Ornithopter Drone Market Size, 2024–2035 ($ Million)

21. China Ornithopter Drone Market Size, 2024–2035 ($ Million)

22. Japan Ornithopter Drone Market Size, 2024–2035 ($ Million)

23. South Korea Ornithopter Drone Market Size, 2024–2035 ($ Million)

24. Australia and New Zealand Ornithopter Drone Market Size, 2024–2035 ($ Million)

25. ASEAN Economies Ornithopter Drone Market Size, 2024–2035 ($ Million)

26. Rest of Asia-Pacific Ornithopter Drone Market Size, 2024–2035 ($ Million)

27. Latin America Ornithopter Drone Market Size, 2024–2035 ($ Million)

28. Middle East and Africa Ornithopter Drone Market Size, 2024–2035 ($ Million)

FAQS

The size of the Ornithopter Drone market in 2024 is estimated to be around USD 8.6 million.

Asia Pacific holds the largest share in the Ornithopter Drone market.

Leading players in the Ornithopter Drone market include AeroVironment, Inc., Bionic Bird, and The Drone Bird Co. among others.

Ornithopter Drone market is expected to grow at a CAGR of 14.8% from 2025 to 2035.

The ornithopter drone market is driven by advancements in biomimicry, stealth technology, and energy efficiency for defense and surveillance applications.