Agriculture Crop Insurance Market

Agriculture Crop Insurance Market & Trends Analysis Report by Coverage (Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance, and Livestock Insurance) by Distribution Channel (Banks , Insurance Companies, Brokers/Agents, and Others) Forecast Period (2022-2028)

Agriculture crop insurance market is anticipated to grow at a CAGR of 6.1% during the forecast period. The introduction of technologies such as satellites, drones, the Internet of Things (IoT), artificial intelligence, mobile application, and other web-based platforms drives the growth of the agriculture crop insurance market. This is attributed to the fact that these technologies enable detection of diseased crops, prediction of weather, storage of data related to crops & micro-level information about the size & condition of land for harvesting crops. Expansion of existing product lines and services offered by crop insurance providers to their customers along various government initatives for supporting the farmers' aganist fluctuation in prices, and yields fuel the growth of the global agriculture crop insurance market during the forecast period. For instance, the Department of Fertilizers has approved a subsidy of $ 76.24 million to provide Nutrient Based Subsidy (NBS) rates for Phosphatic and Potassic (P&K) fertilizers to the farmers.

Further, the presence of prominent players that are highly focused on the development of agriculture crop insurance services is expected to drive market growth. In December 2020, Sompo International Holdings Ltd. (SIH), announced that it has completed the acquisition of Diversified Crop Insurance Services (DCIS) a subsidiary of CGB Enterprises, Inc. (CGB). DCIS and ARMtech, Sompo International’s existing US federally sponsored multi-peril crop insurer, now operate under the brand name AgriSompo North America. Through a deep-rooted commitment to customer service, AgriSompo North America works to make a long-lasting impact on the nation’s farmers and ranchers, and become a premier market-leading multinational crop insurance and reinsurance company.

Segmental Outlook

The global agriculture crop insurance market is segmented based on coverage and distribution channels. Based on coverage, the market is sub-segmented into multi-peril crop insurance (mpci), crop-hail insurance, and livestock insurance. Based on the distribution channel the market is bifurcated into banks, insurance companies, brokers/agents, and others. Based on coverage the multi-peril crop insurance segment is expected to grow at a significant rate, owing to increasing unavoidable damages from insects and disease, rising number of crop fire incidents, and destructive weather condition such as hail, frost, damaging wind, are contributed to the market growth. For instance, as per Congressional Research Serivce, from 2012 to 2021, there were an average of 61,289 wildfires annually and an average of 7.4 million acres impacted annually. In 2021, 58,968 wildfires burned 7.1 million acres. Moreover, the presence of key players Sentera, NAU, and 6.7.Philippine Crop Insurance Corp that adopted various strategies such as partnership, expansion, and technological advacements will further boost the market growth. For instance, in January 2022, NAU Country Signs Deal with Agriculture Intelligence for Agroview, the Next Innovation for Crop Insurance.

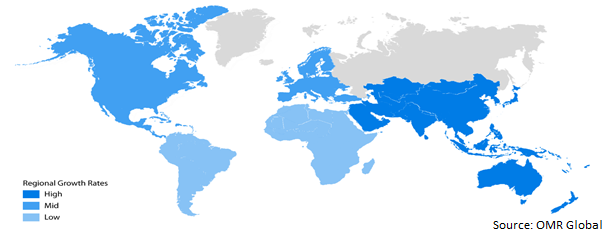

Regional Outlooks

The global agriculture crop insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The North American region has witnessed considerable growth in the market. The major factor that contributed to the market growth are increasing government initiatives to promote agriculture insurance coverage and rising natural disasters in the region is expected to boost the market growth. The Federal Crop Insurance Program was conducted in the US in 2019, among which the program sold more than 2 million policies and insured crops and livestock valued at more than $ 116 billion.

Global Agriculture Crop Insurance Market Growth, by Region 2022-2028

The Asia-Pacific is the Growing Region in the Global Agriculture Crop Insurance Market

The Asia-Pacific is projected to grow at a considerable rate during the forecast period. The growth is mainly augmented owing to increasing farmers and ranchers in the region aspiring to develop and maintain economic crop production by procuring prominent crop insurance coverage. Furthermore, the presence of well-established insurance vendors that provides a range of insurance services, and introduced new advanced technology products to the farmers against crop loss, drives the market growth. For instance, in June 2022, Agriculture Insurance Company of India Limited (AICIL), has signed a three-year agreement with Wingsure, to use Wingsure advanced technology capabilities to significantly strengthen the accessibility of insurance products and services to farmers in India; curate and promote the company’s comprehensive portfolio of agriculture insurance products and enable its channels, including groups and partner brokers, to distribute on its mobile app.

Market Players Outlook

The major companies serving the global agriculture crop insurance market include Chubb’s, Great American Insurance Group, ICICI Lombard General Insurance Co. Ltd., QBE Insurance Group Ltd., Zurich American Insurance Co., AXA XL, Bajaj Allianz General Insurance Co. Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In May 2022, the Philippines with the support of ADB, Asian Development Bank, launched its first public-private partnership on crop insurance a move that could revolutionize the country’s agriculture insurance industry.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agriculture crop insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Chubb’s

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Great American Insurance Group

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. ICICI Lombard General Insurance Co. Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. QBE Insurance Group Ltd.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Zurich American Insurance Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Agriculture Crop Insurance Market by Coverage

4.1.1. Multi-peril Crop Insurance (MPCI)

4.1.2. Crop-hail Insurance

4.1.3. Livestock Insurance

4.2. Global Agriculture Crop Insurance Market by Distribution Channel

4.2.1. Banks

4.2.2. Insurance Companies

4.2.3. Brokers/Agents

4.2.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agriculture Insurance Co. of India Ltd. (AIC)

6.2. AXA XL

6.3. Bajaj Allianz General Insurance Co. Ltd.

6.4. Future Generali India Insurance Co. Ltd.

6.5. Great American Insurance Group

6.6. National Crop Insurance Services

6.7. Philippine Crop Insurance Corp

6.8. Sompo International Holdings Ltd

6.9. Tokio Marine HCC

1. GLOBAL AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

2. GLOBAL MULTI-PERIL AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL AGRICULTURE CROP HAIL AGRICULTURE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AGRICULTURE LIVESTOCK CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

6. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN BANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN INSURANCE COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE THROUGH BROKERS/AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN OTHER DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL , 2021-2028 ($ MILLION)

14. EUROPEAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

16. EUROPEAN AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

20. REST OF THE WORLD AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD AGRICULTURE CROP INSURANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. GLOBAL AGRICULTURE CROP INSURANCE MARKET SHARE BY COVERAGE, 2021 VS 2028 (%)

2. GLOBAL MULTI-PERIL AGRICULTURE CROP INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL AGRICULTURE CROP HAIL INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL AGRICULTURE LIVESTOCK CROP INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL AGRICULTURE CROP INSURANCE MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

6. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN BANKS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN INSURANCE COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE THROUGH BROKERS/AGENTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL AGRICULTURE CROP INSURANCE AVAILABLE IN OTHER DISTRIBUTION CHANNEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL AGRICULTURE CROP INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

13. UK AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD AGRICULTURE CROP INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)