Air Freight Market

Air Freight Market Size, Share & Trends Analysis Report by Service (Freight, Express, Mail and Other Services), by Destination (Domestic and International), by Carrier Type (Belly Cargo and Freighter), and by End-user (Private andCommercial) Forecast Period (2024-2031)

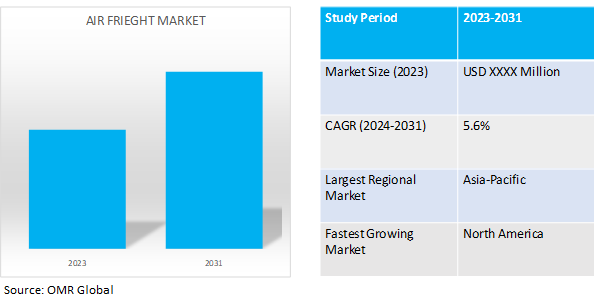

Air freight market is anticipated to grow at a considerable CAGR of 5.6% during the forecast period (2024-2031). The air freight market plays a pivotal role in global trade and commerce, serving as a vital link in the supply chain for businesses across various industries. This dynamic sector encompasses the transportation of goods by air, offering speed, reliability, and efficiency for time-sensitive shipments.

Market Dynamics

Faster Delivery of Shipments

The delivery of items through cargo planes is the fastest among other modes of transportation. While different types of vehicles, such as shipping, rail, or road transport, can take days or weeks to deliver things, air transport can do so in hours. Because there are more miniature goods to offload than cargo ships, customs clearance is rapid, and local warehousing is not required. Furthermore, air freight is the safest means of transport among the others as the items delivered by air undergo minimal handling, and airport safety standards are tightly enforced. The risk of theft and damage to the package is reduced. Furthermore, due to the short duration of the shipment, air freight insurance costs are typically modest.The growing adoption of air cargo delivery option owing to its offered benefits is a key factor driving the growth of the global market.

Rising Popularity of Consolidated Air Freight Service

Four delivery alternatives are available from air freight service companies. Charter, standard, postponed, and consolidated are the four options. Consolidated air freight service provides users with a cost-effective mode of transportation that benefits from lower prices and consistent timetables, allowing them to arrange their supply chains flawlessly.Clients who choose the Consolidated air freight option can combine their shipment with numerous other items to produce a full load. Consolidated air freight becomes a very cost-effective way to transport goods by plane. Furthermore, transportation service firms and airlines benefit from consolidated shipments since flying an airplane with a full cargo load is more cost-effective than flying an aircraft with a partial cargo load. Consolidated air freight is the most cost-effective way to send goods faster and safer, and the increased popularity of this service is likely to propel the global market forward over the forecast period.

Market Segmentation

Our in-depth analysis of the global air freight market includes the following segments by service, destination, carrier type, and end-user:

- Based on service, the market is sub-segmented into freight, express, mail and other services.

- Based on destination, the market is bifurcated into domestic and international.

- Based on carrier type, the market is augmented into belly cargo and freighter.

- Based on end-user, the market is sub-segmented into private and commercial.

Domestic Segment is Projected to Emerge as the Largest Segment

The domestic segment is the dominant segment.The domestic air freight segment is the fastest-growing segment in the market. Domestic air freight refers to the movement of goods within a country. The growth of the domestic air freight market is attributed to the increasing need for fast and reliable delivery of goods within the country. The rise in domestic e-commerce, the expansion of the retail industry, and the growth of the manufacturing sector have fueled the demand for domestic air freight services. The domestic air carrier can closely check flight schedules and link connecting flights as soon as the delivery request is made. Air freight firms also establish a national air charter that employs an aircraft to deliver any specific order. Moreover, charter freight services allow the companies to address emergency deliveries and provide them a standby preference in case standard freight cannot be arranged.

Commercial Sub-segment to Hold a Considerable Market Share

The extensive utilization of air freight by commercial end users, such as manufacturers, retailers, wholesalers, and other industries to transport their goods efficiently is propelling the market growth. For instance, ATA's e-commerce monitor revealed that 18.0% of air cargo comprised e-commerce shipments—a figure expected to rise as consumer behaviors evolve. The air cargo industry, boasting global networks, adaptable capacity, and digitalization initiatives, stands well-equipped to bolster e-commerce growth. These initiatives promise to augment operational efficiency and shipment visibility throughout transit.

Regional Outlook

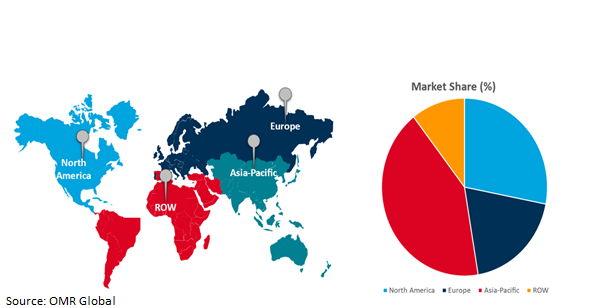

The globalair freightmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). North Americais anticipated to exhibit considerable growth during the forecast period.. Presence of large scaled organizations in the region is estimated to generate rewarding opportunities in the market. Financial support and initiatives by the government is anticipated to drive market expansion. Increasing presence of e-commerce channels and websites that promise fast delivery is anticipated to facilitate market progress. Focus on optimization of supply chains by the air freight companies is estimated to drive market growth in the region.

Global Air Freight Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant market share. The Asia-Pacific region includes China, India, Japan, South Korea, and the rest of Asia-Pacific. Increased growth of the e-commerce industry throughout Asia-Pacific further increases the development of the air freight market over the forecast period. China holds the majority of the Asia-Pacific air freight market share. Moreover, an increase in global demand for automotive and electronics parts is expected to boost the direction of air freight. Furthermore, the improving economy of Japan, development of infrastructure, and rise in trade facilitation through agreements, such as the South Asian Preferential Trade Agreement (SAPTA), further support the growth of the air freight market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global air freightmarket includeFedEx (Federal Express) Corporation, United Parcel Service Inc., The Emirates Group, Cathay Pacific Airways Limited, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in May 2023, FedEx launched FedEx Sustainability Insights for customer emissions tracking. This cloud-based engine uses near-real-time FedEx network data to estimate CO2e emissions for both individual tracking numbers and FedEx.com accounts.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.Annualized

- market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global air freightmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cathay Pacific Airways Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. FedEx (Federal Express) Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Emirates Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. United Parcel Service Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Air Freight Market by Service

4.1.1. Freight

4.1.2. Express

4.1.3. Mail

4.1.4. Other Services

4.2. Global Air Freight Market by Destination

4.2.1. Domestic

4.2.2. International

4.3. Global Air Freight Market by Carrier Type

4.3.1. Belly Cargo

4.3.2. Freighter

4.4. Global Air Freight Market by End-user

4.4.1. Private

4.4.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AirBridgeCargo Airlines

6.2. All Nippon Airways Co. Ltd (ANA)

6.3. American Airlines

6.4. Azul Airlines

6.5. Cargojet Inc.

6.6. Cargolux Airlines International SAa

6.7. China Airlines Ltd

6.8. Copa Airlines*

6.9. Delta Airlines

6.10. Deutsche Lufthansa AG

6.11. Deutsche Post DHL

6.12. Gol Airlines

6.13. International Consolidated Airlines Group SA

6.14. Japan Airlines Co. Ltd.

6.15. Kuehne + Nagel International AG

6.16. LATAM Airlines

6.17. Magma Aviation Limited

6.18. Qatar Airways Company QCSC

6.19. United Airlines

1. GLOBAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

2. GLOBAL AIR FREIGHT SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AIR FREIGHT EXPRESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AIR FREIGHT MAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AIR FREIGHT OTHER SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY DESTINATION, 2023-2031 ($ MILLION)

7. GLOBAL AIR FREIGHT IN DOMESTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AIR FREIGHT IN INTERNATIONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY CARRIER TYPE, 2023-2031 ($ MILLION)

10. GLOBAL AIR FREIGHT FOR BELLY CARGO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AIR FREIGHT FOR FREIGHTER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. GLOBAL PRIVATE AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL COMMERCIAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY DESTINATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY CARRIER TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

21. EUROPEAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY DESTINATION, 2023-2031 ($ MILLION)

22. EUROPEAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY CARRIER TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY DESTINATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY CARRIER TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY DESTINATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY CARRIER TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AIR FREIGHT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL AIR FREIGHT MARKETSHARE BY SERVICE, 2023 VS 2031 (%)

2. GLOBAL AIR FREIGHT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AIR FREIGHT EXPRESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AIR FREIGHT MAIL SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AIR FREIGHT Other Services MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AIR FREIGHT MARKET SHARE BY DESTINATION, 2023 VS 2031 (%)

7. GLOBAL AIR FREIGHT IN DOMESTIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AIR FREIGHT IN INTERNATIONAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AIR FREIGHT MARKET SHARE BY CARRIER TYPE, 2023 VS 2031 (%)

10. GLOBAL AIR FREIGHT FOR BELLY CARGO MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AIR FREIGHT FOR FREIGHTER MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AIR FREIGHT MARKET SHARE BY END-USER, 2023 VS 2031 (%)

13. GLOBAL PRIVATE AIR FREIGHT MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL COMMERCIAL AIR FREIGHT MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AIR FREIGHT MARKETSHARE BY REGION, 2023 VS 2031 (%)

16. US AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

18. UK AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA AIR FREIGHT MARKET SIZE, 2023-2031 ($ MILLION)