Automated Test Equipment Market

Global Automated Test Equipment Market Size, Share & Trends Analysis Report by Type (Memory, Non – memory, Discrete, and Test Handlers), By End-User (Aerospace and Défense, Consumer Electronics, IT and Telecommunications, Automotive, Healthcare, and Others) Forecast Period 2022-2028

The global market for automated test equipment is projected to have a considerable CAGR of around 3.4% during the forecast period. The growth of the market is driven by the increased adoption of Automated Test Equipment (ATE) in the automotive and semiconductor industry. A significant increase in the number of connected devices and consumer electronics, as well as companies increasing their focus on quality improvement and end-to-end testing solutions, will be likely to drive the market growth. Moreover, the ATE market is also expected to be driven by the increasing implementation of System on Chip (SoC) and increased demand for consumer electronics during the forecast period. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are anticipated to fuel the market. Further, in addition to the rise in use of data diagnostics and acquisition tools for testing electronic applications across the aerospace and defense, and industrial automation sector offers a significant opportunity in the automated test equipment market.

Furthermore, with the rapid adoption and implementation of the Internet of Things (IoT) around the globe, the semiconductor industry is projected to play a significant role and benefit from advances across the technology value chain. As the cloud economy becomes mainstream in the IoT era, semiconductor companies need to continuously innovate to drive connectivity across the IoT value chain. In addition, IoT-connected products and applications would require chips with an ultra-small form factor, low power consumption, and wireless connectivity options, and this, in turn, will be boosting the growth of the market.

Segmental Outlook

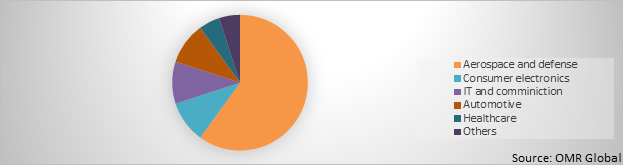

The global automated test equipment market is segmented based on type, and end-user. Based on the type, the market is further classified into memory, non–memory, discrete, and test handlers. Further, based on end-user, the market is segregated into aerospace and defence, consumer electronics, IT and telecommunications, automotive, healthcare, and others.

Global Automated Test Equipment Market Share by material, 2021(%)

The Aerospace And Defense Segment is Considered The Dominating Segment in the Global Automated Test Equipment Market.

Among end-user, the aerospace & defense segment is estimated as dominating segment during the forecast period owing to factors such as increasing defense spending by the governments. This has resulted in rapid technological advancement, with innovation resulting in increased efficiency of existing tools further covering the new scope of operations useful for a wide range of functions. With the increasing implementation of new technology, the need for upgrading the test equipment also arises. For instance, U.S. Naval Air Systems Command (NAVAIR) refreshed the technology as they shifted from the previous system to the newer system for testing aircraft and weapons on carriers. The organization maintained backward compatibility as a requirement, allowing eCASS stations to leverage the test program set from the older CASS program.

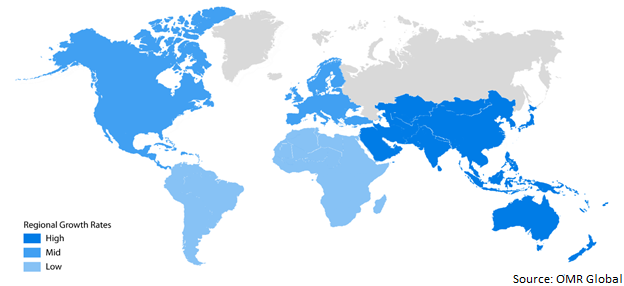

Regional Outlook

Geographically, the global Automated Test Equipment market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant CAGR in the Automated Test Equipment market.

Global Automated Test Equipment Market Growth, by region 2022-2028

North America to hold a considerable share in the global Automated Test Equipment market

Geographically, North America is projected to hold a significant share in the global automated test Equipment market. The factors that are contributing to the growth of the market include growing demand for low-cost consumer products, combined with a continuous rise in use in the semiconductor sector in the region. The market in Canada is majorly driven by the booming mining industry and increased defense spending. Moreover, automated test equipment further finds its application in the defense sector, wherein the country's defense sector has a budget allocation that is greater than in the entire economy of more than half of the existing countries in the world. Further, organizations are enhancing the test coverage for their corporate application suite with the help of ATE around the area as a result of rising cybersecurity threats and increasing application complexity.

Market Players Outlook

The key players in the automated test equipment market contribute significantly by providing different types of products and increasing their geographical presence across the globe. Advantest Corp, Cobham Plc., Astronics Test Systems Inc., Chroma ATE Inc., National Instruments Corp. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In September 2021, Advantest Corp one of the leading semiconductor test equipment suppliers announced a high-frequency resolution option for its TAS7400TS terahertz optical sampling analysis system. It comprises features such as a groundbreaking measurement method for high-frequency characteristic evaluation of radio wave absorbers and base materials, which are indispensable for Beyond 5G / 6G next-generation communications technology and for the millimeter-wave radar technology used in ADAS along with providing an excellent cost performance and ease of operation.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automated test equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current End-user Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automated Test Equipment End-user

• Recovery Scenario of Global Automated Test Equipment End-user

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automated Test Equipment Market by Type

5.1.1. Memory

5.1.2. Non-memory

5.1.3. Discrete

5.1.4. Test Handlers

5.2. Global Automated Test Equipment Market by End-user

5.2.1. Aerospace and Defense

5.2.2. Consumer Electronics

5.2.3. IT and Telecommunications

5.2.4. Automotive

5.2.5. Healthcare

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advantest Corp

7.2. Aemulus Holdings Bhd

7.3. Aeroflex Inc

7.4. Astronics Corp

7.5. Chroma ATE, Inc.

7.6. Danaher Corp

7.7. LTX-Credence Corp

7.8. MAC Panel Co

7.9. Marvin Test Solutions Inc

7.10. National Instruments Corp

7.11. Roos Instruments, Inc.

7.12. Samsung Semiconductor, Inc.

7.13. SPEA SpA

7.14. Star Technologies Inc

7.15. Teradyne Inc

7.16. Tesec Corp

7.17. Virginia Panel Corp

7.18. Xcerra Corp

1. GLOBAL AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL AUTOMATED MEMORY TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL AUTOMATED NON-MEMORY TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AUTOMATED DISCRETE TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL AUTOMATED TEST HANDLERS TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

7. GLOBAL AUTOMATED TEST EQUIPMENT IN AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AUTOMATED TEST EQUIPMENT IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AUTOMATED TEST EQUIPMENT IN IT AND TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AUTOMATED TEST EQUIPMENT IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL AUTOMATED TEST EQUIPMENT IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL AUTOMATED TEST EQUIPMENT IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE , 2021-2028 ($ MILLION)

16. NORTH AMERICAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GAS ANALYZER, 2021-2028 ($ MILLION)

17. NORTH AMERICAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. EUROPEAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE , 2021-2028 ($ MILLION)

20. EUROPEAN AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GAS ANALYZER, 2021-2028 ($ MILLION)

21. EUROPEAN FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE , 2021-2028 ($ MILLION)

24. ASIA-PACIFIC AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GAS ANALYZER, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

26. REST OF THE WORLD AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE , 2021-2028 ($ MILLION)

27. REST OF THE WORLD AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GAS ANALYZER, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AUTOMATED TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PROCESS ANALYZER, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTOMATED TEST EQUIPMENT BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL AUTOMATED TEST EQUIPMENT MARKET, 2021-2028 (%)

4. GLOBAL AUTOMATED TEST EQUIPMENT MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL AUTOMATED TEST EQUIPMENT MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6. GLOBAL AUTOMATED TEST EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AUTOMATED MEMORY TEST EQUIPMENT MARKET GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL AUTOMATED NON - MEMORY TEST EQUIPMENT MARKET GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL AUTOMATED DISCRETE TEST EQUIPMENT MARKET GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL AUTOMATED TEST HANDLERS TEST EQUIPMENT MARKET GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL AUTOMATED TEST EQUIPMENT IN AEROSPACE AND DEFENSE MARKET GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL AUTOMATED TEST EQUIPMENT IN CONSUMER ELECTRONICS MARKET GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL AUTOMATED TEST EQUIPMENT IN IT AND TELECOMMUNICATIONS MARKET GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL AUTOMATED TEST EQUIPMENT IN AUTOMOTIVE MARKET GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL AUTOMATED TEST EQUIPMENT IN HEALTHCARE MARKET GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL AUTOMATED TEST EQUIPMENT IN OTHERS END-USER MARKET GEOGRAPHY, 2021 VS 2028 (%)

17. US AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

19. UK AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

24. ROE AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

28. ASEAN AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD AUTOMATED TEST EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)