Automotive camera Market

Global Automotive camera Market Size, Share & Trends Analysis Report by Type (Viewing Camera and Sensing Camera), By Application (Parking Assistance and ADAS) and Forecast 2019-2025

The global automotive camera market is projected to grow at a significant CAGR of 9.4% during the forecast period. The major factor that is contributing to the growth of the market including the growing demand for safety vehicles coupled with advanced camera technology in automotive applications. With the ever-increasing demand in urban mobility and modern logistics sector, the vehicle population has been steadily growing over the past few decades. The leading automobile giants are coming up with newer self-driving features in their latest models. The respective technological developments are not confined to just communication, information technology, and data analysis; the realm of self-driving cars is also making progress at a brisk speed nowadays. Moreover, the growing demand for autonomous vehicle systems in the automotive sector further provide ample opportunity for the growth of the market

Segmental Outlook

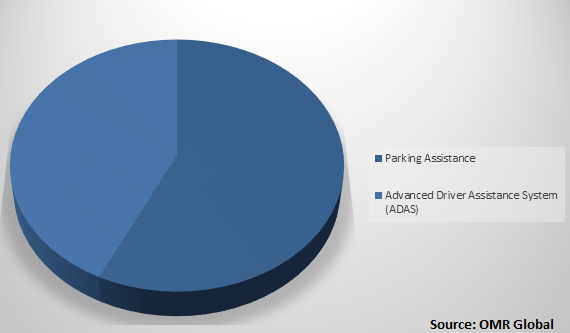

The global automotive camera market is classified on the basis of type and application. Based on type the market is classified into viewing camera and sensing camera. The viewing camera segment is projected to have significant growth in the market owing to the increasing demand ADAS in the automobile as advanced cameras are used in these systems. On the basis of application, the market is segregated into parking assistance and an advanced driver assistance system (ADAS). The parking assistance application segment is projected to have a significant share in the automotive camera industry due to the high application of cameras in the parking assistance system used in vehicles.

Global Automotive camera Market Share by Application, 2018(%)

Global automotive camera market to be driven by the ADAS application

The ADAS application segment is projected to have significant growth in the global market during the forecast period owing to the increasing demand for ADAS in the automotive industry. With the incorporation of AI in automotive, self-driving or autonomous technology have advanced seemingly well. For instance, VisLab Intercontinental Autonomous Challenge, a 13,000 km trip for nearly three months that took place from Italy to China, is regarded as one of the major competitions which led to enhancement in the testing of self-driven vehicles which consequently assisted the market. the majority of the car manufacturing companies such as Audi, BMW are actively adopting AI in their autonomous driving efforts to keep up with the on-going trends. For instance, Audi is testing an AI-based system that employs smart cameras with image recognition software to test and identify tiny cracks in sheet metal that further augment the automotive camera market.

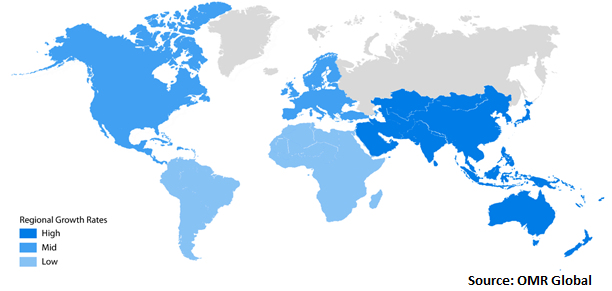

Regional Outlook

Geographically, the global Automotive camera market is further classified into North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific is estimated to have a considerable share in the global market due to the increasing adoption of advanced electronics components such as a digital camera in the automotive sector, growing preference towards safety vehicles in the region.

Global Automotive camera Market Growth, by Region 2019-2025

North America has a considerable share in the global automotive camera market

Geographically, North America is projected to have a significant market share in the global market due to the strict guidelines of safety in the vehicles and the growing adoption of autonomous cars in the region. Further, national initiatives to promote self-driven cars are driving the demand for advanced camera technologies automotive. The US has developed a number of smart car-related policies to promote the integration of intelligent vehicles and existing transportation systems. For instance, the US Transportation Secretary announced that they will render the test and application of automated driving in the capital and give $4 billion support in the next 10 years. At the same time, they will exempt the entire automotive industry, 2500 intelligent vehicles that comply with the relevant provisions of the existing traffic safety within two years.

Market Players Outlook

The key players in the Automotive camera market contributing significantly by providing advanced technology-based products and increasing their geographical presence across the globe. The key players in the market include Aptiv PLC, Continental AG, DENSO Corp., Intel Corp. (MobileEye), Robert Bosch GmbH, Ambarella Inc., Clarion Co., Ltd, FICOSA Group, FLIR Systems, Inc., Hitachi, Ltd., OmniVision Technologies, Inc., Samsung Electronics Co., Ltd., among others. These market players adopt various strategies such as government contracts, product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in June 2019, Hitachi, Ltd. announced the collaboration with Suzuki Motor Corp. to provide its stereo camera for Suzuki’s EVERY light commercial vehicle and Every WAGON light passenger vehicle. With this contract, the company will enable to increase their revenue and sustain a significant position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Automotive camera market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Aptiv PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Continental AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. DENSO Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Intel Corp. (MobileEye)

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Robert Bosch GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive camera Market by Type

5.1.1. Viewing Camera

5.1.2. Sensing Camera

5.2. Global Automotive camera Market by Application

5.2.1. Parking Assistance

5.2.2. Advanced Driver Assistance System (ADAS)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ambarella Inc.

7.2. Aptiv PLC

7.3. Automation Engineering Inc.

7.4. Clarion Co., Ltd

7.5. Continental AG

7.6. DENSO Corp.

7.7. FICOSA GROUP

7.8. FLIR Systems, Inc.

7.9. Gentex Corp.

7.10. Hitachi, Ltd.

7.11. IntelCorp. (MobileEye)

7.12. Kyocera Corp.

7.13. Magna International Inc.

7.14. Motherson Group

7.15. OmniVision Technologies, Inc.

7.16. Robert Bosch GmbH

7.17. Samsung Electronics Co., Ltd.

7.18. STONKAM CO., LTD.,

7.19. Valeo

7.20. ZF Friedrichshafen AG

1. GLOBAL AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL VIEWING CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SENSING CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL AUTOMOTIVE CAMERA IN PARKING ASSISTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL AUTOMOTIVE CAMERA IN ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

10. NORTH AMERICAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

11. EUROPEAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

13. EUROPEAN AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. REST OF THE WORLD AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD AUTOMOTIVE CAMERA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL AUTOMOTIVE CAMERA MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL AUTOMOTIVE CAMERA MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL AUTOMOTIVE CAMERA MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

6. UK AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD AUTOMOTIVE CAMERA MARKET SIZE, 2018-2025 ($ MILLION)