Analytics as a Service Market

Global Analytics as a Service Market Size, Share & Trends Analysis Report, By Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), By Industry (IT & Telecom, BFSI, Manufacturing, Healthcare, Retail & Wholesale, and Others), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global analytics as a service market is expected to grow at a CAGR of 27.6% during the forecast period. Cloud and Big Data are two of the trends that define the emerging enterprise computing and creates a lot of potential and opportunities for a new era of combined applications. The establishment of Big Data analytical capabilities along with the cloud delivery models makes it easy for the adoption by many companies. Moreover, the analytics as a service provides personalized access to centrally managed information data groups, which in turn decreases various delays faced by the data scientists, business analysts, and other information users. This increases the adoption of analytics as a service solution and hence fuels the growth of global analytics as a service industry.

The primary factors that fuel the growth of the analytics as a service market include the rising demands for the advanced and developed technologies to process high workload via cloud-based services and increased adoption and usage of social media platforms. Additionally, analytics as a service offers a number of benefits that include predictions based on experiences and capabilities to identify the patterns, which tend to develop a huge demand for the growth of the market in the near future. However, data security is the factors that hinder the growth of the market over the forecast period.

Various players operating in the analytics as a service market such as Microsoft Corp., IBM Corp., and Google LLC offers efficient analytics as a service solution to their customers. Microsoft offers various analytics services, some of them include Azure Data Share, Azure Data Explorer, Event Hubs, Azure Analysis Services, Data Lake Analytics, Azure Stream Analytics, Machine Learning among others.

Segmental Outlook

The global analytics as a service market is segmented on the basis of deployment and industry. Based on the deployment, the market is segregated into the public cloud, private cloud, and hybrid cloud. Based on the industry, the market is further segmented into IT & telecom, BFSI, manufacturing, healthcare, retail & wholesale, and others. Among these, IT & telecom is expected to show optimistic growth during the forecast period. Analytics services are applied to the telecommunication industry for improving visibility and gaining real insight into core operations and internal process of the enterprises.

Regional Outlook

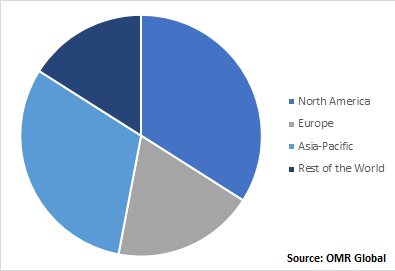

The global analytics as a service market is geographically segmented into North America, Europe, Asia-Pacific, and Rest of the World. North American analytics as a service market holds the most dominating share in the global market. Whereas, Asia-Pacific region is projected to provide a significant growth rate in the market during the forecast period. This is attributed to the surge in the increasing data volume via different channels such as social media and other platforms that propels the growth of the market. Additionally, the emergence of new players in market and rapid adoption of big data in the region is also expected to fuel the growth of the market during the forecast period.

Global Analytics as a Service Market, by Region 2018 (%)

- In October 2018, IBM Corp. completed the acquisition of Red Hat Inc. With this acquisition, IBM became one of the top providers of hybrid cloud services, offering companies the only open cloud solution that may unlock the full value of the cloud for their businesses.

- In May 2018, Oracle Corp. inked a deal for the acquisition of DataScience.com, whose platform centralizes data science tools, projects, and infrastructure in a fully governed workspace. Oracle embeds AI and machine learning capabilities across its Software as a Service (SaaS) and Platform as a Service (PaaS) solutions, including big data, analytics, and security operations, to enable digital transformations.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cloud infrastructure services market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Oracle Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Microsoft Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Google LLC.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Amazon.com Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Analytics as a Service Market by deployment

5.1.1. Public cloud

5.1.2. Private cloud

5.1.3. Hybrid

5.2. Global Analytics as a Service Market by Industry

5.2.1. IT & Telecom

5.2.2. BFSI

5.2.3. Manufacturing

5.2.4. Healthcare

5.2.5. Retail & Wholesale

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accenture PLC

7.2. ALTERYX, INC.

7.3. Amazon.com Inc.

7.4. Appnovation Technologies, Inc.

7.5. Atos SE

7.6. BigML, Inc.

7.7. Centrify Corp.

7.8. CenturyLink, Inc.

7.9. DXC Technology Co

7.10. GoodData Corp.

7.11. Google LLC

7.12. Hewlett Packard Enterprise Co.

7.13. Host Analytics, Inc.

7.14. IBM Corp.

7.15. Intel Corp.

7.16. Microsoft Corp.

7.17. NetApp, Inc.

7.18. Oracle Corp.

7.19. SAP SE

7.20. SAS Institute Inc.

7.21. Teradata Corp.

7.22. ThinkAnalytics Ltd.

1. GLOBAL ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

2. GLOBAL PUBLIC CLOUD FOR ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PRIVATE CLOUD FOR ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HYBRID CLOUD FOR ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

6. GLOBAL ANALYTICS AS A SERVICE FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ANALYTICS AS A SERVICE FOR IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ANALYTICS AS A SERVICE FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ANALYTICS AS A SERVICE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ANALYTICS AS A SERVICE FOR RETAIL & WHOLESALE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL ANALYTICS AS A SERVICE FOR OTHER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

15. NORTH AMERICAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

16. EUROPEAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

18. EUROPEAN ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

22. REST OF THE WORLD ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

23. REST OF THE WORLD ANALYTICS AS A SERVICE MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL ANALYTICS AS A SERVICE MARKET SHARE BY DEPLOYMENT, 2018 VS 2025 (%)

2. GLOBAL ANALYTICS AS A SERVICE MARKET SHARE BY INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL ANALYTICS AS A SERVICE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ANALYTICS AS A SERVICE MARKET SIZE, 2018-2025 ($ MILLION)