Antifreeze Proteins Market

Antifreeze Proteins Market Size, Share & Trends Analysis Report by Form (Solid and Liquid), by Type (Type I, Type III, Antifreeze Glycoprotein, and Others), by Source (Fish, Plants, Insects, and Other Sources) and by End-Use (Medical, Food, Cosmetics, and Others), Forecast Period (2025-2035)

Industry Overview

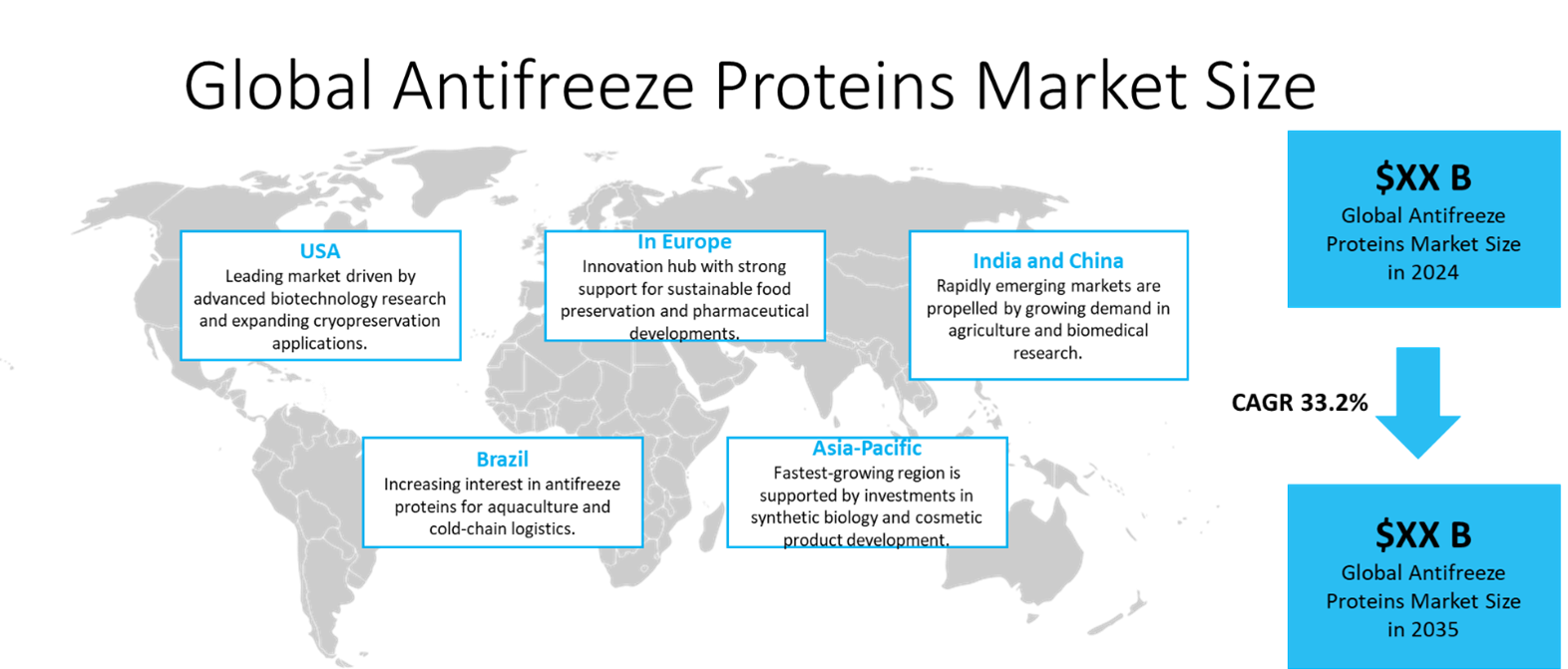

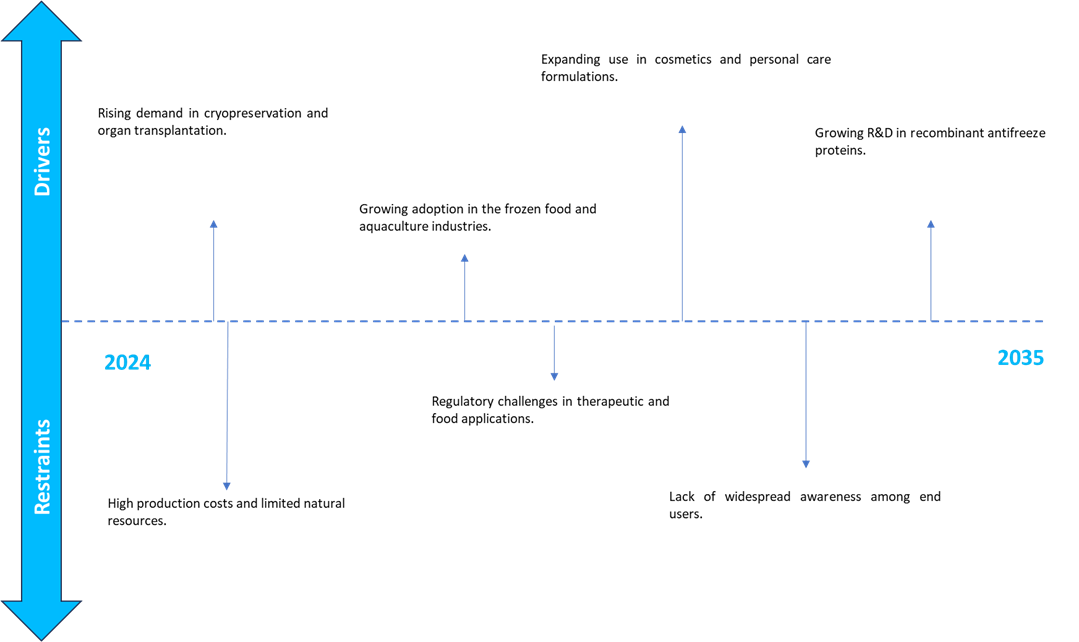

Antifreeze protein market was valued at $10.0 million in 2024 and is projected to reach $281.6 million in 2035, growing at a CAGR of 33.2% during the forecast period (2025-2035). Antifreeze protein is experiencing massive growth in the market owing to growing applications in cosmetics and personal care products. Their cryoprotection abilities, along with their moisture-retention capabilities as a protein, are making them common components of skin care formulas that aim to protect against extreme environmental factors. The protein's stabilization of cellular membranes and increasing skin hydration properties have established it in higher-end and premium cosmetics. The growing interest from consumers in biologically active and scientifically substantiated products has led to the introduction of antifreeze proteins in facial creams, serums, and protective balms.

Market Dynamics

Increased Use in Cosmetics and Personal Care Products

The antifreeze protein industry is booming, especially with expanding uses in cosmetics and personal care products. Antifreeze proteins have unique cryoprotective properties to protect skin cells from extreme heat, cold, and dehydration. They are used in skin creams, serums, and protective formulations, and we know they stabilize cell membranes and protect from moisture. The trend of utilizing natural, biologically active ingredients, antifreeze proteins, has found a place in high-end skin care. In 2022, Evonik Industries AG, a German chemicals company, developed antifreeze protein-derived formulations that were designed to improve skin resilience in cold climates. This has presented new possibilities for functional cosmetics with protective and restorative qualities.

Increasing Demand in Synthetic Biology and Recombinant Production

In a market driven by synthetic biology and recombinant production capabilities, the antifreeze protein market is growing at an impressive rate. The development of these methods will allow for antifreeze proteins to be produced at low costs and at large scales without having to painstakingly extract the proteins from natural sources. Recombinant DNA technology makes engineering protein structures precise and optimizes antifreeze proteins with respect to stability and functional properties. For instance, Biotherma Labs has developed recombinant antifreeze proteins that have optimal cryoprotective properties used for biomedical applications. In addition, these technologies reduce production costs and the eco-footprint of antifreeze proteins and make antifreeze proteins more accessible to a wider range of end-users.

Market Segmentation

- Based on the form, the market is segmented into solid and liquid.

- Based on the type, the market is segmented into Type I, Type III, antifreeze glycoprotein, and others.

- Based on the source, the market is segmented into fish, plants, insects, and other sources.

- Based on the end-user, the market is segmented into medical, food, cosmetics, and others.

Type I Segment to Lead the Market with the Largest Share

The antifreeze protein market is growing considerably, largely owing to the increasing adoption of Type I antifreeze proteins. Type I antifreeze proteins are derived from fish species and are rather simple proteins composed largely of ?helices that slow ice crystal growth. The very stable protein has high efficiency in cold temperatures and is best used in applications where the toxicity to biological systems and cell viability preservation is paramount, such as in cryopreservation. Their low level of toxicity and ability to preserve cell viability have made them very popular in medical research and biotechnology. The proportional success of antifreeze proteins in preserving tissue integrity during water-to-ice transition has made even more demand in organ storage and cell therapy in its human applications. In frozen dairy applications, Type I proteins prevent the recrystallization of ice crystals and maintain product quality through transportation. The positive aspect of the cost and scalability of Type I proteins means its market share is very solid.

Medical: A Key Segment in Market Growth

There is an enormous emerging market for antifreeze proteins stimulated by the demand for medical use. The antifreeze proteins are able to protect cells during freezing and thawing by preventing ice crystals and damage to biological samples. The antifreeze proteins or antifreeze molecules exhibit beneficial properties across many areas important to medical applications; organ preservation, stem cell storage, vaccine stabilization, and more. The emergence of regenerative medicine and biobanks has created the needed demand for a means of preservation. Antifreeze proteins preserve cell viability and structural integrity at sub-zero temperatures. Antifreeze proteins have grown important, indeed a necessary ingredient in medical research and use. For instance, A/F Protein Inc. specializes in antifreeze protein formulations designed for cryobiology and biomedical storage. Their products have therapeutic uses in preserving tissues and cells, aiding and enhancing all stages of processes for tissue and organ transplants, and for all laboratory uses.

Regional Outlook

The global antifreeze proteins market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Smart Building Automation Systems in North America

The North American antifreeze protein (AFP) sector is increasingly booming with a significant research ecosystem and a large biotechnology sector. The North American region, being intrinsically linked to innovation and commercialization of bio-based technologies, is becoming more accepting of the uses of AFPS in many high-value applications. Both biotechnology companies and academic institutions are heavily engaged in North America in new, protein-based products for very specific end-use applications, ranging from cryopreservation to food stabilization.

In North America, the healthcare and pharmaceutical sectors lead the way for the use of AFPs, in particular for the cryogenic storage of biological materials (cells, tissues, reproductive materials). AFPS provides improved viability and preservation during deep freezing and is nicely aligned with the growing i. Interest in regenerative medicine and biobanking in the region. Regenerative medicine and biobanking are attracting a plethora of investment and growth and could lend itself to other advances in cell therapy and precision medicine. The advancements will certainly increase the demand for AFP-based cryoprotectants.

Asia-Pacific Region Dominates the Market with Major Share

Pivotal factors driving the strong growth of the Asia Pacific antifreeze proteins (AFP) market. Improvements in biotechnology in countries such as China, Japan, and South Korea are helping to create a positive environment for the support of research and application of antifreeze proteins. The continued focus on life sciences in the region is exemplified by specific fields like cryopreservation and regenerative medicine, increasing life sciences research output, and an increase in demand for high-purity AFPs amongst vaccine manufacturers involved in medical storage of biological materials and therapeutic research. The food processing industry (and frozen food segment) has increased demand and thus level of activity, leading to an increase in the adoption of antifreeze proteins. Food manufacturers want New technologies for product stability (and texture integrity) preservation during freezing and thawing. AFPs provide a biological tool that mitigates ice recrystallization, preserves product well-being, and extends shelf life.

Market Players Outlook

The major companies operating in the global antifreeze proteins market include A/F Protein Inc., AquaBounty Technologies, Inc., Kaneka Corp., Nichirei Corp., ProtoKinetix, Inc., and Sirona Biochem Corp., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In August 2022, Beijing Huacheng Jinke Technology made a complementary launch of 2 different types I antifreeze membranes, which are specific glycopeptides and peptides developed by different organisms to help cells survive at sub-zero conditions.

- In December 2021, Kaneka Corp. launched a series of type I antifreeze proteins in order to develop different food applications, including noodles and rice. This latest series is part of Kaneka's expansion in the food industry in order to develop its different applications.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global antifreeze proteins market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Antifreeze Proteins Market Sales Analysis – Form | Type | Source| End-User| ($ Million)

• Antifreeze Proteins Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Antifreeze Proteins Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Antifreeze Proteins Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Antifreeze Proteins Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Antifreeze Proteins Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Antifreeze Proteins Market Revenue and Share by Manufacturers

• Antifreeze Proteins Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. A/F Protein Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. AquaBounty Technologies, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Kaneka Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Nichirei Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. ProtoKinetix, Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Sirona Biochem Corp.

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Antifreeze Proteins Market Sales Analysis by Form ($ Million)

5.1. Solid

5.2. Liquid

6. Global Antifreeze Proteins Market Sales Analysis by Type ($ Million)

6.1. Type I

6.2. Type III

6.3. Antifreeze Glycoprotein

6.4. Others

7. Global Antifreeze Proteins Market Sales Analysis by Source ($ Million)

7.1. Fish

7.2. Plants

7.3. Insects

7.4. Other Sources

8. Global Antifreeze Proteins Market Sales Analysis by End-Use ($ Million)

8.1. Medical

8.2. Food

8.3. Cosmetics

8.4. Others

9. Regional Analysis

9.1. North American Antifreeze Proteins Market Sales Analysis – Form | Type | Source | End-Use | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Antifreeze Proteins Market Sales Analysis – Form | Type | Source | End-Use | Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Antifreeze Proteins Market Sales Analysis – Form | Type | Source | End-Use | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Antifreeze Proteins Market Sales Analysis – Form | Type | Source | End-Use | Country ($ Million)

• Macroeconomic Factors for Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. A/F Protein Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Abbexa Ltd.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. AquaBounty Technologies, Inc.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Biosynth AG

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Creative Enzymes

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Kaneka Corp.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. MyBiosource, Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Nichirei Corp.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. ProtoKinetix, Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Sirona Biochem Corp.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. X-Therma GmbH

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

1. Global Antifreeze Proteins Market Research and Analysis by Form, 2024–2035 ($ Million)

2. Global Solid Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

3. Global Liquid Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

4. Global Antifreeze Proteins Market Research and Analysis by Type, 2024–2035 ($ Million)

5. Global Type I Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

6. Global Type III Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

7. Global Antifreeze Glycoprotein Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

8. Global Other Type Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

9. Global Antifreeze Proteins Market Research and Analysis by Source, 2024–2035 ($ Million)

10. Global Fish Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

11. Global Plants Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

12. Global Insects Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

13. Global Other Antifreeze Proteins Sources Market Research and Analysis by Region, 2024–2035 ($ Million)

14. Global Antifreeze Proteins Market Research and Analysis by End-User, 2024–2035 ($ Million)

15. Global Antifreeze Proteins For Medical Market Research and Analysis by Region, 2024–2035 ($ Million)

16. Global Antifreeze Proteins For Food Market Research and Analysis by Region, 2024–2035 ($ Million)

17. Global Antifreeze Proteins For Cosmetics Market Research and Analysis by Region, 2024–2035 ($ Million)

18. Global Antifreeze Proteins For Other End-User Market Research and Analysis by Region, 2024–2035 ($ Million)

19. Global Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

20. North American Antifreeze Proteins Market Research and Analysis by Country, 2024–2035 ($ Million)

21. North American Antifreeze Proteins Market Research and Analysis by Form, 2024–2035 ($ Million)

22. North American Antifreeze Proteins Market Research and Analysis by Type, 2024–2035 ($ Million)

23. North American Antifreeze Proteins Market Research and Analysis by Source, 2024–2035 ($ Million)

24. North American Antifreeze Proteins Market Research and Analysis by End-User, 2024–2035 ($ Million)

25. European Antifreeze Proteins Market Research and Analysis by Country, 2024–2035 ($ Million)

26. European Antifreeze Proteins Market Research and Analysis by Form, 2024–2035 ($ Million)

27. European Antifreeze Proteins Market Research and Analysis by Type, 2024–2035 ($ Million)

28. European Antifreeze Proteins Market Research and Analysis by Source, 2024–2035 ($ Million)

29. European Antifreeze Proteins Market Research and Analysis by End-User, 2024–2035 ($ Million)

30. Asia-Pacific Antifreeze Proteins Market Research and Analysis by Country, 2024–2035 ($ Million)

31. Asia-Pacific Antifreeze Proteins Market Research and Analysis by Form, 2024–2035 ($ Million)

32. Asia-Pacific Antifreeze Proteins Market Research and Analysis by Type, 2024–2035 ($ Million)

33. Asia-Pacific Antifreeze Proteins Market Research and Analysis by Source, 2024–2035 ($ Million)

34. Asia-Pacific Antifreeze Proteins Market Research and Analysis by End-User, 2024–2035 ($ Million)

35. Rest of the World Antifreeze Proteins Market Research and Analysis by Region, 2024–2035 ($ Million)

36. Rest of the World Antifreeze Proteins Market Research and Analysis by Form, 2024–2035 ($ Million)

37. Rest of the World Antifreeze Proteins Market Research and Analysis by Type, 2024–2035 ($ Million)

38. Rest of the World Antifreeze Proteins Market Research and Analysis by Source, 2024–2035 ($ Million)

39. Rest of the World Antifreeze Proteins Market Research and Analysis by End-User, 2024–2035 ($ Million)

1. Global Antifreeze Proteins Market Share by Form, 2024 Vs 2035 (%)

2. Global Solid Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

3. Global Liquid Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

4. Global Antifreeze Proteins Market Share by Type, 2024 Vs 2035 (%)

5. Global Type I Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

6. Global Type III Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

7. Global Antifreeze Glycoprotein Proteins Market Share by Region, 2024 Vs 2035 (%)

8. Global Other Type Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

9. Global Antifreeze Proteins Market Share by Source, 2024 Vs 2035 (%)

10. Global Fish Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

11. Global Plants Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

12. Global Insects Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

13. Global Other Antifreeze Proteins Sources Market Share by Region, 2024 Vs 2035 (%)

14. Global Antifreeze Proteins Market Share by End-User, 2024 Vs 2035 (%)

15. Global Antifreeze Proteins For Medical Market Share by Region, 2024 Vs 2035 (%)

16. Global Antifreeze Proteins For Food Market Share by Region, 2024 Vs 2035 (%)

17. Global Antifreeze Proteins For Cosmetics Market Share by Region, 2024 Vs 2035 (%)

18. Global Antifreeze Proteins For Others End-User Market Share by Region, 2024 Vs 2035 (%)

19. Global Antifreeze Proteins Market Share by Region, 2024 Vs 2035 (%)

20. US Antifreeze Proteins Market Size, 2024–2035 ($ Million)

21. Canada Antifreeze Proteins Market Size, 2024–2035 ($ Million)

22. UK Antifreeze Proteins Market Size, 2024–2035 ($ Million)

23. France Antifreeze Proteins Market Size, 2024–2035 ($ Million)

24. Germany Antifreeze Proteins Market Size, 2024–2035 ($ Million)

25. Italy Antifreeze Proteins Market Size, 2024–2035 ($ Million)

26. Spain Antifreeze Proteins Market Size, 2024–2035 ($ Million)

27. Russia Antifreeze Proteins Market Size, 2024–2035 ($ Million)

28. Rest of Europe Antifreeze Proteins Market Size, 2024–2035 ($ Million)

29. India Antifreeze Proteins Market Size, 2024–2035 ($ Million)

30. China Antifreeze Proteins Market Size, 2024–2035 ($ Million)

31. Japan Antifreeze Proteins Market Size, 2024–2035 ($ Million)

32. South Korea Antifreeze Proteins Market Size, 2024–2035 ($ Million)

33. Australia and New Zealand Antifreeze Proteins Market Size, 2024–2035 ($ Million)

34. ASEAN Economies Antifreeze Proteins Market Size, 2024–2035 ($ Million)

35. Rest of Asia-Pacific Antifreeze Proteins Market Size, 2024–2035 ($ Million)

36. Latin America Antifreeze Proteins Market Size, 2024–2035 ($ Million)

37. Middle East and Africa Antifreeze Proteins Market Size, 2024–2035 ($ Million)

FAQS

The size of the Antifreeze Proteins market in 2024 is estimated to be around $10.0 million.

Asia-Pacific holds the largest share in the Antifreeze Proteins market.

Leading players in the Antifreeze Proteins market include A/F Protein Inc., AquaBounty Technologies, Inc., Kaneka Corp., Nichirei Corp., ProtoKinetix, Inc., and Sirona Biochem Corp., among others.

Antifreeze Proteins market is expected to grow at a CAGR of 33.2% from 2025 to 2035.