Peristaltic Pumps Market

Peristaltic Pumps Market Size, Share & Trends Analysis Report by Discharge Capacity (Up to 30 psi, 30-50 psi, 50-100 psi, 100-200 psi, and Above 200 psi), By Type (Tube pumps, and Hose pumps), and By End-User (Pharmaceutical & Medical, Water & Wastewater Treatment, Food & Beverage, Chemical Processing, Mining and Construction, Pulp & Paper, and Others) Forecast Period (2025-2035)

Industry Overview

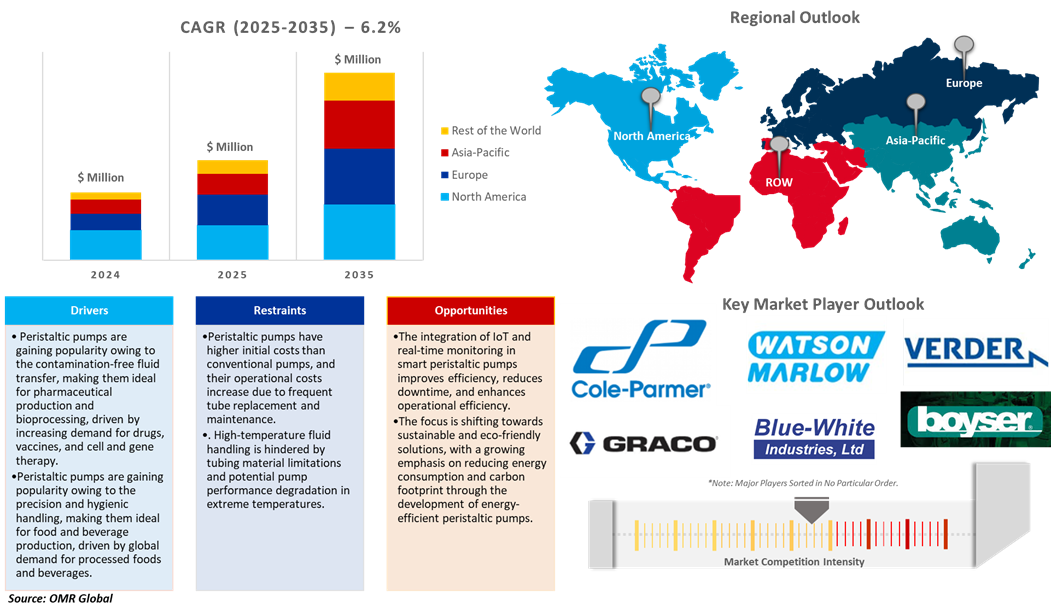

Peristaltic pumps market was valued at $1,875 million in 2024 and is expected to grow at a CAGR of 6.2% during the forecast period 2025 to 2035, reaching an estimated $3,607 million by 2035. The demand for peristaltic pumps is growing based on their sterility, precision, and fluid compatibility. Peristaltic pumps find application in pharmaceuticals, biotech, water and wastewater treatment plant projects, the food and beverage industry, and chemical and industrial processes. Advances in technology, such as digital interfaces and IoT integration, are enhancing operating efficiency. Peristaltic pumps are increasingly being used in medical applications with the aging population and the growing healthcare infrastructure in developing markets. Emerging economies are additionally witnessing growth in industrial automation and fluid control processes.

Market Dynamics

Expansion of Water and Wastewater Treatment Facilities

Peristaltic pumps are gaining market share in water and wastewater treatment facilities due to their efficient chemical dosing and handling, despite increasing environmental regulations. According to the International Trade Administration (ITA), in December 2024, water and wastewater treatment will represent the largest segment of environmental technology exports from the US to India. India ranks 5th globally in this market, currently estimates it at approximately $11 billion, with a projected growth to more than $18 billion by 2026. Although contributing only 4% of the globe's water resources, the global population accounts for 18%. India is severely water-constrained, compelling both the public and private sectors for advanced water treatment and distribution systems to meet growing demands.

Technological Advances

Digital pumping technologies, such as process controllers and diagnostic software, are improving peristaltic pump performance, fueling energy usage and operational expense, and fueling industry growth. For instance, in January 2024, QED Environmental Systems introduced the MicroPurge MP100 peristaltic pump system for low-flow groundwater purging and sampling. The system can produce flow rates of up to 1,500 ml per minute and lift to 9 meters using standard silicone tubing sizes. It offers precise flow control and is ideally suited for sampling PFAS. The MP100 is available with disposable pump tubing and drop tubing.

Market Segmentation

- Based on the discharge capacity, the market is segmented into Up to 30 psi, 30-50 psi, 50-100 psi, 100-200 psi, and Above 200 psi.

- Based on the type, the market is segmented into tube pumps and hose pumps.

- Based on the end-user, the market is segmented into pharmaceutical & medical, water & wastewater treatment, food & beverage, chemical processing, mining and construction, pulp & paper, and others (printing and packaging, and textile industry).

Pharmaceutical & Medical Segment to Lead the Market with the Largest Share

The increasing production of pharmaceuticals and biotech in countries such as India, China, and Southeast Asia is boosting the demand for sterile, contamination-free pumping systems. As per the India Brand Equity Foundation (IBEF), in January 2025, India's pharmaceutical industry is expected to expand, with projections amounting to $65 billion by 2024, around $130 billion by 2030, and $450 billion by 2047. Valued currently at around $50 billion, with exports amounting to more than $25 billion, India supplies 20% of global generic drug exports and serves about 60% of the world's vaccination needs. The industry saw a year-on-year growth of almost 5% in FY23 at $49.78 billion and posted a compound annual growth rate of 6-8% during FY18-FY23, led by an 8% growth in exports and a 6% growth in the domestic market. The increase is especially significant in processes that rely on facilities, such as drug formulation, filling, and packaging. These activities demand precise and contamination-free fluid handling solutions, resulting in a rising interest in peristaltic pumps within the pharmaceutical and bioprocessing industries.

50-100 psi: A Key Segment in Market Growth

The 50-100 psi pressure range is significant for industrial and medical fluid handling because of its high to moderate pressure level. Peristaltic pumps, with a pressure range of 50-100 psi, are applied across multiple industries such as medical and pharmaceutical, food and drink, water treatment, industrial and manufacturing, mining, and construction. It creates a suction effect by compressing and releasing a flexible tube, providing uniform pressure and flow rate. Its major applications are dialysis machines, IV infusion pumps, biopharmaceutical processing, dairy and beverage processing, water treatment, printing and ink supply, and slurry handling for high-pressure materials.

Regional Outlook

The global peristaltic pumps market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Government and Regulatory Support for Green Buildings in North America

Peristaltic pumps play a crucial role in textile dyeing and finishing due to their potential to deal with viscous and shear-sensitive liquids, propelled by the growing interest in sustainable dyeing processes. As per the US Government, in 2024, the US textile sector invested $22.3 billion in new plants and equipment. In recent times, US manufacturers opened new facilities throughout the textile production chain, including waste recycling plants for utilizing the waste in new textile purposes and resins. During 2024, the industry exported $28.0 billion worth of fiber, textile, and apparel products and was the second-largest textile-related product exporter in the world.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the rising demand for food in India necessitates efficient, contaminant-free fluid management in food processing involving Peristaltic pumps are highly valued for their hygienic and non-contaminating qualities. As per the India Brand Equity Foundation (IBEF), in January 2025, India, with its huge and young population, is witnessing high growth in food consumption that is expected to reach $1.2 trillion by 2025-26. The food processing industry is expected to grow from $866 billion in 2022 to $1,274 billion in 2027, owing to population expansion, lifestyle transformations, and higher disposable income. Being the sixth largest food and grocery market in the world, the sector is contributing 32% to the domestic market, 13% to exports, and 6% to industrial investment, providing jobs to 1.93 million in the registered market and 5.1 million in the unregistered market. The future projections expect the sector to grow to $1,100 billion by FY35, $1,500 billion by FY40, $1,900 billion by FY45, and $2,150 billion by FY47.

Market Players Outlook

The major companies operating in the global peristaltic pumps market include Cole-Parmer Instrument Company, LLC, Graco Inc., Blue-White Industries, Ltd., BOMBAS BOYSER, S.L., Verder International B.V., and Watson-Marlow Fluid Technology Solutions, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In November 2024, NETZSCH Pumpen & Systeme GmbH is expanding its product portfolio in the field of peristaltic pumps with the PERIPRO tube pump. The pump has been specially developed for demanding dosing applications and enables efficient pumping in numerous areas of application.

- In April 2024, Watson-Marlow Fluid Technology Solutions (WMFTS) introduced WMArchitect, a versatile solution for biopharmaceutical fluid management. The platform provides customized designs and standard single-use assemblies to streamline processes, safeguard products, and minimize regulatory burden. It features single-use fluid transfer assemblies, fill/finish assemblies, and validation testing. The platform is engineered to be compatible with current fluid-contact materials, maximize fluid transfer between equipment and process steps, and protect therapeutic products during filling processes.

- In July 2023, Duoning Biotech acquired Changzhou PreFluid Technology Co., Ltd., that a manufacturer of peristaltic pumps, to broaden its fluid management solutions and diversify its product offerings across multiple industries, such as medical, pharmaceutical, chemical, and environmental industries.

- In October 2022, Verder Liquids introduced the Verderflex Dura 60, a peristaltic pump used for transfer applications of abrasive slurry and very viscous liquids. The pump features increased durability, efficiency, ease of use, and versatility that ensure low energy usage even under high pressure. It is appropriate for numerous industrial processes, ranging from manufacturing to processing.

- In February 2021, High Purity New England introduced the VerderFlex Vantage 5000 peristaltic pump, which is appropriate for low to medium flow and low to medium pressure. It features a high-resolution 4000:1 turndown drive, touch screen technology, remote monitoring through the Verderflex App, and real-time stamped events.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global peristaltic pumps market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Peristaltic Pumps Market Sales Analysis – Discharge Capacity| Type | End-User ($ Million)

• Peristaltic Pumps Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Peristaltic Pumps Industry Trends

2.2.2. Market Recommendations

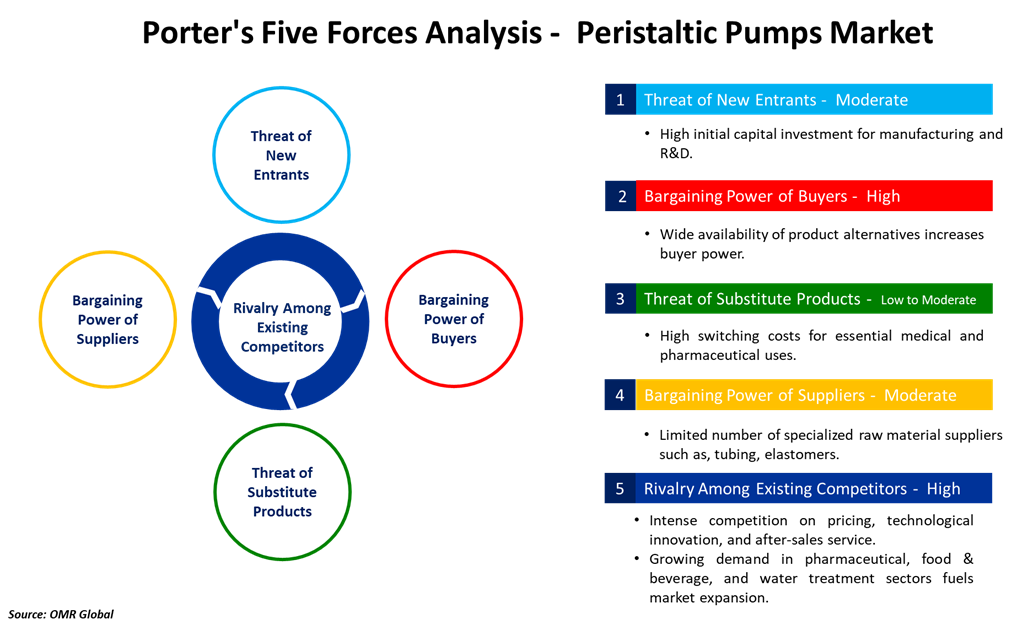

2.3. Porter's Five Forces Analysis for the Peristaltic Pumps Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Peristaltic Pumps Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Peristaltic Pumps Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Peristaltic Pumps Market Revenue and Share by Manufacturers

• Peristaltic Pumps Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Cole-Parmer Instrument Company, LLC.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Graco Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Blue-White Industries, Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. BOMBAS BOYSER, S.L.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Verder International B.V.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Watson-Marlow Fluid Technology Solutions

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1.1. Merger and Acquisition

4.3.1.2. Product Launch

4.3.1.3. Partnership And Collaboration

5. Global Peristaltic Pumps Market Sales Analysis by Discharge Capacity ($ Million)

5.1. Up to 30 psi

5.2. 30-50 psi

5.3. 50-100 psi

5.4. 100-200 psi

5.5. Above 200 psi

6. Global Peristaltic Pumps Market Sales Analysis by Type ($ Million)

6.1. Tube pumps

6.2. Hose pumps

7. Global Peristaltic Pumps Market Sales Analysis by End-User ($ Million)

7.1. Pharmaceutical & Medical

7.2. Water & Wastewater Treatment

7.3. Food & Beverage

7.4. Chemical Processing

7.5. Mining and Construction

7.6. Pulp & Paper

7.7. Others (Printing and Packaging, and Textile Industry)

8. Regional Analysis

8.1. North American Peristaltic Pumps Market Sales Analysis – Discharge Capacity| Type End-User |Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Peristaltic Pumps Market Sales Analysis – Discharge Capacity| Type | End-User |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Peristaltic Pumps Market Sales Analysis – Discharge Capacity| Type | End-User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Peristaltic Pumps Market Sales Analysis – Discharge Capacity |Type | End-User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Albin Pump (Ingersoll Rand)

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Avantor, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. AxFlow Holding AB

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Binaca Pumps

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Blue-White Industries, Ltd.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. BOMBAS BOYSER, S.L.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Chongqing Jieheng Peristaltic Pumps Co., Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Cole-Parmer Instrument Company, LLC.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Crane Co.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Enertech Pvt. Ltd.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Gilson Inc

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Graco Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Holmarc Opto-Mechatronics Ltd.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. INOXMIMGRUP SL

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Merck KGaA

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. NETZSCH Technologies India Pvt. Ltd.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. PCM Group

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Premier Control Technologies Ltd.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. ProMinent GmbH

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. PSG Dover

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. RAGAZZINI srl

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Solinst Canada Ltd.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Stenner Pump Co.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Thermo Fisher Scientific Inc.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Thistle Scientific Ltd.

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Valmet Oyj

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

9.27. Vanton

9.27.1. Quick Facts

9.27.2. Company Overview

9.27.3. Product Portfolio

9.27.4. Business Strategies

9.28. Verder International B.V.

9.28.1. Quick Facts

9.28.2. Company Overview

9.28.3. Product Portfolio

9.28.4. Business Strategies

9.29. Wanner Engineering, Inc.

9.29.1. Quick Facts

9.29.2. Company Overview

9.29.3. Product Portfolio

9.29.4. Business Strategies

9.30. Watson-Marlow Fluid Technology Group

9.30.1. Quick Facts

9.30.2. Company Overview

9.30.3. Product Portfolio

9.30.4. Business Strategies

1. Global Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024-2035 ($ Million)

2. Global Up to 30 psi Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global 30-50 psi Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global 50-100 psi Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global 100-200 psi Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Above 200 psi Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Peristaltic Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

8. Global Hose Tube Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Peristaltic Pumps Market Research And Analysis By End-User, 2024-2035 ($ Million)

11. Global Peristaltic Pumps For Pharmaceutical & Medical Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Peristaltic Pumps For Water & Wastewater Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Peristaltic Pumps For Food & Beverage Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Peristaltic Pumps For Chemical Processing Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Peristaltic Pumps For Mining and Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Peristaltic Pumps For Pulp & Paper Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Peristaltic Pumps For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American Peristaltic Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024-2035 ($ Million)

21. North American Peristaltic Pumps Market Research And Analysis By End-User, 2024-2035 ($ Million)

22. European Peristaltic Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

23. European Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024-2035 ($ Million)

24. European Peristaltic Pumps Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. Asia-Pacific Peristaltic Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Asia-Pacific Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024-2035 ($ Million)

27. Asia-Pacific Peristaltic Pumps Market Research And Analysis By End-User, 2024-2035 ($ Million)

28. Rest Of The World Peristaltic Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

29. Rest Of The World Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024-2035 ($ Million)

30. Rest Of The World Peristaltic Pumps Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Peristaltic Pumps Market Research And Analysis By Discharge Capacity, 2024 Vs 2035 (%)

2. Global Up to 30 psi Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

3. Global 30-50 psi Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

4. Global 50-100 psi Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

5. Global 100-200 psi Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

6. Global Above 200 psi Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

7. Global Peristaltic Pumps Market Research And Analysis By Type, 2024 Vs 2035 (%)

8. Global Tube Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

9. Global Hose Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

10. Global Peristaltic Pumps Market Research And Analysis By End-User, 2024 Vs 2035 (%)

11. Global Peristaltic Pumps For Pharmaceutical & Medical Market Share By Region, 2024 Vs 2035 (%)

12. Global Peristaltic Pumps For Water & Wastewater Treatment Market Share By Region, 2024 Vs 2035 (%)

13. Global Peristaltic Pumps For Food & Beverage Market Share By Region, 2024 Vs 2035 (%)

14. Global Peristaltic Pumps For Chemical Processing Market Share By Region, 2024 Vs 2035 (%)

15. Global Peristaltic Pumps For Mining and Construction Market Share By Region, 2024 Vs 2035 (%)

16. Global Peristaltic Pumps For Pulp & Paper Market Share By Region, 2024 Vs 2035 (%)

17. Global Peristaltic Pumps For Others End-User Market Share By Region, 2024 Vs 2035 (%)

18. Global Peristaltic Pumps Market Share By Region, 2024 Vs 2035 (%)

19. US Peristaltic Pumps Market Size, 2024-2035 ($ Million)

20. Canada Peristaltic Pumps Market Size, 2024-2035 ($ Million)

21. UK Peristaltic Pumps Size, 2024-2035 ($ Million)

22. France Peristaltic Pumps Market Size, 2024-2035 ($ Million)

23. Germany Peristaltic Pumps Market Size, 2024-2035 ($ Million)

24. Italy Peristaltic Pumps Market Size, 2024-2035 ($ Million)

25. Spain Peristaltic Pumps Market Size, 2024-2035 ($ Million)

26. Russia Peristaltic Pumps Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Peristaltic Pumps Market Size, 2024-2035 ($ Million)

28. India Peristaltic Pumps Market Size, 2024-2035 ($ Million)

29. China Peristaltic Pumps Market Size, 2024-2035 ($ Million)

30. Japan Peristaltic Pumps Market Size, 2024-2035 ($ Million)

31. South Korea Peristaltic Pumps Market Size, 2024-2035 ($ Million)

32. ASEAN Peristaltic Pumps Market Size, 2024-2035 ($ Million)

33. Australia and New Zealand Peristaltic Pumps Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Peristaltic Pumps Market Size, 2024-2035 ($ Million)

35. Latin America Peristaltic Pumps Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Peristaltic Pumps Market Size, 2024-2035 ($ Million)

FAQS

The size of the Peristaltic Pumps Market in 2024 is estimated to be around $1,875 million.

Asia Pacific holds the largest share in the Peristaltic Pumps Market.

Leading players in the Peristaltic Pumps Market include Cole-Parmer Instrument Company, LLC, Graco Inc., Blue-White Industries, Ltd., BOMBAS BOYSER, S.L., Verder International B.V., and Watson-Marlow Fluid Technology Solutions, among others.

Peristaltic Pumps Market is expected to grow at a CAGR of 6.2% from 2025 to 2035.

Rising demand for precise fluid handling in pharmaceuticals, food processing, and water treatment is driving the growth of the Peristaltic Pumps Market.