Alternative Data Market

Alternative Data Market Size, Share & Trends Analysis Report by Data Type (Credit & Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage Web Scraped Data, Web Traffic, and Others), by Industry (Automotive, BFSI, Energy, Industrial, IT & Telecommunications, Retail, Transportation & Logistics, and Others), and by End-User (Hedge Fund Operators, Investment Institutions, and Retail Companies) Forecast Period (2024-2031)

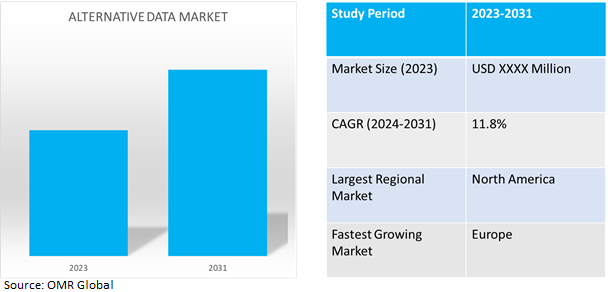

Alternative data market is anticipated to grow at a CAGR of 11.8% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of Alternative Data in asset management companies that developing their research instruments, making investments in automated data-gathering technologies, and forming partnerships with suppliers. With the increasing application of alternative data via online scraping and financial transactions compiling data from all available sources, corporations are actively enhancing their offering. Alternative data is frequently utilized in fields like compliance and risk management. Satellite photography can be used to monitor hazards to the environment, while credit card transaction data can be utilized to detect cases of fraud or money laundering.

Market Dynamics

Ensuring Data Quality and Integrating Multiple Datasets

Alternative data provide data quality and integrate multiple datasets for investment research objectives and their use such as the value they generate for their investment strategy before integrating them into their investment strategy. The data vendor plays a critical role in helping organizations evaluate alternative datasets. When data providers offer metrics on the completeness and quality of their data products, it could be easier for the business to determine whether to include them in their investment plan or not. Additionally, it provides an evaluation based on the strength of signals, scope and coverage of the data product, completeness and quality of the data product, and Risk-reward assessment.

Alternative Data for Alpha Generation, Risk Management, and Portfolio Optimization

Investors can optimize their portfolios with the use of alternative data, which gives them insights into the performance of various assets under various market conditions. By giving investors information about market patterns and company performance that standard data sources are unable to offer, alternative data can assist investors in generating alpha. By giving investors information about possible hazards that standard data sources are unable to provide, alternative data can assist investors in managing risk. Alternative data gives investors insights into their customers and operations, which can help them comply with regulations.

Market Segmentation

Our in-depth analysis of the global alternative data market includes the following segments by data type, industry, and end-users:

- Based on data type, the market is sub-segmented into credit & debit card transactions, Email receipts, geo-location (foot traffic) records, mobile application usage web scraped data, web traffic, and other (satellite & weather data, social & sentiment data).

- Based on industry, the market is sub-segmented into automotive, BFSI, energy, industrial, IT & telecommunications, retail, transportation & logistics, and others.

- Based on end-users, the market is sub-segmented into hedge fund operators, investment institutions, and retail companies.

Credit & Debit Card Transactions is Projected to Emerge as the Largest Segment

Based on the data type, the global alternative data market is sub-segmented into credit & debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage web scraped data, web traffic, and other (satellite & weather data, social & sentiment data). Among these, the credit & debit card transactions sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing investor demand for information combined with the abundance of credit card transaction data providers. Lenders can use alternative data for credit scores to inform loan approval decision data such as gig economy revenue, rent payment history, and utility bill payments. For instance, in March 2024, Nova Credit introduced an alternative credit data platform for lenders. This new platform provides a means for easy integration, efficient management, and insightful analysis of consumer credit data from alternative sources, adhering to consumer reporting agency standards.

Hedge Fund Operators Sub-segment to Hold a Considerable Market Share

Based on end-users, the global alternative data market is sub-segmented into hedge fund operators, investment institutions, and retail companies. Among these, the hedge fund operators sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the growing demand for hedge fund operators that use alternative data extensively to produce alpha including Bridgewater Associates, AQR Capital Management, Blackrock Advisors, and others. Hedge funds can gain distinct and prognostic insights into consumer and market behavior by utilizing alternative data including sentiment analysis on social media, web scraping for employment information, and analysis of satellite imagery.

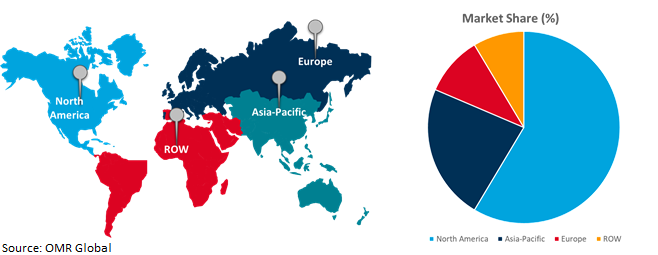

Regional Outlook

The global alternative data market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Alternative Data in Europe

- Pivotal factors, such as wide data availability, technological advancements, and increased demand from investors. Alternative data providers in the U.K. offer a wide range of data sets, including satellite imagery, social media sentiment, web scraping, and credit card transaction data.

- The alternative data market continues growing as more investors and companies recognize the value of non-traditional sources of information in decision-making. With the availability of high-quality data and the increasing demand for insight.

Global Alternative Data Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent technology companies such as Advan Research Corp., Eagle Alpha, M Science LLC, and UBS and research institutions specializing in alternative data and related technologies in the region. The increasing adoption of alternative data in end-user industries such as hedge fund operators, investment institutions, and retail companies accelerates the market growth in the region. For instance, in September 2022, Thinknum Alternative Data introduced its plan to combine data Similarweb, SensorTower, Thinknum, Caplight, and Pathmatics with Lagoon, a sophisticated infrastructure platform to deliver an alternative data source for investment research, due diligence, deal sourcing and origination, and post-acquisition strategies in private markets.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global alternative data market include Bloomberg L.P., DataRobot, Inc., FactSet Research Systems Inc., Nasdaq, Inc., and Snowflake Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In May 2023, Nikkei Inc. and QUICK collaborated on investment decisions other than information from traditional data sources, such as fundamentals (financial statements, earnings estimates, and others) and time series data (market pricing trends).

- In December 2021, Intercontinental Exchange, Inc. acquired risQ and Level 11 Analytics, which deploy sophisticated, data-driven technologies for managing climate change risk and expanding our alternative data capabilities in U.S. fixed-income, municipal, and mortgage-backed securities markets.

- In October 2021, Credit Information Corp. used alternative data to improve access to formal credit for the unbanked sector. The unbanked and underbanked sectors gained access to credit facilities during the webinar on optimizing alternative data for inclusive credit access.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alternative data market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dun & Bradstreet Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. FactSet Research Systems Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nasdaq, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Snowflake Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Alternative Data Market by Data Type

4.1.1. Credit & Debit Card Transactions

4.1.2. Email Receipts

4.1.3. Geo-location (Foot Traffic) Records

4.1.4. Mobile Application Usage

4.1.5. Web Scraped Data

4.1.6. Web Traffic

4.1.7. Other (Satellite & Weather Data, Social & Sentiment Data)

4.2. Global Alternative Data Market by Industry

4.2.1. Automotive

4.2.2. BFSI

4.2.3. Energy

4.2.4. Industrial

4.2.5. IT & Telecommunications

4.2.6. Retail

4.2.7. Transportation & Logistics

4.2.8. Other (Media & Entertainment, Real Estate & Construction)

4.3. Global Alternative Data Market by End-Users

4.3.1. Hedge Fund Operators

4.3.2. Investment Institutions

4.3.3. Retail Companies

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accelleran NV

6.2. Addepar, Inc.

6.3. AIERA, Inc.

6.4. Alphasense Inc.

6.5. BATTLEFIN GROUP, INC.

6.6. Bloomberg L.P.

6.7. DataRobot, Inc.

6.8. Estimize

6.9. Exabel AS

6.10. LSEG

6.11. OneMarketData, LLC

6.12. Orbital Insight

6.13. RavenPack International S.L.

6.14. RS Metrics

6.15. S&P Global Inc.

6.16. Sentieo, Inc.

6.17. Social Market Analytics, Inc.

6.18. Thinknum Alternative Data

6.19. YipitData

1. GLOBAL ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY DATA TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ALTERNATIVE CREDIT & DEBIT CARD TRANSACTIONS DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ALTERNATIVE EMAIL RECEIPTS DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ALTERNATIVE GEO-LOCATION (FOOT TRAFFIC) RECORDS DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ALTERNATIVE MOBILE APPLICATION USAGE DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ALTERNATIVE WEB SCRAPED DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ALTERNATIVE WEB TRAFFIC DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHERS ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

10. GLOBAL ALTERNATIVE DATA FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ALTERNATIVE DATA FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ALTERNATIVE DATA FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ALTERNATIVE DATA FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ALTERNATIVE DATA FOR IT & TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ALTERNATIVE DATA FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ALTERNATIVE DATA FOR TRANSPORTATION & LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ALTERNATIVE DATA FOR OTHERS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. GLOBAL ALTERNATIVE DATA FOR HEDGE FUND OPERATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL ALTERNATIVE DATA FOR INVESTMENT INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL ALTERNATIVE DATA FOR RETAIL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. NORTH AMERICAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. NORTH AMERICAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY DATA TYPE, 2023-2031 ($ MILLION)

25. NORTH AMERICAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

26. NORTH AMERICAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. EUROPEAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. EUROPEAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY DATA TYPE, 2023-2031 ($ MILLION)

29. EUROPEAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

30. EUROPEAN ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY DATA TYPE, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

35. REST OF THE WORLD ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY DATA TYPE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

38. REST OF THE WORLD ALTERNATIVE DATA MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ALTERNATIVE DATA MARKET SHARE BY DATA TYPE, 2023 VS 2031 (%)

2. GLOBAL ALTERNATIVE CREDIT & DEBIT CARD TRANSACTIONS DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ALTERNATIVE EMAIL RECEIPTS DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ALTERNATIVE GEO-LOCATION (FOOT TRAFFIC) RECORDS DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ALTERNATIVE MOBILE APPLICATION USAGE DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ALTERNATIVE WEB SCRAPED DATA DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ALTERNATIVE WEB TRAFFIC DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHERS ALTERNATIVE DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ALTERNATIVE DATA MARKET SHARE BY INDUSTRY, 2023 VS 2031 (%)

10. GLOBAL ALTERNATIVE DATA FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ALTERNATIVE DATA FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ALTERNATIVE DATA FOR ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ALTERNATIVE DATA FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ALTERNATIVE DATA FOR IT & TELECOMMUNICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ALTERNATIVE DATA FOR RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ALTERNATIVE DATA FOR TRANSPORTATION & LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ALTERNATIVE DATA FOR OTHERS INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ALTERNATIVE DATA MARKET SHARE BY END-USER, 2023 VS 2031 (%)

19. GLOBAL ALTERNATIVE DATA FOR HEDGE FUND OPERATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL ALTERNATIVE DATA FOR INVESTMENT INSTITUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL ALTERNATIVE DATA FOR RETAIL COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL ALTERNATIVE DATA MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. US ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

24. CANADA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

25. UK ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

26. FRANCE ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

27. GERMANY ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

28. ITALY ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

29. SPAIN ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF EUROPE ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

31. INDIA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

32. CHINA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

33. JAPAN ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

34. SOUTH KOREA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF ASIA-PACIFIC ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

36. LATIN AMERICA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)

37. THE MIDDLE EAST AND AFRICA ALTERNATIVE DATA MARKET SIZE, 2023-2031 ($ MILLION)