Aerospace Robotics Market

Global Aerospace Robotics Market Size, Share & Trends Analysis Report by Type (Articulated, Cartesian, SCARA, and Others), by Technology (Traditional Robots and Collaborative Robots), and by Application (Assembling & Disassembling, Drilling, Welding, Painting, Inspection, and Others) Forecast Period (2022-2028)

The global aerospace robotics market is anticipated to grow at a CAGR of 11.3% during the forecast period. Robotics manufacturers have increased the size of robots to assemble larger equipment and aircraft components, which has accelerated the demand and use of aerospace robotics. Several companies are deploying robots for the production of components effectively and efficiently. The growing need for robots for efficient aircraft production to increase productivity, and reduce employee workload. For instance, in June 2022, Groupe Blondel decided to deploy six Boby robots with 160 shelf units and two picking stations at its 12,000 sq.m Rochefort site near the Airbus manufacturing facility. After installation, Groupe Blondel expects to see a three-fold improvement in productivity at the site, a 30% increase in storage space, and a reduction in picking errors.

Segmental Outlook

The global aerospace robotics market is segmented based on type, technology, and application. Based on the type, the market is segmented into articulated, Cartesian, SCARA, and others. Based on the technology, the market is bifurcated into traditional robots and collaborative robots. Based on the application, the market is augmented into assembling & disassembling, drilling, welding, painting, inspection, and others. The above-mentioned segments can be customized as per the requirements. The drilling segment is expected to cater to a considerable share of the market growth during the forecast period. Drilling via robots assists to create a hole very efficiently, precisely, repeatedly, and to a very high degree of quality compared to manually. However, manual drilling takes a tremendous amount of skill and experience to get to the level of quality that a robot can. The benefits associated with the drilling are propelling the growth of the market during the forecast period.

The Insection Segment is Expected to Hold a Remarkable Shre in the Global Aerospace Robotics Market

Among the application segment, the inspection is expected to hold a remarkable share in the market during the forecast period. Robots can perform non-destruction inspection processes fast with high accuracy. Robots can provide quality and integrity by carefully and procedurally inspecting every square inch of components for cracks and other errors. Strict safety regulations in favor of customers are pushing the aerospace industry to put more investment into inspection procedures. The growing need for robots for inspection applications is providing lucrative growth to the market during the forecast period.

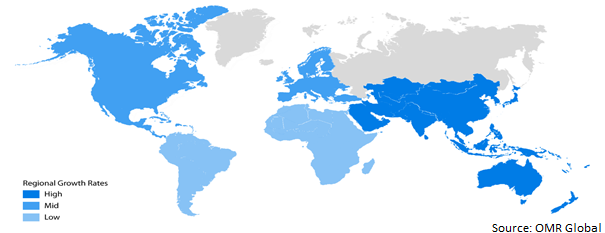

Regional Outlooks

The global aerospace robotics market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is expected to hold a considerable share of the market during the forecast period. The countries such as India and China are increasing investment to strengthen their aerospace manufacturing capacities. Moreover, the heavy investment in AI-enabled robots is further driving the market growth during the forecast period.

Global Aerospace Robotics Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Aerospace Robotics Market

Among all the regions, the North American region is expected to hold a prominent share in the market during the forecast period. With the rapid increase in automation sales and favorable economic conditions in the US manufacturing sector, users have accelerated their orders for robotics and other forms of advanced technologies. According to the Association for Advancing Automation, North American companies ordered 9,853 robots valued at $501 million in Q2 2021, up from 5,196 sold in Q2 2020, the peak of the pandemic. Moreover, robot orders in the second quarter of 2021 were up 67% over the same period in 2020, showing a return to pre-COVID-19 pandemic demand for automation as manufacturers and other North American companies return to business.

Market Players Outlook

The major companies serving the global aerospace robotics market include ABB, AV&R, Bosch Rexroth AG, Diligent Robotics Inc., Electroimpact Inc., Fanuc Corp., General Dynamics Mission Systems, Inc., Gudel Group AG, JH Robotics, Inc., Kawasaki Heavy Industries, Ltd., Kuka AG, Mitsubishi Electric Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2022, ABB Group added two new lines of large manufacturing robots to its portfolio—IRB 5710 and IRB 5720. The new robots are suitable for a wide range of production tasks including material handling and machine tending and assembly, as well as specific operations in electric vehicle (EV) manufacturing such as battery module picking and placing, high precision assembly, and parts handling, the company stated. The IRB 5710 and IRB 5720 are available in a range of variants, with payload options ranging from 70 to 180 kg (154.3 to 396.8 lb.). Reaches range from 2.3 to 3 m (7.5 to 9.8 ft.).

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace robotics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aerospace Robotics Market by Type

4.1.1. Articulated

4.1.2. Cartesian

4.1.3. SCARA

4.1.4. Others (Linear, Parallel)

4.2. Global Aerospace Robotics Market by Technology

4.2.1. Traditional Robots

4.2.2. Collaborative Robots

4.3. Global Aerospace Robotics Market by Application

4.3.1. Assembling & Disassembling

4.3.2. Drilling

4.3.3. Welding

4.3.4. Painting

4.3.5. Inspection

4.3.6. Others (Handling, Surface Treatment)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Ltd.

6.2. AV&R

6.3. Bosch Rexroth AG

6.4. Diligent Robotics Inc.

6.5. Electroimpact Inc.

6.6. Fanuc Corp.

6.7. General Dynamics Mission Systems, Inc.

6.8. Gudel Group AG

6.9. JH Robotics, Inc.

6.10. Kawasaki Heavy Industries, Ltd.

6.11. Kuka AG

6.12. Mitsubishi Electric Corp.

6.13. Mtorres Disenos Industriales S.A.U.

6.14. Nachi-Fujikoshi Corp.

6.15. Oliver Crispin Robotics Ltd.

6.16. Omron Corp.

6.17. Rethink Robotics

6.18. Schneider Electric

6.19. Seiko Epson Corp.

6.20. Universal Robots A/S

6.21. Yaskawa Electric Corp.

1. GLOBAL AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ARTICULATED AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CARTESIAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SCARA AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL OTHER AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

7. GLOBAL TRADITIONAL AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL COLLABORATIVE AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

10. GLOBAL AEROSPACE ROBOTICS FOR ASSEMBLING & DISASSEMBLING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL AEROSPACE ROBOTICS FOR DRILLING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL AEROSPACE ROBOTICS FOR WELDING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL AEROSPACE ROBOTICS FOR PAINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL AEROSPACE ROBOTICS FOR INSPECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL AEROSPACE ROBOTICS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. NORTH AMERICAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

20. NORTH AMERICAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. EUROPEAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. EUROPEAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. EUROPEAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

24. EUROPEAN AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. REST OF THE WORLD AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. REST OF THE WORLD AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

32. REST OF THE WORLD AEROSPACE ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL AEROSPACE ROBOTICS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL ARTICULATED AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL CARTESIAN AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SCARA AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL OTHER AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL AEROSPACE ROBOTICS MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

7. GLOBAL TRADITIONAL AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL COLLABORATIVE AEROSPACE ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL AEROSPACE ROBOTICS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL AEROSPACE ROBOTICS FOR ASSEMBLING & DISASSEMBLING MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL AEROSPACE ROBOTICS FOR DRILLING MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL AEROSPACE ROBOTICS FOR WELDING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL AEROSPACE ROBOTICS FOR PAINTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL AEROSPACE ROBOTICS FOR INSPECTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL AEROSPACE ROBOTICS FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL AEROSPACE ROBOTICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

19. UK AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD AEROSPACE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)