Artificial Lift Pumps Market

Artificial Lift Pumps Market Size, Share & Trends Analysis Report by Type (Rod Lift Systems, Electric Submersible Pumps, Progressive Cavity Pumps, Gas Lift Systems, and Others), by Mechanism (Pump Assisted, and Gas Assisted), by Application (Onshore, and Offshore), and by Well Type (Horizontal Wells, and Vertical Wells) Forecast Period (2025-2035)

Industry Overview

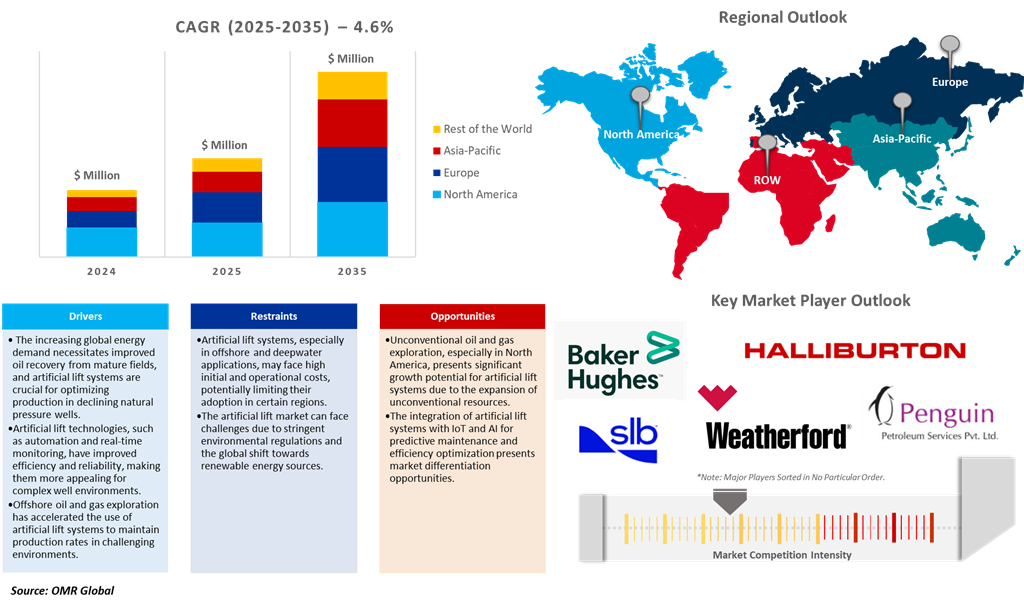

Artificial lift pumps market was valued at $7.6 billion in 2024 and is projected to grow at a CAGR of 4.6% between 2025 and 2035. By 2035, the market is anticipated to reach $12.4 billion. Increased production from existing oil and gas fields, rising crude oil and natural gas demand, and advancements in technology are the major driving factors behind the growth of the Artificial Lift System Market. Additionally, the increasing energy requirement, exploration, and production companies are targeting oil and gas production from unconventional and mature reservoirs, providing a large opportunity for artificial lift systems. The growing investment in research and development of next-generation artificial lift technologies, including electrical submersible pumps (ESPs) and plunger lifts, is likely to continue driving market growth. Government regulations and environmental issues are additionally driving demand for effective and eco-friendly artificial lift solutions. Rising usage of digital technologies, such as cloud computing and the Internet of Things (IoT), is paving the way for enhanced remote monitoring and optimization of artificial lift systems with increased efficiency and cost benefits.

Market Dynamics

Growing Energy Demand Globally

Artificial lift systems play a vital role in oil and gas production, maintaining consistent production and propelling the market growth, owing to the rapid development of renewables. According to the International Energy Agency (IEA), in 2024, it predicts that renewable electricity generation will supply a 32% increase in global electricity demand by 2030, with an additional 9,000 TWh. This is predominantly due to electrification, which lowers CO2 emissions from industries, such as transport and buildings. Renewables are now the second-largest electricity source behind coal. France's consumption of gas hit record highs in 2023, with gas and coal production almost doubling.

Technological Advancements

Technological innovation, including high-temperature-resistant pumps, is propelling artificial lift system market growth, increasing their efficiency and suitability in demanding environments. For instance, in March 2024, Halliburton Company introduced GeoESP lifting pumps, advanced submersible boreholes, and surface pump technology for geothermal power applications. The pumps present an effective, secure, and nimble alternative for moving fluid to the surface, defying limitations such as solids, power, and scale build-up. It has the capability of functioning at 220°C and can be adapted according to varying geothermal well conditions.

Market Segmentation

- Based on the type, the market is segmented into rod lift systems, electric submersible pumps, progressive cavity pumps, gas lift systems, and others (foam lift and capillary lift).

- Based on the mechanism, the market is segmented into pump-assisted (positive displacement and dynamic displacement) and gas-assisted.

- Based on the application, the market is segmented into onshore and offshore.

- Based on the well type, the market is segmented into horizontal wells and vertical wells.

Electric Submersible Pumps Segment to Lead the Market with the Largest Share

An Electric Submersible Pump, also known as an ESP, is a closed, multistage centrifugal pump immersed in liquid and driven by an electric motor, suited for continuous fluid displacement from deep wells or reservoirs. Electric submersible pumps are used in many industries for effective fluid lifting, water management, mining operations, agriculture, and industrial usage. It assists in dewatering mines, avoiding flooding, and providing an assured water supply. In addition, artificial lift systems are seeing market expansion due to improvements in real-time monitoring, automation, and machine learning, that enhanced the cost-effectiveness and efficiency. For instance, in April 2024, SLB presented two new artificial lift systems, including the Reda Agile and PowerEdge systems. The Agile system is an ESP system that is a compact, wide-range electric submersible pump, structured to be highly reliable and efficient. It is linked to live surveillance digital services and real-time optimization, allowing for quicker installation and manufacture with reduced power consumption, operating expenses, and CO2 emissions. PowerEdge ESPCP is an energy-efficient rodless option for low-flow production rates in conventional and unconventional wells.

Regional Outlook

The global artificial lift pumps market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Increased Oil and Gas Exploration in Asia-Pacific

Companies such as Penguin Petroleum Services (P) Ltd., ONGC, and IOC heavily investing in oil and gas exploration, are propelling demand for artificial lift systems to maximize production from new wells, fueling market growth. For instance, in February 2024, ONGC, IOC, and other oil PSUs intended to invest $1,416 in FY25 in oil and gas exploration, refineries, petrochemicals, and pipelines in India. ONGC has a budgeted capital expenditure of $3.68 billion, possibly higher than the capex of $3.6 billion in 2023-24. ONGC Videsh Ltd. will spend 68% in 2024-25 on oil and gas exploration overseas. While IOC invested $3.69 billion in fuel refinery expansion and modernization during the same period.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to artificial lift systems are gaining popularity owing to advancements in digital automation, predictive maintenance, and energy-efficient pumps, ensuring long-term competitiveness in the oil and gas sector. For instance, in March 2025, Lufkin Industries divested its North America Downhole business to Q2 Artificial Lift Services, a top-down provider of downhole reciprocating pumps. The transaction combines Lufkin's core surface business with Q2's subsurface business and positions both organizations for long-term profitability and growth. The acquisition will transfer downhole pump and rods assets, team members, and customer relationships to Q2.

Market Players Outlook

The major companies operating in the global artificial lift pumps market include Baker Hughes Co., Halliburton Energy Services, Inc., Penguin Petroleum Services (P) Ltd., Schlumberger Ltd. (SLB), and Weatherford International plc, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2024, ChampionX Corp. acquired Artificial Lift Performance Ltd., an analytics solutions provider to enhance oil and gas production performance. ALP's pump checker software is integrated with ChampionX's XSPOC, a production optimization software, offering a complete set of analytics for all artificial lift types and chemical applications. It enables operators to make data-driven decisions and optimize production performance.

- In June 2020, Apergy Corp. and ChampionX Holding Inc. merged to form a new entity called ChampionX Corp. The merger provided $75 million of cost synergies and other revenue growth opportunities. The new entity delisted its balance sheet and started trading on the New York Stock Exchange under the ticker symbol CHX.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial lift pumps market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Artificial Lift Pumps Market Sales Analysis – Type| Mechanism| Application| Well Type ($ Million)

• Artificial Lift Pumps Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Artificial Lift Pumps Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Artificial Lift Pumps Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Artificial Lift Pumps Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Artificial Lift Pumps Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Artificial Lift Pumps Market Revenue and Share by Manufacturers

• Artificial Lift Pumps Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Baker Hughes Co.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Halliburton Energy Services, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Penguin Petroleum Services (P) Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Schlumberger Ltd. (SLB)

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Weatherford International plc

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Artificial Lift Pumps Market Sales Analysis by Type ($ Million)

5.1. Rod Lift Systems

5.2. Electric Submersible Pumps

5.3. Progressive Cavity Pumps

5.4. Gas Lift Systems

5.5. Others (Foam Lift and Capillary Lift)

6. Global Artificial Lift Pumps Market Sales Analysis by Mechanism ($ Million)

6.1. Pump Assisted

6.1.1. Positive Displacement

6.1.2. Dynamic Displacement

6.2. Gas Assisted

7. Global Artificial Lift Pumps Market Sales Analysis by Application ($ Million)

7.1. Onshore

7.2. Offshore

8. Global Artificial Lift Pumps Market Sales Analysis by Well Type ($ Million)

8.1. Horizontal Wells

8.2. Vertical Wells

9. Regional Analysis

9.1. North American Artificial Lift Pumps Market Sales Analysis – Type| Mechanism| Application| Well Type |Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Artificial Lift Pumps Market Sales Analysis – Type| Mechanism| Application| Well Type |Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Artificial Lift Pumps Market Sales Analysis – Type| Mechanism| Application| Well Type |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Artificial Lift Pumps Market Sales Analysis – Type| Mechanism| Application| Well Type |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Baker Hughes Co.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Cairn Oil & Gas (Vedanta Limited)

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. ChampionX Corp.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. DNOW L.P.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Endurance Lift Solutions, LLC

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Halliburton Energy Services, Inc.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Jiach Energy

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. JJ Tech

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Levare International

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Lex

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Liberty Lift Solutions LLC.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. National Energy Services Reunited Corp.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. NOV Inc.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Novomet Group

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Penguin Petroleum Services (P) Ltd.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. PSC Teknologis

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Rimera Group

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Roto Pumps Ltd.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Schlumberger Ltd. (SLB)

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Tenaris

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. Valiant Artificial Lift Solutions

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Weatherford International plc

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

1. Global Artificial Lift Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Rod Lift Systems Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Electric Submersible Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Progressive Cavity Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Gas Lift Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Type Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024-2035 ($ Million)

8. Global Artificial Lift Pumps Assisted Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Positive Displacement Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Dynamic Displacement Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Gas Assisted Artificial Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Artificial Lift Pumps Market Research And Analysis By Application, 2024-2035 ($ Million)

13. Global Artificial Lift Pumps For Onshore Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Artificial Lift Pumps For Offshore Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Artificial Lift Pumps Market Research And Analysis By Well Type, 2024-2035 ($ Million)

16. Global Horizontal Wells Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Vertical Wells Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American Artificial Lift Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Artificial Lift Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

21. North American Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024-2035 ($ Million)

22. North American Artificial Lift Pumps Market Research And Analysis By Application, 2024-2035 ($ Million)

23. North American Artificial Lift Pumps Market Research And Analysis By Well Type, 2024-2035 ($ Million)

24. European Artificial Lift Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European Artificial Lift Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

26. European Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024-2035 ($ Million)

27. European Artificial Lift Pumps Market Research And Analysis By Application, 2024-2035 ($ Million)

28. European Artificial Lift Pumps Market Research And Analysis By Well Type, 2024-2035 ($ Million)

29. Asia-Pacific Artificial Lift Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Artificial Lift Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

31. Asia-Pacific Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024-2035 ($ Million)

32. Asia-Pacific Artificial Lift Pumps Market Research And Analysis By Application, 2024-2035 ($ Million)

33. Asia-Pacific Artificial Lift Pumps Market Research And Analysis By Well Type, 2024-2035 ($ Million)

34. Rest Of The World Artificial Lift Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

35. Rest Of The World Artificial Lift Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

36. Rest Of The World Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024-2035 ($ Million)

37. Rest Of The World Artificial Lift Pumps Market Research And Analysis By Application, 2024-2035 ($ Million)

38. Rest Of The World Artificial Lift Pumps Market Research And Analysis By Well Type, 2024-2035 ($ Million)

1. Global Artificial Lift Pumps Market Research And Analysis By Type, 2024 Vs 2035 (%)

2. Global Rod Lift Systems Pumps Market Share By Region, 2024 Vs 2035 (%)

3. Global Electric Submersible Pumps Market Share By Region, 2024 Vs 2035 (%)

4. Global Progressive Cavity Pumps Market Share By Region, 2024 Vs 2035 (%)

5. Global Gas Lift Systems Market Share By Region, 2024 Vs 2035 (%)

6. Global Other Type Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

7. Global Artificial Lift Pumps Market Research And Analysis By Mechanism, 2024 Vs 2035 (%)

8. Global Artificial Lift Pumps Assisted Market Share By Region, 2024 Vs 2035 (%)

9. Global Positive Displacement Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

10. Global Dynamic Displacement Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

11. Global Gas Assisted Artificial Lift Market Share By Region, 2024 Vs 2035 (%)

12. Global Artificial Lift Pumps Market Research And Analysis By Application, 2024 Vs 2035 (%)

13. Global Artificial Lift Pumps For Onshore Market Share By Region, 2024 Vs 2035 (%)

14. Global Artificial Lift Pumps For Offshore Market Share By Region, 2024 Vs 2035 (%)

15. Global Artificial Lift Pumps Market Research And Analysis By Well Type, 2024 Vs 2035 (%)

16. Global Horizontal Wells Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

17. Global Vertical Wells Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

18. Global Artificial Lift Pumps Market Share By Region, 2024 Vs 2035 (%)

19. US Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

20. Canada Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

21. UK Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

22. France Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

23. Germany Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

24. Italy Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

25. Spain Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

26. Russia Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

28. India Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

29. China Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

30. Japan Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

31. South Korea Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

32. ASEAN Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

33. Australia and New Zealand Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

35. Latin America Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Artificial Lift Pumps Market Size, 2024-2035 ($ Million)

FAQS

The size of the Artificial Lift Pumps Market in 2024 is estimated to be around $7.6 billion.

North America holds the largest share in the Artificial Lift Pumps Market.

Leading players in the Artificial Lift Pumps Market include Baker Hughes Co., Halliburton Energy Services, Inc., Penguin Petroleum Services (P) Ltd., Schlumberger Ltd. (SLB), and Weatherford International plc, among others.

Artificial Lift Pumps Market is expected to grow at a CAGR of 4.6% from 2025 to 2035.

The Artificial Lift Pumps Market is growing due to rising energy demand, declining reservoir pressure, and the need to boost oil production from mature wells.