Agricultural Biologicals Market

Agricultural Biologicals Market Size, Share & Trends Analysis Report by Product (Biopesticides, Bio stimulants, and Biofertilizers), by Application (Foliar Spray, Seed Treatment, Soil Treatment, and Post-Harvest), and by Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others) Forecast Period (2025-2035)

Industry Overview

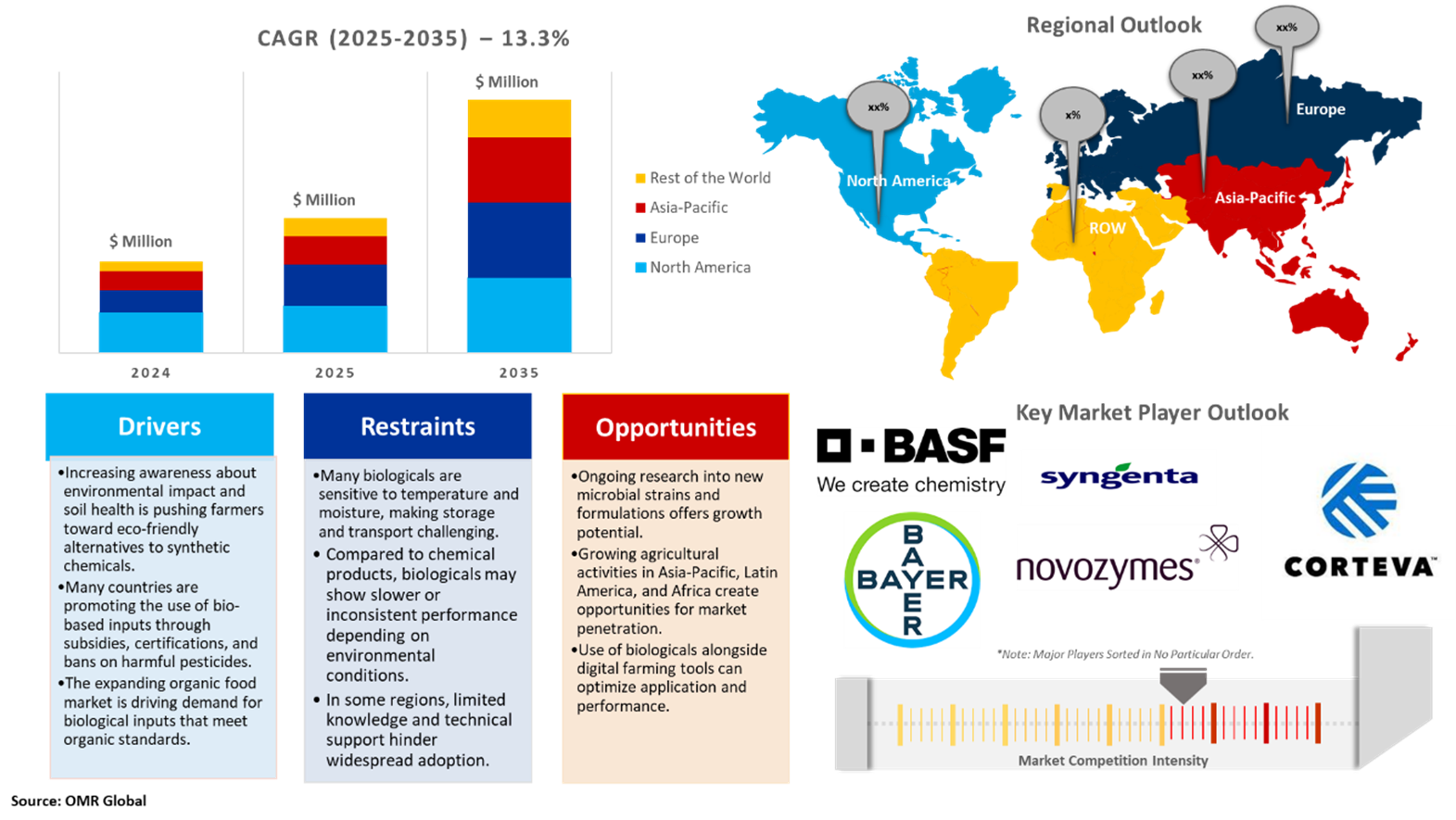

Agricultural biologicals market, estimated at $17.1 billion in 2024, is projected to grow to $66.5 billion with a CAGR of 13.3% during the forecast period (2025–2035). Global agricultural biologicals market focuses on the production of products that are of organic origin, such as microorganisms, plant extracts, and other useful insects. Products such as biopesticides, biofertilizers, and biostimulants are gaining popularity as they not only enhance crop productivity and protect plants but also improve soil health. Farmers are responding to the surge in sustainable and organic farming demand by adopting environmental solutions. Growing consumer interest in organic food, along with stricter regulations on chemical pesticides and fertilizers, is driving market growth while promoting a lower environmental impact in agriculture.

Other companies with leadership positions, including Novozymes (partnering with Bayer), Syngenta Crop Protection, Corteva Agriscience, and BASF SE, are innovating and investing heavily in research and development to launch new biological solutions in the market. The government organizations and bodies, such as the Food and Agriculture Organization (FAO) and the European Union, especially in their programs such as Integrated Pest Management (IPM), are also supporting in encouraging more adoption of such products, as these further fuel the market growth.

Market Dynamics

Demand for Sustainable Agricultural Biologicals

The agricultural biologicals market is witnessing an increasing demand for sustainable and organic inputs as alternatives to chemical-based inputs. There has been a remarkable rise in innovations and collaborations within the agricultural biologicals market. Both government and industry statistics indicate that the rising consumer awareness of environmental concerns, such as soil erosion, water pollution, and biodiversity extinction, is one of the contributing factors that have led to the use of eco-friendly products such as bio pesticides and bio fertilizers. This movement is also supported by government regulations and programs from organizations such as the FAO and the European Union that promote integrated pest management and a reduction in chemical usage. In 2024, Syngenta Crop Protection reported that its biologicals portfolio had grown by over 20% compared to the previous year. Biologicals now account for more than 7% of the company’s total global crop protection sales. Also, Novozymes, the global leader in biological solutions, reported that its BioAg business unit had achieved sales of DKK 2.1 billion (around $300 million) in 2023, indicating farmer acceptance of microbial and enzyme products. These data, provided by the prominent companies, accentuate the high level of market dynamics and the increasing interest in sustainable agricultural technologies.

Digital Integration and Innovation Fuel Growth in Agricultural Biologicals

The rapid integration of biological products with digital and precision agriculture tools is under exploration by companies and research organizations. They are investigating data-driven platforms to enhance the precise application of bio-pesticides, bio-fertilizers, and bio-stimulants. This approach aims to ensure that the right product is applied at the right time and in the right mode. This combination not only improves the effectiveness of the biological but also supports the farmers in making better decisions to maximize production and efficiency of the resources. According to the European Bio stimulants Industry Council (EBIC), in 2024, the demand for bio stimulants in Europe increased more than 12%, especially in the cereal and vegetable sectors. This trend is fueled by changing weather patterns and the need for strong agricultural systems, prompting leading industry players to focus on new formulations and collaborative partnerships to address these challenges. As a result, bio-stimulants are emerging as essential components of sustainable agricultural practices, offering eco-friendly alternatives to enhance productivity and improve crop quality in the face of climate change.

Market Segmentation

- Based on the product, the market is segmented into biopesticides (biochemicals, microbials), bio stimulants (acid-based, seaweed extract, microbials, others), and bio fertilizers (nitrogen fixation, phosphate solubilizing, others).

- Based on the application, the market is segmented into foliar spray, seed treatment, soil treatment, and post-harvest.

- Based on the crop type, the market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others.

Cereals & Grains Dominate Agricultural Biologicals Market

The agricultural biologicals market is dominated by cereals and grains as they are produced on a large scale, and their yield needs sustainable yield practices along with stricter regulations concerning chemical formulations. For instance, in India, the use of biological products in rice fields increased by 47% in 2023-24, covering about 8.2 million hectares. In wheat fields, using microbial mixtures helped increase crop yields by 18-23%, which reduced the need for chemical fertilizers by up to 35%. Similarly, in Brazil expansion of bio-fertilizers, such as azotobacter, improved the production of cereals, whereby they are less dependent on fertilizers composed of nitrogen. Larger firms such as Novozymes (a Bayer partner company), Syngenta Crop Protection, Corteva Agriscience, and BASF SE are also majorly involved in investing in research to come up with biological solutions, especially in crop biology. Also, programs and organizations of governments, such as the FAO and regional agricultural bodies, facilitate the adoption of integrated pest management and organic farming practices. Such initiatives highlight and enhance the position of cereals and grains as primary focus areas for agricultural biologicals.

Regional Outlook

The global agricultural biologicals market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is Anticipated to Fastest the Growing Region

The Asia-Pacific region is expected to experience the fastest growth in the agricultural biologicals market due to a combination of government support, robust organic farming initiatives, and a rapidly expanding consumer base for sustainably grown food. Other large organizations such as Biolchim SpA, Coromandel International Ltd, Gujarat State Fertilizers & Chemicals Ltd, Indian Farmers Fertilizer Cooperative Ltd., and Koppert Biological Systems Inc. are in the process of increasing their presence in the region and developing new products. China is the market leader in the region due to its strategy of a green food system, accompanied by massive investments in research and development of biological solutions. India plays a significant role in organic farming, supported by initiatives such as Paramparagat Krishi Vikas Yojana and the All-India Network Programmed on Organic Farming, driving widespread adoption of biologicals among its 1.3 million organic producers.

Market Players Outlook

The major companies operating in the global agricultural biologicals market include BASF SE, Bayer AG, Corteva Inc., Novozymes A/S, and Syngenta AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2025, Syngenta Crop Protection and Ceres Biotics signed an agreement to provide advanced biological solutions to farmers globally, to increase farmer access to VIXERAN, an innovative bio-stimulant based on endophytic bacteria. This agreement helps farmers to optimize nitrogen fertilizer usage, transition to more sustainable farming practices, and maintain their yield targets.

- In February 2025, Syngenta announced its acquisition of Novartis's repository of natural compounds and genetic strains intended for agricultural use. This acquisition coincides with the opening of Syngenta’s new biological production facility in Orangeburg, South Carolina. This facility is the first of its kind in the U.S., designed for the large-scale production of agricultural biologicals, and will help meet the increasing demand for innovative, science-based biological solutions in both North American and Latin American markets.

- In February 2024, Certis Biologicals and SDS Biotech K.K. declared a collaboration to develop and commercialize agricultural biological products. This collaboration leverages SDS Biotech's expertise in researching, advancing, and producing agricultural solutions, along with Certis’ proficiency in developing and marketing biocontrol products. Their shared goal is to find solutions to the evolving challenges faced by farmers and the agricultural industry.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural biologicals market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Agricultural Biologicals Market Sales Analysis – Product | Application | Crop Type ($ Million)

• Agricultural Biologicals Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Agricultural Biologicals Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Agricultural Biologicals Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Agricultural Biologicals Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For Global Agricultural Biologicals Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Agricultural Biologicals Market Revenue and Share by Manufacturers

• Agricultural Biologicals Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bayer AG

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Corteva, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Novozymes A/S

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Syngenta Crop Protection AG

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Agricultural Biologicals Market Sales Analysis by Product ($ Million)

5.1. Biopesticides

5.1.1. Biochemicals

5.1.2. Microbials

5.2. Bio Stimulants

5.2.1. Acid based

5.2.2. Seaweed extract

5.2.3. Microbials

5.2.4. Others

5.3. Biofertilizers

5.3.1. Nitrogen Fixation

5.3.2. Phosphate Solubilizing

5.3.3. Others

6. Global Agricultural Biologicals Market Sales Analysis by Application ($ Million)

6.1. Foliar Spray

6.2. Seed Treatment

6.3. Soil Treatment

6.4. Post-Harvest

7. Global Agricultural Biologicals Market Sales Analysis by Crop Type ($ Million)

7.1. Cereals & Grains

7.2. Oilseeds & Pulses

7.3. Fruits & Vegetables

7.4. Others

8. Regional Analysis

8.1. North American Agricultural Biologicals Market Sales Analysis – Product | Application | Crop Type | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Agricultural Biologicals Market Sales Analysis – Product | Application | Crop Type | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Agricultural Biologicals Market Sales Analysis – Product | Application | Crop Type | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Agricultural Biologicals Market Sales Analysis – Product | Application | Crop Type | Country ($ Million)

• Macroeconomic Factors for Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. AGRAUXINE BY LESAFFRE

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. ATLÁNTICA AGRÍCOLA, S.A.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BASF SE

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Bayer AG

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Biolchim SPA

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Corteva Agriscience

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. FMC Corp.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Fyteko

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Gowan Company, L.L.C.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. HAIFA GROUP

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Indigo Ag Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Koppert

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Lallemand Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Novozymes A/S

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Nufarm

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. OMEX Agriculture Ltd.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. PI INDUSTRIES LTD.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. STK BIO-AG TECHNOLOGIES

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Sumitomo Chemical India Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Syngenta Crop Protection AG

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. UPL Ltd.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. VALENT BIOSCIENCES LLC

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Vegalab SA

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

1. Global Agricultural Biologicals Market Research and Analysis By Product, 2024-2035 ($ Million)

2. Global Agricultural Biopesticides Market Research and Analysis By Region, 2024-2035 ($ Million)

3. Global Agricultural Biochemicals Market Research and Analysis By Region, 2024-2035 ($ Million)

4. Global Agricultural Microbials Market Research and Analysis By Region, 2024-2035 ($ Million)

5. Global Agricultural Bio Stimulants Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Acid-Based Agricultural Bio stimulants Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Seaweed Extract Agricultural Bio stimulants Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Microbial Agricultural Biologicals Market Research and Analysis By Region, 2024-2035 ($ Million)

9. Global Others Agricultural Bio Stimulants Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Agricultural Biofertilizers Market Research and Analysis By Region, 2024-2035 ($ Million)

11. Global Agricultural Nitrogen Fixation Market Research and Analysis By Region, 2024-2035 ($ Million)

12. Global Agricultural Phosphate Solubilizing Market Research and Analysis By Region, 2024-2035 ($ Million)

13. Global Others Agricultural Biofertilizers Market Research and Analysis By Region, 2024-2035 ($ Million)

14. Global Agricultural Biologicals Market Research and Analysis By Application, 2024-2035 ($ Million)

15. Global Agricultural Biologicals For Foliar Spray Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Agricultural Biologicals For Seed Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Agricultural Biologicals For Soil Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Agricultural Biologicals For Post-Harvest Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Agricultural Biologicals Market Research and Analysis By Crop Type, 2024-2035 ($ Million)

20. Global Agricultural Biologicals For Cereals & Grains Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Agricultural Biologicals For Oilseeds & Pulses Market Research And Analysis By Region, 2024-2035 ($ Million)

22. Global Agricultural Biologicals For Fruits & Vegetable Market Research and Analysis By Region, 2024-2035 ($ Million)

23. Global Agricultural Biologicals For Other Crop Type Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Agricultural Biologicals Market Research and Analysis By Region, 2024-2035 ($ Million)

25. North America Agricultural Biologicals Market Research and Analysis by Country, 2024-2035 ($ Million)

26. North America Agricultural Biologicals Market Research and Analysis by Product, 2024-2035 ($ Million)

27. North America Agricultural Biologicals Market Research and Analysis by Application, 2024-2035 ($ Million) 120

28. North America Agricultural Biologicals Market Research and Analysis by Crop Type, 2024-2035 ($ Million)

29. Europe Agricultural Biologicals Market Research and Analysis by Country, 2024-2035 ($ Million)

30. Europe Agricultural Biologicals Market Research and Analysis by Product, 2024-2035 ($ Million)

31. Europe Agricultural Biologicals Market Research and Analysis by Application, 2024-2035 ($ Million)

32. Europe Agricultural Biologicals Market Research and Analysis by Crop Type, 2024-2035 ($ Million)

33. Asia-Pacific Agricultural Biologicals Market Research and Analysis by Country, 2024-2035 ($ Million)

34. Asia-Pacific Agricultural Biologicals Market Research and Analysis by Product, 2024-2035 ($ Million)

35. Asia-Pacific Agricultural Biologicals Market Research and Analysis by Application, 2024-2035 ($ Million)

36. Asia-Pacific Agricultural Biologicals Market Research and Analysis by Crop Type, 2024-2035 ($ Million)

37. The Rest of the World Agricultural Biologicals Market Research and Analysis by Region, 2024-2035 ($ Million)

38. The Rest of the World Agricultural Biologicals Market Research and Analysis by Product, 2024-2035 ($ Million)

39. The Rest of the World Agricultural Biologicals Market Research and Analysis by Application, 2024-2035 ($ Million)

40. The Rest of the World Agricultural Biologicals Market Research and Analysis by Crop Type, 2024-2035 ($ Million)

1. Global Agricultural Biologicals Market Research and Analysis By Product, 2024 Vs 2035 (%)

2. Global Agricultural Biopesticides Market Research and Analysis By Region, 2024 Vs 2035 (%)

3. Global Agricultural Biochemicals Market Research and Analysis By Region, 2024 Vs 2035 (%)

4. Global Agricultural Microbials Market Research and Analysis By Region, 2024 Vs 2035 (%)

5. Global Agricultural Bio stimulants Market Research And Analysis By Region, 2024 Vs 2035 (%)

6. Global Acid-Based Agricultural Bio stimulants Market Research And Analysis By Region, 2024 Vs 2035 (%)

7. Global Seaweed Extract Agricultural Bio stimulants Market Research And Analysis By Region, 2024 Vs 2035 (%)

8. Global Microbial Agricultural Biologicals Market Research and Analysis By Region, 2024 Vs 2035 (%)

9. Global Others Agricultural Bio Stimulants Market Research And Analysis By Region, 2024 Vs 2035 (%)

10. Global Agricultural Biofertilizers Market Research and Analysis By Region, 2024 Vs 2035 (%)

11. Global Agricultural Nitrogen Fixation Market Research and Analysis By Region, 2024 Vs 2035 (%)

12. Global Agricultural Phosphate Solubilizing Market Research and Analysis By Region, 2024 Vs 2035 (%)

13. Global Others Agricultural Biofertilizers Market Research and Analysis By Region, 2024 Vs 2035 (%)

14. Global Agricultural Biologicals Market Research and Analysis By Application, 2024 Vs 2035 (%)

15. Global Agricultural Biologicals For Foliar Spray Market Research And Analysis By Region, 2024 Vs 2035 (%)

16. Global Agricultural Biologicals For Seed Treatment Market Research And Analysis By Region, 2024 Vs 2035 (%)

17. Global Agricultural Biologicals For Soil Treatment Market Research And Analysis By Region, 2024 Vs 2035 (%)

18. Global Agricultural Biologicals For Post-Harvest Market Research And Analysis By Region, 2024 Vs 2035 (%)

19. Global Agricultural Biologicals Market Research and Analysis By Crop Type, 2024 Vs 2035 (%)

20. Global Agricultural Biologicals For Cereals & Grains Market Research And Analysis By Region, 2024 Vs 2035 (%)

21. Global Agricultural Biologicals For Oilseeds & Pulses Market Research And Analysis By Region, 2024 Vs 2035 (%)

22. Global Agricultural Biologicals For Fruits & Vegetable Market Research and Analysis By Region, 2024 Vs 2035 (%)

23. Global Agricultural Biologicals For Other Crop Type Market Research And Analysis By Region, 2024 Vs 2035 (%)

24. Global Agricultural Biologicals Market Share By Region, 2024 Vs 2035 (%)

25. US Agricultural Biologicals Market Size, 2024-2035 ($ Million)

26. Canada Agricultural Biologicals Market Size, 2024-2035 ($ Million)

27. UK Agricultural Biologicals Market Size, 2024-2035 ($ Million)

28. France Agricultural Biologicals Market Size, 2024-2035 ($ Million)

29. Germany Agricultural Biologicals Market Size, 2024-2035 ($ Million)

30. Italy Agricultural Biologicals Market Size, 2024-2035 ($ Million)

31. Spain Agricultural Biologicals Market Size, 2024-2035 ($ Million)

32. Russia Agricultural Biologicals Market Size, 2024-2035 ($ Million)

33. Rest of Europe Agricultural Biologicals Market Size, 2024-2035 ($ Million)

34. India Agricultural Biologicals Market Size, 2024-2035 ($ Million)

35. China Agricultural Biologicals Market Size, 2024-2035 ($ Million)

36. Japan Agricultural Biologicals Market Size, 2024-2035 ($ Million)

37. South Korea Agricultural Biologicals Market Size, 2024-2035 ($ Million)

38. Australia and New Zealand Agricultural Biologicals Market Size, 2024-2035 ($ Million)

39. ASEAN Economies Agricultural Biologicals Market Size, 2024-2035 ($ Million)

40. Rest Of Asia-Pacific Agricultural Biologicals Market Size, 2024-2035 ($ Million)

41. Latin America Agricultural Biologicals Market Size, 2024-2035 ($ Million)

42. Middle East and Africa Agricultural Biologicals Market Size, 2024-2035 ($ Million)

FAQS

The size of the Agricultural Biologicals market in 2024 is estimated to be around $17.1 billion.

Asia Pacific holds the largest share in the Agricultural Biologicals market.

Leading players in the Agricultural Biologicals market include BASF SE, Bayer AG, Corteva Inc., Novozymes A/S, and Syngenta AG, among others.

Agricultural Biologicals market is expected to grow at a CAGR of 13.3% from 2025 to 2035.

Increasing demand for sustainable farming practices, rising adoption of organic food, and regulatory support for eco-friendly crop protection are driving the agricultural biologicals market growth.