Aircraft Electrical Systems Market

Global Aircraft Electrical Systems Market Size, Share & Trends Analysis Report by Component Type (Generators, Distribution Devices, Conversion Devices, and Battery Management Systems), By Platform (General Aviation, Commercial Aviation, and Military Aviation) and Forecast 2020-2026

The global market for aircraft electrical systems is projected to have considerable CAGR of around 5.5% during the forecast period. The market growth mainly driven by the growing demand of electrical systems in aircraft coupled with growth in the aviation industry. There is significant adoption of electrical systems for military and commercial aircraft systems and growth in research and rising investments for electrical aircraft systems that further propels the market growth. The electrical aircraft systems provides the energy efficiency aircraft systems that reduces emissions in the environment. Despite these benefits , aircraft electrical systems have some drawbacks include the requirement of power electronics to handle the increasing loads, and excess of heat created by losses within the electrical power chain. Therefore these drawbacks of aircraft electrical systems further projected to hamper the market growth.

Segmental Outlook

The global aircraft electrical systems market is segmented based on Component type and platform. Based on the component type, the market is further classified into generators, distribution devices, conversion devices, and battery management systems. Among component type, the generator segment is projected to grow significantly owing to the rising demand of power generation management in aircraft electrical systems. On the basis of industry the market is further segregated into general aviation, commercial aviation, and military aviation.

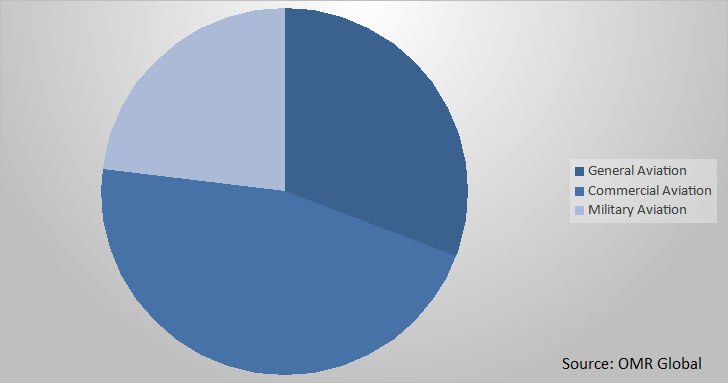

Global Aircraft Electrical Systems Market Share by Platform, 2019(%)

Global Aircraft Electrical Systems Market to be driven by Commercial Aviation

Among platform, the commercial segment held a considerable share in the market owing to increasing demand networks and electric solution in commercial aviation coupled with significant growth in the commercial aircraft industry. As per the World Bank, there were approximately 3.23 billion passengers traveled via air which further raised to 4.23 Billion passengers in 2018, thus such an increase in the number of passengers traveling via air supports the growth of the aviation industry. Moreover, the aircraft companies are installing various networking systems in commercial aircraft. For instance, in September 2019, Gogo Inc. announced that it has surpassed 1,500 total commercial aircraft installed and activated with satellite in-flight connectivity. As of September 1, 2019, the company had 1,262 aircraft installed and activated with 2Ku technology, 252 aircraft installed and activated with Ku technology. Therefore these advancement in the networking solution of the commercial aircraft further expected to grow the demand of aircraft electrical systems and contribute to the segmental growth.

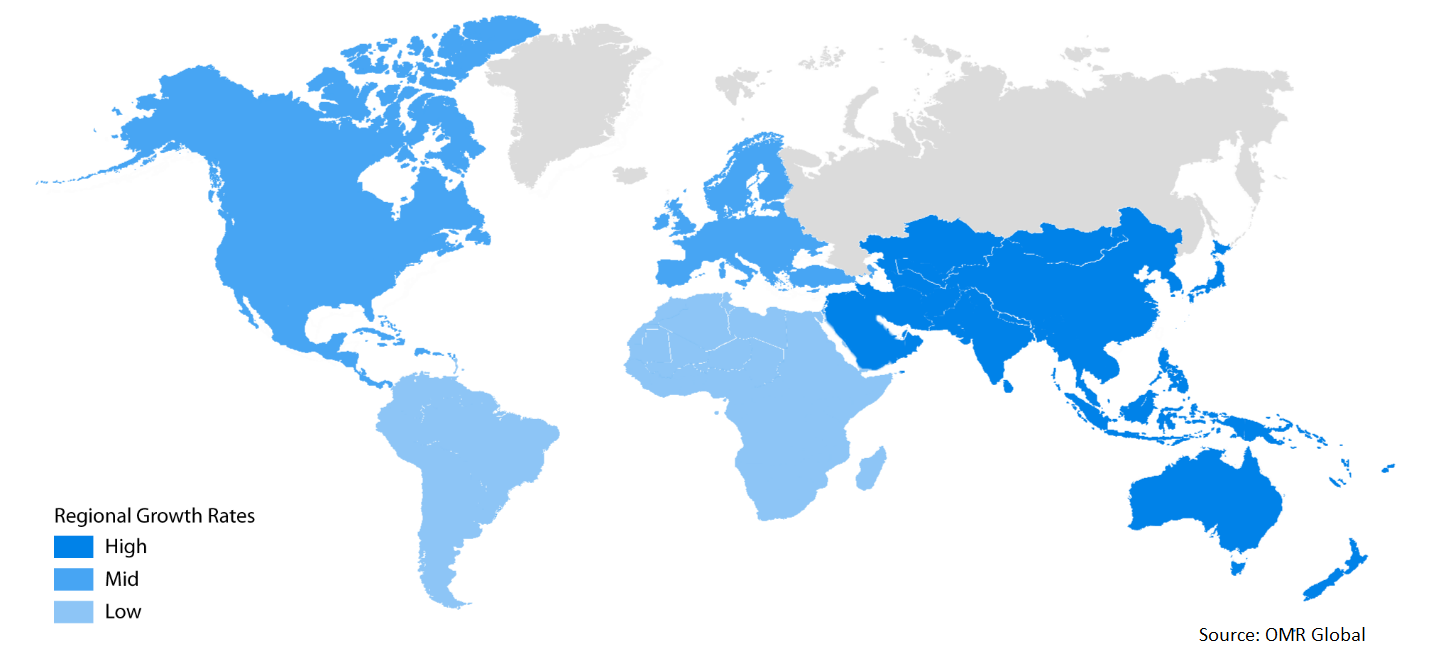

Regional Outlook

Geographically, the global aircraft electrical systems market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is projected to hold a significant market growth in the global aircraft electrical systems market during the forecast period. Major economies which are anticipated to contribute to Asia-Pacific aircraft electrical systems market include China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising demand of electrical systems in aircraft coupled with the growing aviation industry in the region. Additionally, as per the World Bank, the number of passengers in the countries such as India, Vietnam, China are also growing rapidly at a growth rate of 104%, 100% and 57% respectively, which directly fuels the growth of the aviation industry and in turn spurs the market growth during the forecast period.

Global Aircraft Electrical Systems Market Growth, by Region 2020-2026

North America to hold a considerable growth in the global aircraft electrical systems market

Geographically, North America have significant share in the global aircraft electrical systems market. The advancement of technological infrastructure of aviation industry in major economies of North America such as the US and Canada coupled with significant adoption of electrical systems in military aviation are further making a considerable contribution towards the market in the region. As per the General Aviation Manufacturers Association (GAMA), the general aviation flies for over 24 million hours annually, of which nearly two-thirds are for business purposes. Such an increase in air travel by business class is offering growth to the aviation industry in the US that further support the advancement in the electrical systems of aircraft in the region.

Market Players Outlook

The key players in the aircraft electrical systems market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Honeywell International Inc., General Electric Co., Safran S.A., Thales Group, Raytheon Technologies Corp., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft electrical systems market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Honeywell International Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Safran S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Thales Group

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Raytheon Technologies Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Aircraft Electrical Systems Market by Component Type

5.1.1. Generators

5.1.2. Distribution Devices

5.1.3. Conversion Devices

5.1.4. Battery Management Systems

5.2. Global Aircraft Electrical Systems Market by Platform

5.2.1. General Aviation

5.2.2. Commercial Aviation

5.2.3. Military Aviation

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Astronics Corp.

7.2. Amphenol Corp.

7.3. AMETEK.Inc.

7.4. Avionic Instruments, LLC

7.5. BAE Systems plc

7.6. Crane Aerospace & Electronics

7.7. Carlisle Companies Inc.

7.8. EaglePicher Technologies, LLC

7.9. General Electric Co.

7.10. Honeywell International Inc.

7.11. Hartzell Engine Technologies LLC

7.12. Meggitt PLC

7.13. Nabtesco Corp.

7.14. PBS AEROSPACE Inc.

7.15. Raytheon Technologies Corp.

7.16. Radiant Power Corp, A HEICO company

7.17. Safran S.A.

7.18. Thales Group

7.19. Transdigm Group, Inc.

7.20. TE Connectivity Ltd.

1. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL GENERATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL DISTRIBUTION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CONVERSION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL BATTERY MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

7. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS IN GENERAL AVIATION TAGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS IN COMMERCIAL AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS IN MILITARY AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

14. EUROPEAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

20. REST OF THE WORLD AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD AIRCRAFT ELECTRICAL SYSTEMS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2019-2026 ($ MILLION)

1. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET SHARE BY COMPONENT TYPE, 2019 VS 2026 (%)

2. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET SHARE BY PLATFORM, 2019 VS 2026 (%)

3. GLOBAL AIRCRAFT ELECTRICAL SYSTEMS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD AIRCRAFT ELECTRICAL SYSTEMS MARKET SIZE, 2019-2026 ($ MILLION)